WEDNESDAY: 23 August 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

The following trial balance relates to Antony Holdings, a sole trader, as at 30 June 2023:

Additional information:

1. Inventories as at 30 June 2023 were valued at Sh.56 million being the lower of the cost and the net realisable value.

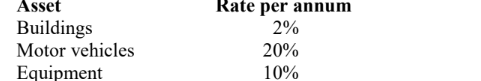

2. Depreciation on property, plant and equipment is to be provided on straight line basis at the following rates:

3. At 30 June 2023, prepaid insurance amounted to Sh.400,000 while accrued rent was Sh.1,400,000.

Required:

Statement of profit or loss for the year ended 30 June 2023. (12 marks)

Statement of financial position as at 30 June 2023. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe TWO roles that ledger accounts play towards the preparation of financial statements of a business entity. (4 marks)

2. Nexton Ltd. manufactures sports equipment. The following balances were extracted from the books of account of the company as at 31 December 2022:

2. The values of opening and closing inventory are given at the transfer price.

3. Finished goods are transferred from factory to sales at a mark-up of 20%

4. Rent is to be apportioned between the factory and office in the ratio of 3:1.

Required:

Manufacturing account for the year ended 31 December 2022. (8 marks)

Statement of profit or loss for the year ended 31 December 2022. (8 marks)

(Total: 20 marks)

QUESTION THREE

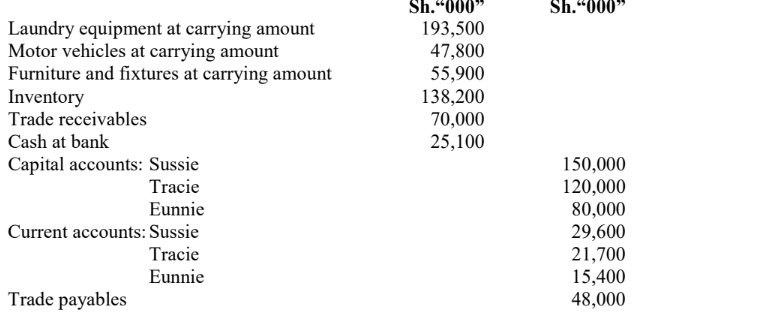

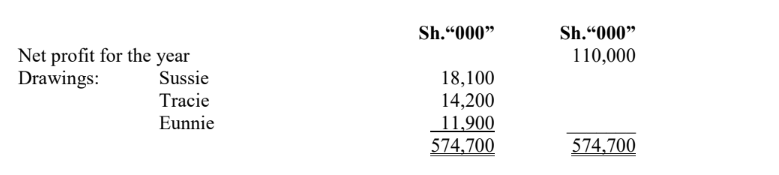

Sussie, Tracie and Eunnie have been partners in a casual wear business for many years sharing profits and losses in the ratio 2:2:1 respectively, after allowing for 10% per annum interest on their capital balances.

The latest trial balance as at 31 December 2022 extracted from the accounting records of the partnership showed the following position:

Following serious disagreements among the partners on the running of the business, the partnership was dissolved with effect from 1 January 2023.

Additional information:

1. Each partner took over a portion of inventory in the profit sharing ratios to set up individual businesses. The inventory had a value of Sh.120,000,000.

2. Tangible non-current assets were sold at a public auction and realised the following amounts:

3. Trade receivables and trade payables were settled net of discounts at the rates of 5% and 10% respectively.

4. The auctioneer’s fees which amounted to Sh.5,000,000 were paid in cash.

Required:

Prepare the following ledger accounts to close off the books of the partnership upon dissolution:

Realisation account. (6 marks)

Cash at bank account. (6 marks)

Partners current accounts. (4 marks)

Partners capital accounts. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. With regards to public sector accounting, explain the following accounting techniques as used by the public sector entities:

Commitment accounting. (2 marks)

Budget accounting. (2 marks)

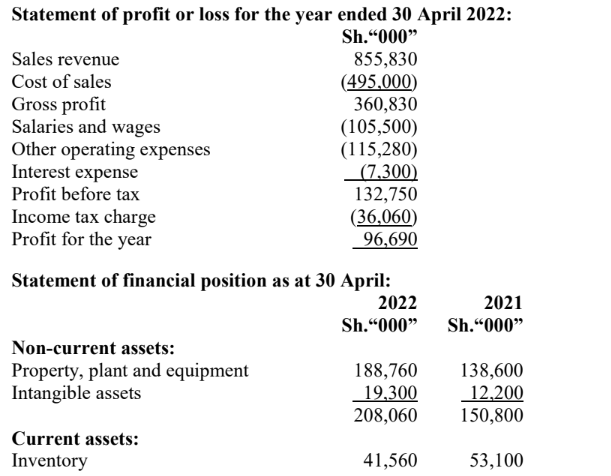

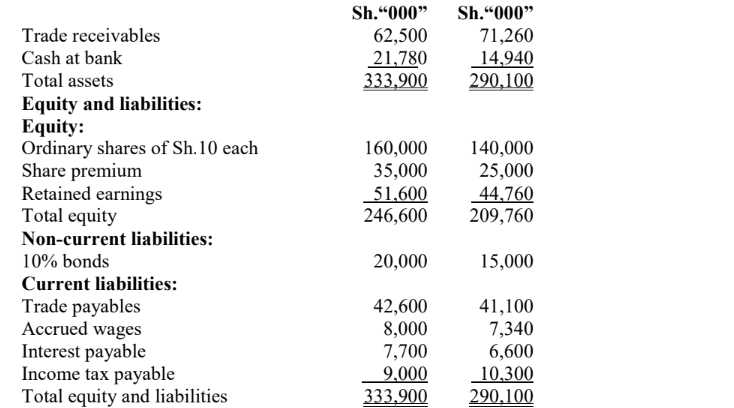

2. The following financial information was extracted from the accounting records of Focus Limited, a medium-sized, private limited liability entity:

Additional information:

1. During the year ended 30 April 2022, an item of plant with a carrying amount of Sh.25 million was

disposed of at a loss of Sh.4 million which had been included in the other operating expenses.

2. Depreciation charged to other operating expenses amounted to Sh.37.7 million.

3. Focus Limited renewed its trade licences at a cost of Sh.10 million on 1 July 2021.

4. Assume that all sales and purchases were made on credit basis.

Required:

Prepare a statement of cash flows for Focus Limited for the year ended 30 April 2022 using the direct method as per International Accounting Standard (IAS) 7 “Statements of Cash Flows”. (16 marks)

(Total: 20 marks)

QUESTION FIVE

1. Identify the accounting information needs for the following users of financial statements:

Investors. (2 marks)

Employees. (2 marks)

Lenders. (2 marks)

Government. (2 marks)

2. Differentiate between the following set of financial statements:

“Statement of financial position” and “statement of profit or loss”. (4 marks)

“Statement of change in equity” and “the statement of cash flows”. (4 marks)

3. Explain FIVE uses of control accounts in an organisation. (4 marks)

(Total: 20 marks)