TUESDAY: 5 December 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2022.

QUESTION ONE

1. Summarise FOUR roles of the Cabinet Secretary of the National Treasury and Planning in relation to public debt management. (4 marks)

2. The Cabinet Secretary for the National Treasury or the state officer responsible for finance in your country is mandated by law to manage the national budget process. One of the task is to issue circulars for setting guidelines to be followed to all government entities.

With reference to the above statement, highlight FOUR contents of such a circular. (4 marks)

3. In a tax seminar, one of the facilitators noted that, “Not later than three months after the end of each financial year, the National Treasury shall prepare and submit to the Auditor-General financial statements for that year including certain information in respect of the contingencies fund as provided in the Public Finance Management Act, 2012.

With reference to the above statement, outline FOUR contents of information included in the financial statements in respect to contingencies fund. (4 marks)

4. Summarise FOUR roles of internal audit as an oversight function in public finance management. (4 marks)

5. The Committee of National Assembly submits to the National Assembly recommendations on revenue matters for approval. This is included in the finance bill as per the Public Finance Management Act, 2012.

With reference to the above statement, examine FOUR considerations that guide the recommendations by the committee. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. An accounting officer of a public entity shall be primarily responsible for ensuring that the public entity complies with the Public Procurement and Asset Disposal Act.

With reference to the above provision, outline FOUR responsibilities of an accounting officer of a procuring entity. (4 marks)

2. Citing THREE benefits derived by the government, justify the establishment of Public Private Partnerships (PPPs) arrangement adopted by most developing countries. (6 marks)

3. Janette Cheptoo is a practicing accountant under Cheptoo and Associates. Her firm is registered for value added tax (VAT) purposes.

The firm made the following transactions in the month of October 2023:

October 2: Tax consultancy work for Betterlife Ltd. at a fee amounting to Sh.840,000 exclusive of VAT.

October 4: Audit for Rwandacell, a company based in Rwanda at a fee amounting to Sh.920,000 exclusive of VAT.

October 10: Consultancy services for Whitestar Ltd. She billed the company Sh.348,000 inclusive of VAT.

October 15: The firm was contracted by Zedcom Ltd. to undertake review of its internal control system at a fee of Sh.603,200 inclusive of VAT.

October 17: Conducted an audit for Whitestar Ltd. for the year ended 31 December 2022. The fee charged was Sh.487,200 inclusive of VAT.

October 18: Stima Ltd. contracted the firm to conduct a survey on power consumption at a fee of Sh.2,400,000 exclusive of VAT.

October 19: The firm audited accounts of Glory Ministries, a church where Cheptoo serves as a volunteer auditor. She estimated that the fees would have been Sh.720,000 excluding VAT.

October 21: Billed Whitestar Ltd. Sh.136,880 inclusive of VAT for debt collection services.

October 22: The firm undertook a financial consultancy services for Speed Netcom S.A, a company based in South Africa. The fee charged was Sh.640,000 exclusive of VAT.

October 24: Conducted an audit for Walkah Ltd. at a fee of Sh.232,000 inclusive of VAT.

October 26: Provided accountancy services to Compassionate Children Home on volunteer basis. She

estimated the value of the services was Sh.139,200 inclusive of VAT.

October 31: She paid the following expenses which were inclusive of VAT where applicable:

Required:

Prepare a value added tax (VAT) account for the month of October 2023 for Cheptoo and Associate.

(8 marks)

Assuming Whitestar Ltd. was adjudged bankrupt by a court having paid Cheptoo and Associate Sh.237,800 only and that all conditions for claiming bad debt refund are met, compute the amount of VAT bad debt refund that is claimable by Cheptoo and Associates. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in customs and excise taxes:

Transshipment. (2 marks)

Ex-factory selling price. (2 marks)

Prohibited goods. (2 marks)

2. Rosemary Aswani is a resident individual who is employed as a senior financial analyst by United Homes Ltd. from the year 2022.

She has provided the following information relating to her income for the year ended 31 December 2022:

1. She received a monthly basic salary of Sh.204,000 from United Homes and a bonus equal to one month basic salary for her exemplary performance. PAYE deducted during the year was Sh.607,200.

2. Terminal dues received from her previous employer for services not rendered amounted to Sh.1,400,000. Her 4-year contract of employment was terminated after 2 years in December 2021 and payment was made as per the employment contract.

3. A commission of Sh.100,000 was paid to her for promoting the sale of houses where two houses were sold to the customers she had referred to the business.

4. She attended a five day master class for financial analysts organised by her professional body and the

employer paid Sh.100,000 for the seminar and she was paid daily subsistence allowance of Sh.12,000 by the employer.

5. She was given an offer to buy a house from United Homes at 20% below the market selling price. She

accepted the offer and bought one house whose market selling price was Sh.8,000,000.

6. She has a fixed deposit account of Sh.2,500,000 at Maisha Bank Ltd. from which she received interest of Sh.150,000 during the year.

7. She has a life insurance policy where she pays 60% of the premiums while the employer pays the balance.

Annual premiums as per the insurance policy was Sh.240,000 for the year.

8. She was provided with a leased saloon car of 2000cc by the employer for both personal use and official duties on 1 September 2022. The saloon car had an initial cost of Sh.2,800,000 and lease charges were Sh.36,000 per month.

9. United Homes has a medical cover for all management staff. She was entitled to a maximum cover of

Sh.880,000 per year although she utilised Sh.420,000 on medical costs during the year.

10. She paid subscription fees to her professional body amounting to Sh.24,000 during the year.

11. Her other incomes include:

• Royalties income of Sh.180,000 net of withholding tax.

• Gross farming income of Sh.450,000 out of which Sh.80,000 was in respect of own consumption of

farm produce.

• Part time practice as content creator where she made Sh.600,000 during the year.

Required:

Compute taxable income for Rosemary Aswani for the year ended 31 December 2022. (12 marks)

Determine tax payable (if any) on the income computed in (b) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. In relation to Tax Procedures Act 2015, explain the circumstances when a taxpayer may appeal to:

Tax appeals tribunal. (2 marks)

High court. (2 marks)

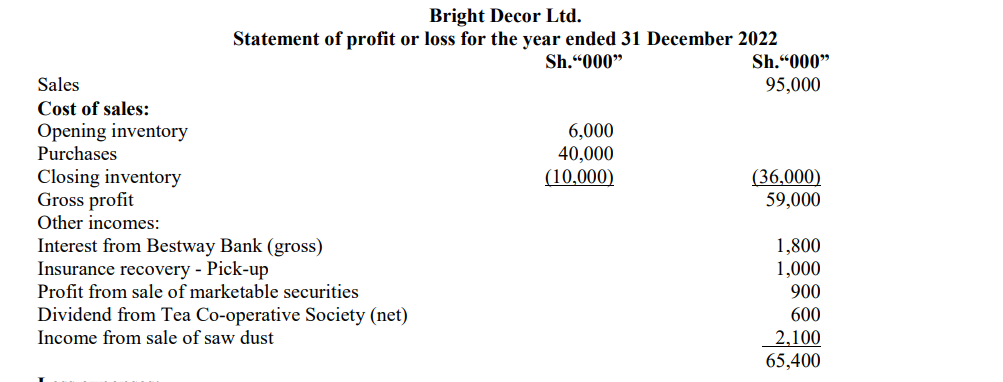

2. Bright Décor Ltd. is a company engaged in furniture and fittings making for both local and export market. The company provided the following statement of profit or loss for the year ended 31 December 2022:

Additional information:

1. Directors allowances include Sh.1,200,000 paid to defend one of the directors in a private legal suit.

2. Legal expenses comprise:

3. 40% of entertainment expenses relate to one of the directors entertainment while on a family holiday in Paris.

4. Inventories were valued at 10% below the cost price consistently.

5. The cost of floating shares was in respect of a private placement where 30% of the shares were sold.

6. Capital allowances were agreed at Sh.2,000,000. No investment allowance had been claimed in respect of the computer software.

7. Bad debts include an estimated default of Sh.80,000.

Required:

Compute the taxable profit or loss for Bright Decor Ltd. for the year ended 31 December 2022. (8 marks)

Compute the tax payable (if any) on the income computed in (2) (i) above. (2 marks)

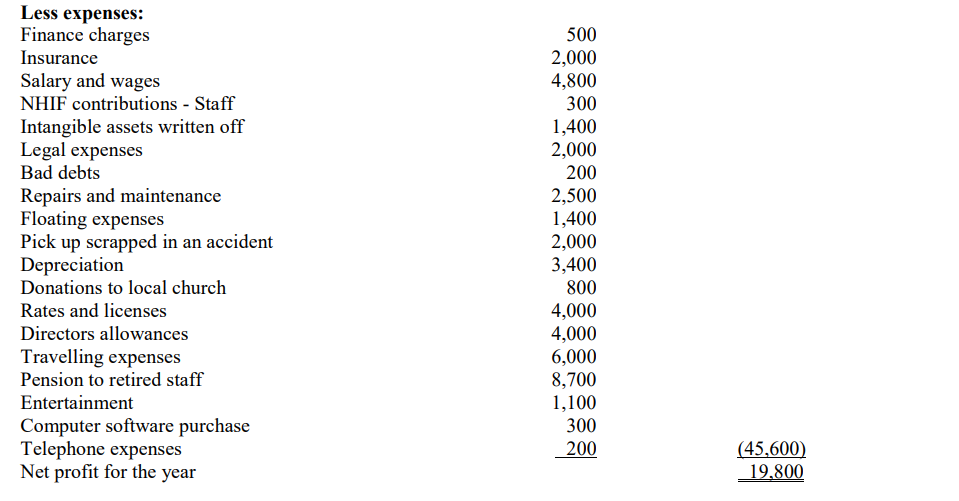

3. Fountain Ltd. manufactures soft drinks for sale in the local market. The company started operations on 1 January 2021 and acquired/constructed the following assets:

Required:

Compute the investment allowances for Fountain Ltd. for each of the two years ended 31 December 2021 and 31 December 2022. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Identify THREE distinctions between “direct taxes” and “indirect taxes”. (3 marks)

2. Hezron Mwaniah, the owner of fleet of vehicles has learnt that, there were changes on motor vehicles advance tax introduced in the Finance Act 2023.

Required:

Advise Hezron Mwaniah on the rate of advance tax and the effective date as provided in the finance Act, 2023. (2 marks)

3. The Revenue Authority in your country established a Medium Taxpayers Office (MTO).

In relation to the above statement, propose THREE objectives of the Medium Taxpayers Office (MTO). (3 marks)

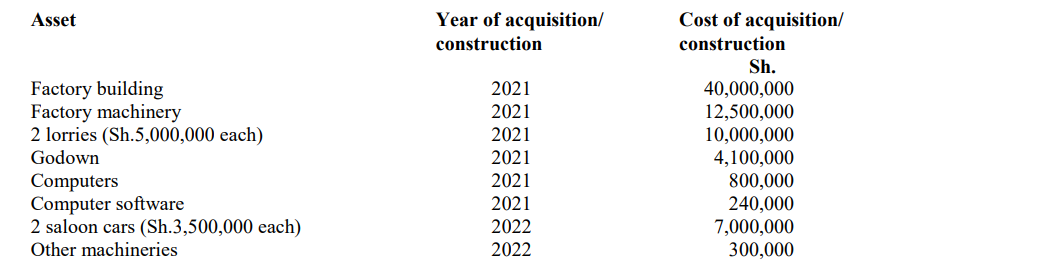

4. James and Patrick are partners trading as Highway Enterprises and sharing profits and losses equally.

The following information was extracted from their books of accounts for the year ended 31 December 2022:

2. Legal fees include Sh.25,000 incurred on drafting a loan arrangement between the partnership and a bank.

3. Cost of goods sold include carriage cost of a machine to the business premises amounting to Sh.34,000.

4. Closing inventory was overvalued by Sh.25,000 and opening inventory undervalued by Sh.48,000.

5. Dividend income was from investment in share in a local Farmers Cooperative Society.

Required:

Compute adjusted taxable profit or loss of the partnership for the year ended 31 December 2022.(10 marks)

Allocation of taxable profit or loss computed in (d) (i) above to the partners. (2 marks)

(Total: 20 marks)