December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain the following concepts:

Going concern concept. (2 marks)

Consistency concept. (2 marks)

Materiality concept. (2 marks)

2. Describe the following types of errors:

Error of Omission. (2 marks)

Error of Commission. (2 marks)

Error of principle. (2 marks)

3. Explain four functions of accounting. (8 marks)

(Total: 20 marks)

QUESTION TWO

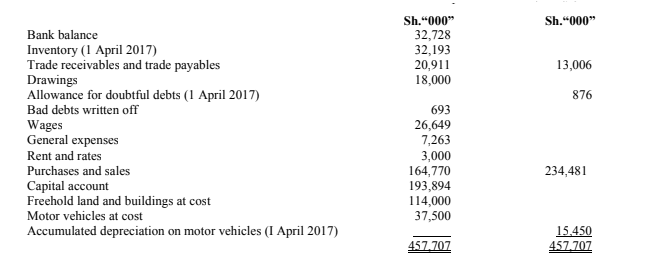

The following trial balance was extracted from the books of Jacob Barasa, a sole proprietor as at 31 March 2021:

Additional Information;

- Rent and rates amounting to Sh 300,000 were prepaid as at 31 March 2021.

- During the year, Barasa took goods costing Sh 1,250,000 for his own use. No entry has been made in the books in respect of this.

- The allowance for doubtful debts is to be increased by Sh. 104,000.

- The wages outstanding as at 31 March 2021 amounted to Sh. 271,000.

- Inventory as at 31 March 2021 was valued at Sh. 34,671,000.

- During the year, a vehicle which had cost Sh. 2,500,000 and had a net book value of Sh. 1,000,000 was sold for 1,500,000.

No entry had been made in the books to record this, other than to credit the sales proceeds to the motor vehicles account. 7. The depreciation on motor vehicles for the year amounted to Sh.7,000,000.

Required:

1. Statement of profit or loss for the year ended 31 March 2021. (12 marks)

2. Statement of financial position as at 31 March 2021. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain two reasons why it is necessary to prepare a bank reconciliation statement. (4 Marks)

2. On 2 May 2021, Mapato Ltd. received their monthly bank statement which showed an overdraft of Sh. 212,900. This amount did not agree with the credit balance of Sh.607,600 shown in the bank column of the cashbook. Upon investigation the following was revealed:

- The bank statement recorded that a cheque for Sh.18,500 paid into the bank had been subsequently dishonoured. The company was unaware of this.

- Bank charges for the month of April 2021 amounting to Sh. 4,800 had been omitted from the cash book.

- A page in the cashbook of debits entries had been undercast by Sh. 52,100 and the incorrect total carried forward in the next page.

- A hire purchase agreement for equipment had been entered into by the company that required Sh. 12,000 to be paid every month for the two years. The first payment was due on 20 February 2021. These amounts were correctly entered by the company, but the bank had inadvertently debited another company.

- A dividend cheque received for Sh. 34,000 had been entered twice in the cashbook.

- The company’s agent had deposited a cheque of Sh. 155,000 into Mapato Ltd bank account, but this was not indicated on the bank statement.

- A standing order of Sh. 11,000 had been duly paid by the bank, but there was no record in the cashbook.

- A cheque totaling Sh. 492,000 had been delivered to suppliers on 30 April 2021 but none of these had been presented to the bank.

- A cheque for Sh. 15,400 had been received from a customer on 25 April 2021 had been entered in the cash book as at Sh. 14,500.

Required:

An updated cash book as at 30 April 2021. (10 marks)

Bank reconciliation statement as at 30 April 2021. (6 marks)

(Total: 20 marks)

QUESTION FOUR

A and B are partners sharing profits and losses in the ratio of 3:2 respectively. The partnership agreement provides for B to receive a salary of Sh. 8 million per annum. Interest on capital allowed at the rate of 5% per annum.

Their statement of financial position as at 31 July 2020 was as follows:

Additional Information:

- On 1 November 2020, C was admitted to the partnership. The terms of her admission were as follows:

Interest on capital was raised from 5% per annum to 6% per annum for all partners.

C introduced Sh. 24 million in cash as capital into the partnership.

C received a salary of Sh. 12million per annum. Lucy’s salary was raised to Sh.12million per annum.

The profit-sharing ratio for A, B and C was adjusted to 4:2:1 respectively.

- The profit for the year ended 31 July 2021 was Sh.111,570,000

- As at 31 July 2021, the working capital of the partnership was as follows:

Sh.“000”

Inventory 25,110

Accounts receivable 7,000

Cash 17,260

Accounts payable and accrual 6,960

- Partners drawings for the year ended 31 July 2021 were as follows:

Sh.“000”

A 51,410

B 39,050

C 16,500

- The non-current assets are to be depreciated as follows:

Asset Rate per annum

Premises 5% on cost

Equipment 10% on cost

Required:

1. Statement of profit or loss and appropriation account for the year ended 31 July 2021. (10 marks)

2. Partners current accounts. (4 marks)

3. Statement of financial position as at 31 July 2021. (6 marks)

(Total: 20 marks)

QUESTION FIVE

The following balances were extracted from the books of Red Sports Club for the year ended 30 June 2020:

Sh.“000”

Land at cost 90,000

Equipment (cost Sh. 25,000,000) 20,000

Furniture and fittings Cost Sh. 80,000,000 46,000

Bar inventory 18,400

Subscriptions in arrears 5,000

Bank balance 4,500

Long term balance bank deposits 12,000

Long term loan 96,000

Bar creditors 16,800

Subscriptions in advance 1,600

Accrued barwages 2,300

The Clubs receipts and payments account for the year ended 30 June 2021 was aa follows:

Additional Information:

- The following information relates to the clun as 30 June 2021:

Sh“000”

Subscriptions in arrears 4,000

Bar creditors 16,000

Bar Inventory 19,800

Subscription in advance 2,400

Bar wages due 3,200

- Interest receivable on long term deposits amounted Sh.2,200,000

- The long-term loan repaid in annual instalments of Sh.30,000,000 excluding interest. The interest for the year ended 30 June 2021 was Sh.9,200,000.

Depreciation is provided as follows:

Asset Rate per annum Method

Equipment 10% Straight line

Furniture and fittings 15% Reducing balance

It is the policy of the club to charge a full years’ depreciation on assets in the year of purchase and no depreciation in the year of disposal.

Required:

1. Bar statement of profit or loss for the year ended 30 June 2021. (4 marks)

2. Statement of income and expenditure for the year ended 30 June 2021. (8 marks)

3. Statement of financial position as at 30 June 2021. (8 marks)

(Total: 20 marks)