Introduction

Performance auditors can be faced with considerable variety and ambiguity in their work. They require skills in analyzing activities and management practices. They can be faced with the need to become familiar with a wide range of organizational contexts and subject matters. They need the ability to write logically and thoroughly on complex issues. These guidelines can provide some assistance in these areas, but much is incumbent on the performance auditors themselves to develop their skills in these areas by other means.

The guidelines take into account relevant INTOSAI auditing standards and are based on generally accepted principles of performance auditing, distilled from the experience of INTOSAI members.[1] In order to produce experience-based implementation guidelines, a study has been made of standards and guidelines from a number of SAIs with many years’ experience of performance auditing. Their experience of conducting performance audits and implementing the Auditing Standards has added valuable information, not least with respect to the practical interpretation of the Auditing Standards.

It is not possible to produce guidelines applicable to all kinds of performance auditing, since comparisons between the practices of performance auditing in different countries show considerable variations in mandate, organisation, and methods used. Guidelines in performance auditing cannot comprehensively embrace all possible approaches, methods and techniques, since in practice that would include everything in the social sciences. Furthermore, performance audits deal with a multitude of topics and perspectives covering the entire government sector, and it would not be possible to develop detailed standards and procedures that work equally well in all these situations. In performance auditing it is not possible to produce a ‘cookbook’ type of manual that can universally be followed for good results.

Consequently, some SAIs will fi nd guidelines of this type of limited value. For instance, they might be considered too ambitious for auditors with little or no experience of dedicated performance audit projects or program evaluations. As stated in the Auditing Standards, paragraph 1.0.6: ‘The SAI should apply its own judgments to the diverse situations that arise in the course of government auditing.’ Moreover, paragraph 1.0.13 states: ‘Because of the approach and structure of some SAIs, not all auditing standards apply to all aspects of their work. For example, the collegial and juridical nature of the reviews conducted by Courts of Account make aspects of their work fundamentally different from the fi nancial and performance audits conducted by SAIs, which are organized under a hierarchic system led by an Auditor-General or a Comptroller General.’ This means that the SAI itself should decide how and to what extent the guidelines are to be used in its own audit practices and development work.[2]

What has been said above must not be taken as an argument against any standardisation or guidelines, but when it comes to standardisation in performance auditing it is mostly a question of what to do, rather than how to do it. For example, in designing a study one would expect the auditors to make certain considerations and cover particular aspects. How that is done must be decided on a case-by-case basis and with consideration of the fact that methods and techniques have to be applied with the necessary care that is commonly considered to be the best practice in social sciences and auditing.

This document refl ects the experience of SAIs with a long tradition and well-established standards of performance auditing. It deals with performance auditing carried out as separate examinations or investigations; i.e. performance auditing as a separate and professional activity that requires specialised skills, separate standards, special planning, special reports, etc.[3] Consequently, this document is aimed mainly at

8

those SAIs that are carrying out – or are planning to carry out – this type of performance auditing.[4]

These guidelines consist of fi ve main parts.

Part 1 sets out the general framework for performance auditing, Part 2 defi nes application of auditing principles to performance auditing,

Part 3 provides standards and guidance for planning performance audits,

Part 4 provides standards and guidance for conducting performance audits,

Part 5 provides standards and guidance for presenting the audit results.

The Appendices contain further information on how to plan and conduct performance audits. The appendices also include information on performance auditing in relation to information technology (IT) and on conducting performance audits with an environmental perspective. Further, a framework of system-oriented approaches in performance auditing is presented.

Part 1: What is performance auditing?

1.1 What is performance auditing according to INTOSAI?

INTOSAI’s Auditing Standards (AS 1.0.38 and 1.0.40) state the following:

‘The full scope of government auditing includes regularity and performance audit’, and ‘Performance auditing is concerned with the audit of economy, effi ciency and effectiveness and embraces:

- audit of the economy of administrative activities in accordancewith sound administrative principles and practices, and management policies;

- audit of the effi ciency of utilisation of human, fi nancial and other resources, including examination of information systems, performance measures and monitoring arrangements, and procedures followed by audited entities for remedying identifi ed defi ciencies; and (c) audit of the effectiveness of performance in relation to achievement of the objectiveness of the audited entity, and audit of the actual impact of activities compared with the intended impact’. Performance auditing is based on decisions made or goals established by the legislature, and it may be carried out throughout the whole public sector.

Performance auditing is an independent examination of the effi ciency and effectiveness of government undertakings, programs or organizations, with due regard to economy, and the aim of leading to improvements.

- What is the special feature of performance auditing?

As stated in the Auditing Standards, performance auditing is not overly subject to specifi c requirements and expectations. While fi nancial auditing tends to apply relatively fi xed standards, performance auditing is more fl exible in its choice of subjects, audit objects, methods, and opinions. Performance auditing is not a regular audit with formalized opinions, and it does not have its roots in private auditing. It is an independent examination made on a non-recurring basis. It is by nature wide-ranging and open to judgments and interpretations. It must have at its disposal a wide selection of investigative and evaluative methods and operate from a quite different knowledge base to that of traditional auditing. It is not a checklist-based form of auditing. The special feature of performance auditing is due to the variety and complexity of questions relating to its work. Within its legal mandate, performance auditing must be free to examine all government activities from different perspectives (AS 4.0.4, 4.0.21-23 and 2.2.16). The character of performance auditing must not, of course, be taken as an argument for undermining collaboration between the two types of auditing.

Performance auditing does not have its roots in the form of auditing common to the private sector. Its roots lie in the need for independent, wide-ranging analyses of the economy, effi ciency, and effectiveness of government programs and agencies made on non-recurring basis.

- What ideas form the basis of performance auditing?

Public accountability means that those in charge of a government program or ministry are held responsible for the effi cient and effective running of such. Accountability presupposes public insight into the activities of the program or ministry. Performance auditing is a way for taxpayers, fi nanciers, legislatures, executives, ordinary citizens and the media to ‘execute control’ and to obtain insight into the running and outcome of different government activities. Performance auditing also provides answers to questions such as: Do we get value for money or is it possible to spend the money better or more wisely? A criterion of good governance is that all public services (or all government programs) are subjected to auditing

Legitimacy and trust are essential values in all government undertakings, and performance auditing may contribute to strengthening these values by pro ducing public and reliable information on the economy, effi ciency, and effectiveness of government programs. This is facilitated by the fact that performance auditing is independent of the government ministries whose activities are subject to the audit. In this way, an independent and reliable view of the performance of the audited program or objects is obtained. The performance audit does not represent any vested interest and has no ties, fi nancial or otherwise, to the audited objects. By producing independent assessments, performance auditing may also serve as a basis for decisions on future investments and activities. The basis for this instrument – providing incentives for change by conducting independent analyses and assessments of public sector performance – is the importance of learning and reliable information. In a rapidly changing, complex world with limited resources and many uncertainties, there is a need for performance auditing.

Certain ideas form the basis of performance auditing:

- One starting point is that it is important to assess the economy, effi ciency, and effectiveness in all government activities and, for that purpose, an audit is needed, which examines and evaluate such matters and which may contribute to better government spending, better public services and better public accountability and management.

- Secondly, it is important to have reliable and independent information. An examiner is needed who represents the public interest; who can think and act independently in order to show and question the current situation.

- Finally, an overview and insights into government activities and the ability to infl uence and improve its performance are important. A competent examiner is needed who can fulfi l this role, who will promote incentives for learning and change and improved conditions for decision-making.

1.4 What are the basic questions in performance auditing?

All government programs or undertakings (and most processes they generate) can, at least in theory, be analysed with the use of a formula that describes how to move from one position to another by certain means in order to achieve specifi c objectives. In performance auditing, this is often done by trying to answer two basic questions:

- Are things being done in the right way?

- Are the right things being done?

The fi rst question is primarily aimed at the ‘producer’ and is concerned with whether policy decisions are being carried out properly. This question is usually associated with a normative perspective, i.e. the auditor wants to know whether the executive has observed the rules or the requirements. In order to widen the analysis, the question may be extended to whether the activities carried out are also considered the most appropriate – provided that the right things are being done. Until this stage in the process, performance auditing has been mainly concerned with different aspects of the economy or the effi ciency of operations.

The scope for analysis becomes considerably wider when the second question – whether the right things are being done – is asked. In other words, whether the adopted policies have been suitably implemented or whether adequate means have been employed.

This kind of question refers to effectiveness or impact on society.

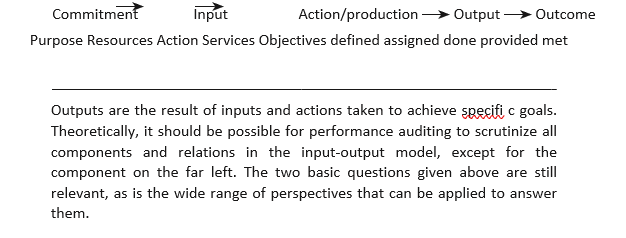

In fact, the question might even imply that a government undertaking – or a chosen measure to achieve a certain objective – runs the risk of being contested. A performance auditor might, for instance, fi nd a chosen measure ineffective and inconsistent with objectives. However, the moment auditors start asking whether the public commitment itself is feasible at all they will also have to be cautious not to go beyond their mandate by crossing the borderline into political territory. The so-called input–output model is another means of illustrating these interactions. The model assumes a fl ow as shown below.

What does auditing of economy, efficiency and effectiveness

mean?

As stated above, performance auditing is mainly concerned with the examination of economy, effi ciency, and effectiveness.[1] According to the Auditing Standards (AS 1.0.40), an individual performance audit

[1] Standards concerning ‘environmental considerations’ and ‘equity requirements’ are also taken into account in performance auditing. (See Appendix 6.)

[1] Standards concerning ‘environmental considerations’ and ‘equity requirements’ are also taken into account in performance auditing. (See Appendix 6.)

may have the objective of examining one or more of these three aspects.

Economy – keeping the costs low

According to the Auditing Standards, ‘economy’ means minimising the cost of resources used for an activity, having regard to appropriate quality.

Audits of economy may provide answers to questions such as:

- Do the means chosen or the equipment obtained – the inputs – represent the most economical use of public funds?

- Have the human, fi nancial or material resources been used economically?

- Are the management activities performed in accordance with sound administrative principles and good management policies? Even though the concept of economy is well defi ned, an audit of economy is not that easy to conduct. It is often a challenging task for an auditor to assess whether the inputs chosen represent the most economical use of public funds, whether the resources available have been used economically, and if the quality and the quantity of the ‘inputs’ are optimal and suitably co-ordinated. It may prove even more diffi cult to be able to provide recommendations that will reduce the costs without affecting the quality and the quantity of services.

Efficiency – making the most of available resources

Effi ciency is related to economy. Here, too, the central issue concerns the resources deployed. The main question is whether these resources have been put to optimal or satisfactory use or whether the same or similar results in terms of quality and turn-around time could have been achieved with fewer resources. Are we getting the most output – in terms of quantity and quality – from our inputs and actions? The question refers to the relationship between the quality and quantity of services provided and the activities and cost of resources used to produce them, in order to achieve results.

Clearly, any opinion or fi nding on effi ciency is usually only relative, while occasionally ineffi ciency is immediately apparent. A fi nding on effi ciency can be formulated by means of a comparison with similar activities, with other periods, or with a standard that has explicitly been adopted. Sometimes standards, such as best practices, are applicable. Assessments of effi ciency might also be based on conditions that are not related to specifi c standards – when matters are so complex that there are no standards. In such cases, assessments must be based on the best available information and arguments and in compliance with the analysis carried out in the audit.

Auditing effi ciency embraces aspects such as whether:

- human, fi nancial, and other resources are effi ciently used;

- government programs, entities and activities effi ciently managed, regulated, organised, executed, monitored and evaluated;

- activities in government entities are consistent with stipulated objectives and requirements;

- public services are of good quality, client-oriented and delivered on time; and

- the objectives of government programs are reached cost effectively. The concept of cost-effectiveness concerns the ability or potential of an audited entity, activity, program or operation to achieve certain outcomes at a reasonable cost. Cost-effectiveness analyses are studies of the relationship between project cost and outcomes, expressed as cost per unit of outcome achieved. Cost effectiveness is just one element in the overall examination of effi ciency, which might also include analyses of, for example, the time in which outputs were delivered. This, however, does not always coincide with the optimal timing with a view to optimising impact.

In some cases it may prove diffi cult to totally separate the two concepts – effi ciency and economy – from each other. They may both directly or indirectly, concern whether, for instance, the audited entity:

- is following sound procurement practices;

- is acquiring the appropriate type, quality, and amount of resources at an appropriate cost;

- is properly maintaining its resources;

- is using the optimum amount of resources (staff, equipment and facilities) in producing or delivering the appropriate quantity and quality of goods or services on time;

- is complying with requirements of regulations that govern/affect the acquisition, maintenance and use of the entity’s resources; and

has established a system of management controls.

In reality, audits of economy tend to focus on the fi rst three points. The concept of effi ciency is mainly restricted to the question of whether the resources have been put to optimal or satisfactory use. Consequently, effi ciency is mostly specifi ed in two possible ways: whether the same output could have been achieved with fewer resources, or, in other words, if the same resources could have been used to achieve better results (in terms of quantity and quality of the output). Financial auditing is also engaged in these issues, for instance when auditing procurement practices. However, in fi nancial auditing the scope is more limited. Unlike performance auditing, the objective strictly relates to fi nancial accountability.

Effectiveness – achieving the stipulated aims or objectives

Effectiveness is essentially a goal-attainment concept.[1] It is concerned with the relationship between goals or objectives, outputs and impacts. Are the stipulated aims being met by the means employed, the outputs produced and the impacts observed? Are the impacts observed really the result of the policy rather than other circumstances?

The question of effectiveness consists of two parts: fi rst, if the policy objectives have been achieved, and second, if this can be attributed to the policy pursued. In order to judge the extent to which the aims have been achieved, they need to be formulated in a way that makes an assessment of this type possible. This cannot easily be done with vague or abstract goals. In order to judge the extent to which observed events could be traced back to the policy, a comparison will be needed. Ideally, this consists of a measurement before and after the introduction of the policy and a measurement involving a control group, which has not been subject to the policy.[2]

In practice, such comparisons are usually diffi cult to make, partly because comparative material is often lacking. In such cases, one alternative is to assess the plausibility of the assumptions on which the policy is based. Often a less ambitious audit objective will

[1] That is, the extent to which a program or entity is achieving its goals and objectives.

[2] The term policy covers both government policy and agency policy (see section 2.1 and footnote 25). There are always diffi culties involved in conducting performance audits when the policy objectives are vague and abstract. For more information, see Appendix 2.

That is, the extent to which a program or entity is achieving its goals and objectives.

[1] The term policy covers both government policy and agency policy (see section 2.1 and footnote 25). There are always diffi culties involved in conducting performance audits when the policy objectives are vague and abstract. For more information, see Appendix 2.

have to be chosen, such as assessing to what extent objectives have been achieved, target groups have been reached, or the level of performance.

The auditor might seek to assess or measure effectiveness by comparing outcomes – or ‘impact’, or ‘state of things’ – with the goals set down in the policy objectives. This approach is often described as ‘goal achievement’ analysis. However, when auditing effectiveness, one should usually try also to determine to what extent the instruments used have in fact contributed towards the achievement of the policy objectives. This is effectiveness auditing in its ‘true’ application and requires evidence that the outcomes, which have been observed, have actually been caused by the action in question rather than by some other factors. For example, if the policy objective is to reduce unemployment, is an observed reduction in the numbers of unemployed the result of the actions of the audited entity, or is it the result of a general improvement in the economic climate over which the audited entity had no infl uence? Here, the design of the audit must include questions of attribution and be able to cope with the problem of effectively excluding external, intermediary variables.

Side effects – a separate aspect of performance auditing is the unintended side effects of policy. The study of side effects is complicated by the fact that they can be very diverse, since they are not limited by the policy objectives. One possible way of limiting the scope of the investigation is to focus on those side effects, which, in other situations, one tries to avoid (e.g. unfavourable environmental effects of economic policy). This does not mean, however, that all side effects are undesirable.

In auditing effectiveness, performance auditing may, for instance,

- assess whether government programs have been effectively prepared and designed and whether they are clear and consistent;

- assess whether the objectives and the means provided (legal, fi nancial, etc.) for a new or ongoing government program are proper, consistent, suitable, or relevant;

- assess the effectiveness of the organizational structure, decisionmaking process and management system for program implementation;

- assess whether the program supplements, duplicates, overlaps, or counteracts other related programs;

- assess whether the quality of the public services meets the people’s expectations or the stipulated objectives;

- assess the adequacy of the system for measuring, monitoring and reporting a program’s effectiveness;

assess the effectiveness of government investments and programs and/or their individual components, i.e. ascertain whether goals and objectives are met;

- assess whether the observed direct or indirect social, economic and environmental impacts of a policy are due to the policy or to other causes;

- identify factors that inhibit satisfactory performance or goal fulfi llment;

- analyse causes of fi ndings and observed problems in identifying ways of making government activities and programs work more effectively; and

- identify the relative utility of alternative approaches to yield better performance or eliminate factors that inhibit program effectiveness. While a particular audit will not necessarily seek to reach conclusions on all three aspects (i.e. economy, effi ciency, and effectiveness), it may be of limited benefi t to examine aspects of economy or effi ciency of activities in isolation without also considering, at least briefl y, their effectiveness. Conversely, in an audit of effectiveness, the auditor may also wish to consider aspects of economy and effi ciency: the outcomes of an audited entity, activity, program or operation may have had the desired impact, but were the resources employed to achieve this used economically and effi ciently?

For the examination of effectiveness, it is generally necessary to assess the outcome or impact of an activity. Thus, while a ‘systembased approach’ may be useful (to assess, e.g. how the audited entity measures and monitors its impact), the auditor will usually also need to obtain suffi cient substantive evidence of the impact of the activity or the program. Likewise, in order to assess the impact of an activity or a government reform, it is in general always necessary to collect information not only on the audited institutions and their activities and interactions, but also on other stakeholders in the area. This is of course of special interest when it is believed that actions of other stakeholders may infl uence the impact.[1]

One specifi c aspect is the study of unintentional effects, especially if these effects were negative. There is a problem of demarcation here, because these effects may spread into areas beyond the competence and powers of the SAI. One way of limiting the scope might be to look at those unintentional effects that are being combated in other programs, environmental side effects of an economic stimulation program, for example.[2]

All other things being equal, economy is about keeping the cost low, effi ciency is about getting the most or best output from available resources, and effectiveness is about achieving the stipulated aims or objectives.

1.6 How does public management affect performance auditing?

The form of public management employed will necessarily infl uence priorities in performance auditing. In countries where public management is mainly concerned with means and less involved with ends, audits also tend to focus on whether rules have been observed and enforced rather than whether the rules serve or are seen to serve their intended purpose. In countries that have acknowledged management by objectives and results, the audit focus is different. Public sector management generally displays a combination of these philosophies. As mentioned above, management by objectives and results tends to promote interest in auditing effi ciency and effectiveness. As a result, the auditor might not have to confront a traditional, rule-bound government administration but an administration whose mandate has been widened considerably in terms of how the intentions of the legislature should be put into

[1] The scope must be limited. The analyses, however, should not be too limited.

[2] For more information: Auditing Effi ciency, Offi ce of Auditor General (Canada), 1995 and Auditing Policy Results Manual, Algemene Rekenkamer (Netherlands), 1997.

The scope must be limited. The analyses, however, should not be too limited.

[1] For more information: Auditing Effi ciency, Offi ce of Auditor General (Canada), 1995 and Auditing Policy Results Manual, Algemene Rekenkamer (Netherlands), 1997.

operation and which means should be employed in order to achieve them.

Typically, the following questions would be of interest to a performance auditor:

- Is there a clear structure of performance goals and have the appropriate priorities and instruments been chosen for the use of public funds?

- Is there a clear distribution of responsibility between the different levels of authority, bearing in mind the principle of subsidiarity?

- Is there a general cost awareness and an orientation towards production of services, putting citizens’ needs in focus?

Is there an adequate emphasis on management controls and reporting requirements?

The ministries and their subordinate bodies are responsible for ensuring that good internal control routines are established. In this context, it is the particular task of the performance auditor to keep an eye on whether this responsibility has been properly taken care of. The extent to which it has in fact also been observed by the auditee or the auditees in their operations is for the fi nancial auditor to judge.[1] In addition, a common objective of most governments today is to improve the quality of public services, particularly as people’s expectations (often with reference to the service they receive from the private sector) of what constitutes quality continue to increase. To promote improvements of this type, many governments have embarked on modernisation programs to deliver better services that are, for instance, more easily accessible and convenient, provide citizens with more choice, and are delivered more quickly. The quality of public services is an increasingly important issue, which members of parliaments and governments across the world expect the SAIs to address in their performance audit reports.

Countries that have acknowledged management by objectives and results tend to focus more on performance than before. The form of public management employed will infl uence the interest in performance auditing.

1.7 How does performance auditing relate to performance measurement and program evaluation?

Both the executive branch and the legislature need evaluative information to help them make decisions about the programs they are responsible for-information that tells them whether, and in what important ways, a government undertaking or program is working well or poorly, and why. Many analytical approaches have been employed over the years by agencies and others to assess the operations and results of government programs, policies, activities, and organizations. Performance audit and evaluation studies are designed to judge how specifi c programs are working and thus may differ a great deal. One particular aspect is the relationship between performance measurement, program evaluation, and performance auditing.

Performance measurement

Performance measurement normally means the ongoing process of monitoring and reporting on program accomplishments, particularly progress towards pre-established goals. Performance measures may address the type or level of program activities conducted (process), the direct products and services delivered by a program (outputs), and/or the results of those outputs (outcomes). Performance measurement focuses on whether a program has achieved its objectives or requirements, expressed as measurable performance standards. Performance measurement, because of its ongoing nature, can serve as an early warning system to management and as a vehicle for improving accountability to the public.

The ongoing process of ensuring that a government program or body has met the targets set is a matter of internal management and control, not a task for external auditors. It is the responsibility of the fi nancial auditors – not the performance auditors – to confi rm that the accounts are correct. However, in the area of performance measurement – the check on the quality of performance-related information produced by the executive branch for the legislature – both fi nancial and performance auditors might be involved, either in separate activities or in joint audits.[2] Performance indicators can sometimes also be used as indicators or references in planning individual performance audits. One topic for performance auditing is whether performance measurement systems in government programs are effi cient and effective. For example, questions could be developed that address whether the performance indicators measure the right things or whether the performance measurement systems involved are capable of providing credible measured results.[3]

[1] In recent years, experience of auditing government administration policies and administrative reforms has been frequently discussed by SAIs.

[2] Ad hoc and in-depth studies of performance measurement systems are typically a task for performance auditing in any SAI. The ongoing or regular performance reports of different government institutions, however, may just as well be an audit task for the fi nancial auditors (sometimes in co-operation with performance auditors, for instance if the fi nancial auditors have not been trained to conduct audits of this type).

[3] See, e.g. AS 1.0.27 and 1.0.45.

[1] Ad hoc and in-depth studies of performance measurement systems are typically a task for performance auditing in any SAI. The ongoing or regular performance reports of different government institutions, however, may just as well be an audit task for the fi nancial auditors (sometimes in co-operation with performance auditors, for instance if the fi nancial auditors have not been trained to conduct audits of this type).

[1] See, e.g. AS 1.0.27 and 1.0.45.

Program evaluation and performance auditing

Program evaluations are individual systematic studies conducted to assess how well a program is working. Program evaluations typically examine a broader range of information on program performance and context than is feasible to monitor on an ongoing basis. A program evaluation may thus allow for an overall assessment of whether the program works and what can be done to improve its results. Program evaluations are one type of study that might be executed by a SAI under the general heading of performance audits.

In recent years, the concept of program evaluation has been a growing subject of discussion amongst SAIs. Whether or not program evaluation is an important task for a SAI has been discussed. A special group (INTOSAI Working Group on Program Evaluation) has been set up to promote principles and guidance in this area. It is generally accepted that program evaluation has objectives identical or similar to those of performance auditing in that it seeks to analyse the relationship between the objectives, resources, and results of a policy or program. It has also been agreed that program evaluation is an important task for a SAI that has the authority and competence to carry out such studies.

Program evaluation has been described as an epitome of activities and methods that have aim to make exhaustive assessments of an issue, using more or less sophisticated scientifi c approaches. Although performance auditing may use the same approaches and methodologies as program evaluation, it does not, according to the INTOSAI Working Group on Program Evaluation, necessarily engage in assessing policy effectiveness or policy alternatives. In addition to examining the impact of outputs, program evaluation may include issues such as whether the stipulated aims are consistent with general policy. This issue has been the subject of discussion among SAIs. Some SAIs have the right to evaluate government and/or agency policy effectiveness and include program evaluation in their performance audit mandate.

Others are not required to conduct such audits.

According to INTOSAI’s Working Group on Program Evaluation, auditing and evaluation may be divided into the following seven categories:[1]

- Regularity audit: are regulations complied with?

- Economy audit: do the means chosen represent the most economical use of public funds for the given performance?

- Effi ciency audit: are the results obtained commensurate with the resources employed?

- Effectiveness audit: are the results consistent with the policy?

- Evaluation of the consistency of the policy: are the means employed by the policy consistent with the set objectives?

- Evaluation of the impact of the policy: what is the economic and social impact of the policy?

- Evaluation of the effectiveness of the policy and analysis of causality:

are the observed results due to the policy, or are there other causes? In practice classifi cations vary. One SAI with many years’ experience of program evaluation is the General Accounting Offi ce of the US. It defi nes four common types of program evaluations in performance auditing:[2]

- Process evaluation

This assesses the extent to which a program is operating as intended. Typically, it is concerned with the program activities’ conformity with statutory and regulatory requirements, program design, and professional standards or customer expectations. It is increasingly important to assess whether the quality of the operations – for instance application forms, processing times, service deliveries and other client-oriented activities – meets the people’s expectations.

- Outcome evaluation

This assesses the extent to which a program achieves its outcomeoriented – and client-oriented – objectives. It focuses on outputs and outcomes (including side effects and unintended effects) in order to judge program effectiveness, but it may also put emphasis on quality issues and client perspectives. An outcome evaluation may also assess program processes in order to fully understand a program and how outcomes are produced.

- Impact evaluation

This assesses the net effect of a program by comparing program outcomes with an estimate of what would have happened in the absence of the program. This form of evaluation is employed when external factors are known to infl uence the program’s outcomes, in order to isolate the program’s contribution to the achievement of its objectives.

- Cost-benefit and cost-effectiveness evaluations

These are analyses that compare a program’s outputs or outcomes with the costs (resources expended) to produce them. When applied to existing programs, they are also considered a form of program evaluation. Cost-effectiveness analysis assesses the cost of meeting a single goal or objective, and can be used to identify the least costly alternative to meet that goal. Cost-benefi t analysis aims at identifying all relevant costs and benefi ts.[3]

In the area of performance measurement both fi nancial and performance auditors might be involved. In some countries, an individual performance audit may include many different kinds of studies and even several program evaluations. In that sense program evaluation may be considered one of many possible ‘tools’ that performance auditing uses. Program evaluation is one type of study that might be executed by the SAI under the general heading of performance auditing. It is an activity of increasing interest and importance.[4]

1.8 Are there differences in analytical ambitions and approaches?

The mandate and orientation of performance auditing may, as stated above, vary in different countries. A number of SAIs are not required to execute performance audits or may consider themselves somewhat limited in their capacity and experience in respect of these audits. Other SAIs may have a long tradition of carrying out both advanced performance audits and complex program evaluations. One of the characteristics of auditing is the normative perspective where discrepancies between ‘the norms and the reality’ – the actual fi ndings – are expressed explicitly, and assessments and recommendations are provided as ‘normative’. However, as well as

[1] INTOSAI Working Group on Program Evaluation (1995), draft summary report.

[2] Performance Measurement and Evaluation: Defi nitions and Relationships (GAO/GGD-98-26), General Accounting Offi ce (USA), 1998.

[3] Some SAIs may as part of their mandate also include ‘Policy evaluation’ (the effectiveness of the policies set), and a few SAIs conduct what they defi ne as ‘System evaluation’ (the appropriateness of the systems adopted).

[4] Other areas of increasing interest are performance audits of activities with an environmental perspective and performance auditing concerning information technology. (See Appendices 5 and 6.)

[1] Some SAIs may as part of their mandate also include ‘Policy evaluation’ (the effectiveness of the policies set), and a few SAIs conduct what they defi ne as ‘System evaluation’ (the appropriateness of the systems adopted).

[1] Other areas of increasing interest are performance audits of activities with an environmental perspective and performance auditing concerning information technology. (See Appendices 5 and 6.)

being normative, performance auditing is usually descriptive, and may also include analytical elements. (A performance audit may, for instance, ascertain the causes of the difference between the conditions and the criteria.)

The results-oriented and the problem-oriented approaches

Performance auditing has various traditions and ambitions. Two approaches differ quite signifi cantly, although each is based on national standards for performance auditing. They are called the results-oriented and the problem-oriented approaches.

The results-oriented approach deals mainly with questions such as: ‘What is the performance or what results have been achieved, and have the requirements or the objectives been met?’ In this approach, the auditor studies performance (concerning economy, effi ciency, and effectiveness) and relates observations to the given norms (goals, objectives, regulations, etc.) or the audit criteria (more or less precisely defi ned before the main study begins). If the criteria are diffi cult to determine, the auditor may need to work with experts in the fi eld to develop credible criteria that, when applied, are objective, relevant, reasonable and attainable. The audit criteria make it possible to provide assessments on the fi ndings. In this approach, shortcomings are likely to be defi ned as deviations from norms or criteria. Recommendations, if presented, are often aimed at eliminating such deviations. The perspective is in that sense basically normative.

The problem-oriented approach, on the other hand, deals primarily with problem verifi cation and problem analysis, normally without reference to predefi ned audit criteria.[1] In this approach, shortcomings and problems – or at least indications of problems – are the starting point of an audit, not the conclusion.[2] A major task in the audit is to verify the existence of stated problems and to analyse their causes from different

[1] In order to assess a problem one must fi rst understand it (and its possible intricate causes and implications). When it comes to analyses of complex problems of effi ciency and effectiveness, it is not always possible to defi ne the audit criteria in the planning stage.

[2] Indications of problems concerning effi ciency and effectiveness are often vague, subjective, and diffi cult to defi ne and understand. Examples of possible indications of problems concerning the three Es (economy, effi ciency, and effectiveness) are: rising costs resulting in demands for more resources; stated imbalances between inputs and goals; lack of clarity in the allocation of responsibility between executive bodies involved; ambiguities and contradictions in regulation; long waiting times or large backlogs; stated lack of competence, criticism of management style, shortcomings in services and client-orientation; large numbers of complaints or appeals by the public; changes in external conditions; and indications of negative side effects of government programs.

[1] In order to assess a problem one must fi rst understand it (and its possible intricate causes and implications). When it comes to analyses of complex problems of effi ciency and effectiveness, it is not always possible to defi ne the audit criteria in the planning stage.

[1] Indications of problems concerning effi ciency and effectiveness are often vague, subjective, and diffi cult to defi ne and understand. Examples of possible indications of problems concerning the three Es (economy, effi ciency, and effectiveness) are: rising costs resulting in demands for more resources; stated imbalances between inputs and goals; lack of clarity in the allocation of responsibility between executive bodies involved; ambiguities and contradictions in regulation; long waiting times or large backlogs; stated lack of competence, criticism of management style, shortcomings in services and client-orientation; large numbers of complaints or appeals by the public; changes in external conditions; and indications of negative side effects of government programs.

perspectives (problems related to economy, effi ciency, and effectiveness of government undertakings or programs). The problemoriented approach deals with questions such as: ‘Do the stated problems really exist and, if so, how can they be understood and what are the causes?’ Hypotheses about possible causes and consequences are formulated and tested.[1] The perspective is analytical and instrumental; the aim is to deliver updated information on the stated problems and how to deal with them. The auditors are not restricted in their analyses.[2] All possible material causes are considered (only general goals are taken for granted), so proposals to amend laws, regulations, and structural design of government undertakings are not excluded, if is shown that the existing structure give rise to severe and verifi ed problems.[3]

Thus, assessment in these two performance audit approaches might be derived normatively (based on deviations from norms or criteria) or analytically (based on analyses of the specifi c causes of problems). In fact, it is the independent analysis that characterizes the problemoriented approach, while the results-oriented approach is mainly characterized by its impartial assessment of whether given norms or criteria have been met (even though it may involve analytical elements as well). On the one hand, the results-oriented and the problem-oriented approaches represent different audit traditions.[4] On the other, the approaches may also serve to illustrate the fact that performance auditing includes various types of practical methods.[5]

Top-down and bottom-up perspectives

The perspectives of the two objectives may also vary. Performance auditing is normally based on an overall owner perspective, that is, a top-down perspective. It concentrates mainly on the requirements, intentions, objectives and expectations of the legislature and central government. In

[1] A hypothesis is a well-founded (testable) statement regarding causes and consequences of the problem to be audited (based on the assumption that the problem exists).

[2] They are not limited to analyses of differences between conditions and audit criteria.

[3] For more information on the problem-oriented approach, see for instance Handbook on Performance Auditing, RRV (Sweden), 1998.

[4] They can be said to represent different levels of ambition.

[5] The two methodological approaches can also been seen as linked to each other in terms of different steps in an audit. Even if the problem-oriented approach by nature goes wider and deeper in its analytical ambition, the results-oriented approach may in its advanced form also allow for sophisticated analyses.

[1] A hypothesis is a well-founded (testable) statement regarding causes and consequences of the problem to be audited (based on the assumption that the problem exists).

[1] They are not limited to analyses of differences between conditions and audit criteria.

[1] For more information on the problem-oriented approach, see for instance Handbook on Performance Auditing, RRV (Sweden), 1998.

[1] They can be said to represent different levels of ambition.

[1] The two methodological approaches can also been seen as linked to each other in terms of different steps in an audit. Even if the problem-oriented approach by nature goes wider and deeper in its analytical ambition, the results-oriented approach may in its advanced form also allow for sophisticated analyses.

some countries, however, it is also possible – within the framework of given objectives and premises – to add a ‘client-oriented perspective’ (a focus on service-management, waiting-time, and other issues relevant to the ultimate clients or consumers involved).

This might be viewed as an interpretation of the audit mission in order to meet citizens’ interest in having SAIs focus on problems of real signifi cance to the people and the community – a kind of bottom-up perspective.

Focus on accountability or causes to the problems

Auditing is normally associated with accountability, but in performance auditing this is not always the case. Auditing accountability can be described as judging how well those responsible at different levels have reached relevant goals and met other requirements for which they are fully accountable, (factors outside the control of the auditees are not expected to infl uence the outcome). An alternative approach is to focus on understanding and explaining the actual observations that have been made during the audit. Instead of trying to fi nd out who is at fault, it is possible to analyse the factors behind the problems uncovered and to discuss what may be done about these problems. This approach refl ects the idea that the overall aim of performance auditing is to promote economy, effi ciency and effectiveness. The two approaches represent different ideas to performance auditing; one in which accountability (as in compliance and fi nancial auditing) is at the centre of attention of the audit, while the other – which put emphasis on economy, effi ciency and effectiveness – primarily concerns itself with the subject matter of the audit causes of problems observed. (Even if the main area of focus is not accountability, recommendations arising from the audit as a rule encompass the question of division of responsibility.)

Accountability auditing has the advantage that it is often easier to carry out and that it corresponds to the conventional picture of auditing. The problem, however, is that effi ciency and effectiveness are complex issues which demand more comprehensive analyses (of conditions and circumstances outside the control of the auditees). Accountability auditing also involves risks – the perspective and scope must be limited, which in turn unduly limits the possibility of making an independent analysis. If, on the other hand, focus is placed on problems observed and possible causes, this facilitates audits covering the areas of responsibility of several different parties. Conditions are thereby created for comprehensive analyses. It must be stated, however, that this approach makes greater demands in terms of the skills of auditors.

The message of this section is that there are also differences in methodological approaches with respect to analytical ambitions. Generally speaking, there are SAIs that have established high analytical ambitions in their performance auditing, while others have settled for a lower level.

Performance auditing should not be streamlined. Advanced performance auditing is complex investigatory work that requires fl exibility, imagination and high levels of analytical skills. Streamlined procedures, methods and standards may in fact hamper the functioning and the progress of performance auditing. Consequently, standards – as well as quality assurance systems – that are too detailed should be avoided. Progress and practices must be built on learning from experience.

The orientation of performance auditing varies between SAIs. Two approaches differ more signifi cantly, namely the results-oriented and the problem-oriented approaches. The results-oriented approach deals with questions such as: ‘What is the performance, and have the objectives been met?’ The problem-oriented approach deals primarily with problem analysis. It deals with questions such as: ‘Do the stated problems really exist and, if so, what are the causes to the problems?’ Performance auditing may apply both top-down and bottom-up perspectives. Auditing is normally associated with accountability, but in performance auditing this is not always the case. Performance auditing should not be guided by standards that are too detailed and streamlined. This may hamper creativity and professionalism.

1.9 Summary

- Performance auditing examines the economy, the effi ciency and the effectiveness of government programs and organizations and answers questions such as: Do the inputs chosen represent the most economical use of public funds? Are we getting the best services from available resources? Are the aims of the policy being fully met, and are the impacts the result of the policy? The perspectives and the objects to be audited may vary, i.e. both individual agencies as well as government-wide undertakings may be audited. Performance auditing is based on decisions made and goals set by the legislature, and it may be carried out throughout the whole public sector.

- Performance auditing is not a regular audit with formalized opinions. It is an examination made on an ad hoc basis. It is an audit that focuses on performance, rather than expenditure and accounting. It has its roots in the requirements for independent analyses of the economy, effi ciency, and effectiveness of government programs and organizations. The special feature of performance auditing is partly due to the variety and complexity of questions related to its work.

- All government activities can be analysed with the use of a formula that describes how to move from one position to another by certain means in order to achieve specifi c objectives. In performance auditing, this is often done by trying to answer two basic questions: Are things being done in the right way? Are the right things being done?

- The ongoing process of ensuring that a government program or body has met the targets set is a matter of internal management and control. However, in the area of performance measurement, both fi nancial and performance auditors might be involved.

- Apart from examining the impact of outputs, program evaluation may include issues such as whether the objectives are consistent with the policy or with the options given for changing the policy in order to achieve outcomes that are more effective. In some countries, performance audits may include many kinds of studies and even several program evaluations. In that sense program evaluation may be considered one of many possible ‘tools’ that performance auditing uses.

- Performance auditing has various traditions. Two approaches differ quite signifi cantly. The results-oriented approach deals mainly with questions such as: ‘What is the performance or what results have been achieved, and have the requirements or the objectives been met?’ The problem-oriented approach deals primarily with questions such as: ‘Do the stated problems really exist and what causes them?’ Auditing is usually associated with accountability, but in performance auditing this does not always have to be the case.

- Performance auditing should not be streamlined. It is investigatory work that requires fl exibility, imagination and analytical skill. Streamlined and detailed procedures, methods and standards may in fact hamper the functioning of performance auditing.

Part 2: Government auditing principles applied to performance Auditing

In conducting a performance audit the auditors should follow the

INTOSAI Code of Ethics and Auditing Standards as well as relevant

SAI standards and guidelines applicable to performance auditing. The INTOSAI general auditing standards states that the audit and the SAI must be independent, possess required competence and exercise due care (AS 1.0.6 and 2.2.1.). [1]

2.1 How do the auditing principles apply to performance auditing?

The audit mandate and the general goals should be properly defined

Statutes generally lay down the audit mandate. Among other things it regulates the extent to which a SAI can audit public sector programs and organizations. Special regulations are often needed that specify the

[1] For more information see these INTOSAI-documents: The Lima Declaration, The Code of Ethics and Auditing Standards, and Independence of Supreme Audit Institutions.

some countries, however, it is also possible – within the framework of given objectives and premises – to add a ‘client-oriented perspective’ (a focus on service-management, waiting-time, and other issues relevant to the ultimate clients or consumers involved).

This might be viewed as an interpretation of the audit mission in order to meet citizens’ interest in having SAIs focus on problems of real signifi cance to the people and the community – a kind of bottom-up perspective.

Focus on accountability or causes to the problems

Auditing is normally associated with accountability, but in performance auditing this is not always the case. Auditing accountability can be described as judging how well those responsible at different levels have reached relevant goals and met other requirements for which they are fully accountable, (factors outside the control of the auditees are not expected to infl uence the outcome). An alternative approach is to focus on understanding and explaining the actual observations that have been made during the audit. Instead of trying to fi nd out who is at fault, it is possible to analyse the factors behind the problems uncovered and to discuss what may be done about these problems. This approach refl ects the idea that the overall aim of performance auditing is to promote economy, effi ciency and effectiveness. The two approaches represent different ideas to performance auditing; one in which accountability (as in compliance and fi nancial auditing) is at the centre of attention of the audit, while the other – which put emphasis on economy, effi ciency and effectiveness – primarily concerns itself with the subject matter of the audit causes of problems observed. (Even if the main area of focus is not accountability, recommendations arising from the audit as a rule encompass the question of division of responsibility.)

Accountability auditing has the advantage that it is often easier to carry out and that it corresponds to the conventional picture of auditing. The problem, however, is that effi ciency and effectiveness are complex issues which demand more comprehensive analyses (of conditions and circumstances outside the control of the auditees). Accountability auditing also involves risks – the perspective and scope must be limited, which in turn unduly limits the possibility of making an independent analysis. If, on the other hand, focus is placed on problems observed and possible causes, this facilitates audits covering the areas of responsibility of several different parties. Conditions are thereby created for comprehensive analyses. It must be stated, however, that this approach makes greater demands in terms of the skills of auditors.

The message of this section is that there are also differences in methodological approaches with respect to analytical ambitions. Generally speaking, there are SAIs that have established high analytical ambitions in their performance auditing, while others have settled for a lower level.

Performance auditing should not be streamlined. Advanced performance auditing is complex investigatory work that requires fl exibility, imagination and high levels of analytical skills. Streamlined procedures, methods and standards may in fact hamper the functioning and the progress of performance auditing. Consequently, standards – as well as quality assurance systems – that are too detailed should be avoided. Progress and practices must be built on learning from experience.

The orientation of performance auditing varies between SAIs. Two approaches differ more signifi cantly, namely the results-oriented and the problem-oriented approaches. The results-oriented approach deals with questions such as: ‘What is the performance, and have the objectives been met?’ The problem-oriented approach deals primarily with problem analysis. It deals with questions such as: ‘Do the stated problems really exist and, if so, what are the causes to the problems?’ Performance auditing may apply both top-down and bottom-up perspectives. Auditing is normally associated with accountability, but in performance auditing this is not always the case. Performance auditing should not be guided by standards that are too detailed and streamlined. This may hamper creativity and professionalism.

1.9 Summary

- Performance auditing examines the economy, the effi ciency and the effectiveness of government programs and organizations and answers questions such as: Do the inputs chosen represent the most economical use of public funds? Are we getting the best services from available resources? Are the aims of the policy being fully met, and are the impacts the result of the policy? The perspectives and the objects to be audited may vary, i.e. both individual agencies as well as government-wide undertakings may be audited. Performance auditing is based on decisions made and goals set by the legislature, and it may be carried out throughout the whole public sector.

- Performance auditing is not a regular audit with formalized opinions. It is an examination made on an ad hoc basis. It is an audit that focuses on performance, rather than expenditure and accounting. It has its roots in the requirements for independent analyses of the economy, effi ciency, and effectiveness of government programs and organizations. The special feature of performance auditing is partly due to the variety and complexity of questions related to its work.

- All government activities can be analysed with the use of a formula that describes how to move from one position to another by certain means in order to achieve specifi c objectives. In performance auditing, this is often done by trying to answer two basic questions: Are things being done in the right way? Are the right things being done?

- The ongoing process of ensuring that a government program or body has met the targets set is a matter of internal management and control. However, in the area of performance measurement, both fi nancial and performance auditors might be involved.

- Apart from examining the impact of outputs, program evaluation may include issues such as whether the objectives are consistent with the policy or with the options given for changing the policy in order to achieve outcomes that are more effective. In some countries, performance audits may include many kinds of studies and even several program evaluations. In that sense program evaluation may be considered one of many possible ‘tools’ that performance auditing uses.

- Performance auditing has various traditions. Two approaches differ quite signifi cantly. The results-oriented approach deals mainly with questions such as: ‘What is the performance or what results have been achieved, and have the requirements or the objectives been met?’ The problem-oriented approach deals primarily with questions such as: ‘Do the stated problems really exist and what causes them?’ Auditing is usually associated with accountability, but in performance auditing this does not always have to be the case.

- Performance auditing should not be streamlined. It is investigatory work that requires fl exibility, imagination and analytical skill. Streamlined and detailed procedures, methods and standards may in fact hamper the functioning of performance auditing.

Part 2: Government auditing principles applied to performance Auditing

In conducting a performance audit the auditors should follow the

INTOSAI Code of Ethics and Auditing Standards as well as relevant

SAI standards and guidelines applicable to performance auditing. The INTOSAI general auditing standards states that the audit and the SAI must be independent, possess required competence and exercise due care (AS 1.0.6 and 2.2.1.). [1]

2.1 How do the auditing principles apply to performance auditing?

The audit mandate and the general goals should be properly defined

Statutes generally lay down the audit mandate. Among other things it regulates the extent to which a SAI can audit public sector programs and organizations. Special regulations are often needed that specify the

[1] For more information see these INTOSAI-documents: The Lima Declaration, The Code of Ethics and Auditing Standards, and Independence of Supreme Audit Institutions.

conditions for performance auditing, for example, access to information from sources other than the auditees, the ability to give recommendations, the mandate to scrutinize government undertakings and programs, and the effectiveness of legislation. The mandate ordinarily specifi es the minimum audit and reporting requirements, specifi es what is required of the auditor, and provides the auditor with authority to carry out the work and report the results (AS 2.2.12, 2.2.19, 1.0.32-38, 1.0.42 and 1.0.47).

If possible, the mandate should cover the whole state budget, including all relevant executive bodies and all corresponding government programs or public services. Without suffi cient legal support, it might even be considered illegal to publish justifi ed criticism of the effi ciency and effectiveness of government programs, at least in respect to issues that are politically sensitive. To avoid this situation – and suspicion of self-censorship – the mandate needs to be both politically and publicly supported (AS 2.2.18-20 and 2.2.23)

The audit objects (those that might be subjected to performance audits by the SAI according to the mandate) can be described as ‘policy’,’ programs’, ‘organization’ and ‘management’. ‘Policy’ is usually defi ned as an effort to achieve certain aims with certain resources and perhaps within a certain time.[1] A ‘program’ can be described as a set of interrelated means – legal, fi nancial, etc.– to implement a given government or agency policy. ‘Organization’ can be defi ned in different ways, but mostly it is taken to mean the aggregate of people, structures, and processes that have the aim of achieving particular objectives. ‘Management’ is generally taken to mean all the decisions, actions, and rules for the steering, accounting and deployment of human, fi nancial, and material resources. Management is often related to the internal operations of an organization. Policies and programs–decided by the legislature, the executive or executive offi cials–may also have an internal focus, relating to a specifi c organization (and its internal activities and performance). But mostly their focus is wider and more external and relates to activities of even non-governmental organizations (NGOs) (and the impacts of the policies and programs in society, etc.).[2] In many countries, the constitution or legislation gives the SAI the explicit right to undertake

[1] The term policy covers in this guidelines – if nothing else is said – both government and agency policy. The term policy can be used as equivalent to agency policy for SAIs who do not have the right to review or evaluate government policy. (The term government undertaking covers both policy and program.)

[2] See for instance Manual of Performance Auditing, AG (The Netherlands), 1996.

[1] The term policy covers in this guidelines – if nothing else is said – both government and agency policy. The term policy can be used as equivalent to agency policy for SAIs who do not have the right to review or evaluate government policy. (The term government undertaking covers both policy and program.)

[1] See for instance Manual of Performance Auditing, AG (The Netherlands), 1996.

some form of performance auditing. Some SAIs may carry out examinations of the effi ciency and effectiveness of complex government policies or undertakings, perhaps by in-depth analyses of stated problems. Others are more limited in their approach. As part of the explanation of standards, the Auditing Standards (AS 1.0.42) state: ‘In many countries, the mandate of performance auditing will stop short of review of the policy bases of government programs.’ In these cases, performance auditing does not question the merits of policy objectives but rather involves examinations of actions taken to design, implement, or evaluate the results of these policies, and may imply an examination of the adequacy of information leading to policy decisions. Even in countries where the constitution or legislation does not require the SAI to carry out audits of economy, effi ciency, and effectiveness, current practice shows a tendency to include this sort of work as part of fi nancial or regularity audits (AS 1.0.13, 1.0.42-43). The general goals of performance auditing should also be defi ned in the legislation or be decided on by the SAI. In general, SAIs may seek to achieve one or more of the following general goals:

- To provide the legislature with independent examination of the economical, effi cient, or effective implementation practices of government policies or programs.

- To provide the legislature with independent, ad hoc analyses of the validity and reliability of performance measurement systems, or statements or self-evaluations about performance that are published by executive entities.

- To provide the legislature with independent analyses of problems of economy, effi ciency, and effectiveness in government activities and thus contribute to improvements.

- To provide the legislature with independent assessments of the intended and unintended direct or indirect impact of government and agency programs and whether, and to what extent, stated aims or objectives have been met or why they have not been met.

One common objective of performance auditing in many countries – set by the legislator or the SAI itself – is to assess and improve the functioning of government programs, central government itself and any connected bodies (AS 1.0.20, 1.0.27, 1.0.40 and 4.0.25). Providing recommendations is important in most countries. In others, recommendations are not given at all, due to legal conditions and historical traditions.[1]

Performance auditing must be free to select audit areas within its mandate

According to the Auditing Standards (AS 2.2.10-19), a SAI must be free to determine the areas covered by its performance audits. AS 2.2.8 states: ‘The SAI may give members of legislature factual briefi ngs on audit reports, but it is important that the SAI maintain its independence from political infl uence, in order to preserve an impartial approach to its audit responsibilities. This implies that the SAI should not be responsive, nor give the appearance of being responsive, to the wishes of particular political interest.’ In paragraph 2.2.10 it is stated: ‘In some countries the audit of the executive’s fi nancial management is the prerogative of the Parliament or elected Assembly; this may also apply to the audit of expenditure and receipts at a regional level, where external audit is the responsibility of a legislative assembly. In these cases audits are conducted on behalf of that body and it is appropriate for the SAI to take account of its requests for specifi c investigations in programming audit tasks. It is nevertheless important that the SAI remains free to determine the manner in which it conducts all its work, including those tasks requested by the Parliament.’ It is also important ‘that there be no power of direction by the executive in relation to the SAIs performance of its mandate’ (AS 2.2.14).

Performance audits should in general be ex post audits

The earliest point at which a SAI can examine effi ciency and effectiveness is after the government has made a decision on the policy concerned (this is more ore less implied in AS 4.0.22 and 4.0.25). An analysis of objectives or an audit of policy preparation activities may be carried out in some countries before the policy itself is implemented. Even so, the problems that performance auditing focuses on – or aims to eliminate – should be current problems in order to add value for the user of the audit reports.

[1] Most SAIs provide recommendations in their performance audit reports. It has been claimed that such a policy has inherent disadvantages. It could compromise the SAI’s independence and make further examinations diffi cult. However, a SAI cannot be hold accountable for its recommendations, and performance auditors can never claim to have found the only rational solutions (even if the recommendations put forward are both logical and well founded, there are always other options). A SAI’s recommendation can only be based on an assessment of what appeared at the time to be a rational, or possibly the most rational, solution. Moreover, performance auditing is by nature a non-recurrent activity. It is therefore unlikely that a subject will be audited in the same way twice. For more information, see Performance Auditing at the Swedish National Audit Bureau, 1993, pp 51.

[1] Most SAIs provide recommendations in their performance audit reports. It has been claimed that such a policy has inherent disadvantages. It could compromise the SAI’s independence and make further examinations diffi cult. However, a SAI cannot be hold accountable for its recommendations, and performance auditors can never claim to have found the only rational solutions (even if the recommendations put forward are both logical and well founded, there are always other options). A SAI’s recommendation can only be based on an assessment of what appeared at the time to be a rational, or possibly the most rational, solution. Moreover, performance auditing is by nature a non-recurrent activity. It is therefore unlikely that a subject will be audited in the same way twice. For more information, see Performance Auditing at the Swedish National Audit Bureau, 1993, pp 51.

General aims of legislature should be taken for granted

Political decisions and goals established by the legislature are in general the frame of reference, which form the basis of the audit criteria used in performance auditing. It is not the role of a SAI to question these decisions and goals. However, a SAI may, as a result of its fi ndings, make critical comments on the goals, for example if they are inconsistent or if it proves impossible to follow up the extent to which they have been achieved. Consequently, a performance audit report may in fact question the merits of existing policies or decisions. The goals or objectives may be too vague, in confl ict with other objectives, or based on insuffi cient information. The policy may be ineffi cient and ineffective, and changes might be required if existing shortcomings are to be overcome. On the other hand, it is defi nitely the role of performance auditing to assess the economy, effi ciency and effectiveness of more specifi c objectives and regulations established, for example, by government agencies. (See AS 2.2.5 and 2.2.9.)

While performance auditing does not question political goals, it can highlight the consequences of a given policy. It may also identify and illustrate shortcomings resulting from confl icting goals. Thus, performance auditing does not for example question the level of compensation in social welfare systems. The auditors must have, as a starting point, a set of problems that are related to economy, effi ciency, and effectiveness in the welfare systems being audited. This might be the case when, for example, a level of compensation in a given area has unintended marginal effects in another area. The performance auditor can then study the lack of coordination between different systems and point out the resulting problems. If the actual level of compensation is demonstrably different from the level that was originally set, the performance audit can examine the reasons for this development.

High professional quality of work should be promoted and secured

INTOSAI’s Auditing Standards and its Code of Ethics states that all government auditors should act with integrity, impartiality, objectivity, competence and professionalism. High ethical standards must be exercised in order to serve the public interest best, and in AS 2.2.36 it is stated, ‘Since the duties and responsibilities thus borne by the SAI are crucial to the concept of public accountability, the SAI must apply to its audits, methodologies and practices of the highest quality. It is incumbent upon it to formulate procedures to secure effective exercise of its responsibilities for audit reports, unimpaired by less than full adherence by personnel or external experts to its standards, planning procedures, methodologies and supervision.’

Performance audits are often complex undertakings, requiring a wide range of skills, expertise, and experience. AS 2.1.26 states ‘Because of the importance of ensuring a high standard of work by the SAI, it should pay particular attention to quality assurance programs in order to improve audit performance and results.’ It is also stated that the SAI should establish systems and procedures in order to ‘(a) confi rm [that] the integral quality assurance processes have operated satisfactorily; (b) ensure the quality of the audit report; and (c) secure improvements and avoid repetition of weaknesses’ (AS 2.1.27). However, no system for quality assurance can guarantee high quality performance audit reports. It is, simply put, more important to have competent and motivated staff than advanced systems for quality assurance. In other words, systems for quality assurance should be relevant and easy to manage, rather than complex and overly sophisticated. According to INTOSAI, quality issues must be integrated in the execution process. Even in the early planning stages, systems of quality assurance might prove indispensable to ensure that the problems to be addressed are material and well defi ned. The objectives, problems, audit questions, and selected areas largely determine the quality of the audit. The process of planning, and the various stages that make up the decision-making process, ensure that quality is regularly assessed, since certain conditions must be met before the audit can move forward. Meticulous preparations are important to defi ne the audit questions, the information needed, and the audit design (AS 2.1.27 and 3.1.1). For more information, see Appendices 3 and 4.

The mandate of performance auditing should cover the state budget and all corresponding government programs. The auditor must be free to select audit areas within its mandate. Political decisions and goals established by the legislature are the basic frame of reference. A performance audit may, as a result of its fi ndings, question the merits of existing policies. Performance audits are in general ex post audits that deal with current issues. High levels of quality in the work must be promoted and secured.

2.2 What are the general requirements for a performance auditor?

Performance auditors must posses specific professional skill