TUESDAY: 25 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

QUESTION ONE

1. Explain the tax position of a resident individual with respect to the following:

-

- Royalty income (2 marks)

- Loan received from an employer at an interest rate below the market interest rate (2 marks)

2. Identify FOUR ways through which the government might prevent loss of revenue from (4 marks)

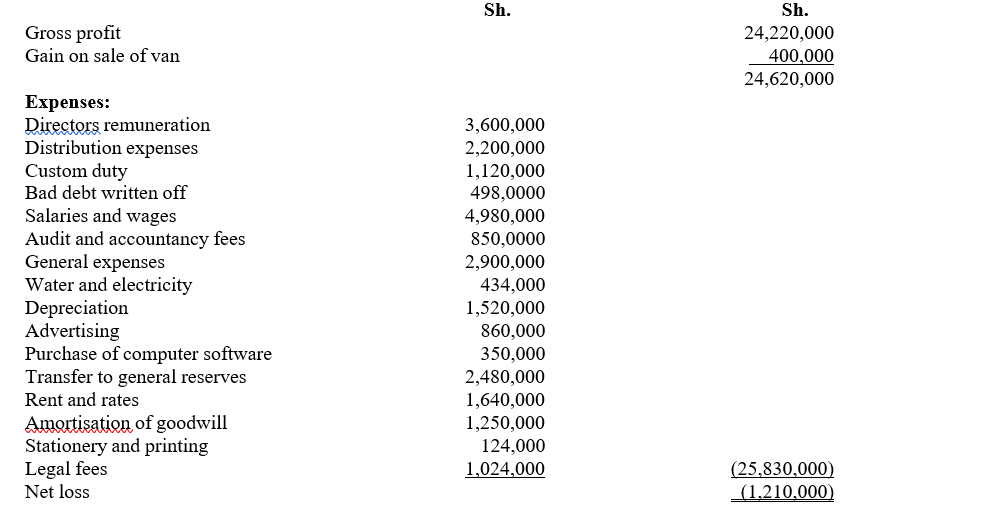

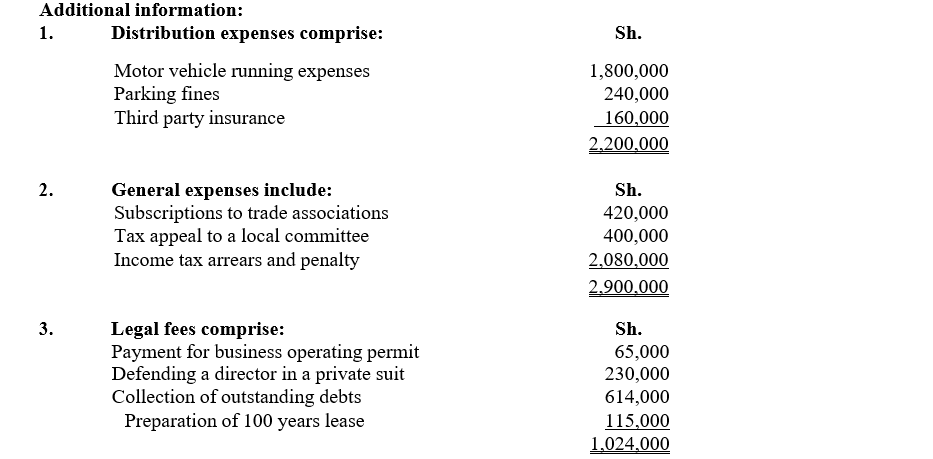

3. Suntech is in trading business. The following is its statement of profit or loss for the year ended 31 December 2022:

Required:

- Compute adjusted taxable profit or loss for Suntech for the year ended 31 December 2022. (10 marks)

- Determine tax payable (if any) by Suntech for the year ended 31 December 2022. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following principles of taxation:

- Elasticity (2 marks)

- Flexibility (2 marks)

2. Identify FOUR reasons that may give rise to an amended assessment by the Commissioner of Domestic Taxes (4 marks)

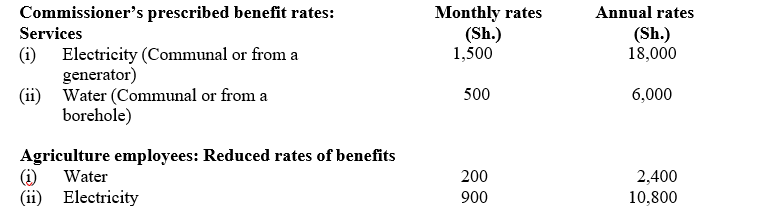

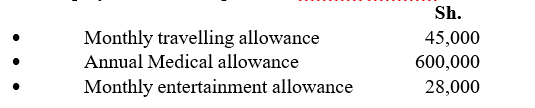

3. Imbaiza Mwatete is the Finance Manager of Rotoh Her employment income for the year ended 31 December 2022 was as follows:

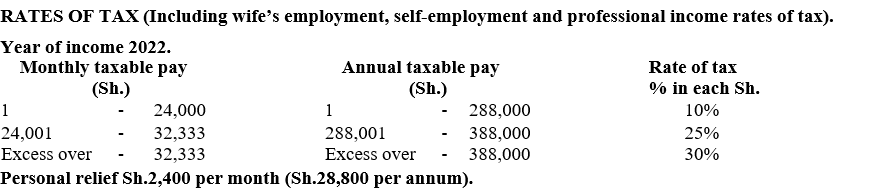

- Her basic salary was 194,000 per month (PAYE Sh.48,000 per month).

- The company pays a gardener for Imbaiza Mwatete at a monthly salary of 25,000.

- The company provided her with meals for 45 days during the year, she did not contribute anything towards this benefits which amounted to 180,000.

- The employment contract provided Imbaiza Mwatete with the following allowances

5. The company provided her with a company house whose market rent was 85,000 per month for which she contributes Sh.35,000 per month.

6. Imbaiza Mwatete incurred reimbursable expenses of 450,000 during the year while performing official duties of the company.

7. The company paid insurance premium of Sh.250,000 during the year for the life insurance cover of Imbaiza Mwatete and her

8. The company contributed 300,000 during the year to a registered retirement fund for the benefit of Imbaiza Mwatete of which 10% was deducted from her employment income.

9. Imbaiza Mwatete received 120,000 as extraneous allowance during the year.

10. She was provided with a 2000cc Saloon car which had been purchased for 1,800,000 from July 2022. The company stopped paying travelling allowance once she was provided with a car.

Required:

- Compute the total taxable income for Imbaiza Mwatete for the year ended 31 December (10 marks)

- Determine the tax payable (if any) from the income calculated in (c) (i) (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Identify FOUR transactions where use of Personal Identification Number (PIN) is required (4 marks)

2. Explain TWO circumstances under which a tax refund may arise to a taxpayer (4 marks)

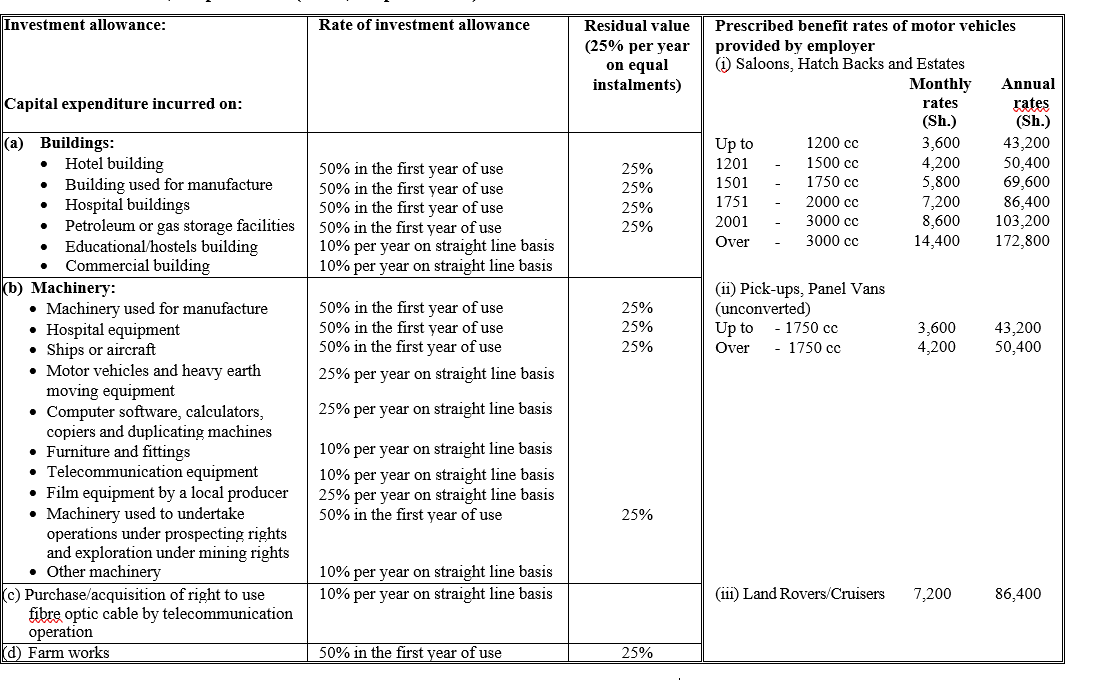

3. Safi Manufacturing Company started its operations on 1 January 2022 producing soft drinks for the local market.

The company acquired the following assets on commencement of its operations:

Additional information:

- Motor vehicles comprised of pick-ups to supply soft drinks to the local

- The cost of trailers was 1,400,000.

Required:

Compute the investment allowance due to Safi Manufacturing Company Ltd. for the year ended 31 December 2022. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in taxation:

- Specific custom (2 marks)

- Advalorem custom duty. (2 marks)

2. Outline FOUR offences under the value added (VAT) act (4 marks)

3. Sabina Kali is a business woman dealing in a variety of value added tax (VAT) designated The following transactions were recorded in the month of December 2022:

December 1: Received a payment of Sh.600,000 from a debtor.

December 3: Sold goods valued at Sh.675,000.

December 5: Imported goods valued at Sh.960,000 being cost insurance and freight excluding import duty and VAT. Import duty rate was 20% during the month.

December 7: Purchased goods locally for Sh.375,000.

December 9: Purchased furniture for Sh.180,000 for office use.

December 11: Paid for bottled water supplied for office use for Sh.45,000.

December 13: Paid motor vehicle branding for Sh.87,500.

December 15: Sold goods on cash valued at Sh.337,500.

December 17: Sold goods to a company based in Tanzania for Sh.255,000.

December 19: Purchased goods locally for Sh.250,000.

December 21: Purchased goods on credit valued out Sh.270,000.

December 23: Sold goods valued at Sh.540,000.

December 29: Paid the following expenses:

All transactions are inclusive of value added tax (VAT) at the standard rate of 16% where applicable.

Required:

Prepare the VAT account for Sabina Kali for the month of December 2022. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following classification of taxes:

-

- Direct taxes (2 marks)

- Indirect taxes (2 marks)

2. Propose TWO ways of tax avoidance that could be engaged by an employed person (4 marks)

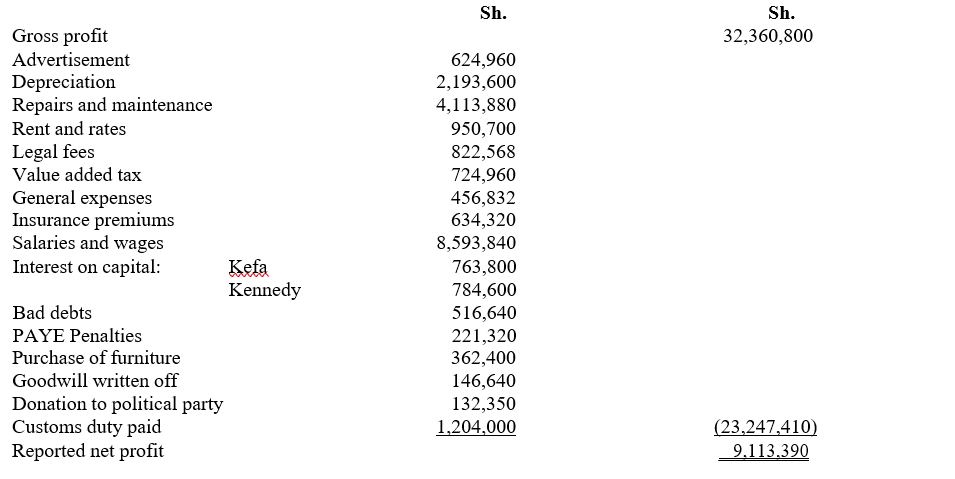

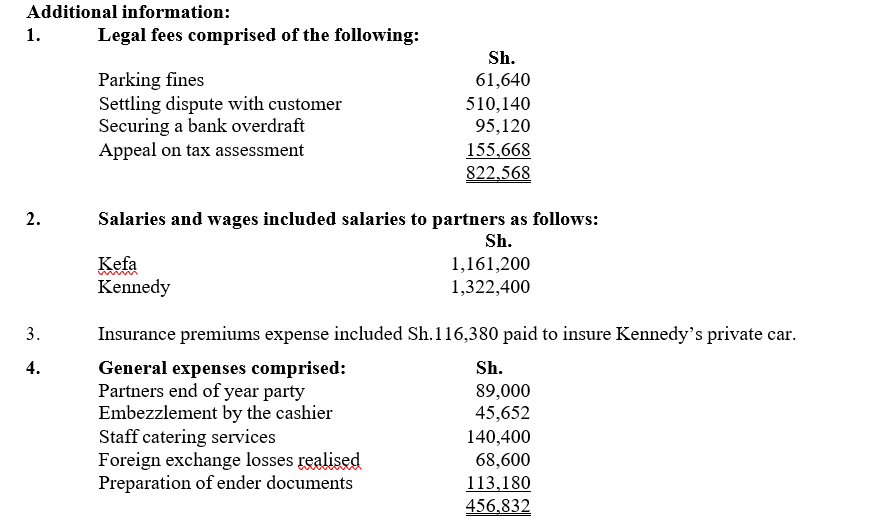

3. Kefa and Kennedy are partners trading as Keken Traders and sharing profits and losses in the ratio of 2:1 respectively

The statement of profit or loss for the year ended 31 December 2022 reflected the following:

5. 70% of bad debts represented the general provision as at 31 December 2022

6. Capital allowances were agreed to be 2,522,000 by the commission of domestic taxes.

7. Half of the rent paid related to the amount paid to Kefa for letting part of his building to the partnership

8. Included in gross profit is Sh.498,000 being profit on sale of motor vehicle

Required:

- Compute taxable profit or loss of the partnership for the year ended 31 December (10 marks)

- Allocation of the profit or loss in (c) (i) above to the (2 marks)