TUESDAY: 5 December 2023. Afternoon Paper. Time Allowed: 2 hours.

This paper is made up of fifty (50) Multiple Choice Questions. Answer ALL questions by indicating the letter (A, B, C or D) that represents the correct answer. Each question is allocated two (2) marks. Do NOT write anything on this paper.

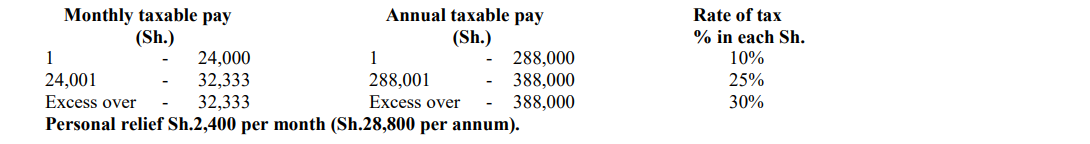

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2022.

1. Which of the following condition must be fulfilled for passage to be excluded from taxation of an employee’s income?

A. The employee must be solely in Kenya to serve the employer

B. The employee must be a citizen of Kenya

C. The employee must be recruited or engaged in Kenya

D. The employee must get travel allowances from the employer (2 marks)

2. Paul Matata is an employee of Hill Care Ltd. He reported an annual employment income of Sh.1,360,000 before housing benefit for the year 2022. He lived in a company house and paid a nominal rent of Sh.5,000 per month for the house. The fair market rental value of houses in the estate was Sh.50,000 per month.

Required:

Calculate the housing benefit due to Paul Matata for the year ended 31 December 2022.

A. Sh.204,000

B. Sh.600,000

C. Sh.540,000

D. Sh.336,000 (2 marks)

3. An objection to a tax decision of the commissioner of domestic taxes must be done within a period not exceeding ______________________.

A. 30 days

B. 14 days

C. 60 days

D. 21 days (2 marks)

4. Deylight Manufacturers Ltd. commenced its operations on 1 January 2022 after incurring the following expenditure:

Sh.

• Factory building 7,780,000

• Processing machinery 2,800,000

• Saloon car 3,500,000

• Forklift 1,400,000

• Generator 1,100,000

The cost of the factory building include cost of staff canteen Sh.800,000 and sports pavilion Sh.600,000.

Required:

Determine the investment allowance due to Deylight Manufacturers Ltd. for the year ended 31 December 2022.

A. Sh.6,920,000

B. Sh.5,950,000

C. Sh.6,380,000

D. Sh.5,550,000 (2 marks)

5. The following instruments are not chargeable to stamp duty EXCEPT ________________________.

A. Instrument of divorce

B. Mortgage agreements

C. Letter of allotment of shares

D. Acknowledgement of debt (2 marks)

6. Alex Mambo is a senior manager of Hyrax Ltd. His employment agreement indicated that he was entitled to a commission of 5% of company’s average monthly sales. The average sales per month for the year 2022 was Sh.104,400 inclusive of value added tax (VAT) at the rate of 16%.

Required:

Determine monthly commission due to Alex Mambo for the year ended 31 December 2022.

A. Sh.4,500

B. Sh.4,750

C. Sh.5,220

D. Sh.4,985 (2 marks)

7. Amos Kiplop is an employee of Neroh Ltd. During the year ended 31 December 2022, he contributed Sh.6,000 per month to Maisha Insurance for his personal life insurance premium and Sh.1,700 per month to National Hospital Insurance Fund (NHIF). How much was his insurance relief for the year?

A. Sh.10,800

B. Sh.13,860

C. Sh.9,240

D. Sh.7,700 (2 marks)

8. The following are reasons why accounting profit may be different from taxable profit EXCEPT _______________.

A. Inclusion of non-taxable income in the income statement

B. Allowable expenses may be omitted in computing taxable profit

C. Inclusion of non-business income in computing accounting profit

D. Use of the same accounting period when computing taxable profit (2 marks)

9. What is the tax position on house furniture provided by an employer to an employee provided with a furnished house?

A. It is a tax-free benefit if below Sh.3,000 per month

B. The taxable amount is 2% per month on the cost of the furniture

C. The taxable amount is 1% per month on the cost of the furniture

D. The taxable amount is 1.5% per month on the cost of the furniture (2 marks)

10. Welview Ltd. had the following expenses in their financial statement for the year ended 31 December 2022:

Sh.

• Advertisement 369,000

• Depreciation 266,000

• Subscription to chamber of commerce 355,000

• Goodwill amortisation 399,000

• Bad debts written off 230,000

Determine the total allowable expenses for Welview Ltd. for income tax purposes.

A. Sh.998,000

B. Sh.954,000

C. Sh.990,000

D. Sh.865,000 (2 marks)

11. The following are circumstances under which a late objection can be accepted by the commissioner EXCEPT ____________________.

A. When the tax payer has no power in the office

B. When the tax payer is sick to the extent that he/she cannot handle his/her tax matters

C. When the tax payer was out of the country

D. When the tax payer is held in a police custody (2 marks)

12. Harrison Mutua received a gross employment income of Sh.1,300,000 for the year 2022. He took a mortgage loan to acquire his own house from Faidah Bank on 1 February 2022 amounting to Sh.3,900,000 at an interest rate of 4% per annum. What is his taxable income for the year ended 31 December 2022?

A. Sh.1,300,000

B. Sh.3,900,000

C. Sh.1,157,000

D. Sh.1,144.000 (2 marks)

13. The following documents should accompany a self-assessment return to the revenue authority EXCEPT ______________________.

A. A list of customers and suppliers

B. A set of final accounts fully audited

C. Tax computation schedule

D. Documents supporting instalment tax paid (2 marks)

14. Derrick Onyango obtained a loan amounting to Sh.4,320,000 from his employer, Linda Ltd, at an interest rate of 9% per annum while the market rate was 12% per annum. What is the fringe benefit tax per month?

A. Sh.3,240

B. Sh.10,800

C. Sh.7,560

D. Sh.3,780 (2 marks)

15. Housing benefit may not be taxed under the following circumstances EXCEPT ______________________.

A. If housing is provided for better performance of duty for example caretaker of a building

B. Housing was necessary for such kind of employment for example a school matron

C. Housing was provided for security reason for instance soldiers in barracks

D. Housing was provided due to position or rank for instance senior management (2 marks)

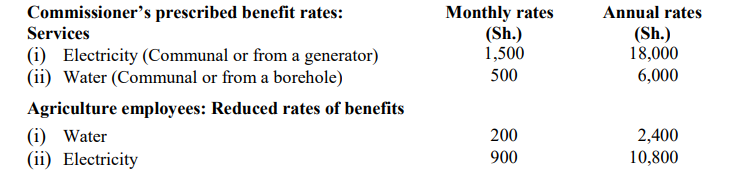

16. Martin Ruru is an employee of Taifa Ltd. During the year ended 31 December 2022, he was provided with a company car of 2500cc which had cost the company Sh.1,500,000 at the beginning of the year. The company paid for his medical expenses amounting to Sh.244,000. The medical scheme was only available to senior managers only.

The company also paid school fees for his son amounting to Sh.78,000 which was expensed in the company’s books. Determine the taxable employment benefits due to Martin Ruru for the year ended 31 December 2022.

A. Sh.640,000

B. Sh.682,000

C. Sh.438,000

D. Sh.322,000 (2 marks)

17. Unity Ferry Ltd. started ship operations in the year 2022 after incurring various capital expenditures among them acquiring a ship of 440 tonnes at a cost of Sh.420,800,000 and telecommunication equipment at a cost of Sh.276,000. Compute Unity Ferry Ltd.’s investment allowance for the year 2022.

A. Sh.210,427,600

B. Sh.105,227,600

C. Sh.242,107,600

D. Sh.210,469,000 (2 marks)

18. Although value added tax (VAT) contributes significantly to government revenue, it has limitations which impact on the government, tax payers and the economy at large. Which of the following is NOT a limitation of VAT?

A. High tax avoidance and evasion where invoicing is not strictly enforced

B. VAT is a direct tax therefore it is hard to shift the tax burden

C. It is discriminatory where some goods and services are not vatable

D. It requires many statutory records which are time consuming to maintain (2 marks)

19. Jezzy Ltd. sold goods to Winny Ltd., a withholding tax agent for Sh.999,050 inclusive of 16% value added tax (VAT). What is the amount of VAT paid by Jezzy Ltd. on the due date in regards to the goods sold?

A. Sh.159,848

B. Sh.137,800

C. Sh.120,575

D. Sh.17,225 (2 marks)

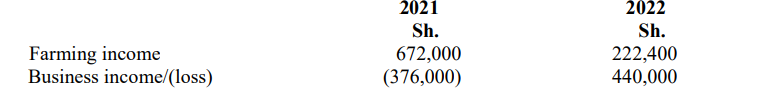

20. Joel Wekesa, a farmer and a sole trader made the following income in the year 2021 and 2022:

What is his total taxable amount for the year ended 31 December 2022?

A. Sh.662,400

B. Sh.894,400

C. Sh.1,112,000

D. Sh.286,400 (2 marks)

21. Nyota Ltd. reported a net profit of Sh.367,500 for the year ended 31 December 2022 after deducting the following expenses:

• General provision for bad and doubtful debts Sh.112,500

• Specific provision for bad and doubtful debts Sh.157,500

• Bad debts written off Sh.75,000

• Depreciation Sh.90,000

• Conveyance Sh.45,000

Determine the adjusted taxable profit for Nyota Ltd.

A. Sh.690,000

B. Sh.615,000

C. Sh.645,000

D. Sh.502,500 (2 marks)

22. Binding assessments are assessments which are final and conclusive. Which among the following is NOT a binding assessment?

A. Assessment determined by local committee

B. Assessment made and no appeal has been made

C. Assessment made and no objection has been raised within the statutory period

D. Assessment awaiting determination by local committee (2 marks)

23. Identify one of the following strategies that cannot be used by the Revenue Authority to enhance tax compliance.

A. Creating awareness by the revenue authority on the roles of taxes and the civic duty to pay taxes

B. Increasing the rates of various taxes for example customs duty and VAT

C. Enhancing efficiency in tax collection for example requiring PIN in some transactions

D. Providing more tax incentives for example tax reliefs and allowances (2 marks)

24. Mercy Mumbih received a loan amounting to Sh.2,000,000 from Tech Ltd., the employer at an interest rate of 12% while the prescribed rate was 14% on 1 January 2022. Determine the low interest benefit due to Mercy Mumbih for the year ended 31 December 2022.

A. Sh.240,000

B. Sh.40,000

C. Sh.100,000

D. Sh.80,000 (2 marks)

25. The following statements are true about stamp duty EXCEPT _____________________.

A. It is levied by the government on certain transactions and documents

B. The rate of stamp duty in urban areas is 4% and in rural areas 2%

C. It is paid in advance and the tax payer does not get a direct reward

D. Its purpose is to legalise the transaction (2 marks)

26. Which of the following measures CANNOT be used by the customs and excise duty departments of your country to prevent dumping.

A. Establishment of the advisory committee to recommend to the minister the imposition of antidumping or countervailing measures on investigated products imported into the country

B. Prohibition and restriction of all imports from time to time and ensuring that the directives are adhered to

C. Pre-shipment and pre-verification of exports done by qualified and reputable inspection firms and

institutions of regular off-shore inspections

D. Collusion between customs officers and importers are policed strictly and heavily penalised (2 marks)

27. The commissioner of income tax has the following options upon receiving a valid objection EXCEPT ___________________.

A. Amend the assessment in light of the objection

B. Keep the documents and not to communicate to the tax payer

C. Amend the assessment in light of the objection with some adjustment

D. Refuse to amend and confirm the assessment (2 marks)

28. Lightway Ltd. is a manufacturing company that prepares its accounts on 31 December every year. On 1 February 2022, the company imported a processing machinery and incurred the following costs:

Sh.

• Cost of machinery 925,000

• Freight charges 150,000

• Insurance on transit 35,000

• Duty paid 205,000

• Installation costs 180,000

What is the qualifying cost for investment allowance which can be claimed by Lightway Ltd. in respect of the processing machines?

A. Sh.1,255,000

B. Sh.1,290,000

C. Sh.1,315,000

D. Sh.1,495,000 (2 marks)

29. Which of the following is a taxable benefit from employment?

A. Employer contribution on behalf of the employee to a registered pension scheme

B. Employer contribution on behalf of the employee to life insurance policy

C. Employer subscriptions on behalf of the employee to a professional body

D. School fees paid by the employer for the employee’s children if it was taxed on the employer (2 marks)

30. Michael Ng’etich borrowed loan from a bank to construct his residential house. During the year he paid Sh.320,000 as interest on loan to the bank. How much did he qualify for mortgage interest deduction?

A. Sh.320,000

B. Sh.150,000

C. Sh.300,000

D. Sh.240,000 (2 marks)

31. Zawadi Moraa received a gross rental income of Sh.2,500,000 in the year ended 31 December 2022 from her residential buildings. The buildings had been constructed through a bank loan where she paid annual interest and principal amount of Sh.350,000 and Sh.768,000 respectively. Determine the rental income tax payable by Zawadi Moraa assuming she takes advantage of the prevailing tax amnesty.

A. Sh.215,000

B. Sh.250,000

C. Sh.138,200

D. Sh.173,200 (2 marks)

32. Which of the following statements are true about an employee with more than one employer as per the Income Tax Act provisions in relation to year of income 2022?

(i) The employer who pays the highest income is considered as the primary employer.

(ii) A secondary employer taxes the employee at a flat rate of 30% PAYE.

(iii) A primary employer treats the employee as a permanent employee and taxes the employee per the normal PAYE brackets.

(iv) The employee can choose who should be the primary and secondary employer.

A. (i) and (ii)

B. (ii), (iii) and (iv)

C. (i) only

D. (i), (ii), (iii) and (iv) (2 marks)

33. Cotek Inspection South Africa is a non- resident company operating in several regions in East and Western Africa. During the year ended 31 December 2022, the company reported a net profit of Sh.4,500,000 from Kenyan operations. How much tax should the company pay to the Revenue Authority for the year 2022?

A. Sh.900,000

B. Sh.1,125,000

C. Sh.1,350,000

D. Sh.1,687,500 (2 marks)

34. The VAT Act (Amended) requires that any trader who carries out a taxable activity should issue an invoice generated by electronic Tax Management System (eTIMS). Which of the following obligations is excluded from the user of eTIMS?

(i) To possess an electronic invoicing system.

(ii) To issue an electronic invoice to a buyer who requests for an electronic invoice.

(iii) To indicate the name of goods, buyer and related prices and quantity.

(iv) To notify the Revene Authority of the failure of electronic system within 24 hours.

A. (i) and (ii)

B. (ii), (iii) and (iv)

C. (ii) only

D. (ii), (iii) and (iv) (2 marks)

35. Which of the following statements concerning self-assessment tax returns for individuals registered for income tax purpose is TRUE?

A. Individuals with income of less than Sh.300,000 in a tax year are not required to file annual tax returns

B. All individuals who submit their annual tax returns on time can have their tax payable calculated by the Revenue Authority

C. Individuals are only required to file annual tax returns for a tax year if they receive a notice from the

Revenue Authority

D. All individuals are required to submit their annual tax returns on or before the due date to the Revenue

Authority whether they have earned income or not (2 marks)

36. Identify the withholding tax rate applicable to legal fees paid to a non-resident company.

A. 5%

B. 10%

C. 15%

D. 20% (2 marks)

37. Which of the following income is exempted from taxable employment income?

A. Jane Kadzo has taken a 3-day sick leave and received Sh.5,000 as sick pay

B. Jerad Maka is reimbursed Sh.10,000 spent on entertaining potential clients

C. Philip Daku received Sh.20,000 as being the best employee of the year

D. Susan Mweni is paid Sh.50,000 as 13th month salary (2 marks)

38. Benard Okaka earns a gross monthly salary of Sh.185,000. He is provided with an entertainment allowance of Sh.25,000 per month and the company has rented him a house at monthly rent of Sh.45,000. The rented house was furnished by the company at Sh.250,000. Determine Benard Okaka’s annual taxable income.

A. Sh.3,310,000

B. Sh.3,090,000

C. Sh.2,932,500

D. Sh.3,060,000 (2 marks)

39. James Mwema is a Kenyan resident serving as an agent for different companies in sales and marketing promotion. In the month of October 2023, he earned a commission of Sh.320,000. What is his withholding tax liability for the month of October 2023?

A. Sh.48,000

B. Sh.16,000

C. Sh.32,000

D. Sh.64,000 (2 marks)

40. Jonathan Bundi is a Finance Manager of Umoja Ltd. He received a gross remuneration of Sh.250,000 for the month of December 2022. His monthly contribution towards National Hospital Insurance Fund (NHIF) was Sh.1,700. Determine the tax payable on the remuneration received net of applicable reliefs.

A. Sh.69,783.35

B. Sh.66,383.35

C. Sh.67,383.35

D. Sh.67,128.35 (2 marks)

41. Which of the following expenses would be an allowable expense when calculating taxable income of a corporate entity?

A. Repairs of a large processing machinery due to breakdown

B. Purchase of computer software

C. Construction of a building extension

D. Purchase of a second hand delivery van (2 marks)

42. Which of the following taxes would be considered as direct taxes?

(i) Withholding tax on interest

(ii) Excise tax on alcohol

(iii) Value added tax

(iv) Import duties on goods and services

A. (i) and (iv)

B. (i) and (iii)

C. (ii) and (iv)

D. (iii) and (iv) (2 marks)

43. Johnson Mwamba placed a bet of Sh.150,000 in a football match between Simba Stars and Chui United. After the end of the game, Johnson Mwamba was rewarded with Sh.680,000. What is the withholding tax on Johnson’s win from the bet?

A. Sh.68,000

B. Sh.34,000

C. Sh.136,000

D. Sh.102,000 (2marks)

44. Milly Chirih was employed as a casual cleaner by The ICT Tech Ltd. for three weeks only in the month of September 2022. Each week she earned Sh.6,000. Determine her tax liability at the end of the month of September 2022.

A. Sh.1,800

B. Sh.2,400

C. Sh.5,400

D. Nil (2 marks)

45. Which of the following would be classified as taxable employment income?

A. Reimbursement cost of fuel for delivering goods to a customer

B. A mobile phone purchased by an employer for office use by the employees

C. Bonus compensation for working in hardship regions

D. Employers’ contribution to a registered pension scheme (2 marks)

46. Zachariah Rioba was employed by Link Ltd. on 1 March 2023. He has not previously filed a self-assessment tax return and therefore wants to know when will be the deadline of filing his return for the year 2023.

Required:

Advise Zachariah Rioba on the last date by which he will be expected to file self-assessment tax return for the year 2023 to avoid late filing penalty.

A. 30th January 2024

B. 31st March 2024

C. 31st December 2023

D. 30th June 2024 (2 marks)

47. Grain Bulk Ltd. is a registered trader for value added tax (VAT) purposes. In the month of September 2023, the company incurred the following expenses exclusive of VAT at the rate of 16% where applicable:

Sh.

Insurance premiums 350,000

Printing and stationery 180,000

Delivery van fuel 86,000

Purchase of goods for sale 2,800,000

Determine the amount of input VAT recoverable by Grain Bulk Ltd. for the month of September 2023 in respect of the above transactions.

A. Sh.546,560

B. Sh.490,560

C. Sh.448,000

D. Sh.461,760 (2 marks)

48. Which of the following information is NOT required to be included on eTIMS valid value added tax (VAT) invoice?

A. The customer’s PIN number

B. The invoice number

C. Terms of payment

D. A description of the services supplied (2 marks)

49. Maven Ltd., started its operations on 1 January 2022 after acquiring telecommunication equipment for Sh.960,000 and other machines worth Sh.256,000. Determine the investment allowance claimable by the company for the year ended 31 December 2022.

A. Sh.240,000

B. Sh.265,600

C. Sh.121,600

D. Sh.304,000 (2 marks)

50. Which of the following statements correctly explain the difference between tax evasion and tax avoidance?

A. Both tax evasion and tax avoidance are illegal, but tax evasion involves providing the Revenue Authority with deliberately false information

B. Tax evasion is illegal, whereas tax avoidance involves the minimisation of tax liabilities using any lawful means

C. Both tax evasion and tax avoidance are illegal, but tax avoidance involves providing the Revenue Authority with deliberately false information

D. Tax avoidance is illegal, whereas tax evasion involves the minimisation of tax liabilities using any lawful means (2 marks)