TUESDAY: 6 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Outline SIX benefits that would accrue to an organisation that encourages employees to participate in budget preparation. (6 marks)

2. Highlight FOUR benefits of continuous stock taking to a company. (4 marks)

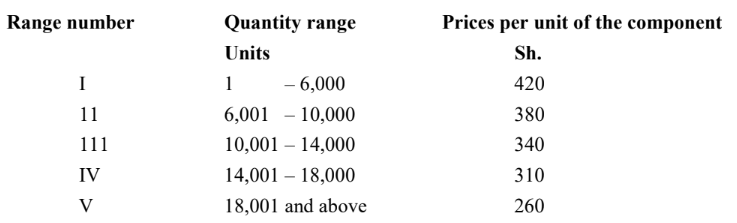

3. Babu Ltd. places orders for one of the components used in its manufacturing process. The price of the componentvhas been fluctuating thus affecting the production of the final product and hence eroding market confidence of thevcompany’s clients. The company’s accountant has presented the following quantity ranges and respective price of the component which he believes would result in a cost saving to the company:

Additional information:

1. The company’s annual demand is 60,000 units.

2. The ordering cost per order is Sh.50,000.

3. The holding cost is 20% of the purchase price

4. The company practices continuous stock taking throughout the year.

Required:

Advise the company on the quantity range that would yield the highest cost savings. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the meaning of the following types of inventory costs:

Out of pocket costs. (2 marks)

Set-up costs. (2 marks)

Opportunity costs. (2 marks)

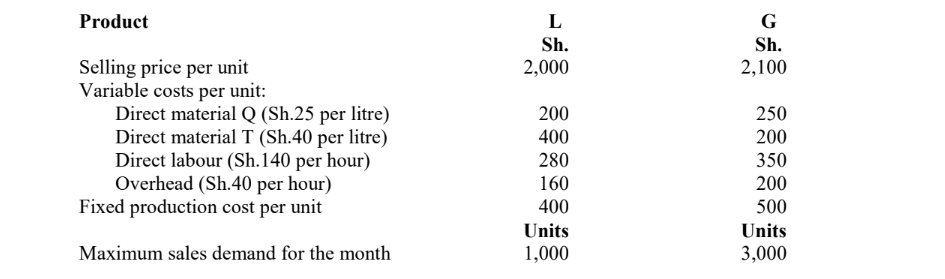

2. Lengo Ltd. manufactures and sells two products L and G to a number of customers. The company is currently preparing its budget for the year ending 31 December 2023.

The cost, selling prices and demand units details for its two products are as follows:

Additional information:

1. The fixed production cost per unit is based upon an absorption rate of Sh.200 per direct labour hour and

total annual production activity is 90,000 direct labour hours. One-twelfth ( 1 /12) of the annual fixed production cost will be incurred.

2. In addition to the above costs, non-production overhead costs are expected to be Sh.577,500.

3. During the period, the availability of material Q is expected to be limited to 31,250 litres.

4. It is the policy of Lengo Ltd not to hold inventory of finished goods

Required:

Compute the shortfall in litres for material Q. (3 marks)

The optimal production mix based on priority ranking. (7 marks)

The net profit at optimal production mix. (4 marks)

(Total: 20 marks)

QUESTION THREE

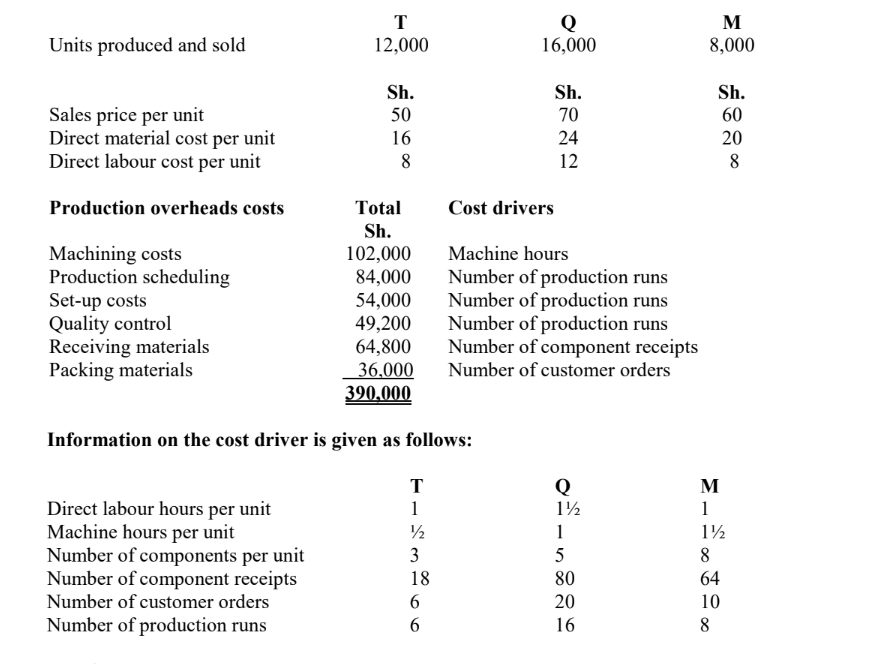

1. TQM Ltd. is a manufacturing company that makes three products namely; T, Q, and M. The data for the period ended 30 November 2022 is given as follows:

Required:

Using activity-based costing (ABC), determine the cost and gross profit per unit for each product during the period. (10 marks)

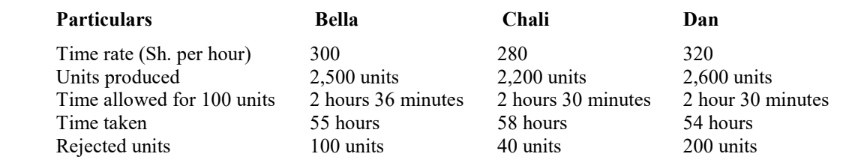

2. Bingwa Ltd. operates a premium bonus system where workers receive a guaranteed basic hourly minimum rate of

pay plus a bonus of 50% of the time saved.

The following data is provided for the last week of November 2022:

Additional information:

1. No payment is made beyond the time allowed.

2. The bonus which is paid at the basic hourly rate is applicable to the accepted output only.

3. No penalty is imposed on rejected output.

Required:

From the above information, calculate for each employee:

Bonus hours and amount of bonus earned. (6 marks)

Labour cost for each good unit produced. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain FOUR arguments in favour of marginal costing system. (8 marks)

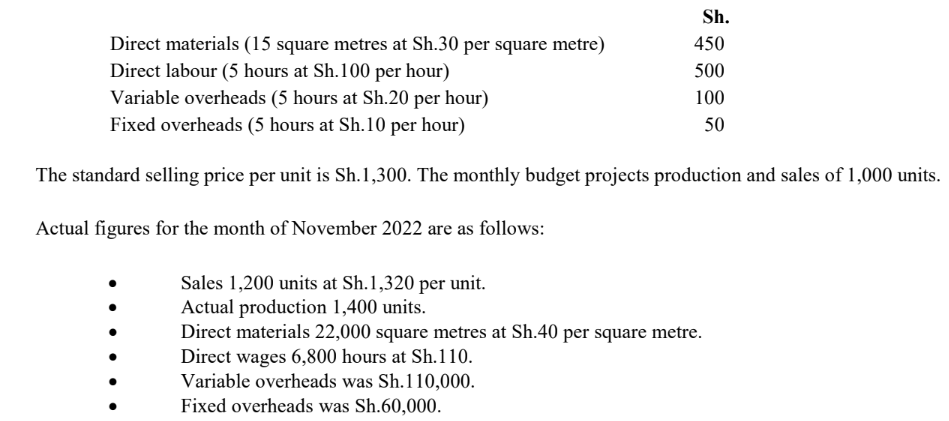

2. Quota Ltd manufactures and sells a single product branded “TT” with a standard cost of Sh.1,100 made up as follows:

Required:

Material price variance and material usage variance. (4 marks)

Labour rate variance and labour efficiency variance. (4 marks)

Fixed overhead capacity variance and fixed overhead efficiency variance. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise FOUR salient features of process costing systems. (4 marks)

2. Highlight SIX benefits that a firm would derive from establishing a good cost accounting system. (6 marks)

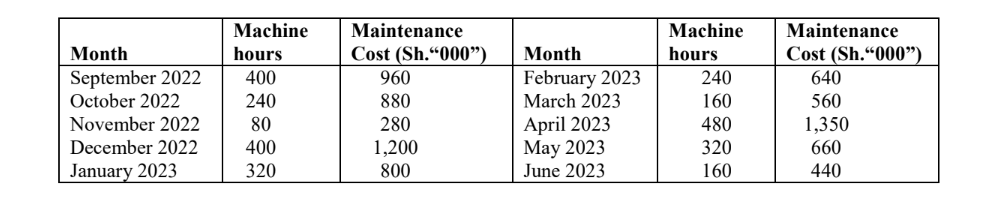

3. Ocean Ltd. is preparing its budget for the year ending 30 June 2023.

It is decided to estimate an equation of the form, Y = a + bx,

Where;

Y is the total maintenance expense at an activity level x.

a is the fixed maintenance expense.

The following information relate to the year ending 30 June 2023:

Required:

Estimate the total cost function using the ordinary least squares method. (8 marks)

Determine the total cost if 1,050 machine hours were applied. (2 marks)

(Total: 20 marks)