Exam focus

Risk assessment and planning normally makes up a significant number of marks of the exam. It is also essential for all areas of the exam that you are able to assess the materiality of a matter.

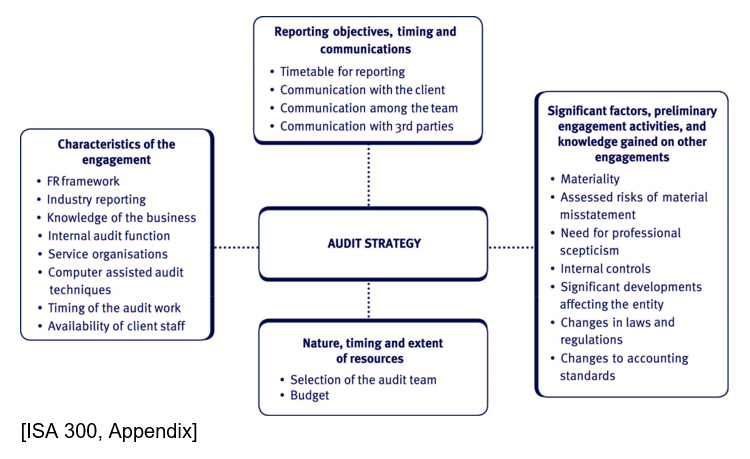

1 The audit strategy and plan

Planning an audit involves establishing the overall audit strategy for the engagement and developing an audit plan.

[ISA 300 Planning an Audit of Financial Statements, 2]

Once the strategy has been established the auditor should develop an audit plan. The audit plan is more detailed than the strategy and should include specific descriptions of:

The nature, timing and extent of risk assessment procedures.

The nature, timing and extent of further audit procedures, including:

– What audit procedures are to be carried out

– Who should do them

– How much work should be done (sample sizes, etc.)

– When the work should be done (interim vs. final) Any other procedures necessary to conform to ISAs.

[ISA 300, 9]

Both the strategy and the plan must be formally documented in the audit working papers.

Planning procedures for initial engagements

In an initial audit engagement there are several factors which should be considered in addition to the planning procedures which are carried out for every audit.

Arrangements should be made with the predecessor auditor to review their working papers.

Any matters which were brought to the firm’s attention when professional clearance was obtained should be considered for their potential impact on the audit strategy.

Matters which were discussed with management in connection with the appointment should be considered, for example, discussion of significant accounting policies which may impact on the planned audit strategy.

Audit procedures necessary to obtain sufficient appropriate audit evidence regarding opening balances, and procedures should be planned in accordance with ISA 510 Initial Audit Engagements – Opening Balances.

procedures may be increased for initial engagements, for example, the involvement of another partner or senior individual to review the overall audit strategy prior to commencing significant audit procedures and an engagement review should be performed. Compliance with any such procedures should be fully documented.

[ISA 300, A22]

In addition:

Additional time and resource may be necessary in the first year of an audit for a new client, in order to obtain the required knowledge of the client, e.g. documenting the internal control systems of the client for the first time, understanding the business including the legal and regulatory framework applicable to the company.

It may be difficult to place reliance on analytical procedures as a source of substantive audit evidence as these require knowledge and experience of the client in order to set appropriate expectations, and therefore increased tests of detail may be necessary.

Given the increased risk associated with initial engagements, consideration should be given to using an experienced audit team in order to reduce detection risk.

The impact of ISAs and IFRS standards

The impact of ISAs

ISA 315 (Revised) Identifying and Assessing the Risks of Material

Misstatement through Understanding the Entity and Its Environment states that the auditor should adopt a risk based approach to the audit.

“The objective of the auditor is to identify and assess the risks of material misstatement, whether due to fraud or error, at the financial statement and assertion levels, through understanding the entity and its environment, including the entity’s internal control, thereby providing a basis for designing and implementing responses to the assessed risks of material misstatement.” [ISA 315, 3]

ISA 330 The Auditor’s Response to Assessed Risks further develops the concept by stating that:

“The objective of the auditor is to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement, through designing and implementing appropriate responses to those risks.” [ISA 330, 3]

The importance of financial reporting standards

The audit opinion states whether or not the financial statements have been prepared in accordance with the financial reporting framework.

In order to reach this opinion, the auditor must fully understand the relevant financial reporting standards, and must evaluate whether the financial statements comply with these standards. This knowledge and understanding needs to be applied throughout the audit.

At the planning stage the auditor needs to assess the risk of material misstatement in the financial statements. The auditor must understand the required accounting treatment in order to identify potential omission or incorrect measurement, recognition, presentation or disclosure of an item.

The risk of material misstatement will increase with the complexity of the financial reporting issue, and where the matter requires the use of significant judgment.

2 Risk assessment

ISA 315 (Revised) Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment requires auditors to perform the following (minimum) risk assessment procedures:

Enquiries with management, of appropriate individuals within the internal audit function (if there is one), and others with relevant information within the client entity (e.g. about external and internal changes the company has experienced).

Analytical procedures to identify trends/relationships that are inconsistent with other relevant information or the auditor’s understanding of the business.

Observation (e.g. of control procedures).

Inspection (e.g. of key strategic documents and procedural manuals). [ISA 315, 6]

Analytical procedures at the planning stage

Analytical procedures involve analysis of plausible relationships among financial and non-financial data.

At the planning stage analytical procedures may be performed using management accounts or the draft financial statements if available.

Analytical procedures will be useful at the planning stage to help identify unusual fluctuations or balances which are not consistent with the auditor’s expectation. These areas indicate risks of material misstatement.

In the exam you may be provided with financial information and be expected to perform analytical procedures as part of your risk assessment.

Example risk assessment procedures

It is impossible to prepare a comprehensive list of risk assessment procedures that need to be carried out. The procedures need to be prepared in light of the unique circumstances of the client. However, examples include:

Enquiries of management:

Have any share issues occurred during the year?

Has the company invested in any new capital assets during the year?

Have any new competitors or products entered the market?

How does the company manage exposure to exchange rate risk?

Have there been any changes in senior management during the year?

Analytical procedures:

Compare actual results to forecast to identify any significant changes to plan.

Compare the client’s performance and position to any available industry data to identify significant variations.

Compare the client’s financial statements in comparison to the prior year to identify any unexpected changes in performance or position.

Observe:

The application of controls over the counting of inventory during the year.

The performance of year-end reconciliations (bank, supplier statement) to ensure they are performed regularly.

Month-end adjustments/reconciliations being performed during an interim visit to ensure controls are applied throughout the year.

Inspect:

Organisation charts to identify changes in key staff.

Examples of controls operating throughout the year, e.g. evidence of review of month end reconciliations, evidence of review of aged receivables on a monthly basis.

HR records/payroll records to identify movements in staff.

News/media reports to identify any significant issues, such as potential legal action.

The entity and its environment

Auditors should obtain an understanding of:

Relevant industry, regulatory and other external factors.

The nature of the entity, including:

– Its operations

– Its ownership and governance structures

– The types of investment the entity makes

– The way the entity is structured and financed.

The entity’s selection and application of accounting policies.

The entity’s objectives and strategies, and those related business risks that may result in material misstatement.

The measurement and review of the entity’s financial performance. [ISA 315, 11]

If the entity has an internal audit function, obtaining an understanding of that function also contributes to the auditor’s understanding of the entity and its environment, including internal control, in particular the role that the function plays in the entity’s monitoring of internal control over financial reporting. [ISA 315, A113]

The auditor may also consider how management has responded to the findings and recommendations of the internal audit function regarding identified deficiencies in internal control relevant to the audit, including whether and how such responses have been implemented, and whether they have been subsequently evaluated by the internal audit function. [ISA 315, A80]

The entity’s internal control

The components of internal control include:

The control environment.

The entity’s risk assessment process.

The information system relevant to financial reporting. The control activities.

The monitoring system.

[ISA 315, A59]

The auditor must evaluate the design of the controls to determine whether they have been implemented during the financial reporting period and whether they are effective at preventing and detecting potentially material fraud and error. [ISA 315, 13]

- Materiality

The objective of an audit is to express an opinion as to whether the financial statements are prepared, in all material respects, in accordance with an applicable financial reporting framework. [ISA 200, 11a]

It is therefore of vital importance for auditors to apply the concept of materiality in the planning and performance of the audit.

Misstatements, including omissions, are considered to be material if they, individually or in aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.

[ISA 320 Materiality in Planning and Performing an Audit, 2]

Calculation

ISA 320 Materiality in Planning and Performing an Audit, recognises, and permits, the use of benchmark calculations of materiality.

A traditional calculation basis is as follows:

| Value | Comments | |

| Pre-tax | 5–10% | Appropriate where users are primarily interested in |

| profit | the profitability of the company. | |

| Revenue | ½–1% | Materiality by reference to the size of the business |

| can be measured in terms of revenue. | ||

| Total | 1–2% | Size can also be measured in terms of the asset |

| assets | base. |

These benchmarks should be used in the initial assessment of materiality.

The auditor must then use judgment to modify materiality to ensure it is relevant to the unique circumstances of the client.

When deciding on an appropriate benchmark the auditor must consider:

The elements of the financial statements.

Whether particular items tend to be the focus of the users. The nature of the entity, its life cycle and its environment.

The ownership and financing structure.

The relative volatility of the benchmark.

[ISA 320, A4]

Material by nature

Materiality is not just a purely financial concern. Some items may be material by nature i.e. the impact they have on the financial statements.

Examples of items which are material by nature include:

Misstatements that affect compliance with regulatory requirements. Misstatements that affect compliance with debt covenants.

Misstatements that, when adjusted, would turn a reported profit into a loss for the year.

Misstatements that, when adjusted, would turn a reported net-asset position into a net-liability position (or net-current asset to net-current liability).

Related party transactions including transactions with directors, e.g. salary and benefits, personal use of assets, etc.

Disclosures in the financial statements relating to possible future legal claims or going concern issues, for example, could influence users’ decisions and may be purely narrative. In this case a numerical calculation is not relevant.

Performance materiality

It is unlikely, in practice, that auditors will be able to identify individually material misstatements. It is much more common that misstatements are material in aggregate (i.e. in combination). For this reason auditors must also consider what is known as ‘performance materiality.’

This is an amount, set by the auditor at less than materiality for the financial statements as a whole to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole. [ISA 320, 9]

Case Study: Performance materiality

LeJoG Co is a company that organises accommodation, luggage transportation, and support for charitable sporting enthusiasts attempting to travel from one end of the country to the other. All customers pay in full when booking their trip. LeJoG has a complicated cancellation policy, the amount refundable decreases with the length of time before the start of the trip.

The audit engagement team has planned the audit of the financial statements for the year ended 30 June 20X4. The team has determined a materiality level for the financial statements as a whole, of $100,000, which has been calculated using an average of 1 % of revenue, 2% total assets and 10% profit before tax. Performance materiality needs to be applied to revenue and the associated liabilities recognised when taking payment from customers in advance, as revenue recognition is an area of audit risk.

Performance materiality could be determined as a percentage of financial

statement materiality, say 75%, i.e. a performance materiality of

($100,000 × 75%) $75,000 could be set for the audit of revenue and the

associated liabilities. The audit team could use a higher or lower

percentage, or use a different calculation, depending on their professional

judgment.

The aim of performance materiality is to reduce the risk that misstatements in aggregate exceed materiality for the financial statements as a whole. For example, if a misstatement was identified of, say $80,000, without performance materiality the auditor would conclude that revenue is not materially misstated. However, the audit may not have detected further misstatements which when added to the $80,000 identified would result in a material misstatement. By using performance materiality, the auditor would conclude that a misstatement of $80,000 could be material, thereby prompting them to do additional work. If no additional misstatements are detected, an unmodified opinion may be issued.

4 Risk and the exam

In the exam it is likely that you will be asked to perform a risk assessment for an audit client. The three types of risk examinable are:

Risk of material misstatement

Audit risk

Business risk.

It is vital that you understand the difference between these types of risk to ensure you answer the question appropriately.

F8 recap: Audit risk

Audit risk = Risk of material misstatement × Detection risk

Risk of material misstatement = Inherent risk × Control risk

Inherent risk is the susceptibility of an assertion about a class of transaction, account balance or disclosure to a misstatement that could be material, before consideration of any related controls. [ISA 200, 13ni]

Control risk is the risk that a misstatement that could occur will not be prevented, or detected and corrected, on a timely basis by the entity’s internal control. [ISA 200, 13nii]

Detection risk is the risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists that could be material. [ISA 200, 13e]

(ISA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with International Standards on Auditing)

Risk of material misstatement

Risk of material misstatement is the risk the financial statements are materially misstated (either due to fraud or error), prior to the audit. Risk of material misstatement comprises inherent and control risk. [ISA 200, 13n]

The financial statements may be materially misstated for 3 main reasons:

Numbers are misstated – e.g. overstatement of receivables due to bad debts not being written off.

Disclosures are missing or inadequate – e.g. going concern disclosures being omitted.

The basis of preparation is inappropriate – the going concern basis has been used when the break up basis should have been used.

The financial statements will be materially misstated if they are not prepared in accordance with the applicable financial reporting framework. In order for the auditor to identify material misstatement they need to know what the appropriate accounting treatment is and whether it has been complied with.

When evaluating the risk of material misstatement it is crucial to discuss the specific impact of the risk on the financial statements, i.e.

The specific account balance, transaction or disclosure affected.

Whether the item might be overstated, understated, omitted, inappropriately recognised, etc.

The auditor is also required to determine whether any of the risks are a significant risk. A significant risk is a risk of material misstatement that requires special audit consideration. [ISA 315, 4]

In the exam you will have to comment on whether the accounting treatment is appropriate therefore your knowledge from Strategic Business Reporting will be required in this exam. The ‘Financial reporting revision’ summarises the key points from these standards.

Audit risk

Audit risk is the risk that the auditor expresses an inappropriate opinion when the financial statements are materially misstated. [ISA 200, 13c]

The auditor will express an inappropriate opinion if the financial statements are materially misstated and they fail to detect that misstatement.

Detection risks include situations such as:

First year of auditing the client therefore a lack of cumulative knowledge and experience.

The client is putting the auditor under undue time pressure resulting in the audit being rushed and misstatements possibly going undetected.

The client operates from multiple sites and the auditor may not be able to visit each site during the audit. This will be an issue, for example, if a material amount of inventory is held at sites not visited by the auditor.

If no detection risks are given in the scenario, an answer to an audit risk question will be identical to an answer to a risk of material misstatement question.

Business risk

A business risk is one resulting from “significant events, conditions, circumstances, actions or inactions that could adversely affect an entity’s ability to achieve its objectives and execute its strategies”. [ISA 315, 4b]

Auditors must assess business risk in order to:

Develop business understanding

Increase the likelihood of identifying specific risks of material misstatement

Evaluate overall audit risk.

Examples of business risks

These risks are often categorised as being ‘external’ or ‘internal’ risks.

Typical ‘external risks’ – risks derived from the environment in which the entity operates

Changing legislation

Changing interest rates

Changing exchange rates

Public opinion, attitudes, fashions Price wars initiated by competitors

Untried technologies and ideas, political factors

Natural hazards

Typical ‘internal risks’ – risks derived from the entity and its operations

Employees

Failure to modernise products, processes, labour relations, marketing

Overtrading

Cash flow difficulties Rapidly increasing gearing

Excessive reliance on a dominant CEO

Fraud

Excessive reliance on one or few

products, customers, suppliers

Computer systems failures

The relationship between business risk and the risk of material misstatement/audit risk

Most business risks will eventually have financial consequences, and therefore an effect on the financial statements. If the client does not account for these issues in the correct manner, the financial statements could be materially misstated.

Business risk v risk of material misstatement

Operating in a technologically fast paced market could lead to a company’s products being outdated by superior products. This is a business risk because it may stop a company achieving desired profit margins.

The risk of material misstatement is that inventory may be overstated in the financial statements: the net realisable value of inventory may have fallen below cost, requiring a write-down of the inventory balance.

Additional information to help plan the audit

In the exam you may be asked to suggest additional information to help plan the audit. The scenario will have provided some information on the client, but in order to fully identify the risks, further information will be required.

By obtaining additional information, a greater understanding of the risk areas can be obtained to allow the impact on the financial statements to be considered. This will enable the audit to be planned more effectively.

Additional information

Example 1 – Purchase of shares during the year

The client has purchased 25% of a company’s share capital during the year. Additional information would be required to determine the appropriate accounting treatment. It is possible that it is being treated as an associate when in fact no significant influence can be exercised. In this case it should be treated as an investment. Additional information is required regarding voting rights attached to the shares to determine whether significant influence has been acquired.

Example 2 – New loan taken out during the year

The client has taken out a ten year loan during the year. Additional information would be required to determine whether the loan should be split between current and non-current liabilities and whether any disclosure needs to be made of any security for the loan. Whilst it would be expected that the loan should be split between current and non-current liabilities, if there are no payments due for the first twelve months, the loan will be a non-current liability for the first year. In this case the loan agreement would provide the additional information required regarding payment terms and details of whether the loan is secured over the company’s assets.

5 Assessing whether a risk is significant

As part of the risk assessment process the auditor should consider the significance of the identified risks, including:

Whether the risk is one of fraud.

Whether it is related to recent economic, accounting or other developments that require specific attention.

The complexity of the related transactions. Whether it involves related parties.

The degree of subjectivity involved in measuring financial information.

Whether it involves transactions outside the normal course of business. [ISA 315, 28]

If the auditor determines that a significant risk exists they must then obtain the necessary understanding of how the entity controls that risk. Only then can the auditor determine an appropriate response in terms of further audit procedures.

6 Response to risk assessment

The main purpose of performing risk assessment is to guide the auditor in the design and performance of further audit procedures to obtain sufficient appropriate audit evidence. The only way the auditor can reduce audit risk is by manipulating their detection risk. Detection risk can be reduced by:

Emphasising the need for professional scepticism.

Assigning more experienced staff to complex or risky areas of the engagement.

Providing more supervision.

Incorporating additional elements of unpredictability in the selection of further audit procedures.

Making changes to the nature, timing or extent of audit procedures, e.g.

– Placing less reliance on the results of systems and controls testing.

– Performing more substantive procedures.

– Consulting external experts on technically complex or contentious matters.

– Changing the timing and frequency of review procedures.

[ISA 330, A1]

7 Professional scepticism

Professional scepticism is defined as: ‘An attitude that includes a questioning mind, being alert to conditions which may indicate possible misstatement due to error or fraud, and a critical assessment of audit evidence.’

[ISA 200, 13]

It is both an ethical and a professional issue. Professional scepticism includes maintaining independence of mind.

Professional scepticism requires the auditor to be alert to:

Audit evidence that contradicts other audit evidence.

Information that brings into question the reliability of documents and responses to enquiries to be used as audit evidence.

Conditions that may indicate possible fraud.

Circumstances that suggest the need for audit procedures in addition to those required by ISAs.

[ISA 200, A20]

In the exam you may be required to critically evaluate the planning or performance of an audit engagement. This will include assessing whether auditor has exercised professional scepticism.

Examples of circumstances where professional scepticism has not been applied include:

Contradictory evidence has not been questioned.

The reliability of documents and responses to enquiries from the client has not been evaluated.

The sufficiency and appropriateness of evidence has not been considered.

The authenticity of a document has not been considered when there are indications of possible fraud.

Past experience of the dishonesty or lack of integrity of the client has been disregarded.

The auditor has accepted less persuasive evidence because of their past experience of the honesty and integrity of the client.

If professional scepticism is not exercised, the auditor may:

Overlook unusual circumstances Use unsuitable audit procedures Reach inappropriate conclusions.

Exercising professional scepticism

The auditor may make an enquiry of management regarding compliance with laws and regulations. Management may inform the auditor that there have been no instances of non-compliance during the year. Application of professional scepticism would require the auditor to seek alternative, corroborative evidence to support management’s claim as they may not wish the auditor to know about any breaches. This may involve speaking with the company’s compliance department to confirm management’s statement as well as reviewing board minutes for any discussions that indicate non-compliance or reviewing invoices from legal advisers which may indicate advice has been obtained regarding non-compliance.

Current issue: Professional scepticism

IAASB: Toward enhanced Professional Scepticism – observations of the Professional Scepticism Working Group

The importance of professional scepticism to the public interest is increasing due to:

Increased complexity of business and financial reporting Greater use of estimates and management judgment

Changes in business models due to technological developments Reliance by the public on reliable financial reporting.

The main observations of the working group are:

Strong business acumen and knowledge of the client’s business model is essential for robust professional scepticism.

Professional scepticism can be impeded by tight reporting deadlines and resource constraints.

Personal traits such as confidence and an inquisitive nature can enhance the exercise of professional scepticism.

Professional scepticism starts at the beginning of one’s career. It needs to be ‘part of the auditor’s DNA’.

Standard setters such as the IAASB, IESBA and IAESB can do more to emphasise and provide guidance on how to exercise professional scepticism.

The concepts of professional scepticism may be relevant to all professional accountants, not just auditors.

Standard setting alone will not be enough. All stakeholders such as the audit committee have a role to play e.g. by challenging the auditor to ask tough questions of management.

This is likely to affect areas such as:

– ensuring the auditor is unbiased and that an appropriate audit team is selected.

Risk assessments – being aware of management incentives and biases, and challenging management.

Accounting estimates – performing enhanced risk assessment and taking a step back for riskier estimates.

Group audits – exercising sufficient scepticism when using other auditors.

IAASB: Proposed Application Material Relating to Professional Scepticism and Professional Judgment

Proposed objective

The IAASB has proposed new application material to:

Describe how compliance with the fundamental principles in the Code of Ethics supports the exercise of professional scepticism in the context of audit and other assurance engagements.

Emphasise the importance of professional accountants obtaining a sufficient understanding of the facts and circumstances known to them when exercising professional judgment in applying the conceptual framework.

Reasons for the changes

Currently the Code of Ethics only refers to professional scepticism in the context of audit and assurance engagements. The IAASB is looking at whether the Code should refer to the need professional scepticism to be applied by all professional accountants for all services.

If a professional accountant accepts information at face value, without regard to whether it could result in being associated with false or misleading information, it would constitute non-compliance with integrity and professional competence and due care.

Research suggests that:

Drivers and impediments to compliance with fundamental principles and the exercise of professional scepticism are the same.

Auditors who comply with the fundamental principles tend to apply greater scepticism.

Time pressure which creates a threat to the fundamental principles also impairs the application of professional scepticism.

Details of the proposed changes

- Definitions of the fundamental principles to be extended. Integrity – being straightforward and honest is consistent with a questioning mind and the critical assessment of audit evidence in exercising professional scepticism.

Objectivity – avoiding bias is consistent with exercising professional scepticism.

Professional competence and due care – exercising professional scepticism enables the auditor to assess whether audit evidence if sufficient and appropriate in the circumstances.

- New section on how to exercise professional judgment Professional judgment involves the application of training, knowledge and experience. When exercising professional judgment the accountant should identify, evaluate and address threats to the fundamental principles. The accountant should consider whether:

There is an inconsistency between known facts and circumstances and the accountant’s expectations.

The information provides a reasonable basis on which to draw a conclusion.

Other reasonable conclusions could be drawn from the information being considered.

The accountant’s own preconception or bias might be affecting the accountant’s judgment.

The accountant’s own expertise and experience are sufficient, or whether there is a need to consult with others.

IAASB Questions and Answers: Professional Scepticism in an Audit of Financial Statements (February 2012)

Provides additional explanations relating to professional scepticism.

Specifically, professional scepticism:

Is fundamentally a mind-set that drives auditor behaviour to adopt a questioning approach.

Is inseparably linked to objectivity and auditor independence.

Forms an integral part of the auditor’s skill set and is closely interrelated with professional judgment, both of which are key inputs to audit quality.

Enhances the effectiveness of an audit procedure and reduces the risk of giving an inappropriate opinion.

The Q&A reiterates the importance of the components of in enhancing the awareness of the importance and application of professional scepticism.

In addition, the Q&A emphasises that although professional scepticism is not referred to within each ISA, it is relevant and necessary throughout the audit and is particularly important when considering the risks of material misstatement due to fraud and when addressing areas of the audit that are more complex, significant or highly judgmental (e.g. accounting estimates, going concern, related party transactions, non-compliance with laws and regulations).

Audit documentation is critical in evidencing professional scepticism, particularly documentation demonstrating how significant judgments and key audit issues were addressed, which may provide evidence of the auditor’s exercise of professional scepticism.

Effective oversight and inspection of audits by regulators and oversight bodies should incorporate challenging, influencing and stimulating auditors to be sceptical and focusing auditors on the importance of professional scepticism and how it can be appropriately applied through constructive dialogue.

UK syllabus: Professional scepticism

In March 2012, the FRC released a Briefing Paper Professional Scepticism.

The briefing paper takes a theoretical approach to discussing the importance of professional scepticism in the audit, specifically:

Exploring:

– the roots of scepticism and identifying lessons for its role in the conduct of the audit

– scientific scepticism

– the origins of modern audit.

Concluding about professional scepticism and the audit.

Discussing the conditions necessary for auditors to demonstrate professional scepticism.

The paper highlights the significance of scepticism to the quality of the audit. It defines scepticism as ‘examination, inquiry into, hesitation or doubt’ specifically, doubt that stimulates challenge and inquiry.

It explains that scientific scepticism is a ‘systematic form of continual informed questioning’, or critical appraisal, looking for evidence that contradicts management’s assertions and suspending judgment about the validity of those assertions. In the context of an audit, this means actively looking for risks of material misstatement.

Applying ISAs proportionately

Applying ISAs Proportionately with the Size and Complexity of an

Entity (IAASB – August 2009)

The auditor’s objectives are the same for audits of entities of different sizes and complexities. This, however, does not mean that every audit will be planned and performed in exactly the same way. In particular ISAs explain that the appropriate audit approach for designing and performing audit procedures depends on the auditor’s risk assessment and the exercise of appropriate professional judgment.

Often, small and medium-sized entities (SMEs) engage in relatively simple business transactions. This means that their audits will generally be relatively straightforward. For example, consider the requirement in ISA 315 for the auditor to obtain an understanding of the entity and its environment. The typically simpler structure and processes in a SME often mean that the auditor may obtain understanding quite readily and document this in a straightforward manner. Similarly, internal control in the context of a SME may be simpler.

Of particular relevance is the fact that the ISAs include useful guidance that assists the auditor in applying specific requirements in the context of a SME audit. Where appropriate, guidance is included in ISAs under the subheading ‘Considerations Specific to Smaller Entities’.

For example:

Standard audit programs drawn up on the assumption of few relevant control activities may be used for the audit of a SME provided that they are tailored to the circumstances of the engagement.

In the absence of interim or monthly financial information the auditor may need to plan analytical procedures when an early draft of the entity’s financial statements becomes available.

Given the potential lack of documentary evidence concerning control activities, the attitudes, awareness, and actions of management are of particular importance to the auditor’s understanding of a SME’s control environment.

Other guidance indicates that specific aspects of the audit will vary with the size, complexity, and nature of the entity, for example:

The nature and extent of the auditor’s planning activities. The auditor’s consideration of fraud risk factors.

The communication process between the auditor and those charged with governance.

The level of detail at which to communicate significant deficiencies in internal control.

The judgment as to whether a control is relevant to the audit.

Not all of the ISAs are necessarily relevant in every audit, that is, the circumstances in which an ISA applies may not exist in the engagement. For example, some of the ISAs that may not be relevant in a SME audit include:

ISA 402 Audit Considerations Relating to An Entity Using a Service

Organisation, if the client does not use a service organisation.

ISA 600 Special Considerations – Audit of Group Financial Statements (including the work of component auditors), if it is not a group audit.

ISA 610 Using the Work of Internal Auditors, if there is no internal audit function.

Even if an ISA is relevant, not all of its requirements may be relevant in the particular circumstances of an audit. A few examples include:

Holding an engagement team meeting if it is only a one person team.

Performing the specified substantive procedures if the auditor has not identified previously unidentified or undisclosed related parties or related party transactions.

Obtaining sufficient appropriate audit evidence to determine whether

a material uncertainty exists if the auditor has not identified any event or condition that casts doubt on the entity’s ability to continue as a going concern.

Finally, to further assist the auditor, the ISAs provide examples of how the documentation in a SME audit can be approached in an efficient and effective manner. For example:

It may be helpful and efficient to record various aspects of the audit together in a single document, with cross-references to supporting working papers as appropriate.

The documentation of the understanding of the entity may be incorporated in the auditor’s documentation of the overall strategy and audit plan.

The results of the risk assessment may be documented as part of the auditor’s documentation of further procedures.

It is not necessary to document the entirety of the auditor’s understanding of the SME and matters related to it.

A brief memorandum may serve as the documented audit strategy. At the completion of the audit, a brief memorandum could be developed and then updated to serve as the documented audit strategy for the following year’s audit engagement.

Auditing significant, unusual or highly complex transactions

In September 2010, the IAASB issued a Questions & Answers publication, Auditor considerations regarding significant unusual or highly complex transactions in response to specific requests for information on how the ISAs deal with this particular topic.

The publication highlights that because of their nature, these transactions may give rise to risks of material misstatement of the financial statements and, accordingly, may merit heightened attention by auditors.

The publication does not provide any additional guidance beyond that which is contained within the ISAs themselves. Instead, it highlights the most salient points from the ISAs for auditors to consider when approaching the audit of significant, unusual or highly complex transactions, and in particular highlights:

What considerations in the ISAs are relevant when forming an opinion on the financial statements.

What general considerations in the ISAs are relevant in relation to audit documentation, , and interim reviews of financial statements when dealing with such transactions.

How the ISAs guide the auditor in the auditor’s communication with those charged with governance when dealing with such transactions.

The publication highlights many specific requirements of the ISAs, including:

The requirement to exercise professional judgment and maintain professional scepticism throughout the planning and performance of an audit.

The need to identify and assess the risks of material misstatement by performing risk assessment procedures designed to obtain the required understanding of the entity and its environment, including the entity’s internal control.

The requirement to design and implement overall responses to address the assessed risks of material misstatement and to design and perform further audit procedures whose nature, timing, and extent are based on and are responsive to the assessed risks of material misstatement at the assertion level.

When approaching the audit of significant, unusual or highly complex transactions, the auditor should consider the need to obtain more persuasive audit evidence in responding to the assessed risks, as the auditor’s assessment of risk is likely to be higher, in particular there is the possibility of increased risk of bias in management’s judgments due to the complexity involved therein.

Approach to exam questions: Risk assessment

Risk questions in the exam usually contain the largest single allocation of marks, therefore it is important that you can do well on these questions.

Here are some tips to help you score well:

Audit risks and risks of material misstatement

Use analytical procedures to evaluate the risks of material misstatement/audit risks

When asked to perform analytical procedures, do your calculations first and present them neatly in a table.

Each calculation is usually worth ½ mark. There will usually be 5 or 6 marks available for calculations.

Refer to your calculations as you perform your risk assessment.

Using the information provided/the results of your analytical procedures, evaluate the risks of material misstatement/audit risks

Each risk is usually worth 1½ or 2 marks. To earn the full marks for each risk you need to properly explain the risk. If your answers are too brief or do not demonstrate sufficient understanding you will not score the marks.

To ensure your answer is sufficiently detailed, use the following approach:

Identify the information from the scenario that creates the potential risk.

If numbers are provided, calculate whether the balance is material. This helps to assess whether the risk is significant.

State the required accounting treatment.

State the risk to the financial statements if the required treatment is not followed.

For example:

Receivables

A major customer is struggling to pay their debt and as a result the receivables balance is significantly higher than last year.

The balance outstanding represents 5% of total assets therefore is material and a significant risk.

Receivables should be valued at the fair value of the economic benefit expected to be received in accordance with IFRS 9 Financial Instruments. If the debt is not likely to be paid it should be written off or written down.

There is a risk that receivables and profit are overstated if the debt is not written off or written down.

Foreign currency transactions

The company purchases all goods from an overseas supplier resulting in foreign currency transactions.

Foreign currency purchases should be translated using the spot rate or average rate at the date of the transaction. Any payables balance outstanding at the year-end must be revalued using the year-end rate in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates.

There is a risk that purchases are misstated if the exchange rate used is incorrect or if errors are made when translating the purchase cost. Payables may be misstated if they have not been revalued at the year-end.

Provisions

The client has this year started offering warranties with products sold but no provision has been recognised for warranty costs.

A provision is required to be recognised if there is a present obligation as a result of a past event which can be measured reliably and is probable to lead to a transfer of economic benefits in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

The sale of goods with a warranty creates an obligation for the company to repair or replace goods returned within the warranty period.

Provision liabilities and expenses are understated if a provision for warranty costs is not recognised.

Note how the explanation of the risks focuses on how the financial statements may be materially misstated.

Evaluate the business risks facing the client

Make sure you explain business risks as risks the directors of the business will care about. The focus here should be on adverse impact to profit, revenue, or cash flow.

Identify the information from the scenario creating the risk. Explain the impact it will have on the business operations. Explain the financial impact.

Major customer

A major customer is struggling to pay their debt.

If the customer cannot pay their balance, the company will not receive the cash which will reduce cash inflows.

The debt will need to be written off which will reduce profit.

Future revenues will also decrease as the major customer will no longer be trading with the client.

Foreign currency transactions

The company purchases all goods from an overseas supplier resulting in foreign currency transactions.

If the company does not use any hedging instruments it will be exposed to exchange rate fluctuations which will affect the price of purchases.

If exchange rates move in an adverse direction, the cost of purchases will be higher resulting in a reduction in profit.

Relevance of the information provided

The scenario for the risk question will be quite detailed and require you to evaluate it in the context of the audit. Be aware that it may contain some information that will not necessarily be relevant for planning the audit.

Some information may be provided to help set the scene of the scenario and to enable you to understand the client and its operations. If you can’t see how the information relates specifically to the requirement, don’t try and force it into an answer. This will waste valuable time in the exam that could be better used on a different question.

For example, a supplier may have increased prices to the client. This does not create any audit risk as such. If the client continues to process and record purchases in the usual way there is no risk of material misstatement in the financial statements. However, if the question had asked for business risks, this would be a business risk as it impacts the company’s profits.

Professional marks

Professional marks will be awarded in one of the questions for clarity of explanation or evaluation, the use of logical structure and an appropriate format. In the exam, you should prioritise risks identified as this adds to the professionalism of the risk assessment performed.

Test your understanding 1 – Yates

Your firm has successfully tendered for the audit of Yates Co, a private national haulage and distribution company with over 2,000 employees. This long-established company provides refrigerated, bulk and heavy haulage transport services to time-sensitive delivery schedules. You have obtained the following financial information from Yates:

| Statement of profit and loss | 30 June 20X4 | 30 June 20X3 |

| Draft | Actual | |

| $m | $m | |

| Revenue (note 1) | 161.5 | 144.4 |

| Materials expense (note 2) | (88.0) | (74.7) |

| Staff costs | (40.6) | (35.6) |

| Depreciation and amortisation | (8.5) | (9.5) |

| Other expenses | (19.6) | (23.2) |

| Finance costs | (2.9) | (2.2) |

| Total expenses | 159.6 | 145.2 |

| Profit/loss before tax | 1.9 | (0.8) |

| 7 | |||||

| Statement of financial position | 30 June 20X4 | 30 June 20X3 | |||

| $m | $m | ||||

| Intangible assets (note 3) | 7.2 | 6.2 | |||

| Tangible assets (note 4) | |||||

| – | Property and transport | 55.1 | 57.8 | ||

| equipment | |||||

| – | Vehicles | 16.4 | 16.0 | ||

| – | Other equipment | 7.4 | 9.3 | ||

| Inventories | 0.6 | 0.5 | |||

| Trade receivables (note 5) | 13.7 | 13.4 | |||

| Cash and cash equivalents | 3.4 | 2.8 | |||

| Total assets | 103.8 | 106.0 | |||

| Provisions | |||||

| – | Restructuring (note 6) | 9.7 | 10.8 | ||

| – | Tax provision | 3.0 | 3.3 | ||

| Lease liabilities (note 7) | 5.4 | 4.4 | |||

| Trade payables | 13.8 | 13.1 | |||

| Other liabilities (note 8) | 8.5 | 7.9 | |||

| Total liabilities | 40.4 | 39.5 | |||

| Note 1: Revenue is net of rebates to major customers that increase with | |||||

| the volume of consignments transported. Rebates are calculated on | |||||

| cumulative sales for the financial year and awarded quarterly in arrears. | |||||

Note 2: Materials expense includes fuel, repair materials, transportation and vehicle maintenance costs.

Note 3: Purchased intangible assets, including software and industrial licences, are accounted for using the cost model. Internally generated intangible assets, mainly software developed for customers to generate consignment documents, are initially recognised at cost if the asset recognition criteria are satisfied.

Note 4: Depreciation is charged at the following rates on a straight line basis:

Property 6 – 60 years

Vehicles and transport equipment 3 – 8 years

Other equipment 3 – 15 years

Note 5: Trade receivables are carried at their principal amount, less allowances for irrecoverable debts.

Note 6: The restructuring provision relates to employee termination and other obligations arising on the closure and relocation of distribution depots in December 20X2.

Note 7: Leases are capitalised at the date of inception of the lease at fair value or the present value of the minimum lease payments, if less.

Note 8: Other liabilities include amounts due to employees for accrued wages and salaries, overtime, sick leave, maternity pay and bonuses.

Required:

Prepare briefing notes for the audit partner which:

- Evaluate the risks of material misstatement for the audit of Yates Co

for the year ending 30 June 20X4. (12 marks)

- Describe the audit procedures to be performed in respect of the carrying amount of the following items in the statement of financial position:

(i) Trade receivables (5 marks)

(ii) Vehicles (4 marks)

Professional marks will be awarded for the presentation, logical flow and

clarity of explanation of the briefing notes (4 marks)

(Total: 25 marks)

Test your understanding 2 – Ivor

You are the audit senior in a firm of accountants. One of the partners has given you the following financial information for a client, Ivor Co, whose final audit is due to take place in a month’s time. The partner has asked you to conduct an analytical review of the management accounts in comparison to the prior year’s financial statements.

| 31.12.20X3 | 31.12.20X2 | ||

| (Management | (Audited | ||

| accounts) | financial | ||

| statements) | |||

| Statement of profit or loss | $000 | $000 | |

| Revenue | 13,095 | 10,160 | |

| Sales discounts | (525) | (200) | |

| –––––– | –––––– | ||

| Cost of sales | 12,570 | 9,960 | |

| (9,556) | (7,603) | ||

| Gross profit | –––––– | –––––– | |

| 3,014 | 2,357 | ||

| Distribution costs | (762) | (498) |

| Admin expenses | |||||

| Wages and salaries | 1,275 | 960 | |||

| Directors’ salaries | 125 | 115 | |||

| Rent | 35 | 12 | |||

| Profit on disposal | (510) | (75) | |||

| Other expenses | 137 | 153 | |||

| ––––– | ––––– | ||||

| (1,062) | (1,165) | ||||

| Net profit before tax | –––––– | –––––– | |||

| 1,190 | 694 | ||||

| –––––– | –––––– | ||||

| Statement of financial position | |||||

| Non-current assets | |||||

| Tangible assets (note 1) | 1,073 | 2,130 | |||

| Intangible assets (note 2) | 54 | 75 | |||

| Current assets | ––––– | ––––– | |||

| 1,127 | 2,205 | ||||

| Inventory | 1,640 | 1,200 | |||

| Trade receivables | |||||

| (note 3) | 2,204 | 1,353 | |||

| Other receivables | 46 | 42 | |||

| Cash | 104 | – | |||

| ––––– | ––––– | ||||

| 3,994 | 2,595 | ||||

| ––––– | ––––– | ||||

| 5,121 | 4,800 | ||||

| Equity and liabilities | ––––– | ––––– | |||

| Ordinary share capital | 1,700 | 1,000 | |||

| Retained earnings | 1,894 | 1,004 | |||

| ––––– | ––––– | ||||

| Non-current liabilities | 3,594 | 2,004 | |||

| Bank loan | 500 | 1,000 | |||

| Current liabilities | |||||

| Overdrafts | – | 129 | |||

| Trade payables | 703 | 1,479 | |||

| Other payables | 32 | 20 | |||

| Tax payable | 292 | 168 | |||

| ––––– | ––––– | ||||

| 1,027 | 1,796 | ||||

| ––––– | ––––– | ||||

| 5,121 | 4,800 | ||||

| ––––– | ––––– | ||||

| 209 | |||||

| Note 1 | Land & | Plant & | Total | |

| buildings | machinery | |||

| Cost | $000 | $000 | $000 | |

| B/f at 1 Jan 20X3 | 2,000 | 750 | 2,750 | |

| Disposals | (1,100) | – | (1,100) | |

| ––––– | ––––– | ––––– | ||

| C/f at 31 Dec 20X3 | 900 | 750 | 1,650 | |

| Depreciation | ––––– | ––––– | ––––– | |

| B/f at 1 Jan 20X3 | 200 | 420 | 620 | |

| Disposals | (110) | – | (110) | |

| Charge | 18 | 67 | 49 | |

| ––––– | ––––– | ––––– | ||

| C/f at 31 Dec 20X3 | 108 | 469 | 577 | |

| Carrying value | ––––– | ––––– | ––––– | |

| At 31 Dec 20X3 | 792 | 281 | 1,073 | |

| ––––– | ––––– | ––––– | ||

| At 31 Dec 20X2 | 1,800 | 330 | 2,130 | |

| ––––– | ––––– | ––––– |

Buildings are depreciated over 50 years on a straight line basis.

Plant and machinery are depreciated at 15% using the reducing balance method.

| Note 2 – Development costs | Total | |

| $000 | ||

| B/f at 1 Jan 20X3 | 125 | |

| Additions | 5 | |

| ––––– | ||

| C/f at 31 Dec 20X3 | 130 | |

| Amortisation | ––––– | |

| B/f at 1 Jan 20X3 | 50 | |

| Charge | 26 | |

| ––––– | ||

| C/f at 31 Dec 20X3 | 76 | |

| Carrying value | ––––– | |

| At 31 Dec 20X3 | 54 | |

| ––––– | ||

| At 31 Dec 20X2 | 75 | |

| ––––– |

Development costs are being amortised over five years using the straight line method.

| Notes: | ||

| 31.12.20X3 | 31.12.20X2 | |

| $000 | $000 | |

| Trade receivables | 2,274 | 1,423 |

| Allowance for doubtful receivables | (70) | (70) |

| ––––– | ––––– | |

| 2,204 | 1,353 | |

| ––––– | ––––– |

Required:

Prepare briefing notes for the partner which evaluate the audit risks that should be taken into consideration when planning the final audit of Ivor Co.

Professional marks will be awarded for the presentation, logical flow and

clarity of explanation of the briefing notes. (15 marks)

Test your understanding 3

Engine Co

You are the audit senior in a firm of accountants. You are assisting with the planning for the year-end audit of one of your main clients, Engine Co. The senior manager has asked you to perform an analytical review of the financial statements that she can use to brief the engagement partner of the key audit risks.

| 30.06.20X4 | 30.06.20X3 | ||||

| (Draft) | (Audited) | ||||

| Statement of profit or loss | $m | $m | $m | $m | |

| Revenue | 128 | 107 | |||

| Cost of sales | |||||

| Opening inventory | 9 | 6 | |||

| Purchases | 87 | 74 | |||

| Closing inventory | (14) | (9) | |||

| –––– | (82) | –––– | (71) | ||

| –––– | –––– | ||||

| Gross profit | 46 | 36 | |||

| Distribution costs | (11) | (9) | |||

| Admin expenses (note 1) | (20) | (18) | |||

| –––– | –––– | ||||

| Profit before tax | 15 | 9 | |||

| –––– | –––– | ||||

| Statement of financial position | |||

| Non-current assets | |||

| Tangible assets (note 2) | 77 | 67 | |

| Intangible assets (note 3) | 17 | 13 | |

| –––– | –––– | ||

| Current assets | 94 | 80 | |

| Inventory (note 4) | 14 | 9 | |

| Trade receivables | 17 | 13 | |

| Cash | 3 | 3 | |

| –––– | –––– | ||

| 34 | 25 | ||

| Total assets | –––– | –––– | |

| 128 | 105 | ||

| Equity and liabilities | –––– | –––– | |

| Ordinary share capital | 20 | 20 | |

| Revaluation reserve | 38 | 30 | |

| Retained earnings | 30 | 25 | |

| –––– | –––– | ||

| Non-current liabilities | 88 | 75 | |

| Bank loan | 13 | 11 | |

| Current liabilities | |||

| Trade payables | 17 | 13 | |

| Other payables | 5 | 3 | |

| Tax payable | 5 | 3 | |

| –––– | –––– | ||

| 27 | 19 | ||

| –––– | –––– | ||

| 128 | 105 | ||

| –––– | –––– | ||

Note 1

Included within operating profits are the following items:

| 30.06.20X4 | 30.06.20X3 | |

| $m | $m | |

| Wages and salaries | 7 | 7 |

| Directors’ salaries | 2 | 2 |

| Depreciation | 3 | 3 |

| Amortisation | 4 | 3 |

| 7 | ||||||

| Note 2 | ||||||

| Land & | Plant & | Total | ||||

| buildings | machinery | |||||

| Cost | $m | $m | $m | |||

| B/f at 1 July 20X3 | 70 | 30 | 100 | |||

| Additions | – | 5 | 5 | |||

| Revaluations | 8 | – | 8 | |||

| –––– | –––– | –––– | ||||

| C/f at 30 June 20X4 | 78 | 35 | 113 | |||

| Depn | –––– | –––– | –––– | |||

| B/f at 1 July 20X3 | 10 | 23 | 33 | |||

| Charge | 1 | 2 | 3 | |||

| –––– | –––– | –––– | ||||

| C/f at 30 June 20X4 | 11 | 25 | 36 | |||

| Carrying value | –––– | –––– | –––– | |||

| At 30 June 20X4 | 67 | 10 | 77 | |||

| –––– | –––– | –––– | ||||

| At 30 June 20X3 | 60 | 7 | 67 | |||

| –––– | –––– | –––– | ||||

| The revaluation relates to land. | ||||||

Plant and machinery are depreciated at 25% using the reducing balance method.

| Note 3 | ||

| Development costs | Total | |

| Cost | $ | |

| B/f at 1 July 20X3 | 16 | |

| Additions | 8 | |

| –––– | ||

| C/f at 30 June 20X4 | 24 | |

| Amortisation | –––– | |

| B/f at 1 July 20X3 | 3 | |

| Charge | 4 | |

| –––– | ||

| C/f at 30 June 20X4 | 7 | |

| Carrying value | –––– | |

| At 30 June 20X4 | 17 | |

| –––– | ||

| At 30 June 20X3 | 13 | |

| –––– |

During the year significant research and development has taken place with regard to a new product for which commercial production has now commenced.

| Note 4 | ||

| 30.06.20X4 | 30.06.20X3 | |

| $m | $m | |

| Inventory | 3 | 2 |

| Raw materials | 1 | 1 |

| WIP | 11 | 7 |

| Finished goods | (1) | (1) |

| –––– | –––– | |

| Allowance for slow-moving inventory | 14 | 9 |

| –––– | –––– |

Required:

Prepare briefing notes for your manager which evaluate the audit risks identified during your analytical review of the financial statements.

Professional marks will be awarded for the presentation, logical flow and

clarity of explanation of the briefing notes. (15 marks)

Test your understanding 4

- Kingston Co operates in the computer games industry, developing new games for sale in retail stores.

- Portmore Co is currently waiting for confirmation from their bank that their overdraft facility will be extended. The bank have requested a copy of the audited financial statements as soon as they are available.

- Montego Co has recently started selling their products overseas.

- Lucea Co, a manufacturer, has negotiated a contract with a new supplier for all its raw materials.

Required:

For each of the scenarios below identify the business risks and state the impact this might have on your assessment of the risk of material

misstatement for the planning of the audit. (8 marks)

Test your understanding 1 – Yates

Briefing notes

To: Audit partner

From: Audit manager

Date: 01 June 20X4

Subject: Planning of the audit of Yates for the year ended 30

June 20X4

Introduction

These briefing notes evaluate the risks of material misstatement and suggest audit procedures to be included in the audit plan in respect of trade receivables and vehicles.

- Risks of material misstatement Revenue

Revenue is recorded net of rebates which are calculated quarterly in arrears. Revenue has increased by 11.8%.

There is a risk of overstatement of revenue if rebates for the last quarter have not been accrued at the year-end.

Intangibles

Intangible assets have increased by $1 m and represent 6.9% of total assets therefore are material and an area of significant risk.

IAS 38 Intangible Assets states that internally-generated intangibles should not be recognised as they cannot be reliably measured.

Intangible assets may be overstated if the balance includes intangibles which do not meet the criteria of IAS 38.

Restructuring provision

The restructuring provision that was made last year represents 9.3% of total assets therefore are material and an area of significant risk.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets requires a provision to be recognised only if there is a present obligation that is probable to result in an outflow of benefits and can be measured reliably.

There is a risk that provisions are overstated as the restructuring occurred 18 months ago and there may no longer be any obligations for the company to fulfil.

Lease liabilities

Lease liabilities represent 5.2% of total assets and are therefore material and an area of significant risk.

Leases of twelve months or longer should be recognised as assets and a corresponding liability recognised for the lease payments, unless the underlying asset has a low value. Leases of less than twelve months should be expensed.

There is a risk of under or overstatement of assets and lease liabilities if leased assets are treated incorrectly.

There is also a risk of inadequate disclosure if the disclosure requirements of IFRS 16 Leases are not met.

Opening balances

Yates is a new audit client which means the opening balances were not audited by our firm last year.

There is a risk of misstatement of opening balances if the auditors last year failed to detect any material misstatements.

The predecessor auditor should be contacted and their working papers reviewed as part of our firm’s testing on opening balances this year.

Tangible assets

The carrying value of property has fallen by 5%, vehicles increased by 2.5% and other equipment has fallen by 20.4%.

Vehicles and equipment may be overstated if:

– Disposals have not been recorded

– Depreciation has been undercharged (e.g. not for a whole year)

– Impairments have not yet been accounted for.

Depreciation and amortisation

Depreciation and amortisation expense has fallen by 10.5%. This could be valid if Yates has significant assets already fully depreciated or the asset base is lower since last year’s restructuring.

However, there is a risk of understatement of depreciation and therefore overstatement of assets, if, for example:

– Not all assets have been depreciated (or depreciated at the wrong rates, or only for 11 months of the year).

– Impairment losses have not been recognised (as compared with the prior year).

Materials expense

Materials expense has increased by 17.8% which is more than the increase in revenue.

This could be legitimate for example if fuel costs have increased significantly. However, the increase could indicate misstatement in relation to capital expenditure treated as revenue (e.g. on overhauls or major refurbishment) or misclassification of expenses.

There is a risk of overstatement of materials expense.

Other expenses

Other expenses have fallen by 15.5% which is unusual given the increase in the level of business.

Expenses may be understated due to:

– expenses being misclassified as materials expense.

– underestimation of accrued expenses (especially as the financial reporting period has not yet expired).

Trade payables

These have increased by only 5.3% compared with the 17.8% increase in materials expense.

There is a risk of understatement of liabilities if supplier invoices are still to be received in respect of goods delivered before the year-end (the month of June being an unexpired period).

Receivables

Trade receivables have increased by just 2.2% although revenue has increased by 11.8%. Receivables days have reduced from 34 days to 31 days.

This seems unusual and may indicate understatement of the receivables balance due to a lack of completeness.

Other liabilities

These may be understated as they have increased by only 7.6% although staff costs have increased by 14%.

For example, balances owing in respect of outstanding holiday entitlements at the year-end may not yet be accurately estimated, or employment taxes may not have been accrued on bonuses.

- Audit procedures

- Trade receivables

– Review agreements to determine the volume rebates terms. For example:

– the % discounts

– the volumes to which they apply

– the period over which they accumulate

– settlement method (e.g. by credit note or other off-set or repayment).

– Perform a direct positive confirmation of a sample of balances (i.e. larger amounts) to identify potential overstatement (e.g. due to discounts earned not being awarded).

– Inspect after-date cash receipts and match against amounts due as shortfalls may indicate disputed amounts.

– Review after-date credit notes to ensure adequate allowance (accrual) is made for discounts earned in the year.

– Enquire with management to identify if prompt payment discounts have been offered and level of take up.

– Enquire of management the basis for the allowance for receivables and assess whether the basis is reasonable.

– Compare the prior year allowance to the amount of irrecoverable debts written off during the year to assess the reasonableness of management’s estimate.

– Review the aged receivables listing for very old debts which may be irrecoverable and compare with the allowance to assess the adequacy of the allowance.

- Vehicles

– Physically inspect a sample of vehicles selected from the asset register to confirm existence and condition (for evidence of impairment). If analytical procedures use management information on mileage records this should be checked (e.g. against millimetres) at the same time.

– Inspect purchase invoices for additions to confirm the cost has been recorded accurately in the asset register.

– Review the terms of all lease contracts entered into during the year to ensure that leases have been capitalised appropriately.

– Recalculate the depreciation charge for a sample of vehicles to ensure arithmetical accuracy.

– Review repairs and maintenance accounts (included in materials expense) to ensure that there are no material items of capital nature that have been expensed (completeness).

Conclusion

The above audit risks demonstrate that the audit of Yates Co is a high risk engagement. These risks must be addressed by designing appropriate audit procedures to be included in the audit plan. Appropriately experienced staff must be assigned to the audit team to ensure any material misstatements are detected.

Test your understanding 2 – Ivor

Briefing notes

To: Audit partner

From: Audit senior

Date: 24 March 20X4

Subject: Audit risks of Ivor Co to assist the planning of the year-end

audit.

Introduction

These briefing notes evaluate the audit risks that should be considered when planning the audit of Ivor Co.

Analytical procedures

Annual movements

| Revenue (gross) | 2,935/10,160 × 100 | 28.9% |

| Cost of sales | 1,953/7,603 × 100 | 25.7% |

| Distribution costs | 264/498 × 100 | 53% |

| Wages/salaries | 315/960 × 100 | 32.8% |

| Directors’ salaries | 10/115 × 100 | 8.7% |

| Rent | 23/12 × 100 | 191.7% |

| Other | 16/153 × 100 | (10.5%) |

| 7 | ||||||||

| Ratio analysis | ||||||||

| 20X3 | 20X2 | |||||||

| Gross margin | 3,014/13,095 × 100 | 23% | 2,357/10,160 × 100 | 23.2% | ||||

| Operating margin | 1,190/13,095 × 100 | 9.1% | 694/10,160 × 100 | 6.8% | ||||

| ROCE | 1,190/4,094 × 100 | 29.1% | 694/3,004 × 100 | 23.1% | ||||

| Asset turnover | 13,095/4,094 | 3.2 | 10,160/3,004 | 3.4 | ||||

| Current ratio | 3,994/1,027 | 3.9:1 | 2,595/1,796 | 1.4:1 | ||||

| Quick ratio | 2,354/1,027 | 2.3:1 | 1,395/1,796 | 0.8:1 | ||||

| Inventory days | 1,640/9,556 × 365 | 62.6 | 1,200/7,603 × 365 | 57.6 | ||||

| Receivable days | 2,204/13,095 × 365 | 61.4 | 1,353/10,160 × 365 | 48.6 | ||||

| Payable days | 703/10,150 × 365 | 25.3 | 1,479/7,830 × 365 | 68.9 | ||||

Revenue

Revenue has increased by 29% during the year. This significant increase suggests a risk that revenue could be overstated.

The increase in revenue has been partly fuelled by offering greater discounts, totalling 4% of revenue as compared with 2% in the prior year. It is possible that extended credit terms have been offered due to the lengthening of the receivables collection period from an average 49 days last year to an average of 61 days this year.

The significant increase may indicate inappropriate cut-off or revenue recognition procedures which are not in accordance with IFRS 15 Revenue From Contracts With Customers.

Sale of buildings

During the year buildings with a carrying value of $990,000 have been sold for $1,500,000. At the same time the company’s rental expenses have increased by 190%. It appears the company has entered into a sale and leaseback arrangement as it is unlikely that the company would be able to increase production so much having sold half of their buildings.

There is a risk that this has not been accounted for in accordance with IFRS 16 Leases . If the sale is not a genuine sale the asset building should continue to be recognised by Ivor and a financial liability recognised equal to the proceeds received.

As there is no financial liability included in the statement of financial position, this would indicate that Ivor has treated the sale and leaseback as a sale.

There is a risk of understatement of tangible assets and financial liabilities. In addition, the relevant disclosures for the transaction may not be made adequately.

Development costs

Development costs of $54k represent 1 % of total assets and are material.

The costs may not be accounted for in accordance with IAS 38 Intangible Assets. The amortisation policy is 5 years. This may not be the expected life of the product and therefore may be inappropriate.

There is a risk of overstatement of development costs if the amortisation charge is not appropriate.

Inventory

Inventory represents 32% of total assets therefore is material and an area of significant risk.

Inventory should be valued at the lower of cost and net realisable value in accordance with IAS 2 Inventories. The discounts offered must be taken into account when determining the net realisable value. Some products may be used as loss leaders in a drive to tempt new customers.

As inventory days have increased from 58 days to 63 days, this could indicate an increased risk of overvaluation of inventory.

Receivables

The overall increase in credit sales, coupled with the greater credit period increases the risk of irrecoverable receivables. However, the allowance for receivables has not been adjusted from the previous balance of $70,000, which represented 5% of total receivables last year but only 3% of receivables this year. Receivable days have increased from 49 days to 61 days.

There is a risk of overstatement of trade receivables and understatement of the allowance for receivables.

Going concern

During the year there appears to have been an improvement in the liquidity of the company, with the current and quick ratios improving from 1.4 and 0.8 last year to 3.9 and 2.3 this year, respectively.

Ivor has raised a significant amount of cash from the disposal of buildings and the issuing of new shares during the year. In total $2.2m has been raised ($1.5m disposal + $700k share issue) and it appears as though this has been used to pay off significant external debts, most notably the bank loan and trade payables. The result is a healthier statement of financial position.

However, there is very little residual cash left over and the company appears to be having difficulty generating trading cash balances. Inventory days and receivables days have both increased and this increase in the operating cycle could be caused by offering extended credit in an attempt to win new customers.

The inability to generate cash balances could indicate the company is unable to meet loan or lease repayments. A failure to pay trade payables could lead to a loss of supplier goodwill and have implications for future trade relationships.

If the business is no longer a going concern then the break up basis should be used. There is a risk the financial statements are prepared on an inappropriate basis.

If the basis of preparation is deemed appropriate, there is a risk of inadequate disclosure of going concern issues.

Cost of sales

Cost of sales has increased by 25.7% when revenue has increased by 28.9%. Cost of sales may be understated or revenue overstated as it would be expected that these balances would increase by the same proportion.

Purchases including accruals may not be completely recorded or closing inventory may be overstated.

Distribution costs

These have increased by over 53% during the financial year which is much higher than the increase in revenue. This could be due to greater geographical spread of customers, rising fuel costs or misallocation of expenses.

Conclusion

The above evaluation demonstrates that the audit of Ivor Co is a high risk engagement. The audit plan will need to include audit procedures to address these risks. The audit team selected will need to have the relevant skills to address the risks.

Test your understanding 3

Briefing Notes

To: Audit Manager

From: Audit senior

Date: 27 September 20X4

Subject: Engine Co – audit risk assessment Introduction

These briefing notes evaluate the audit risks identified during the analytical review of the financial statements of Engine Co and the possible implications for the year-end audit.

Analytical procedures

| 20X4 | 20X3 | |||

| Gross margin | 46/128 × 100 | 35.9% | 35/107 × 100 | 33.6% |

| Operating margin | 15/128 × 100 | 11.7% | 9/107 × 100 | 8.4% |

| ROCE | 15/101 × 100 | 14.8% | 9/86 × 100 | 10.5% |

| Asset turnover | 128/101 | 1.27 | 107/86 | 1.24 |

| Current ratio | 34/27 | 1.3:1 | 25/19 | 1.3:1 |

| Quick ratio | 20/27 | 0.7:1 | 16/19 | 0.8:1 |

| Inventory days | 14/82 × 365 | 62 | 9/71 × 365 | 46 |

| Receivables days | 17/128 × 365 | 48 | 13/107 × 365 | 44 |

| Payables days | 17/87 × 365 | 71 | 13/74 × 365 | 64 |

| Gearing | 13/101 × 100 | 12.9% | 11/86 ×100 | 12.8% |

Profitability

Gross margins have increased during the year from 34% to 36%. Operating margins, however, have increased significantly from 8% to 12%.

The change in gross margin appears to have been achieved through economies in purchasing, which could be due to bulk purchasing consistent with the increase in revenue.

If this is not the case, there is a risk that cost of sales are understated possibly by overvaluation of closing inventory or incomplete recording of purchases.

The gains made due to savings at the operational level appear to be driven through administrative efficiencies. These costs have increased by 11% in the year in comparison to an overall 20% increase in revenue.

A review of operating costs suggests that this has been achieved through labour efficiencies, given the stable salary costs.

There is a risk that expenses have not been completely recorded and attention should be paid to cut-off at the year-end.

Salary costs

There is a risk that salary costs are understated and at the same time intangible development costs are overstated.

During the year Engine Co capitalised $8 million of development costs relating to a project which has now begun commercial production. In accordance with IAS 38 Intangible Assets, only those development costs meeting all the capitalisation criteria may be taken to the statement of financial position. Research costs must be expensed.