TUESDAY: 6 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

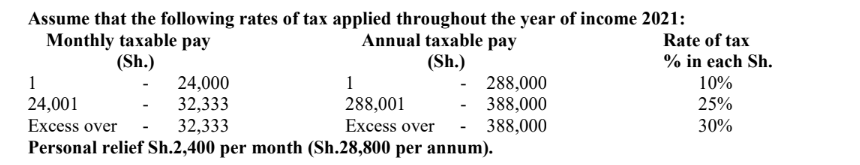

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

QUESTION ONE

1. Explain the following types of funds:

The contingency fund. (2 marks)

The equalisation fund. (2 marks)

2. An accounting officer of a procuring entity is empowered at any time, prior to notification of tender award, to terminate or cancel procurement or asset disposal proceedings without entering into a contract.

Highlight SIX circumstances under which the procurement or asset disposal proceedings may be terminated or cancelled

as provided under the Public Procurement and Asset Disposal Act, 2015. (6 marks)

3. Outline SIX contents that should be included in development plan prepared by every county government as specified

under Section 126 (1) of the Public Finance Management Act, 2012. (6 marks)

4. “Each year, the county treasury shall submit to the county assembly a statement setting out the debt management strategy of the county government”.

With reference to the above statements, identify FOUR items that the county treasury should include in the statement.

(4 marks)

(Total: 20 marks)

QUESTION TWO

1. The Revenue Authority is empowered to undertake different types of tax audit to ascertain the actual tax liability of the

tax payers involved. The tax audit may be triggered by general or specific details that come to the attention of the

Commissioner.

With reference to the above statement, suggest FOUR triggers of PAYE audit. (4 marks)

2. A contracting authority is empowered to use direct procurement method as one of the Public Private Partnerships (PPPs) procurement methods by the Act.

In relation to the above statement, summarise SIX circumstances under which a contracting authority could use direct procurement as one of the PPPs procurement method. (6 marks)

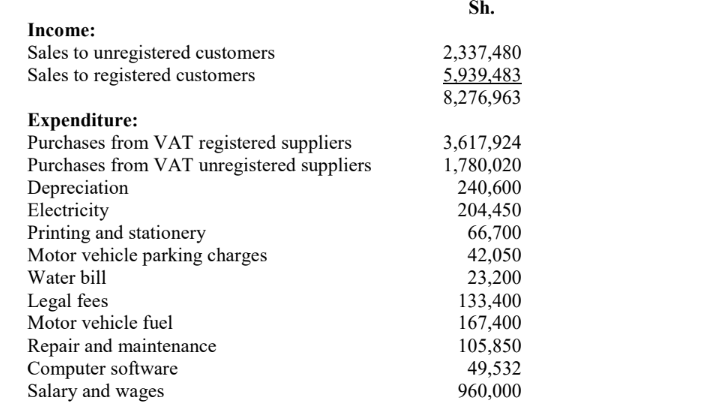

3. The following are the transactions of Starlite Traders for the month of August 2022. The business is registered for value

added tax (VAT) purposes:

Additional information:

1. The reported sales to unregistered customers include goods sold to a customer in South Sudan of Sh.536,000.

2. An invoice of Sh.160,000 issued to Wema Traders has been omitted from the records during the month.

3. Motor vehicle fuel and repairs and maintenance relates to the van used to supply goods to customers.

4. Water bill related to the water supplied by the county government during the month.

All transactions are inclusive of value added tax (VAT) at the standard rate of 16% where applicable.

Required:

A value added tax (VAT) account for the month of August 2022 for Starlite Traders. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the term “Certificate of Origin” as used under customs and excise taxes. (2 marks)

2. Identify FOUR categories of information the Commissioner should include in the default assessment sent to the taxpayer. (4 marks)

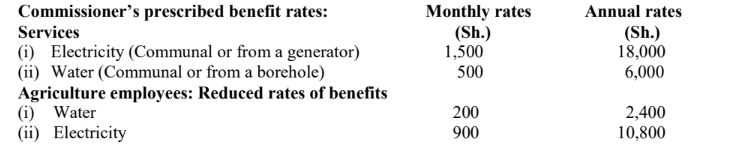

3. Henry Mwala who holds a dual citizenship, had been living in Denmark since September 2014. He returned to the country on 17 December 2020 and opened a hardware shop on 2 January 2021. On 1 July 2021, he secured a formal

employment with Bestfreight Ltd. a logistic company as a fleet manager.

He provided the following information relating to his income for the year ended 31 December 2021:

1. Basic salary Sh.180,000 per month (PAYE Sh.46,000 per month).

2. He was paid overtime amounting to Sh.30,000 per month and risk allowance of Sh.25,000 per month during the year.

3. The employer provided him with meals worth Sh.5,000 per month.

4. He received house allowance of Sh.60,000 per month.

5. Up to 30 September 2021, he used his personal car for official duties and the employer reimbursed a monthly mileage allowance of Sh.40,000.

6. On 1 October 2021, he was provided with a saloon car of 2400cc purchased by the company in year 2019 at a cost of Sh.2,000,000.

7. He was out of office on official duties for five days and received a per diem of Sh.6,000 from the employer.

8. The company paid school fees of Sh.80,000 for each of his three children during the year. This was included in the

employer’s books of accounts.

9. The employer bought a Sh.120,000 air ticket to facilitate Henry Mwala to visit the rest of his family in Denmark during his annual leave.

10. With effect from 1 July 2021, he contributed Sh.15,000 (monthly) as pension contribution and Sh.92,000 for life insurance annual premium respectively.

11. He bought a residential house on 1 September 2021 through mortgage of Sh.6,000,000 provided by Excel Bank

Ltd. at an interest rate of 16% per annum. He moved into the house on 2 October 2021.

12. The net loss from the hardware shop during the year amounted to Sh.370,000.

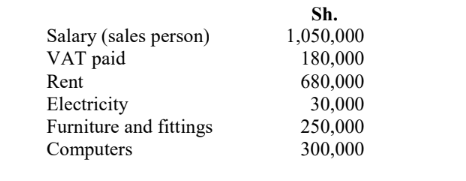

This was after deducting the following:

Required:

Determine total taxable income for Henry Mwala for the year ended 31 December 2021. (12 marks)

Compute tax payable (if any) from the income computed in 3 above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the term “Railway development levy” as used in taxation. (2 marks)

2. Highlight THREE benefits derived by member countries of the East African Community from use of the Single Customs Territory. (3 marks)

3. Identify THREE objectives of fiscal policies adopted by most developing countries. (3 marks)

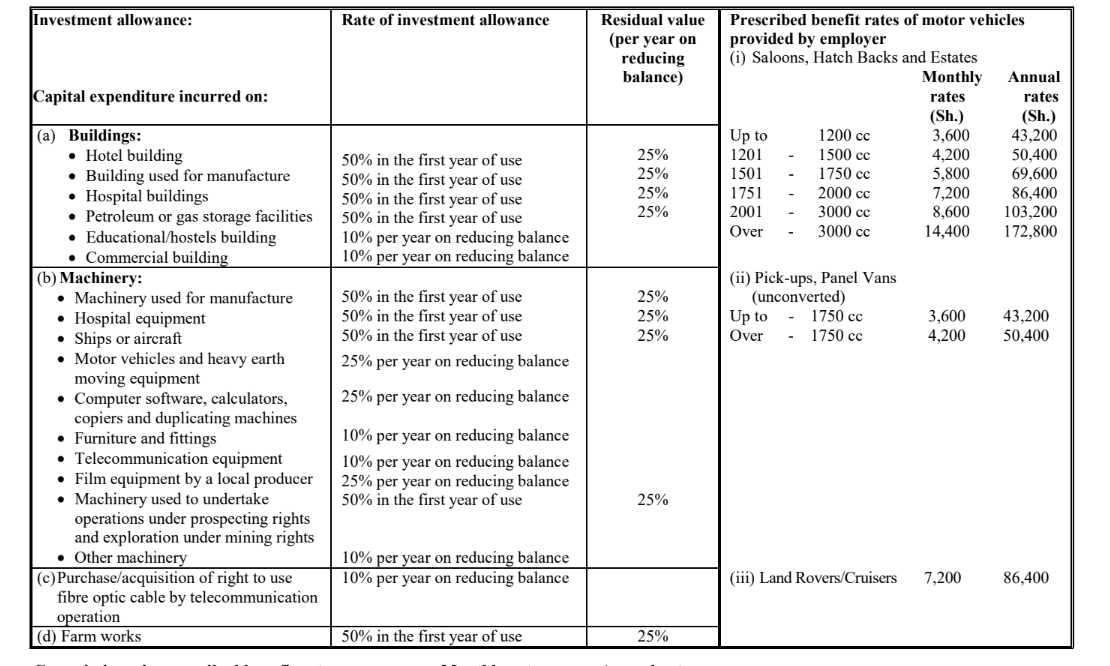

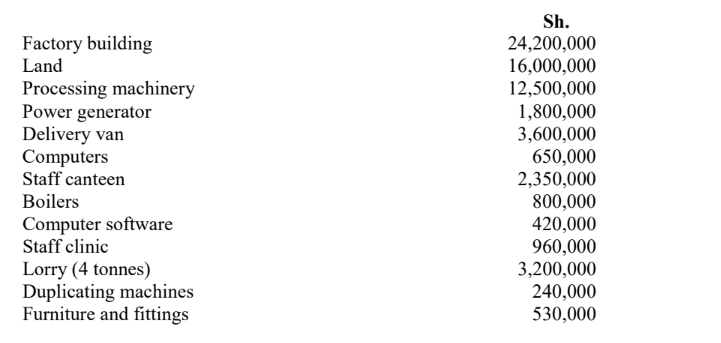

4. Leeds Manufacturing Ltd. commenced operations on 1 January 2021 after incurring the following expenditure:

Additional information:

1. The factory building includes the cost of a showroom and a retail shop of Sh.1,850,000 and Sh.1,690,000 respectively.

2. A perimeter wall was constructed at a cost of Sh.4,200,000 and utilised from 1 October 2021.

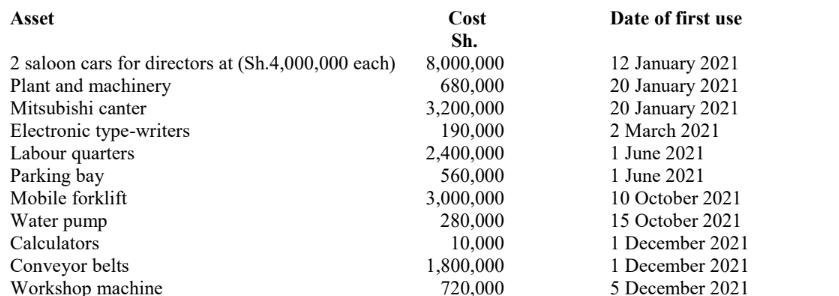

3. The company acquired the following additional assets during the year ended 31 December 2021:

4. In June 2021, one of the saloon cars was involved in an accident and the insurance company paid Sh.3,000,000 as compensation.

5. A borehole was drilled at a cost of Sh.1,400,000 and put in to use on 1 November 2021.

6. The company made a gross profit of Sh.56,000,000 during the year ended 31 December 2021.

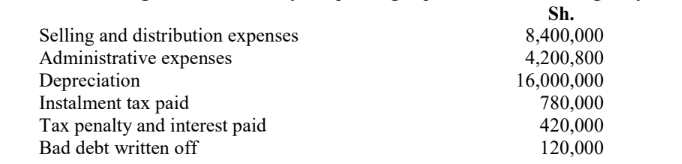

7. The following were the summary of operating expenses incurred during the year ended 31 December 2021:

Required:

Compute Leeds Manufacturing Ltd.’s Investment allowances for the year ended 31 December 2021.(9 marks)

Ascertain the taxable profit or loss for the year ended 31 December 2021. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Identify FOUR factors that might influence tax shifting. (4 marks)

2. Summarise FOUR roles of the Parliamentary Budget Office. (4 marks)

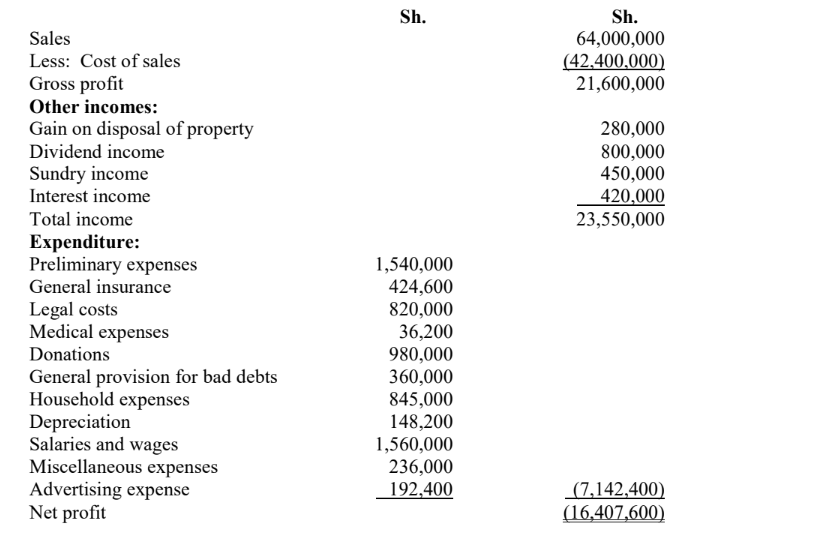

3. Hightec Ltd. presented the following statement of profit or loss for the year ended 31 December 2021:

Additional information:

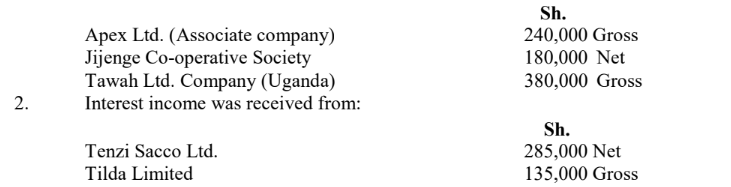

1. Dividend income was received from:

3. Donations include Sh.340,000 made to a golf club during a national golf tournament. The balance was made to an organisation involved in household poverty reduction campaigns, and it is a tax exempt organisation.

4. Inventories at each year end has consistently been undervalued by 20%. Closing inventory amounted to Sh.2,600,000 and included a photocopy machine of Sh.180,000.

5. Sundry income represents recovery of bad debts previously allowed as a deduction against taxable income of Sh.200,000 and insurance recovery on stolen cash while in transit of Sh.250,000.

6. Miscellaneous expenses comprised of tools and implements of Sh.180,000 and computer software purchased at a cost of Sh.56,000.

7. Advertising expense includes annual trade fair fee of Sh.40,000 and Sh.50,000 fee for renewing billboards advertising license.

8. Legal costs include Sh.236,000 incurred in successfully defending the company against allegations of breach of contract, Sh.180,000 in respect of renewal of trademark, and Sh.40,000 in respect of an appeal against VAT assessment by the revenue authority.

9. Sales and purchases are quoted inclusive of VAT at the rate of 16%. Purchases for the year amounted to Sh.43,600,000 while opening inventory was valued at Sh.1,400,000.

10. Medical expenses represent reimbursements to staff for medical bills paid. The medical scheme only covers senior employees.

Required:

Prepare the adjusted taxable profit or loss of Hightec Ltd. for the year ended 31 December 2021. (10 marks)

Determine the tax liability (if any) arising from the profit or loss computed in 3 above. (2 marks)

(Total: 20 marks)