Exam focus

A group could appear in any question in the exam, and is relevant to all stages of an engagement.

Read the scenario to identify whether the question relates to a single entity or a group.

Take care to identify whether you are the auditor for the entire group (including subsidiaries) or just the parent company. Reliance on the work of other auditors will only be relevant if you are not responsible for the audit of the subsidiaries.

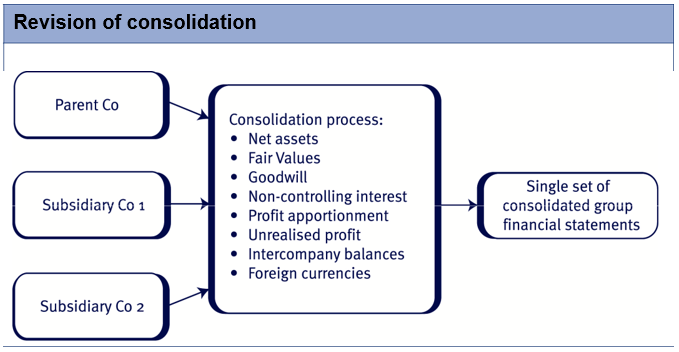

Revision of consolidation

Consolidation involves taking a number of sets of individual company financial statements and adding them all together to form one combined set. Due to various complications, such as companies using different currencies and intergroup trading, a number of adjustments have to be made before the consolidated financial statements can be finalised.

Before the group financial statements can be audited, the individual company’s financial statements have to be prepared and audited. In the diagram above this includes Parent Co, Subsidiary Co 1 and Subsidiary Co 2. It is the responsibility of individual company directors/management to prepare their financial statements. These may be audited by the group auditor or another firm of auditors.

Once this process is complete the financial statements are combined to create a single set of consolidated financial statements. This process is the responsibility of the group’s directors.

Once the consolidated financial statements have been prepared the group auditor performs an audit of the consolidated financial statements.

As the group is a summary of the trading results and positions of the various components of the group (and is itself not a trading entity) the group auditor does not need to audit the group financial statements in the same way. They rely on the audited figures of the individual financial statements to confirm the majority of balances and then audit the consolidation process and adjustments.

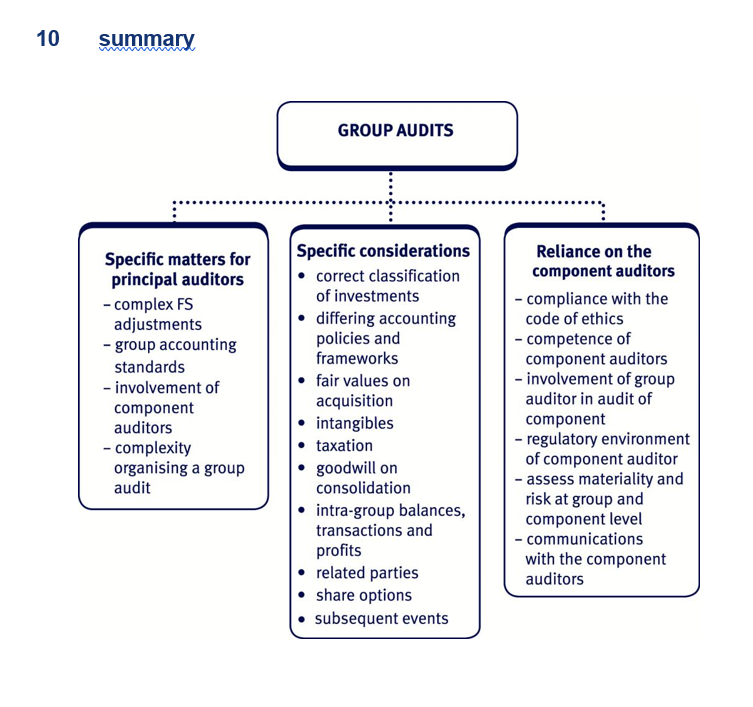

1 Group audits – specific considerations

The principles of auditing a group are the same as the audit of a single company and all of the ISAs are still relevant to a group audit. There are, however, some specific considerations relevant to the audit of a group:

Group financial statements require numerous and potentially complicated consolidation adjustments.

Specific accounting standards relating to group financial statements must be complied with.

The components of the group (i.e. the subsidiaries) may be audited by firms other than the group auditor.

The organisation and planning of a group audit may be significantly more complex than for a single company.

The objectives of an auditor with regard to these matters are identified in ISA 600 Special Considerations – Audits of Group Financial Statements (Including the Work of Component Auditors) as follows:

To determine whether it is appropriate to act as the auditor of the group financial statements.

If acting as the auditor of the group financial statements:

– To communicate clearly with the component auditors about the scope and timing of their work on financial information related to components and their findings.

– To obtain sufficient appropriate evidence regarding the financial information of the components and the consolidation process to express an opinion on whether the group financial statements are prepared, in all material respects, in accordance with the applicable financial reporting framework.

[ISA 600, 8]

Key terms

The auditor with the responsibility for reporting on the consolidated group financial statements (as well as the parent company financial statements) is referred to as the group auditor.

The related subsidiaries, associates, joint ventures and branches etc. of the group are referred to as components.

The audit firms responsible for the audits of the components are referred to as the component auditors.

2 Acceptance

Acceptance as group auditor

In addition to the normal acceptance considerations discussed in 6, firms should consider whether to accept the role of group auditor. To assist the decision they must consider:

Whether sufficient appropriate audit evidence can reasonably be expected to be obtained in relation to the consolidation process and the financial information of the components of the group.

Where component auditors are involved, the engagement partner shall evaluate whether the group engagement team will be able to be involved in the work of the component auditors.

[ISA 600, 12]

If the engagement partner concludes that it will not be possible to obtain sufficient appropriate evidence due to restrictions imposed by group management and that the possible effect of this will result in a disclaimer of opinion then they must not accept the engagement. If it is a continuing engagement, the auditor should withdraw from the engagement, where possible under applicable laws and regulations. [ISA 600, 13]

Acceptance as component auditor

The component auditor will consider the following before accepting appointment:

Whether they are independent of the parent and component companies and can comply with ethical requirements applying to the group audit.

Whether they possess any special skills necessary to perform the audit of the component and are competent to perform the work.

Whether they have an understanding of the auditing standards relevant to group audits and can comply with them.

Whether they have an understanding of the relevant financial reporting framework applicable to the group.

Whether they can comply with the group audit team instructions including the deadlines.

Whether they are willing to have the group auditor involved in their work and evaluate it before relying on it for group audit purposes.

3 Planning and performing the group audit

Overall audit strategy and plan

The group auditor is responsible for establishing an overall group audit strategy and plan in accordance with ISA 300 Planning an Audit of Financial Statements. [ISA 600, 15]

The group engagement partner is ultimately responsible for reviewing and approving this. [ISA 600, 16]

The audit plan will describe the work to be performed covering areas such as:

Obtaining an understanding of:

– the group, its components and their environments [ISA 600, 17]

– the component auditor [ISA 600, 19]

– the consolidation process. [ISA 600, 32]

Setting materiality for the group including the components [ISA 600, 21]

Responding to assessed risks, including consideration of whether a component is significant. [ISA 600, 24]

Subsequent events review in relation to the group. [ISA 600, 38]

Understanding the group, its components and their environments

The group auditor must:

Enhance its understanding of the group, its components and their environments including group-wide controls, obtained during the acceptance/continuance stage. [ISA 600, 17a]

Obtain an understanding of the consolidation process, including instructions issued by group management to components. [ISA 600, 17b]

Confirm or revise its initial identification of components that are likely to be significant. [ISA 600, 18a]

Assess the risks of material misstatement. [ISA 600, 18b]

Understanding the component auditor

Group auditors cannot simply rely on the work of other auditors. They must evaluate the work of others before relying on it. Therefore the group auditor should obtain an understanding of:

Whether the component auditor understands and will comply with the code of ethics.

The professional competence of the component auditor.

Whether the group auditor will be able to be involved in the work of the component auditor.

Whether the component auditor operates in a regulatory environment that actively oversees auditors.

[ISA 600, 19]

If the group auditor has serious concerns about any of the above issues then they should obtain evidence relating to the component’s financial statements without using the work of the component auditor. [ISA 600, 20]

Understanding the consolidation process

Consolidation adjustments do not pass through the usual transaction processing systems and may not be subject to the same internal controls as other transactions. Therefore the group auditor needs to:

Evaluate whether the adjustments appropriately reflect the events and transactions underlying them.

Determine whether adjustments have been correctly calculated, processed and authorised.

Determine whether adjustments are supported by sufficient appropriate documentation.

Ensure intra-group balances and transactions reconcile and have been eliminated.

[ISA 600, A56]

Examples of matters to be understood

In order to perform their risk assessment thoroughly, the group auditor must obtain a wide ranging understanding of matters relevant to the unique circumstances of the group and its components. Whilst the list below is not exhaustive, it provides a range of common examples to be considered specific to the circumstances of a group:

Instructions issued by group management to components:

– Accounting policies to be applied.

– Identification of reporting segments.

– Related party relationships.

– Intra-group transactions and balances.

– Reporting timetable.

[ISA 600, A25]

Group-wide controls:

– Regularity of meetings between group and component management.

– Monitoring process of component’s operations and financial results.

– Group management’s risk assessment process.

– Monitoring, controlling, reconciling and elimination of intra-group transactions.

– Centralisation of IT systems.

– Activities of internal audit.

– Consistency of policies across the group.

– Group wide codes of conduct and fraud prevention.

Consolidation process:

– The extent to which component management understand the consolidation process.

– The process for identifying and accounting for components.

– The process for identifying reportable segments.

– The process for identifying related party transactions.

– How changes to accounting policies are managed.

– The procedures for dealing with differing year-ends.

– The procedures for dealing with differing accounting policies.

– Group’s process for ensuring complete, accurate and timely financial reporting.

– The process for translating foreign components.

– How IT is used in the consolidation.

– Procedures for reporting subsequent events.

– The preparation and authorisation of consolidation adjustments.

– Frequency, nature and size of transactions between components.

– Steps taken to arrive at fair values.

[ISA 600, Appendix 2]

Materiality

The group auditor is responsible for establishing:

Materiality and performance materiality for the group financial statements as a whole.

Materiality for components where they are to be audited by other auditors. In order to reduce the risk of material misstatement in the group financial statements, materiality for the components should be set at an amount below materiality for the group as a whole.

[ISA 600, 21

Responding to assessed risks

The group audit team has to determine the type of work to be performed on the financial information of the components, irrespective of whether the audit of the component was performed by the group team or another auditor. [ISA 600, 24]

The amount of work required will depend on whether a component is significant to the group.

Significant components

A significant component is a component identified by the group engagement team that is either:

of individual significance to the group, or

likely to include significant risks of material misstatement to the group financial statements.

[ISA 600, 9m]

A significant component is identified by using an appropriate benchmark such as assets, liabilities, cash flows, profit, revenue. The benchmark is a matter of auditor judgment. [ISA 600, A5]

ISA 600 gives an example that an auditor may consider a component to be significant if it exceeds 15% of the chosen benchmark, however a different auditor may use a higher or lower amount. In the exam you should use the figure of 15% to assess whether a component is significant.

Components which are individually significant to the group

For components individually significant to the group a full audit must be performed. [ISA 600, 26]

If the audit of a significant component is to be performed by another auditor then the group auditor should be involved in the component’s risk assessment. [ISA 600, 30]

This includes:

Discussing with the component auditor the susceptibility of the component to material misstatement. [ISA 600, 30b]

Reviewing the component auditor’s documentation of identified risks of material misstatement. [ISA 600, 30c]

Performing risk assessment procedures themselves. [ISA 600, 31]

If significant risks of material misstatement are identified in a component that is audited by another auditor then the group auditor should evaluate whether the audit procedures performed were appropriate to address the risks.

Components which include significant risks of material misstatement

Where the component is significant because there is a significant risk of material misstatement to the group financial statements, the auditor can perform:

An audit of the component’s financial statements.

An audit of one or more account balances which are considered to be a significant risk.

Specified audit procedures relating to the significant risks.

[ISA 600, 27]

Components which are not significant

Analytical procedures (rather than a full audit) may be performed on components which are not significant. [ISA 600, 28]

Communication with component auditors

The group auditor is responsible for communicating with the auditors of the components on a timely basis. Communication shall include:

The work to be performed by the component and the use made of this.

The form and content of the communications made by the component auditor to the group auditor.

A request that the component auditor cooperates with the group team.

The ethical requirements relevant to the group audit. Component materiality and the threshold for triviality.

Identified significant risks of material misstatement of the group financial statements.

A list of identified related parties.

[ISA 600, 40]

As part of the communication process the group auditor should also request that the component auditor communicates matters that are relevant to the group audit on a timely basis. Such matters include:

Compliance with ethical standards. Compliance with audit instructions.

Identification of financial information upon which the component auditor is reporting.

Instances of non-compliance with laws and regulations. Uncorrected misstatements.

Indications of management bias.

Significant deficiencies in internal control.

Other significant matters to be communicated to those charged with governance.

Any other matters relevant to the group audit. The component auditor’s overall conclusion.

[ISA 600, 41]

Further communications

As well as the matters identified above, the group auditor should also communicate further matters in a letter of instruction. This is likely to include:

Matters relevant to the planning of the component audit:

– The timetable for completion.

– Dates of planned visits by the group auditor.

– A list of key contacts.

– Work to be performed on intra-group balances.

– Guidance on other statutory reporting responsibilities.

– Instructions for subsequent events review.

Matters relevant to the conduct of component auditor’s work:

– The findings of the group auditor’s tests of controls on common systems.

– The findings of internal audit relevant to the component.

– A request for timely communication of evidence that contradicts evidence used in the group risk assessment.

– A request for written representations on component management’s compliance with the applicable financial reporting framework.

– Matters to be documented by the component auditor. Other information:

A request that the following be reported in a timely fashion:

– Significant accounting, financial reporting and auditing matters, including accounting estimates and related judgments.

– Matters relating to the going concern status of the component.

– Matters relating to litigation and claims.

– Significant deficiencies in internal control and information that indicates the existence of fraud.

– A request that the group auditor be notified of any unusual events as early as possible.

[ISA 600, Appendix 5]

4 Audit risks specific to a group audit

In addition to the risks covered in 7 which could affect any audit, group audits present additional risks. There are specific accounting standards which relate to groups such as:

IFRS 3 Business Combinations

IFRS 10 Consolidated Financial Statements

IFRS 11 Joint Arrangements

IAS 27 Separate Financial Statements

IAS 28 Investments in Associates and Joint Ventures

As always, there is a risk that the client does not comply with the relevant accounting treatment which would mean the financial statements are materially misstated. Some examples include:

Valuation of goodwill

Translation of foreign subsidiaries in the consolidation process

Non-coterminous year-ends

Inconsistent accounting policies used across the group Fair value adjustments

Calculation of non-controlling interests

Elimination of intercompany balances and trading

Profit apportionment where there has been an acquisition or disposal Simple transposition or arithmetical errors in the consolidation process.

The auditor must ensure that audit procedures are designed and performed to address these specific risks.

Risk indicators for group audits

The following examples could indicate an increased risk of material misstatement of the group financial statements:

A complex group structure.

Frequent acquisitions, disposals and/or reorganisations.

Poor corporate governance systems.

Non-existent or ineffective group-wide controls.

Components operating under foreign jurisdictions that may be subject to unusual government intervention.

High risk business activities of components.

Unusual related party transactions.

Prior occurrences of intra-group balances that did not reconcile.

The existence of complex transactions that are accounted for in more than one component.

Differing application of accounting policies.

Prior occurrences of unauthorised or incomplete consolidation adjustments.

Aggressive tax planning.

Frequent changes of auditor.

[ISA 600, Appendix 3]

Dealing with non-coterminous year-ends

IFRS 10 Consolidated Financial Statements requires the parent and subsidiaries to have the same year-end or to consolidate based on additional financial information prepared by the subsidiary (or if impracticable, the most recent financial statements adjusted for significant transactions or events). The difference between the parent and subsidiary’s year-end must be no more than three months.

Audit risk is increased if there is a difference between the year ends as some of the transactions and adjustments included within the consolidated financial statements will not have been audited.

The group auditor must plan to obtain sufficient appropriate evidence about transactions or events that have not been subject to audit.

5 Auditing the consolidated financial statements

Procedures over the consolidation schedule

Agree the figures from the component financial statements into the consolidation schedule to ensure accuracy.

Recalculate the consolidation schedule to ensure arithmetical accuracy.

Recalculate the translation of any foreign components to ensure accuracy.

Recalculate any non-controlling interest balances to verify accuracy.

Agree the date of any acquisitions or disposals and recalculate the time apportionment of the results for these components included in the consolidation.

Evaluate the classification of the component (i.e. subsidiary, associate, joint venture etc.) to ensure this is still appropriate.

For investments in associates ensure that these are accounted for using the equity method of accounting and not consolidated.

Review the financial statement disclosures for related party transactions.

Review the policies and year-ends applied by the components to ensure they are consistent across the group.

Reconcile intercompany balances and ensure they cancel out in the group financial statements.

Assess the reasonableness of the client’s goodwill impairment review to ensure goodwill is not overstated.

Calculate any goodwill on acquisition arising in the year paying special attention to:

– Consideration paid – agree to bank statements.

– Acquisition related costs – ensure they have been expensed and not capitalised.

– Contingent consideration – whether this has been valued at fair value taking into account the probability and timing of payment.

– Deferred consideration – should be discounted to present value.

6 Completion and review

Review of the work of the component auditor

The group auditor must review the work of the component auditor to ensure it is sufficient and appropriate to rely on for the purpose of the group auditor’s report.

This may be achieved by the component auditor sending the group auditor a questionnaire or checklist which identifies the key aspects of the audit.

The group auditor can then make an assessment as to whether any further work is needed.

If any significant matters have arisen they should discuss with the component auditor or group management, as appropriate. [ISA 600, 42a]

If necessary the group auditor should then also review other relevant parts of the component auditor’s working papers. [ISA 600, 42b]

If the group auditor is not satisfied with the component auditor’s work they should determine what additional procedures are required. [ISA 600, 43]

If it is not feasible for the component auditor to perform this then the group auditor must perform the procedures. [ISA 600, A62]

When all procedures on the components have been completed, the group engagement partner must consider whether the aggregate effect of any uncorrected misstatements will have a material impact on the group financial statements. [ISA 600, A63]

Other completion activities

Subsequent events, going concern and final analytical procedures will need to be considered for the group in the same way as they are considered for a single entity audit.

Letters of support

If a subsidiary has going concern issues the parent company may offer financial support to enable it to continue trading for the foreseeable future. If this is the case the directors must give the component auditor a letter of support which confirms their intention to support the subsidiary. This is also known as a comfort letter.

The component auditor should not take this at face value. They should consider the position of the parent and the group to help identify whether it has the resources to fulfil its promise of support before accepting the letter as sufficient appropriate evidence of the going concern basis for the subsidiary.

The group auditor must consider the impact of the going concern issues for the group as a whole.

The parent company must disclose this guarantee of assistance in their financial statements.

7 Reporting

Where one or more of the subsidiaries has a modified auditor’s report (regardless of who audited the subsidiary) the group auditor must consider the impact of the issue on the group financial statements, according to group materiality levels.

If the matter is not material in a group context, an unmodified report will be issued.

If the matter is material to both the component and the group the auditor

should consider whether the issue causing the modification can be resolved as a consolidation adjustment and aim to resolve the matter with the client. If this is resolved, an unmodified report can be issued.

If the matter is material and cannot be resolved through the consolidation process, the modification should be carried through to the group auditor’s report, (e.g. if the evidence is not available to support the balance).

Note that a matter which is pervasive to the component may be material but not pervasive to the group. In which case, a disclaimer of opinion or adverse opinion in a subsidiary will become a qualified opinion in the group auditor’s report.

Reporting to management and those charged with governance

Deficiencies in controls identified by either the group audit team or component auditors should be reported to management of the group. [ISA 600, 46]

Any frauds or deficiencies in the group-wide controls identified by either the group auditor or the component auditor should be reported to management of the group. [ISA 600, 47]

The following matters should be reported to those charged with governance of the group:

Overview of the work performed and involvement in the component auditor’s work.

Areas of concern over the quality of the component auditor’s work. Difficulties obtaining sufficient appropriate evidence.

Fraud identified or suspected.

[ISA 600, 49]

8 Joint audit

A joint audit is when two audit firms are appointed to provide an opinion on a set of financial statements. They will work together planning the audit, gathering evidence, reviewing the work and providing the opinion.

Benefits

Retention of a subsidiary auditor and therefore their cumulative audit knowledge and experience following acquisition.

Availability of a wider range of resources which may be particularly important across national boundaries.

Possible efficiency improvements as each firm can perform work that plays to their strengths.

Disadvantages

The two firms may have different cultures leading to cultural clashes when trying to work together.

There may be difficulty setting a joint approach. One firm may feel the work has not been divided equitably.

Both firms will need to be paid a fee making it more expensive than a traditional audit.

Before accepting a joint audit, the firm must consider the level of risk associated with issuing a report alongside the other firm. The auditor’s report will be signed by both firms and they will be jointly responsible if the report is wrong.

The firm should consider the experience and quality of the other firm to ensure they are competent.

If accepted, an engagement letter should be signed and the planning can commence which will involve agreeing an acceptable and fair division of the workload.

Joint audit – recent trends

Joint auditing allows small and medium sized entities to continue to be involved in an audit once their client has been acquired or merged with another organisation. Given recent trends in globalisation the alternative would likely be the replacement of the existing auditor with a larger firm.

Given the nature of the current economy and the level of acquisition activity, this could significantly reduce the pool of business for small and medium sized accountancy practices. Joint audits are therefore considered to be an important tool in combating the increased power of the ‘Big 4’ and the more significant medium tier firms.

9 Transnational audits

Transnational audit means an audit of financial statements which may be relied upon outside the audited entity’s home jurisdiction.

Reliance on these audits might be for purposes of significant lending, investment or regulatory decisions.

The differences between a ‘normal’ audit, conducted within the boundaries of one set of legal and regulatory requirements, and a transnational audit are largely due to variations in:

Auditing standards

Regulation and oversight of auditors Financial reporting standards

Corporate governance requirements.

Auditing standards

Despite the prevalence of International Standards on Auditing, many countries use modified versions and many continue to use local standards. As a result, in a group audit with components from a wide range of geographical backgrounds, it is possible that the audits of the components will be performed according to different standards. This could lead to inconsistency and poor quality for the group audit as a whole.

Regulation and oversight of auditors

As well as differing auditing standards there are many different ways in which the auditing profession is regulated. Some regulatory regimes are more stringent than others. This will mean the penalties for not complying with professional regulations are more severe and firms may perform work to a higher standard to avoid such penalties. This can affect the quality of the audit of components from different regimes, which will lead to inconsistency in the quality of a group audit.

Financial reporting standards

Within a multinational group it is likely that adjustments will be required due to the application of different financial reporting standards. These standards will be reflected in the component financial statements but, on consolidation, must be adjusted to reflect the parent’s accounting policies. This can lead to some technically complex consolidation adjustments which will increase the risk of material misstatement.

Corporate governance requirements

In some countries there are very strict corporate governance requirements that not only affect the directors of the company but their auditor. Often the auditor is required to perform, and report on, compliance with corporate governance requirements. In other countries the corporate governance requirements, particularly with regard to internal controls, are much more relaxed. This affects the audit as it could indicate that internal controls may be less effective than those of a component that operates in a highly regulated environment.

Auditors must be aware of the different regimes that apply to the audit of a transnational entity because they will be bound by the varying laws and regulations. Given the globalisation of businesses and stock markets this is an increasingly significant concern for many firms of auditors.

The Transnational Audit Committee

The International Federation of Accountants (IFAC) has a committee with specific responsibilities for transnational audits: the Transnational Audit Committee (TAC).

Globalisation

| Advantages | Disadvantages | |||

| Wide ranging expertise | Lack of competition and | |||

| Global facilities | choice, particularly for large | |||

| companies | ||||

Can invest in expensive systems and necessary IT to meet needs of international clients

The concentration of the audit market into a few very large firms has come about because of globalisation. The larger firms found that amalgamations amongst the audit firms were the way forward leading to a more concentrated audit market:

Affiliation is used by the larger accounting firms to develop an internationally recognised brand name.

Co-operation is used by the mid-tier firms who join international co-operatives of firms who send each other business, but retain their own trading name in their home countries.

Current trends

Current trends still lean towards:

Mergers of firms in the countries where the profession is more highly developed, for example USA and many European countries, and

Mergers between firms in the more developed arenas with practices in less developed locations.

In the mid-tier sector, the fastest way for firms to grow and achieve dominance in the sector is to merge with other similar sized companies. Recent mergers and acquisitions of firms include:

BDO and PKF, now BDO

Baker Tilly and RSM Tenon, now Baker Tilly.

Test your understanding 1

You are an audit manager in Ross & Co, a firm of Chartered Certified Accountants. The principal activity of one of your audit clients, Murray Co, is the manufacture and retail sale of women’s fashions and menswear throughout the capital cities of Western Europe.

The following financial information has been extracted from Murray’s most recent consolidated financial statements:

| 20X4 | 20X3 | ||

| $000 | $000 | ||

| Revenue | 36,367 | 27,141 | |

| –––––– | –––––– | ||

| Gross profit | 22,368 | 16,624 | |

| –––––– | –––––– | ||

| Profit before tax | 5,307 | 4,405 | |

| Intangible assets: | |||

| – | Goodwill | 85 | 85 |

| – | Trademarks | 52 | 37 |

| Property, plant and equipment | 7,577 | 4,898 | |

| Current assets | 13,803 | 9,737 | |

| –––––– | –––––– | ||

| Total assets | 21,517 | 14,757 | |

| –––––– | –––––– | ||

| Equity | 13,226 | 10,285 | |

| Non-current liabilities: | |||

| Provisions | 201 | 87 | |

| Current liabilities: | |||

| Trade and other payables | 8,090 | 4,385 | |

| –––––– | –––––– | ||

| Total equity and liabilities | 21,517 | 14,757 | |

| –––––– | –––––– | ||

In May 20X3 Murray purchased 100% of the shareholding of Di Rollo Co. Di Rollo manufactures fashion accessories (for example, jewellery, scarves and bags) in South America that are sold throughout the world by mail order. Murray’s management is now planning that clothes manufacture will expand into South America and sold into Di Rollo’s mail order market. Additionally, Di Rollo’s accessories will be added to the retail stores’ product range.

Murray is a member of an ethical trade initiative that aims to improve the employment conditions of all workers involved in the manufacture of its products. Last week Di Rollo’s chief executive was dismissed following allegations that he contravened Di Rollo’s policy relating to the environmentally-friendly disposal of waste products. The former chief executive is now suing Di Rollo for six months’ salary in lieu of notice and a currently undisclosed sum for damages.

Ross & Co has recently been invited to accept nomination as auditor to Di Rollo. Murray’s management has indicated that the audit fee for the enlarged Murray group should not exceed 120% of the fee for the year ended 31 March 20X3.

You have been provided with the following information relating to the acquisition of Di Rollo:

| Carrying | Fair value | Fair | |

| amount | adjustment | value to | |

| the group | |||

| $000 | $000 | $000 | |

| Di Rollo brand name | – | – | 600 |

| Plant and equipment | 95 | 419 | 514 |

| Current assets | 400 | – | 400 |

| Current liabilities | (648) | – | (648) |

| ––––– | ––––– | ––––– | |

| Net assets at date of acquisition | (153) | 419 | 866 |

| ––––– | ––––– | ––––– | |

| Goodwill arising on acquisition | 859 | ||

| ––––– | |||

| Cash consideration | 1,725 | ||

| ––––– |

Required:

- Using the information provided, explain the matters that should be considered before accepting the engagement to audit the financial statements of Di Rollo Co for the year ending 31 March 20X4.

(5 marks)

- Explain what effect the acquisition of Di Rollo Co will have on the

planning of your audit of the consolidated financial statements of

Murray Co for the year ending 31 March 20X4. (10 marks)

(Total: 15 marks)

Test your understanding 2

You are the manager responsible for the audit of the Nassau Group, which comprises a parent company and six subsidiaries. The audit of all individual companies’ financial statements is almost complete, and you are currently carrying out the audit of the consolidated financial statements. One of the subsidiaries, Exuma Co, is audited by another firm, Jalousie & Co. Your firm is satisfied as to the competence and independence of Jalousie & Co.

You have received from Jalousie & Co the draft auditor’s report on

Exuma Co’s financial statements, an extract from which is shown below:

Qualified Opinion (extract)

In our opinion, except for effects of the matter described in the Basis for Qualified Opinion paragraph, the financial statements give a true and fair view of the financial position of Exuma Co as at 31 March 20X1…’

Basis for Qualified Opinion (extract)

The company is facing financial damages of $2 million in respect of an ongoing court case, more fully explained in note 12 to the financial statements. Management has not recognised a provision but has disclosed the situation as a contingent liability. Under International Financial Reporting Standards, a provision should be made if there is an obligation as a result of a past event, a probable outflow of economic benefit, and a reliable estimate can be made. Audit evidence concludes that these criteria have been met, and it is our opinion that a provision of $2 million should be recognised. Accordingly, net profit and shareholders’ equity would have been reduced by $2 million if the provision had been recognised.

An extract of Note 12 to Exuma Co’s financial statements is shown below:

Note 12 (extract)

The company is the subject of a court case concerning an alleged breach of planning regulations. The plaintiff is claiming compensation of $2 million. The management of Exuma Co, after seeking legal advice, believe that there is only a 20% chance of a successful claim being made against the company.

Figures extracted from the draft financial statements for the year ending 31 March 20X1 are as follows:

| Nassau Group | Exuma | |

| $ million | $ million | |

| Profit before tax | 20 | 4 |

| Total assets | 85 | 20 |

Required:

- Identify and explain the matters that should be considered, and actions that should be taken by the group audit engagement

team, in forming an opinion on the consolidated financial

statements of the Nassau Group. (10 marks)

A trainee accountant, Jo Castries, is assigned to your audit team. This is the first group audit that Jo has worked on. Jo made the following comment regarding the group audit:

‘I understand that in a group audit engagement, one of the requirements is to design and perform audit procedures on the consolidation process. Please explain to me the principal audit procedures that are performed on the consolidation process.’

Required:

(b) Respond to the trainee accountant’s question. (5 marks)

(Total: 15 marks)

Test your understanding 1

- Acceptance matters Competence

Ross & Co should be sufficiently competent and experienced to undertake the audit of Di Rollo as it has similar competence and experience in auditing the larger Murray Co. However, Ross needs knowledge of conducting businesses in South America including legal and tax regulations.

Independence

Factors that might impair Ross’s objectivity in forming an opinion on the financial statements of Di Rollo (and the consolidated financial statements of Murray). For example, if Ross was involved in any due diligence review of Di Rollo, the same senior staff should not be assigned to the audit.

Resources

Adequacy of resources in South America (e.g. in representative/ associated offices). Ross must have sufficient time to report on Di Rollo within the timeframe for reporting on the consolidated financial statements of Murray.

Expected limitation of scope

Ross should not accept the nomination if any limitation imposed by management would be likely to result in the need to issue a disclaimer of opinion on Di Rollo’s financial statements.

Proposed fee

The proposed restriction in audit fee may compromise the quality of the audit of Di Rollo and/or the Murray group. The 20% increase needs to be sufficient to cover the cost of the audit of Di Rollo and the incremental costs associated with auditing Murray’s consolidated financial statements (as well as any general annual price increase that might be applied to audit fees).

Impact on the audit of Murray if the audit of Di Rollo is declined Di Rollo is material to the Murray group. At acquisition the fair values of Di Rollo’s tangible non-current assets, current assets and current liabilities represent 6.8%, 2.9% and 8%, respectively, of those in Murray’s consolidated financial statements at 31 March 20X3.

It is usual that a parent company should want its auditors to audit its subsidiaries. If Ross declined the nomination, Murray’s management may seek an alternative auditor for the group.

Professional clearance

Murray should give Ross written permission to communicate with Di Rollo’s current auditor to enquire if there is any professional reason why they should not accept this assignment.

Murray may provide Ross with additional fee-earning opportunities (e.g. due diligence reviews, tax consultancy, etc.) if it continues to expand in future.

- Effect of acquisition on planning the audit of Murray’s consolidated financial statements

Group structure

The new group structure must be ascertained to identify all entities that should be consolidated into the Murray group’s financial statements for the year ending 31 March 20X4.

Materiality assessment

Preliminary materiality for the group will be much higher, in monetary terms, than in the prior year. For example, if a % of total assets is a determinant of the preliminary materiality, it may be increased by 10% (as the fair value of assets acquired, including goodwill, is $2,373,000 compared with $21.5 million in Murray’s consolidated financial statements for the year ended 31 March 20X3).

The materiality of each subsidiary should be reassessed, in terms of the enlarged group as at the planning stage. For example, any subsidiary that was just material for the year ended 31 March 20X3 may no longer be material to the group.

This assessment will identify, for example:

– significant components requiring a full audit, and

– components for which analytical procedures will suffice.

As Di Rollo’s assets are material to the group, Ross should plan to inspect the South American operations. The visit may include meeting with Di Rollo’s previous auditors to discuss any problems that might affect the balances at acquisition and a review of the prior year audit working papers, with their permission.

Di Rollo was acquired two months into the financial year therefore its post-acquisition results should be expected to be material to the consolidated statement of profit and loss.

Goodwill acquired

The assets and liabilities of Di Rollo at 31 March 20X4 will be combined on a line-by-line basis into the consolidated financial statements of Murray and goodwill arising on acquisition recognised.

Audit work on the fair value of the Di Rollo brand name at acquisition, $600,000, may include a review of a brand valuation specialist’s working papers and an assessment of the reasonableness of assumptions made.

Significant items of plant are likely to have been independently valued prior to the acquisition. It may be appropriate to plan to place reliance on the work of expert valuers. The fair value adjustment on plant and equipment is very high (441 % of carrying amount at the date of acquisition). This may suggest that Di Rollo’s depreciation policies are over-prudent.

As the amount of goodwill is material (approximately 50% of the cash consideration) it may be overstated if Murray has failed to recognise any assets acquired in the purchase of Di Rollo. For example, Murray may have acquired intangible assets such as customer lists or franchises that should be recognised separately from goodwill and amortised (rather than tested for impairment).

Subsequent impairment

The audit plan should draw attention to the need to consider whether the Di Rollo brand name and goodwill arising have suffered impairment as a result of the allegations against Di Rollo’s former chief executive.

Liabilities

Proceedings in the legal claim made by Di Rollo’s former chief executive will need to be reviewed. If the case is not resolved at 31 March 20X4, a contingent liability may require disclosure in the consolidated financial statements, depending on the materiality of amounts involved. Legal opinion on the likelihood of Di Rollo successfully defending the claim may be sought. Provision should be made for any actual liabilities, such as legal fees.

Group (related party) transactions and balances

A list of all companies in the group (including any associates) should be included in group audit instructions to ensure that intra-group transactions and balances (and any unrealised profits and losses on transactions with associates) are identified for elimination on consolidation. Any transfer pricing policies (e.g. for clothes manufactured by Di Rollo for Murray and sales of Di Rollo’s accessories to Murray’s retail stores) must be ascertained and any provisions for unrealised profit eliminated on consolidation.

It should be confirmed at the planning stage that intercompany transactions are identified as such in the accounting systems of all companies and that intercompany balances are regularly reconciled.

Other auditors

If Ross plans to use the work of other auditors in South America (rather than send its own staff to undertake the audit of Di Rollo), group instructions will need to be sent containing:

– a request for confirmation of independence

– proforma statements

– a list of group and associated companies

– a list of related parties

– a statement of group accounting policies (see below)

– the timetable for the preparation of the group financial statements (see below)

– a request for copies of written representations from management

– an audit work summary questionnaire or checklist

– contact details (of senior members of Ross’s audit team).

Accounting policies

Di Rollo may have material accounting policies which do not comply with the rest of the Murray group. As auditor to Di Rollo, Ross will recalculate the effect of any non-compliance with a group accounting policy that Murray’s management would be requested to adjust on consolidation.

Timetable

The timetable for the preparation of Murray’s consolidated financial statements should be agreed with management as soon as possible. Key dates should be planned for:

– agreement of intercompany balances and transactions

– submission of proforma statements

– completion of the consolidation package

– tax review of group financial statements

– completion of audit fieldwork by other auditors

– subsequent events review

– final clearance on the financial statements of subsidiaries

– Ross’s final clearance of consolidated financial statements.

Test your understanding 2

- Matters that should be considered when forming an opinion on the group financial statements

Significant component

A significant component is a component identified by the group audit engagement team that is of individual significance to the group. Exuma Co meets the definition of a significant component because it contributes 20% of group profit before tax, and 23.5% of group total assets. Exuma Co is therefore material to the group financial statements.

Materiality of accounting issue

The legal case against Exuma Co involves a claim against the company of $2 million. This is material to the individual financial statements of Exuma Co as it represents 50% of profit before tax, and 10% of total assets. The matter is also material to the group financial statements, representing 10% of group profit before tax and 2.4% of group total assets.

Qualified Opinion – Exuma Co financial statements

Jalousie & Co has expressed a modified opinion due to a material misstatement regarding the accounting treatment of the court case. Management has treated the matter as a contingent liability as they believe that it is possible, but not probable, that the court case will go against the company. The auditors believe that it should have been recognised as a provision according to IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Given the materiality of the matter to the individual financial statements, this opinion seems appropriate (rather than an adverse opinion), as long as the audit evidence concludes that a provision is necessary.

Review and discussion of audit work relating to the court case Due to the significance of this matter, the audit work performed by Jalousie & Co should be subject to review by the group audit engagement team. Specifically, the evidence leading to the conclusion that a probable outflow of cash will occur should be reviewed, and the matter should be discussed with the audit partner responsible for the opinion on Exuma Co’s financial statements.

Evidence should include copies of legal correspondence, a copy of the actual claim showing the $2 million claimed against the company, and a written representation from management detailing management’s reason for believing that there is no probable cash outflow.

Further audit procedures

Given the subjective nature of this matter, the group engagement partner may consider engaging an external expert to provide an opinion as to the probability of the court case going against Exuma Co.

Discussion with Nassau Group management

The matter should be discussed with the Group management team as to whether a provision is necessary. Their views should be documented in a written representation. There should also be discussion with management, and communication with those charged with governance regarding the potential impact of the matter on the group audit opinion. The impact depends on whether an adjustment is made in the individual accounts of Exuma Co, on consolidation, or not made at all, as explained below.

Adjustment to Exuma Co financial statements

Exuma Co is a subsidiary of Nassau and by definition is under the control of the parent company. Therefore, management of Exuma Co can be asked to adjust the financial statements to recognise a provision. If this happens, Jalousie & Co’s auditor’s report can be redrafted as unmodified, and the group audit opinion will also be unmodified.

Adjustment on consolidation

Even if Exuma Co’s financial statements are not amended, an adjustment could be made on consolidation of the group financial statements to include the provision. In this case, the opinion on Exuma Co’s financial statements would remain qualified, but the group audit opinion would not be qualified as the matter causing the material misstatement has been rectified.

No adjustment made

If no adjustment is made, either to Exuma Co’s individual financial statements, or as a consolidation adjustment in the group financial statements, and if the group engagement partner disagrees with this accounting treatment, then the group audit opinion should be qualified due to a material misstatement. In this case, a paragraph entitled Basis for Qualified Opinion should explain the reason for the qualification, i.e. non-compliance with IAS 37, and should also quantify the financial effect on the consolidated financial statements. Reference to the work performed by a component auditor should not be made.

- Procedures

– Agree the figures from the component financial statements into the consolidation schedule to ensure accuracy.

– Recalculate the consolidation schedule to ensure arithmetical accuracy.

– Recalculate the translation of any foreign components to ensure accuracy.

– Recalculate any non-controlling interest balances to verify accuracy.

– Agree the date of any acquisitions or disposals and recalculate the time apportionment of the results for these components included in the consolidation.

– Evaluate the classification of the component (i.e. subsidiary, associate, joint venture etc.) to ensure this is still appropriate.

– Review the financial statement disclosures for related party transactions.

– Review the policies and year-ends applied by the components to ensure they are consistent with the group.

– Reconcile intercompany balances and ensure they cancel out in the group financial statements.

– Assess the reasonableness of the client’s goodwill impairment review to ensure goodwill is not overstated.

– Review and recalculate the deferred tax consequences of any fair value adjustments.

One thought on “Group and transnational audits p7”