WEDNESDAY: 26 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Citing examples, describe the intangible heritage assets with reference to International Public Sector Accounting Standard (IPSAS) 31 “Intangible Assets”. (4 marks)

2. Differentiate between “not-for-profit entities” and “profit-driven entities”. (4 marks)

3. Outline FOUR disadvantages of a sole proprietorship business. (4 marks)

4. With reference to double entry book-keeping, explain the concept of the “accounting equation”. (4 marks)

5. In the context of manufacturing accounts, differentiate between the following elements of costs:

“Variable costs” and “fixed costs”. (2 marks)

“Direct costs” and “indirect costs”. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Japeth Willis, a sole trader had an opening balance as at 1 May 2021 on his trade receivables account of Sh.253,000.

During the year ended 30 April 2022, the business made credit sales of Sh.1,317,000 and received cash from credit customers amounting to Sh.1,265,000. Outstanding debts of Sh.5,000 were considered irrecoverable and therefore were written off.

Japheth Willis makes a provision for doubtful debts at the rate of 5% of the outstanding receivables balances.

Required:

Prepare the following for the year ended 30 April 2022:

Trade receivables account. (2 marks)

Allowance for doubtful debts account. (2 marks)

Irrecoverable debts expense account. (2 marks)

2. Keikei Limited, a public limited entity has been in manufacturing and distribution business for several years and owns a wide range of property, plant and equipment.

Its property, plant and equipment as at 1 November 2021 comprised of:

Additional information:

1. On 1 November 2021, Keikei Limited adopted revaluation model for its property and revalued it to a fair value of Sh.105,000,000 million for land and Sh.360,000,000 million for buildings.

The property was acquired on 1 November 2011 and buildings were being depreciated at the rate of 2% per annum on straight line basis.

2. The company disposed of a fleet of old distribution vehicles during the year for cash proceeds of Sh.45,000,000 million. These vehicles had cost Sh.100,000,000 million and had an accumulated depreciation of Sh.60,000,000 million as at 1 November 2021.

During the year to 31 October 2022, the company acquired new motor vehicles at a cost of Sh.75,000,000 million. Motor vehicles are depreciated at the rate of 20% per annum on straight line basis.

3. On 1 May 2022, the company entered into a lease contract for the right-of-use of an item of plant whose economic useful life was 10 years. The term of the lease was agreed at 5 years and the asset would revert to the lessor at the end of the lease term. The initial cost of the right-of-use asset was Sh.20,000,000 million.

Plant and equipment, other than the leased plant, are depreciated at the rate of 15% per annum on reducing balance basis.

4. New fittings were acquired at a cost of Sh.10,000,000 million during the year ended 31 October 2022.

Fixtures and fittings are depreciated at the rate of 10% per annum on a straight line basis.

5. The company’s policy is to provide full year depreciation in the year of asset acquisition and non in the

year of disposal.

Required:

A non-current asset movement schedule for Keikei Limited as at 31 October 2022. (14 marks)

(Total: 20 marks)

QUESTION THREE

1. Summarise the rationale of control accounts and control account reconciliations. (6 marks)

2. The following balances of assets and liabilities were obtained from the accounting records of Stars Sports Club as at 31 May:

Additional information:

- Depreciation on non-current assets is to be provided based on the book values at the following rates:

- Petty cash balance relates to bar activities.

Required:

Bar statement of profit or loss for the year ended 31 May 2022. (4 marks)

Income and expenditure account for the year ended 31 May 2022. (4 marks)

Statement of financial position as at 31 May 2022. (6 marks)

(Total: 20 marks)

QUESTION FOUR

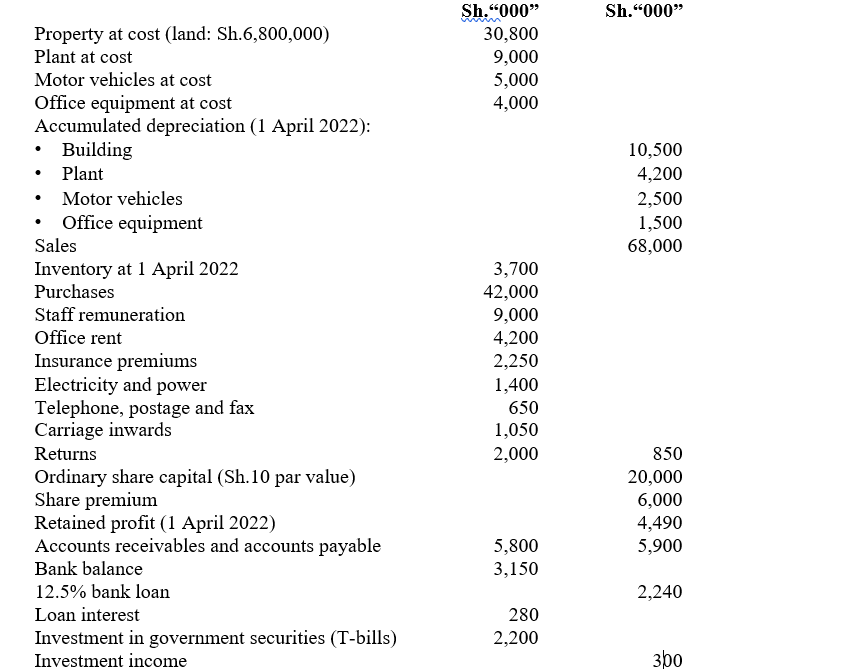

The following trial balance extracted as at 31 March 2023 relates to United Limited:

Additional information:

- Inventory as at 31 March 2023 had a value of Sh.4,000,000.

- The company paid insurance premiums on 1 April 2022 to cover a period of 15 months at a monthly rate of Sh.150,000.

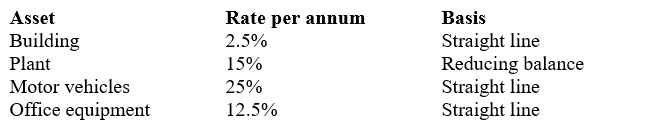

- Depreciation on property, plant and equipment is to be provided as follows:

4. A provision for current tax of Sh.1,350,000 for the year ended 31 March 2023 is required.

Required:

1. Statement of profit or loss for the year ended 31 March 2023. (12 marks)

2. Statement of financial position as at 31 March 2023. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe THREE benefits of preparing bank reconciliation statements. (6 marks)

2. Explain the term “ratio analysis”. (2 marks)

List FOUR limitations of ratio analysis. (4 marks)

3. Harmony Limited extracted its trial balance as at 30 November 2022 which did not balance and the difference was posted to a suspense account.

Upon investigations, the book-keeper discovered the following errors and omissions in the preparation of the ledger accounts:

- Accrued operating expenses of Sh.340,000 had been omitted from the books.

- Cash of Sh.500,000 paid for plant repairs and maintenance was correctly accounted for in the cash book, but was erroneously credited to the plant cost account.

- A cheque for Sh.2,300,000 paid for the purchase of equipment was posted to the relevant ledger accounts as Sh.3,200,000.

- During the year ended 30 November 2022, a motor vehicle which had cost Sh.1,200,000 and had an accumulated depreciation of Sh.480,000 was disposed of for cash proceeds of Sh.680,000.

The only accounting entries passed were to debit the cash proceeds to the cashbook and crediting the suspense account.

- A cash receipt of Sh.450,000 from a credit customer had been correctly entered in the cashbook, but no corresponding entry was made in the books of accounts.

- Interest revenue of Sh.25,200 was erroneously recorded on the credit side of interest expense account.

Required:

Prepare the relevant journal entries to correct the above errors and omissions. (8 marks)

(Total: 20 marks)