WEDNESDAY: 3 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Examine four dividend payout policies. (4 marks)

2. Explain three common reasons for restructuring a business. (6 marks)

3. Peacock Ltd. is considering undertaking financial reconstruction during which it would repurchase its outstanding ordinary shares using debt. This will raise its debt to equity ratio to 1.6.

The following information was available for the company:

1. Existing debt to equity ratio is 1.2.

2. The asset beta (ungeared beta of equity) is 0.40.

3. The risk free rate of return is 6%.

4. The return of market portfolio is 12%.

5. The firm adopts 60% payout ratio as its dividend policy.

6. The firm expects to generate earnings per share (EPS) of Sh.8.

7. The corporate tax rate is 30%.

Required:

The weighted average cost of capital (WACC) before financial reconstruction. (4 marks)

The weighted average cost of capital (WACC) after financial reconstruction. (4 marks)

Advise Peacock Ltd. management on the appropriate action to take. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four types of risk in the banking industry. (4 marks)

2. Describe three financial intermediaries and institutions driving green finance trading. (6 marks)

3. Vibe Ltd. has earnings before interest and taxes (EBIT) of Sh.2 million and a 30% tax rate. The required rate of return on equity in the absence of leverage is 14%.

Required:

In the absence of personal taxes, determine the value of the company in a Modigliani and Miller world:

With no debt. (2 marks)

With Sh.6 million in debt. (2 marks)

4. With reference to (c) above, assume that personal as well as corporate taxes now exist. The marginal personal tax rate on common stock income is 25% and the marginal personal tax rate on debt income is 30%.

Required:

Determine the value of the firm:

With no debt. (3 marks)

With Sh.6 million in debt. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Citing justification in each case, describe four activities that are prohibited in Islamic Finance. (4 marks)

2. Tarakilishi Ltd. deals with computer accessories. A computer component sells for Sh.400 a piece and has a variable cost of Sh.200 per piece. The firm has fixed operating costs of Sh.400,000 and fixed financing costs of Sh.600,000.

Further analysis of the firm reveals that if the firm sales increases by 10%, the firm’s earnings before interest and taxes (EBIT) increases by 15% and if the firm’s EBIT increases by 10%, the firm earnings per share (EPS) increases by 12%.

Required:

Calculate the following measures of leverage for the firm:

Breakeven quantity of sales in units. (2 marks)

Operating breakeven quantity of sales in units. (2 marks)

Degree of operating leverage (DOL). (2 marks)

Degree of financial leverage (DFL). (2 marks)

Degree of total leverage (DTL). (2 marks)

3. Kazi Ltd. estimates its total cash requirements as Sh.20 million for next year. The company’s opportunity cost of funds is 15% per annum. The company will have to incur Sh.150 per transaction when it converts its short term securities to cash.

Required:

Using the Baumol’s cash management model, determine the following:

The optimum cash balance. (2 marks)

The total annual cost of the demand for the optimum cash balance. (2 marks)

The number of deposits that will be made during the year. (2 marks)

(Total: 20 marks)

QUESTION FOUR

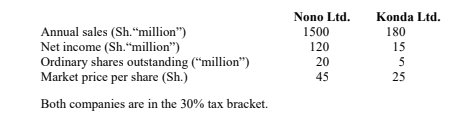

1. Nono Ltd. is considering acquiring Konda Ltd. Given below are selected financial data for the two companies:

Required:

The non-diluting maximum exchange ratio. (2 marks)

The post acquisition earnings per share (EPS) assuming the firm settles on an offer price of Sh.25 per share. (3 marks)

Calculate Nono’s Ltd.’s post acquisition earning per share (EPS) if every 100 shares of Konda Ltd. are exchanged for 2 units of 15% debentures with par value of Sh.1,000 per unit. (3 marks)

Considering the results in 1 (ii) and 1 (iii) above, state the financing option that you would recommend? (2 marks)

2. Usawa Ltd. is considering whether it is necessary to purchase equipment to increase its production and sales volumes. The equipment costs Sh.600,000 and has a useful life of three years after which it can be sold as scrap for Sh.96,000. For each of the three years of usage, the equipment is expected to increase both the sales revenue and operating costs by Sh.720,000 and Sh.468,000 respectively. The company’s cost of capital is 12%.

Required:

Compute the percentage change required in each of the following factors for the project to be rejected;

Initial cost of the equipment. (4 marks)

Scrap value of the equipment. (3 marks)

Sales revenue. . (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. With respect to agency theory, explain three ways of resolving agency conflict between shareholders and managers. (6 marks)

2. Discuss three reasons that may drive mergers and acquisitions to fail. (6 marks)

3. Magenta Ltd. intends to borrow Sh.30 million for share repurchase. The Chief Financial Officer (CFO) of the company has compiled the following information about the company.

• Share price at the time of buy-back = Sh.50.

• Shares outstanding before buy-back =20,000,000.

• Earning per share (EPS) before buy-back = Sh.5.00

• Earnings yield = 10%

• After tax cost of borrowing = 8%

• Planned buy-back = 600,000 shares.

Required:

The earnings per share (EPS) after share repurchase. (3 marks)

Comment on your results in 3 (i) above. (1 mark)

The earnings per share (EPS) assuming the after tax cost of borrowing increases by 7%. (3 marks)

Comment on your results in 3 (iii) above. (1 mark)

(Total: 20 marks)