Facts

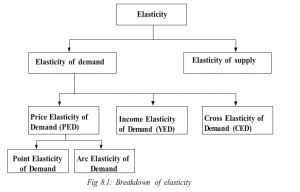

The degree of reaction of dependent variables to changes in independent variables is what is called elasticity. An independent variable is a factor that has an influence on another associated factor (that is called a dependent variable). Price of a commodity, income of the consumer and price of related commodities are examples of independent variables. These independent variables have a direct influence on dependent variables such as quantity demanded or quantity supplied.

8.2. ELASTICITY OF DEMAND

Facts

Elasticity of demand is a measure of the degree of responsiveness of quantity demanded of a commodity to changes in factors that affect demand. When factors that influence quantity demanded such as price of the commodity, income of the consumer, or price of related commodities change, the quantity demanded of a commodity responds. However, our main concern is the percentage of this response. Elasticity of demand thus measures the percentage of such response.

In your study of the demand schedules in the group activity at the beginning of this unit, you discovered that quantity demanded of commodities V, X, Y and Z responded differently to price changes. The difference in their response shows these commodities have a difference in their price elasticity of demand.

In this unit, we shall categorise elasticity of demand into:

- Price elasticity of demand.

- Income elasticity of demand.

- Cross elasticity of demand.

Price elasticity of demand refers to a measure of the degree of the responsiveness of quantity demanded of a commodity to changes in its own price. When the price of a commodity increases or decreases, its quantity demanded reacts to a certain extent. Quantity demanded may reduce, increase or even remain constant. Price elasticity of demand therefore measures the extent of this reaction.

Price elasticity of demand is measured as a percentage change in quantity demanded to the percentage change in price.

Price elasticity of demand may be categorised into:

- Perfectly inelastic demand.

- Inelastic demand.

- Unitary elastic demand.

- Elastic demand.

- Perfectly elastic demand.

Elastic demand

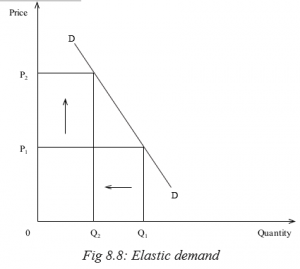

When demand is elastic, then PED>1<∝

A change in price results into a proportionately bigger change in quantity demanded. Consumers vigorously respond to changes in price. There is a smaller change in price leading to a bigger change in quantity demanded. As the price changes, consumers buy much less of the commodity.

As price increases from OP1 to OP2 (a smaller change), quantity demanded responds by changing from OQ1 to OQ2 (a bigger change).

8.2.1.5 Perfectly elastic demand

When demand is perfectly elastic, then PED =∞.

There is a constant price. Quantity demanded changes. At a constant price, consumers vary the amounts of a commodity they buy.

Point elasticity: This is the price elasticity at a point on the demand curve. It gives price elasticity with a complete accuracy at a point

Arc elasticity: This represents the coefficient of price elasticity between two points on the demand curve. It is an estimate of the elasticity along a range of the demand curve.

Discovery

The following are the determinants of price elasticity of demand:

- Consumer income.

- Price expectations.

- Price of the commodity.

- Degree of urgency involved.

- Consumers’ ignorance.

- Habit forming commodities.

- Durable products.

- Several uses of the commodity.

Facts

- Consumer’s income: Generally consumers with high incomes have inelastic demand. At any price, they will purchase the commodity they want because their purchasing capacity is high. Low-income earners have elastic demand. When the price increases, their purchasing capacity is affected and so they purchase less of the commodity.

- Availability of substitutes: Commodities with close substitutes have elastic demand. This is because when their prices increase and those of their substitutes remain constant, consumers shift to substitutes. Commodities with no close substitutes have inelastic demand.

- Price expectations: When prices are expected to increase in future, demand for such commodities becomes inelastic. When there is an increase in price in the current period, consumers may not cut on their purchases because they expect prices to increase further in the coming days.

- Price of the commodity: Cheap commodities have inelastic demand. Commodities like matchboxes, razor blades, needles are really cheap. The price of a matchbox is around 50 FRW. Even if there is 100% increase in its price, still it remains cheap and affordable. Its demand thus becomes inelastic. However expensive commodities have elastic demand.

- Degree of urgency involved: Urgently needed commodities have inelastic demand. A sick person will be ready to pay any price for medicine that the doctor has prescribed. Necessities have inelastic demand, such that even if their prices increase or reduce, consumers have to buy almost the same quantities. Luxuries however have elastic demand. If consumption of a commodity can be postponed, its demand becomes elastic.

- Consumer’s ignorance: When consumers are ignorant of the market conditions, demand becomes inelastic. For instance, a commodity may have substitutes. But the consumer is not aware. So when its price increases, the consumer will continue to purchase it not knowing that there is a close substitute, which is even cheaper.

- Habit forming commodities: Commodities whose consumption develops habit tend to have inelastic demand. Even if their prices change, consumers consume the same quantities. Drug addicts will be ready to pay any price to acquire the commodity.

- Advertising: Promotional advertising may make demand inelastic. Consumers may be made to buy a commodity at high price because of persuasive advertising.

- Durable commodities: Highly durable commodities have inelastic demand. A flat iron box for instance, is durable and lasts for over a year. Even if the price of the iron box reduces by a bigger percentage, the customer may not buy another iron box.

- Several uses of the commodity: Commodities that serve many functions have elastic demand. When their prices increase, consumers only buy them for the most important of their uses. Their quantity demanded so reduces. Commodities with single functions have inelastic demand.

8.2.3 Practical applications of price elasticity of demand

Activity 8.12

Using your knowledge of elasticity of demand, discuss and identify real life situations where you can apply elasticity of demand. Make class presentations of your discoveries.

The concept of price elasticity of demand is essential to:

- The government.

- The producer.

- The consumer.

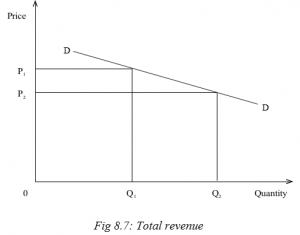

Price elasticity of demand enables the producer to decide whether to increase or decrease the price in order to increase total revenue.

If price elasticity of demand is elastic, producers’ total revenue increases when the price is reduced.

When price elasticity of demand is inelastic, producers’ total revenue increases when prices are increased.

Price elasticity of demand is helpful to the monopolist when practising price discrimination. A low price should be charged in a market where price elasticity of demand is high/elastic. Similarly, a high price should be charged in a market with a low/inelastic price elasticity of demand.

Price elasticity of demand helps the producer to determine the wage level for his or her workers. When demand is inelastic, wages should be increased as the price increases. Producer’s incomes will be high when the price rises. So, the producer can increase workers’ wages.

The government sometimes devalues its currency. This is done to increase the volume of exports by making them cheap in a foreign currency. Devaluation also reduces the volume of imports by making them expensive in the domestic currency. In order for devaluation to succeed elasticity of demand and supply for both imports and exports should be elastic.

Price elasticity of demand helps government to decide which commodities to tax. Government levies taxes with various objectives. Taxes may be used as sources of revenue, or used to reduce consumption of particular commodities. In order to increase tax revenue, the government should tax more commodities with inelastic demand. For reduction of consumption of a commodity, the government should target commodities with elastic demand.

The consumer’s expenditure is equal to seller’s income. Thus increase in producer’s income due to increase or decrease in producer prices, implies that the consumer’s expenditure has increased proportionally. Thus price elasticity of demand helps the consumer to determine his expenditure by looking at price changes.

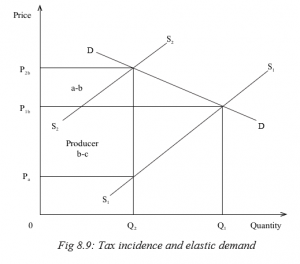

Price elasticity of demand helps the government to determine the tax incidence. The tax incidence is the final resting of tax, that is, who actually bears the burden of a tax? Is it the producer, the consumer or both? If both, who bears more tax burden than the other? This depends on the price elasticity of the commodity involved.

Taxes on production increase the costs of production. When costs of production increase, the scale of production and supply reduces. Increase in costs of production and decrease in supply increases the price of commodities. When demand is elastic, the tax burden is shared by both the consumer and the producer. However, the producer bears the biggest proportion of the tax burden as illustrated in the diagram below.

a-b represents the tax borne by the consumer and b-c, the proportion of the tax that is borne by the producer. a-b is smaller than b-c.

When demand is inelastic, both the consumer and the producer share the tax burden. However, the consumer bears the biggest proportion of the tax burden as illustrated in the diagram below.

a-b represents the whole tax that is borne by the consumer alone.

When demand is perfectly elastic, the tax burden is borne by the producer alone

Income elasticity of demand is a measure of the degree of responsiveness of quantity demanded of a commodity to change in consumer’s income. When the income of the buyer increases or decreases, quantity demanded reacts to a certain extent. Quantity demanded may reduce, increase or even remain constant. Income elasticity of demand therefore measures the extent of this reaction.

Income elasticity of demand is measured as a percentage change in quantity demanded to the percentage change in income.

Income elasticity of demand may be:

- Positive, which implies that the commodity is a normal good/service.

- Negative, which shows that the commodity is an inferior good/ service.

- Zero, which implies that the commodity is a necessity.

Cross elasticity of demand is a measure of the degree of responsiveness of quantity demanded of one commodity X to changes in price of another commodity Y. When the price of one commodity increases or decreases, quantity demanded of other related products reacts to a certain extent. Quantity demanded may reduce, increase or even remain constant. Cross elasticity of demand is measured as a percentage change in quantity demanded of one commodity to the percentage change in price of another.

Cross elasticity of demand can be:

- Positive; this implies that the two commodities X and Y are

- Negative; this shows that the two commodities X and Y are

- Zero; this implies that the two commodities X and Y are

Elasticity of supply refers to a measure of the degree of responsiveness of quantity demanded of a commodity to changes in factors that affect supply. Quantity supplied of a commodity is influenced by a number of factors like cost and availability of factors of production, goals of the firm, the level of technology, change in prices of related products, government policy, seasonal changes, the number of producers, degree of freedom entry of new firms into the industry, gestation period, or demand for the commodity. Elasticity of supply measures the extent to which quantity supplied responds to changes in these variables.

Price elasticity of supply refers to a measure of the degree of responsiveness of quantity supplied of a commodity to changes in the price of the commodity.

Price elasticity of supply is measured as a percentage change in quantity supplied to the percentage change in price.

8.3.2 Interpretation of price elasticity of supply

Price elasticity of demand may be categorised as follows:

- Perfectly inelastic supply.

- Inelastic supply.

- Unitary elastic supply.

- Elastic supply.

- Perfectly elastic supply.

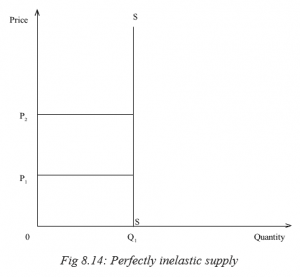

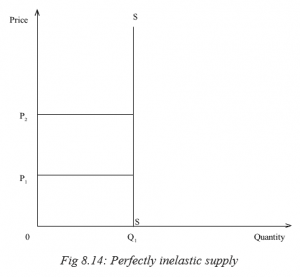

When supply is perfectly inelastic, then PES = 0

A change in price results into zero change in quantity supplied. Consumers do not respond to changes in price. As the price changes, sellers continue to supply the same amount of a commodity that they have been buying before the price changed.

As price increases from OP1 to OP2 (a bigger change), quantity supplied remains constant at OQ1.

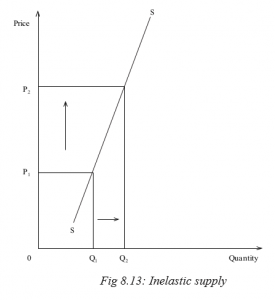

When supply is inelastic, then PES>0<1

A change in price results into a proportionately smaller change in quantity supplied. Suppliers do not vigorously respond to changes in price. There is a bigger change in price leading to a smaller change in quantity supplied. As the price changes, sellers continue to supply almost the same amount of a commodity that they have been buying before the price changed.

As price increases from OP1 to OP2 (a bigger change), quantity supplied slightly reacts by changing from OQ1 to OQ2 (a smaller change).

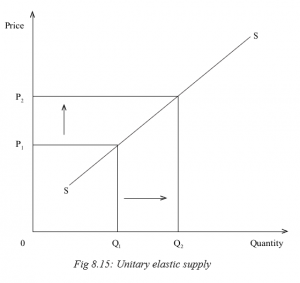

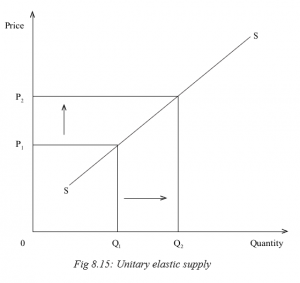

When supply is unitary elastic, then PES = 1

A change in price results into a proportionately equal change in quantity supply. Suppliers respond to changes in price. A change in price leads to a relatively equal change in quantity supplied.

As price increases from OP1 to OP2, quantity supplied responds by changing from OQ1 to OQ2. The change in price is almost equal to the change in quantity supplied.

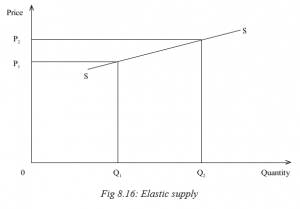

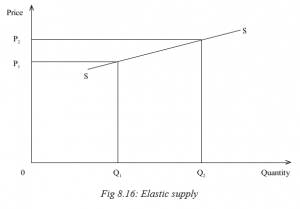

When supply is elastic, then PES>1<∞

A change in price results into a proportionately bigger change in the quantity supplied. Suppliers vigorously respond to changes in price. There is a smaller change in price leading to a bigger change in quantity supplied. As the price changes, sellers supply more of the commodity.

As price increases from OP1 to OP2 (a smaller change), quantity supplied responds by changing from OQ1 to OQ2 (a bigger change).

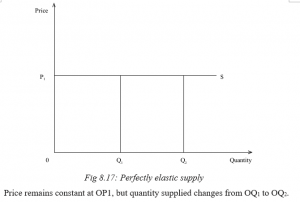

When supply is perfectly elastic, then PES =∞

There is a constant price. Quantity supplied changes. At a constant price, suppliers vary the amounts of a commodity to be supplied.

Discovery

The following are the determinants of price elasticity of supply:

- Cost and availability of factors of production

- Nature of the commodity

- Gestation period

- Time

- Method of production used

- Government policy

- Freedom of entry of new firms into the industry

- Mobility of factors of production

Facts

- Cost and availability of factors of production: When factors of production are scarce and expensive, supply cannot be easily increased even if the price of the commodity rises. Thus it becomes inelastic. But when they are readily available and cheap, supply becomes elastic.

Gestation period (maturity period): This is the time lag between when the decision to supply a commodity is taken and when it is actually supplied. Commodities with a short maturity period have elastic supply. Their supply can be increased quickly and easily when prices increase. Those with long gestation periods have inelastic demand.

Nature of the commodity: Perishables have inelastic supply such that when prices reduce, almost the same quantity will be supplied. This is because they cannot be stored to be supplied in future when prices are favourable. Durables have elastic supply. As a result, they can be stored and supply varied depending on the price level.

- Time: In the short run, supply becomes inelastic because it cannot be increased easily even if prices increase. In the long run, supply becomes elastic since time is enough to allow supply to increase with increase in prices.

- Method of production used: Advanced methods of production make supply elastic. This is because it is easier and quicker to produce and increase supply. Use of traditional, inefficient and past methods of production slows down the rate of production, making supply inelastic.

- Government policy: Rigid, bureaucratic tendencies, unattractive policies or high tax rates backslide production, making supply inelastic. Subsidisation of producers reduces costs of production and makes it easy to increase supply and so make it elastic.

Mobility of factors of production: Mobility of factors of production both occupational and geographical quickens and simplifies production. This makes supply elastic. Immobility of factors makes supply inelastic.

Freedom of entry of new firms into the industry: Freedom of entry of new firms into the industry makes supply elastic. Restricted entry makes supply inelastic.

Unit Assessment 8

- Distinguish between elasticity of demand and elasticity of supply.