THURSDAY: 4 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

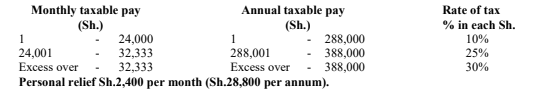

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

QUESTION ONE

1. Summarise four functions of the Commission on Revenue Allocation (CRA). (4 marks)

2. Highlight two objectives of the public debt management office. (2 marks)

3. Explain three roles of the Cabinet Secretary of the National Treasury in public debt management. (6 marks)

4. Outline the stages to be followed in the budget process for the national government in any financial year. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. An accounting officer of a procuring entity may use restricted tendering if any of the provided conditions are satisfied. With reference to the above statement, state four such conditions as provided under the Public Procurement and Asset Disposal Act (PPADA), 2015. (4 marks)

2. Outline six values and principles of the constitution and relevant legislation that should guide public procurement and asset disposal by state organs and public entities, as provided for under the PPADA, 2015. (6 marks)

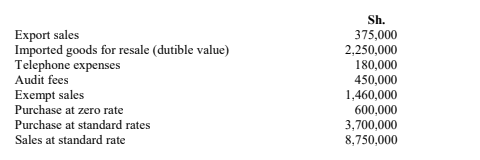

3. The following information was extracted from the books of Pately Traders, a registered business for Value Added Tax (VAT) purposes for the month of May 2022:

Transactions are stated exclusive of VAT at the rate of 16% where applicable.

Additional information:

1. Pately Traders received debit notes and credit notes of Sh.1,000,000 and Sh.500,000 respectively for standard rate supplies.

2. The imported goods for resale were subject to custom duty at the rate of 25%. These goods were subsequently transported to the business premises at a cost of Sh.100,000 and repackaged at a cost of Sh. 25,000. The goods were later sold at a mark up of 10% (sales proceeds on these goods were not included in the reported sales at standard rate).

3. A debtor for goods sold at standard rate for Sh.300,000 was declared bankrupt.

4. Telephone expenses relate to bills received from the provider of wireless telephone services.

Required:

VAT payable by or refundable to Pately Traders for the month of May 2022. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in taxation:

Absolute taxable capacity. (2 marks)

Relative taxable capacity. (2 marks)

2. Propose four reasons why you would discourage the government from embarking on Public Private Partnerships (PPPs). (4 marks)

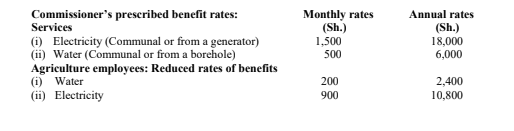

3. Henry Musoki is employed as the Finance Manager at Pandah Ltd. He has provided the following details relating to his income for the year ended 31 December 2021:

1. His employment contract provided for the following:

Sh.

Basic monthly salary 182,500

Transport allowance per month 12,000

Leave pay (paid in December) 60,000

2. He was accommodated in a company owned house where he was deducted Sh.25,000 per month as nominal rent. If the house had been rented at market value, the company could have been charging monthly rentals of Sh.45,000. The company furnished the house for him at Sh.260,000.

3. He was paid Sh.120,000 as a labour day award by the company for being the most hard working and committed employee during the year.

4. The company has a registered pension scheme for its employees where it contributes 15% of each employees’ basic salary. Henry Musoki contributed 10% of his monthly basic salary towards the scheme.

5. He was enrolled to a medical scheme with Bahati Insurance Ltd. where he spent Sh.230,000 on medical bills during the year. The medical scheme catered for senior employees only.

6. His wife was given goods worth Sh.180,000 by the company during the Christmas season.

7. The company provided him with a cook and a security guard from 1 October 2021 where it paid them monthly salaries of Sh.15,000 and Sh.20,000 respectively.

8. On 1 July 2021, he secured an education insurance policy for his child at an annual premium of Sh.150,000 payable by the company.

9. He was out of the work station in the month of September 2021 for 8 days for which he was paid a daily per diem allowance of Sh.5,000.

10. PAYE deducted by the company from his salary was Sh.46,500 per month.

Required:

Taxable income for Henry Musoki for the year ended 31 December 2021. (10 marks)

Tax payable if any on the income computed in 3 (i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline four functions of the controller of budget in respect to public finance matters. (4 marks)

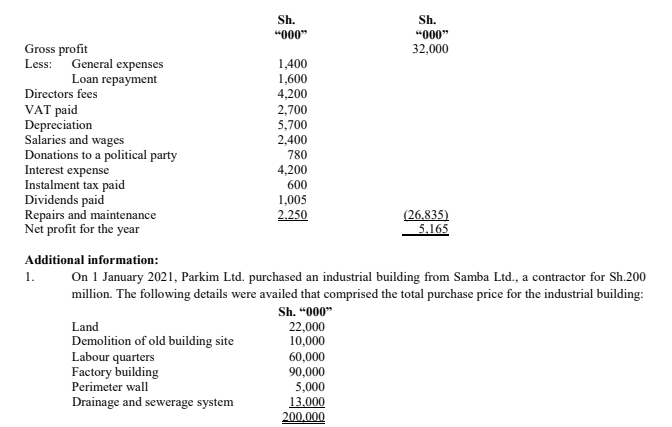

2. Parkim Ltd., a large manufacturing company has provided you with the following statement of profit or loss for the year ended 31 December 2021:

2. The factory building above houses a warehouse costing Sh.7,000,000, administration block costing Sh.7,000,000 and a showroom at a cost of Sh.4,000,000.

3. Parkim Ltd. purchased and installed a processing machinery in the factory at a cost of Sh.40,000,000 on 2 January 2021 and started manufacturing leather products. The cost of processing machinery included workshop machine and a boiler at a cost of Sh.5,000,000 and Sh.6,000,000 respectively.

4. The following additional assets were acquired during the year ended 31 December 2021:

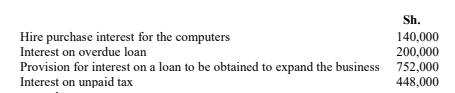

• On 5 January 2021, computers were acquired on hire purchase at Sh.620,000. Hire purchase interest included was Sh.140,000.

• Acquired furniture and other machines at Sh.720,000 and Sh.968,000 respectively.

• On 15 March 2021, Parkim Ltd. bought a pickup for Sh.2,250,000, a motorcycle for Sh.190,000, a water pump for Sh.48,000 and two delivery trucks for Sh.5,000,000 each.

• Two saloon cars were purchased at Sh.3,600,000 each in April 2021. In October 2021, one saloon car was involved in an accident and the insurance company paid Sh.2,000,000 as compensation.

• In November 2021, the pickup vehicle was traded in with a new delivery van valued at Sh.3,000,000. The pickup had a value of Sh.1,600,000 at the time of the trade in.

5. Interest expense include:

6. Gross profit included anticipated foreign exchange gain of Sh.2,000,000 and a reduction in general bad debts of Sh.620,000.

Required:

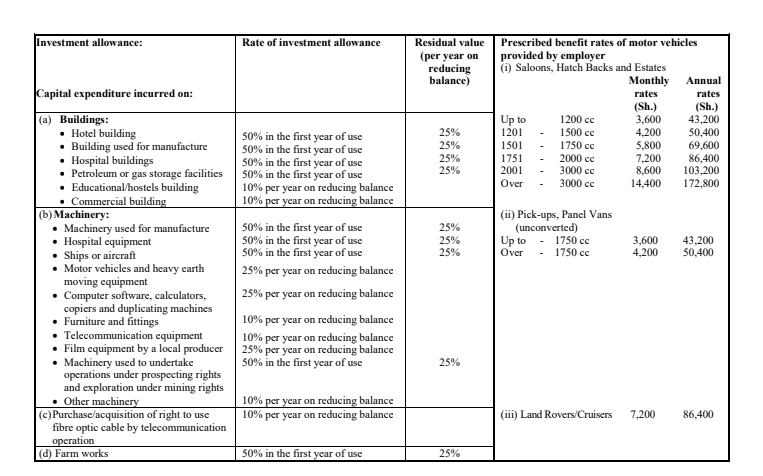

Parkim Ltd.’s investment allowances for the year ended 31 December 2021. (8 marks)

Ascertain the taxable profit or loss for the year. (6 marks)

Explain the tax treatment of tax losses. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following terms as used under the customs and excise duties:

Bonded warehouse. (2 marks)

Duty drawback. (2 marks)

2. Outline four cases where a person is considered as the tax representative of another person as provided under the Tax Procedures Act, 2015 or any other tax law of your country. (4 marks)

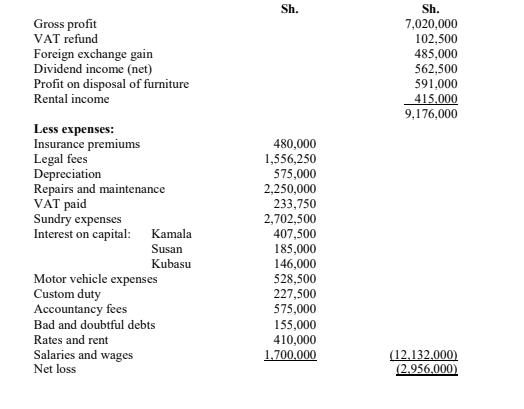

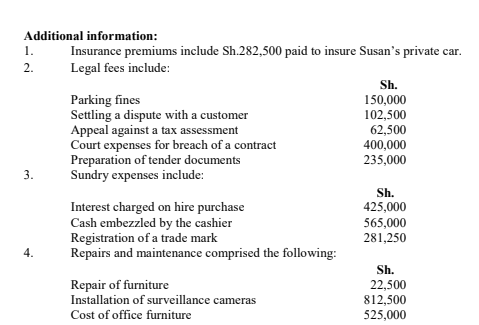

3. Kamala, Susan and Kubasu are in partnership trading as Kasuku Traders sharing profit or losses equally. They have provided the following statement of profit or loss for the year ended 31 December 2021:

5. The partners took goods for personal use which had a cost price Sh.225,000. The gross profit margin was 20%, as recorded in partnership books of account.

6. The investment allowances were agreed with the revenue authority at Sh.1,475,000 during the year ended 31 December 2021.

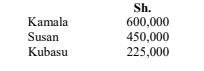

7. Salaries and wages included salaries to partners as follows:

Required:

The adjusted partnership profit or loss for the year ended 31 December 2021. (10 marks)

Distribution schedule of the profit or loss computed in 3 (i) above. (2 marks)

(Total: 20 marks)