FRIDAY: 21 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Highlight four benefits of investing in an index fund. (4 marks)

2. You have been appointed as a fund manager for a pension development fund for civil servants in your country.

Required:

Draft an investment policy statement (IPS) for the fund, clearly indicating the key sections. (10 marks)

3. Examine three key differences between “traditional finance” and “behavioural finance”. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Felix Otieno, an analyst at Diamond Investment Fund has outlined the factor exposures of two stocks using macroeconomic factors as shown below:

Factor Stock A Stock B

Confidence 0.2 0.6

Time horizon 0.6 0.8

Inflation — 0.1 — 0.5

Business cycle 4.0 2.0

Market timing 1.0 0.7

Required:

Compute the factor exposures of a portfolio invested 50% in Stock A and remainder in Stock B. (3 marks)

Contrary to general forecasts, you expect strong economic growth with a slight increase in inflation. Recommend the stock that you should overweigh in your portfolio. (2 marks)

2. An investment advisor is counselling Susan Nkatha, a client who recently inherited Sh.l.2 billion and has above average risk tolerance (RA = 2) and wants returns that will outpace inflation in the long-term.

Susan expects to liquidate Sh.60 million of the portfolio in 12 months ideally without invading the initial capital. The alternative strategic asset allocation choices for Susan are as follows:

Investor’s forecasts

Asset allocation Expected Return Standard deviation of return

A 10% 20%

B 7% 10%

C 5.25% 5%

Required:

Determine the preferred asset allocation based on risk adjusted expected returns for the asset allocation. (5 marks)

Determine the shortfall level, RL, assuming that Susan’s desire is not to invade the Sh. 1.2 billion principal. (2 marks)

Select the best asset allocation using Roy’s safety first criterion. (3 marks)

3. The following information relates to price movements of some selected shares:

Share Start of year 2020 End of year 2020

X 110 130

Y 76 72

Z 95 100

Required:

Calculate the following types of means based on the holding period return:

Arithmetic mean. (2 marks)

Geometric mean. (2 marks)

Explain why a financial analyst is more likely to apply geometric mean as opposed to arithmetic mean. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. Summarise six assumptions of the capital asset pricing model (CAPM). (6 marks)

2. An investor has decided to invest Sh.1 million in the shares of two companies namely Edulink (E) and Bookstore (B).

The projections of returns from the shares of the two companies along with their probabilities are as follows:

Probability Edulink (%) Bookstore (%)

0.20 12 16

0.25 14 10

0.25 —7 28

0.30 28 —2

Required:

Determine the proportion of each of the above shares required to formulate a minimum risk portfolio. (8 marks)

3. Jeremiah Kiragu owns a portfolio with the following characteristics:

Security A Security B Risk free security

Factor 1 sensitivity 0.80 1.50 0

Factor 2 sensitivity 0.60 1.20 0

Expected return 15% 20% 10%

It is assumed that security returns are generated by a two factor model.

Required:

Determine the sensitivity of Kiragu’s portfolio to the two factors assuming that he has Sh.l million to invest and sell short Sh.500,000 of security B and purchases Sh.1,500,000 of security A. (2 marks)

Determine the sensitivity of the portfolio to the two factors assuming that Kiragu borrows Sh.1 million at the risk free rate and invest the amount he borrows along with the original amount of Sh.1 million in security A and security B in the same proportion as described in (i) above. (2 marks)

Calculate the expected return premium of factor 2. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the meaning of the following types of risks that could affect a portfolio:

Compliance risk. (1 mark)

Operational risk (1 mark)

Counterparty risk. (1 mark)

2. Summarise three ways that could be used by a portfolio manager to manage credit risks. (3 marks)

3. Propose two applications of trusts as an estate planning tool. (4 marks)

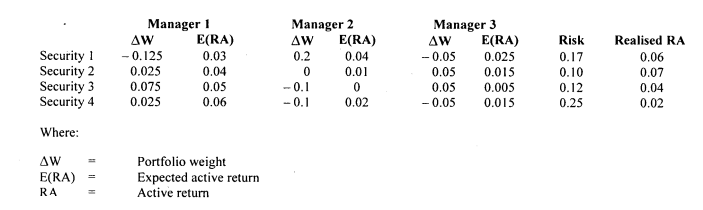

4. A consultant is analysing three investment managers for a new mandate.

The table below provides the managers’ ex-ante active return expectations and portfolio weights.

The last two columns include the risk and the ex-post, realised active returns for the four securities:

All the three managers claim to be good at forecasting returns and also claim to be efficient in portfolio construction.

Required:

Determine, using the full fundamental law of active management the following:

The manager that is best at efficiently building portfolios by anticipating future returns. (5 marks)

The manager that is best at building portfolios to make full use of their ability to correctly anticipate returns. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Analyse three standardised methods for estimating value at risk (VaR). (6 marks)

2. Evaluate four factors that could hinder a portfolio manager from investing internationally. (4 marks)

3. The following information relates to a fund manager’s annual return and the share index’s return for the last five years:

Year Fund Manager’s Returns (%) Share index’s Returns (%)

2020 11.9 12.1

2019 – 6.8 – 5.9

2018 9.5 9.7

2017 13 12.8

2016 9.5 10.0

Required:

The fund manager’s tracking error. (3 marks)

State whether the fund manager is making progress on his portfolio management strategy. Justify your answer. (1 mark)

4. As the Chief Investment Officer (CIO) of Uwezo Ltd., which is an all-equity financed company, you have over the years been investing in short-term projects that do not exceed one year to complete.

The company is considering investing in the following one year projects:

Project Initial Outlay Expected cash flow Beta factor

Sh.”000″ Sh.”000″

A 13,300 14,600 0.3

B 13,300 15,100 0.5

C 20,000 23,700 1.0

D 26,700 31,800 1.5

E 26,700 32,000 2.0

Additional information:

- The risk free rate is 8% and the expected return on the market portfolio is 15%.

- The market-equilibrium cost of capital is 18.5%.

- Neither of the projects is divisible.

Required:

The company’s beta factor. (1 mark)

Required rate of returns for each project using the capital asset pricing model (CAPM). (2 marks)

Expected returns for each project using undiscounted cash flows. (3 marks)

(Total: 20 marks)