THE ELEMENTS OF COST

The expenditure we are considering in our cost accounting is, of course, the same expenditure (subject to certain considerations which will be mentioned) as that which is dealt with in the financial accounts. It is merely that we are looking at it in a different way. Whereas the financial accounts are normally concerned only with the nature of the expense, e.g. whether it is wages, lighting and heating, etc., the cost accounts are concerned with the purpose of the expense, e.g. whether the wages are in respect of, say, manufacturing or distribution, and if manufacturing, whether they are in respect of labour directly or indirectly concerned with the product, and so on.

Make sure that you clearly UNDERSTAND, and then REMEMBER, the following classifications.

Labour, Materials and Expenses

All expenditure can be classified into three main groups – labour, materials and expenses.

Each of the expenses may be subdivided into one of two categories:

- Items directly applicable to the product, i.e. direct.

- Items which cannot be directly applied to the product, i.e. indirect.

The total of indirect materials, indirect labour and indirect expenses is called overhead.

Fixed and Variable Costs

There is a further subdivision of costs which we may briefly note here (and about which I will say more later), and that is between fixed costs and variable costs. Fixed costs are those which remain constant (in total) over a wide range of output levels, while variable costs are those which vary (in total) more or less according to the level of output. This division is of great significance, and we shall be dealing with it later. Observe, now, that by its very nature “prime cost” consists of variable items only, while the various overhead categories may contain some of each kind.

- Examples of fixed costs: rent, rates, insurance, depreciation of buildings, management salaries.

- Examples of variable costs: raw materials, commission on sales, piece-work earnings.

Definitions

Here are some definitions in this connection, which you must understand clearly:

Direct Labour Cost

This is the cost of remuneration for employees’ efforts applied directly to a product or saleable service which can be identified separately in product costs.

Examples of direct labour, as defined above, would include the costs of employing bricklayers, machine operators, bakers, miners, bus drivers. There is no doubt as to where you would charge these labour costs. Doubt would arise, however, with a truck driver’s wage in a factory. His wage cannot be charged direct to any product, as he is helping many departments and operators. Therefore, his wage would have to be classified as indirect. In a few exceptional circumstances it may be established that the truck driver is employed only to transport materials for the manufacture of one product. If this were the case, his wage could be charged direct to the product, and he would be as much a direct worker as the operator who is using the materials.

Direct Materials Cost

This is the cost of materials entering into and becoming constituent elements of a product or saleable service and which can be identified separately in product cost. The following materials fall within this definition:

- All materials specially purchased for a particular job, order or process.

- All materials requisitioned from the stores for particular production orders.

- Components or parts produced or purchased and requisitioned from the finished goods store.

- Material passed from one operation to another.

We must consider here the term “raw material”. In many cases the raw material of one industry or process is the finished product of another. Thus leather in the form of hides constitutes the finished product of a tannery but the raw material of a footwear factory; while carded wool, the product of the carding process, becomes the raw material of the hardening section.

Direct Expenses

These are costs, other than materials or labour, which are incurred for a specific product or saleable service.

Direct expenses are not encountered as often as direct materials or labour costs. An example would be electric power to a machine, provided that the power is metered and the exact consumption by the machine is known. We can then charge the cost of power direct to the job. More often, however, we will know only the electricity bill for the whole factory, so this will be an indirect expense.

Another example of a direct expense is a royalty payment to the inventor of a product.

Prime Cost

This is the total cost of direct wages, direct material and direct expenses.

Overhead

Overhead is the total cost of indirect labour, indirect materials and indirect expenses.

Examples of indirect materials include oils, cotton waste and grease. Examples of indirect labour include the costs of employing maintenance workers, oilers, cleaners and supervisors. Examples of indirect expenses include lighting, rent and depreciation.

Overheads may be divided into four main groups:

- works or factory expense;

- administration expense;

- selling expense;

- distribution expense.

An Example from the Confectionery Industry

The cost of production of most commodities is made up mainly of the cost of the raw materials of which they are manufactured and the cost of labour which is employed making them, i.e. wages.

To this total of factory cost will be added administration, selling and distribution expenses, to arrive at a figure of total cost, to which will be added profit to give the selling price. (This method of costing is known as Absorption Costing – see later.)

The example given above is of a “process” industry in which the product passes from one process to the next. Unless production is shut down completely at the end of each accounting period, which would be most uneconomical, there will at all times be some product “in the pipeline” at various stages of completion which will be credited against the charges for the period in question and become the opening charge for the subsequent period. These opening and closing adjustments are always necessary.

An Example from the Photographic Industry

Let us now consider a business which manufactures cameras, where the amount of labour involved in manufacture is small compared with the amount of precision machinery which is necessary for the manufacture of efficient apparatus. In such an industry, costs arising from the depreciation and obsolescence of machinery may be of much greater importance compared with the cost of materials and labour than they were in the case of the confectionery manufacturing company. These charges which are related only indirectly to output are said to constitute indirect expenditure, as against materials and labour and other similar items which constitute direct expenditure.

In addition to depreciation, all the charges incurred in the general offices (such as salaries of managers, rent and rates) together with the expenses involved in marketing the product (such as advertising and carriage) must be included in the indirect expenses. You will appreciate, therefore, that in order to give a reflection of the cost of production for each unit of output, accounts must be prepared to show the allocation of these indirect expenses as well as the direct expenses (provided it is intended to follow Absorption Costing methods rather than Marginal Costing – see later).

BASIC COSTING METHODS

The basic costing method employed by an organisation must be devised to suit the methods by which goods are manufactured or services are provided. The choice is between specific order costing, service/function costing and continuous operation/ process costing.

Specific Order Costing

This costing method is applicable where the work consists of separate contracts, jobs or batches, each of which is authorised by a special order or contract.

The subdivisions of specific order costing are:

Job Costing

This applies where work is undertaken to a customer’s special requirements. Each “job” is of comparatively short duration. Throughout the manufacturing process, each job is distinct from all other jobs. Examples of industries using job costing are: building maintenance, certain types of engineering (e.g. manufacture of special purpose machines) and printing.

Batch Costing

This is a form of specific order costing which applies where similar articles are manufactured in batches, either for sale, or for use within the undertaking. In most cases the costing is similar to job costing.

Contract Costing

This applies when work of long duration is undertaken to customers’ special requirements, e.g. builders, civil engineers, etc.

In job costing, costs of each job (or batch) can be separately identified.

Continuous Operation/Process Costing

This is the basic costing method applicable where goods or services are produced by a sequence of continuous or repetitive operations or processes to which costs are charged before being averaged over the units produced during the period. This procedure is widely used, for example, in the chemicals industry.

Service/Function Costing

This is the method used for specific services or functions, e.g. canteens, maintenance and personnel. These may be referred to as service centres, departments or functions.

COST CENTRES AND COST UNITS

Cost Centre

A cost centre is a location, function or item of equipment in respect of which costs may be ascertained and related to cost units for control purposes. A cost centre may be a productive department, an individual machine, a service department such as stores serving the productive departments, etc.

Cost Unit

This is a quantitative unit of product or service in relation to which costs are ascertained. For instance, in paint manufacture, costs would be ascertained “per litre of paint”. The litre of paint is therefore the cost unit.

Examples of cost units in other activities are:

| Accounting | Account maintained | |

| Brewing | Barrel of beer racked | |

| Brickmaking | 1,000 bricks | |

| Building industry | Complete job or contract | |

| Cable manufacture | 1,000 yards (or m) of cable | |

| Canteen | Employee or meal served | |

| Chemicals industry | Per gram, kg, etc. depending on relative quantity | |

| produced | ||

| Power station | Kilowatt/hours | |

| Gravel or sand pits | Cubic yard/metre extracted | |

| Hospitals | Per patient-day, or per bed-week | |

| Invoicing | Per 100 or 1,000 invoices | |

| Liquids | Gallon, litre | |

| Maintenance | Operating hour or value of asset | |

| Metal plating | Square foot/metre | |

| Police service | Per 1,000 population or per constable-day | |

| Printing | Ream or 1,000 copies | |

| Public transport | Miles run, passenger-mile, 100-seat mile or fare-stage | |

| Purchasing | Per order placed, or value of materials | |

| Sales order department | Per enquiry, or value of sales made | |

| Sales representative | Per call or value of sales made | |

| School | Per pupil-day or per examination passed | |

| Steam | 1,000 lbs steam raised | |

| Storage | Tonne of material, gallon or litre of liquid, value of | |

| materials | ||

| Street cleaning | 1,000 population, or mile of road | |

| Street lighting | Lamp or mile of road | |

| Timber | 1,000 cu. ft, board-foot, etc. | |

| Typing | Space, line typed or standard document typed | |

| Water supply | 1,000 population or 1,000 gallons produced | |

| Window cleaning | per window or 100 sq. yds | |

Profit Centre

A profit centre is a location or function in respect of which both expenditure and income may be attributable. A profit centre may be a division of the business or a specific function within the organisation. In order that true profitability may be assessed, it is necessary to install procedures to transfer-charge all relevant costs and revenue to the profit centre. Ideally, the net costs of all central operating areas should be allocated, on an agreed basis, to profit centres.

The development of the profit centre concept means that profit centres have come to act as a focal point for the collation of cost centres and the provision of useful high-level management information. Examples of profit centres in the financial services industry are:

− UK clearing banking

− Merchant banking

− Credit card operations

− Corporate banking − International banking.

SUPERIMPOSED PRINCIPLES AND TECHNIQUES

Whichever costing method is in use (a choice which will be largely dictated by the production method), there is a choice of principles and techniques which may be adopted in presenting information to management. These are introduced briefly here, and we will study some of them in detail later.

Absorption Costing

This principle involves all costs, including the costs of selling and administration, being allotted to cost units. Total overheads are “absorbed”, via the method thought most appropriate.

Marginal Costing

This is a principle whereby variable costs only are charged to cost units, and the fixed cost attributable to the relevant period is written off in full against the “contribution” for that period, contribution being the difference between total sales value and total variable costs. At this stage therefore, remember when using marginal costing, do NOT attempt to apportion fixed costs to individual cost units.

Actual Cost Ascertainment

This is the ascertainment of costs in retrospect, after they have been incurred. It is also known as historical costing.

Variance Accounting

This is a technique whereby the planned activities of an undertaking are quantified in budgets, standard costs, standard selling prices and standard profit margins. These are then compared with the actual results, and note is taken of the differences, i.e. the “variances”, for subsequent examination.

Differential Costing

This is a technique used in the preparation of “ad hoc” information, in which only cost and income differences between alternative courses of action are taken into consideration. In other words, any costs which would be incurred whatever decision were taken, are ignored.

Incremental Costing

This is another technique used in the preparation of “ad hoc” information. Here consideration is given to a range of graduated or stepped changes in the level or nature of activity, and the additional costs and revenues likely to result from each degree of change are presented.

Uniform Costing

This is the use by several undertakings of the same costing system (i.e. the same basic method, specific order costing or operation costing, and the same superimposed principles and techniques, e.g. absorption costing rather than marginal costing). Uniform costing enables the results of the various organisations concerned to be compared. In many industries, a trade association advises member firms on costing methods, and collects data from them, which is then circulated to member firms so that they can see how they compare with other firms in the industry. Strict anonymity is, of course, maintained.

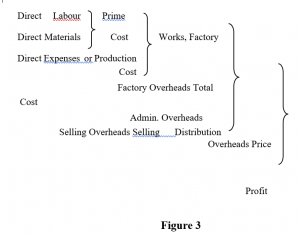

To recapitulate at this stage, a reminder of the total cost structure, within the context of Absorption Costing, can be represented as follows:

SOME MORE TERMINOLOGY

Controllable and Uncontrollable Costs

Sometimes reference is made to costs being either “controllable” or “uncontrollable”. As we have seen already, costs are charged or allocated to cost centres. Each cost centre has an officer in control. Costs are said to be “controllable” when the costs charged can be influenced by the actions of this person in charge. Where they cannot, they are of course “uncontrollable” costs. Sometimes controllable costs are referred to as “managed costs”.

Avoidable and Unavoidable Costs

“Avoidable costs” are the specific costs of part of an organisation which would be avoided if that part or sector/activity did not exist. Another term for this is “relevant costs”. It follows, therefore, that “unavoidable costs” are those that are unaffected by a particular decision. As they are in fact irrelevant to the decision, they are also known as “irrelevant costs”.

DIFFERENCE BETWEEN ABSORPTION AND MARGINAL COSTING SYSTEMS

We have already looked at the broad divisions between Absorption and Marginal Costing systems but we have not yet considered them in detail. This we will do later in the course. In the meantime, let us consider a case which may indicate more clearly the difference