Introduction

In the previous chapters, we have studied most aspects of income tax. In this

chapter we will look at the overseas aspects of income tax.

We start this chapter, by considering where taxpayers are resident and

domiciled and at how this affects their tax position. We then consider the

special rules which apply to people working away from their home countries.

We briefly consider the tax implications of trading overseas. Finally, we look at

the tax relief which can be available when income is taxed both overseas and in

the UK.

In the next chapter, will we turn our attention to CGT. We will consider the

administration of income tax when we have finished studying CGT as the

personal tax return deals with both income and capital gains.

Study guide

| Intellectual level | ||

| 1 | Income and income tax liabilities in situations involving further overseas aspects and in relation to trusts, and the application of exemptions and reliefs | |

| (a) | The contents of the Paper F6 study guide for income tax and national insurance contributions, under headings: | 2 |

| | B1 The scope of income tax | |

| (b) | The scope of income tax: | 3 |

| (i) | Explain and apply the concepts of residence and domicile and advise on the relevance to income tax | |

| (ii) | Advise on the availability of the remittance basis to UK resident individuals | 2 |

| (iii) | Advise on the tax position of individuals coming to and leaving the UK | |

| (iv) | Determine the income tax treatment of overseas income | |

| (v) | Understand the relevance of the OECD model double tax treaty to given situations | |

| (vi) | Calculate and advise on the double taxation relief available to individuals | |

| (c) | Income from employment | 3 |

| (iii) | Advise on the overseas aspects of income from employment, including travelling and subsistence expenses | |

| (d) | Income from self employment: | |

| (iii) | Recognise the tax treatment of overseas travelling expenses | 3 |

Exam guide

In an exam, question you may have to advise an individual how they will be taxed on their income from overseas. You may also need to advise an individual who has gone overseas how they will be taxed on their UK income, or how a taxpayer who is not domiciled in the UK is taxed on their non-UK income whilst they are resident in the UK. You must be sure that you can correctly determine an individual’s residence status.

The topics covered in this chapter are mostly new at P6 level, apart from the basic knowledge of the test of residence which is in the F6 syllabus.

1 Residence and domicile

| An individual may be both or either of resident and domiciled in the UK. |

One of the competencies you require to fulfil Performance Objective 15 Tax computations and assessment of the PER is to explain the basis of tax calculations, and interpret the effect of current legislation and case law. You can apply the knowledge you obtain from this section of the text to help to demonstrate this competence.

| 1.1 Residence

1.1.1 Statutory residence test |

12/14, 6/15 |

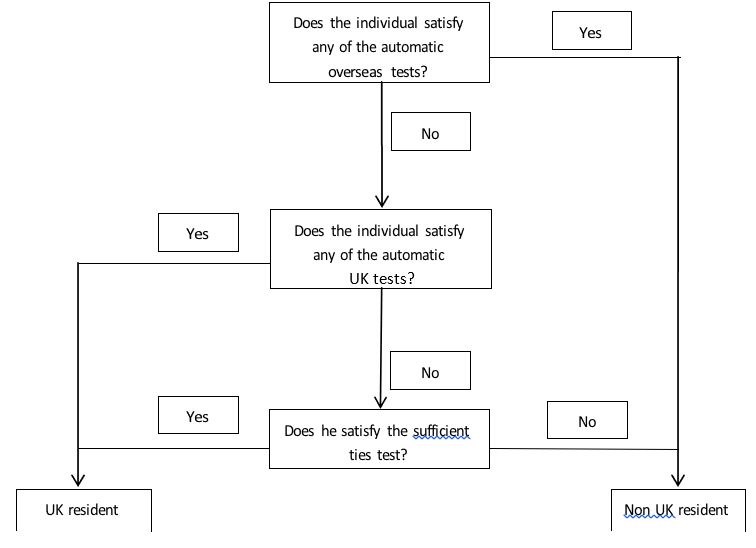

FAST FORWARD An individual will automatically not be UK resident if he meets any of the automatic overseas tests. An individual, who does not meet any of the automatic overseas tests, will automatically be UK resident if he meets any of the automatic UK tests. An individual who has not met any of the automatic overseas tests nor any of the automatic UK tests will be UK resident if he meets the sufficient ties test.

Statute sets out a test to determine whether or not an individual is UK resident in a tax year.

The operation of the test can be summarised as follows.

Automatic overseas tests

The automatic overseas tests must be considered first.

The automatic overseas tests treat an individual as not resident in the UK in a tax year if that individual:

- Spends less than 16 days in the UK in that tax year and was resident in the UK for one or more of the three previous tax years (typically someone who is leaving the UK), or

- Spends less than 46 days in the UK in that tax year and was not resident in the UK for any of the previous three tax years (typically someone who is arriving in the UK), or

- Works full-time overseas throughout that tax year, without a significant break, and spends less than 91 days in the UK during that tax year and there are less than 31 days in the tax year where the individual works in the UK for more than three hours a day. A significant break from overseas work is any 31 day period in which there is no day that the individual works overseas for more than three hours or would have worked overseas for more than three hours but does not do so due to annual leave, sick leave or parenting leave.

1.1.3 Automatic UK tests

If none of the automatic overseas tests are met, then the automatic UK tests are considered.

The automatic UK tests treat an individual as UK resident in a tax year if that individual:

- Spends 183 days or more in the UK during that tax year; or

- During at least one period of 91 consecutive days, at least 30 days of which fall in the tax year, has a home in the UK in which the individual is present (no matter for how short a time) for at least 30 days in the tax year and either the individual has no home overseas or has an overseas home or homes in each of which the individual is present (again, no matter for how short a time) for fewer than 30 days in the tax year or

- Works full-time, without a significant break, in the UK during a 365-day period, some of which falls within that tax year. A significant break from UK work is defined as for the third automatic overseas test, but in terms of UK, rather than overseas, work.

1.1.4 Sufficient UK ties tests

If the individual meets none of the automatic overseas tests and none of the automatic UK tests, the ‘sufficient ties’ test must be considered.

The sufficient ties test compares the number of days spent in the UK and the number of connection factors or ‘ties’ to the UK.

An individual who was not UK resident in any of the previous three tax years (typically someone who is arriving in the UK) must determine whether any of the following ties apply:

- UK resident close family (eg spouse/civil partner, partner if living together as if married or in a civil partnership, child under the age of 18),

- Substantive UK work (employment or self-employment) where 40 days or more of working three hours a day is regarded as substantive,

- UK accommodation (not necessarily owned by the individual) which is available to that individual for a consecutive period of 91 days or more in the tax year and in which the individual spends one or more nights during the tax year (16 or more nights if it is the home of a close relative such as a parent or an adult child),

- More than 90 days spent in the UK in either or both of the previous two tax years.

An individual who was UK resident in any of the previous three tax years (typically someone who is leaving the UK) must also determine whether an additional tie applies:

- Present in the UK at midnight for the same or more days in that tax year than in any other country.

The following table shows how an individual’s UK residence status is found by comparing the number of days in the UK during a tax year and the number of UK ties:

| Days in UK | Previously resident | Not previously resident |

| Less than 16 | Automatically not UK resident | Automatically not UK resident |

| Between 16 and 45 | Resident if 4 UK ties (or more) | Automatically not UK resident |

| Between 46 and 90 | Resident if 3 UK ties (or more) | Resident if 4 UK ties |

| Between 91 and 120 | Resident if 2 UK ties (or more) | Resident if 3 UK ties (or more) |

| Between 121 and 182 | Resident if 1 UK tie (or more) | Resident if 2 UK ties (or more) |

| 183 or more | Automatically UK resident | Automatically UK resident |

| This table will be given in the tax rates and allowances section of the examination paper. |

Exam focus point

1.1.5 Days spent in UK

Generally, if a taxpayer is present in the UK at the end of a day (ie midnight), that day counts as a day spent by the taxpayer in the UK. However he does not need to count the first 60 days in a tax year that he spends in the UK due to circumstances beyond his control, such as serious illness.

1.1.6 Examples

- James had not previously been resident in the UK before he arrived on 6 April 2015. He spent 40 days in the UK during the tax year 2015/16. James did not work during 2015/16.

James is arriving in the UK. He satisfies one of the automatic overseas tests since he spent less than 46 days in the UK in 2015/16 and was not resident in the UK for any of the previous three tax years. James is therefore not UK resident for the tax year 2015/16.

- Caroline had not previously been resident in the UK before she arrived on 6 April 2015. She spent 60 days in the UK during the tax year 2015/16. She did not work during 2015/16. Her only home during 2015/16, which she has throughout the whole year, is in the UK.

Caroline is arriving in the UK. She does not satisfy any of the automatic overseas tests since she spends 46 days or more in the UK and does not work overseas. She satisfies one of the automatic UK tests since there is a period of at least 91 days (the whole year) when she has a UK home in which she is present for 30 days or more in 2015/16, and she has no overseas home. Caroline is therefore UK resident for the tax year 2015/16.

- Miranda had always been resident in the UK before the tax year 2015/16 and has spent more than 90 days in the UK in every tax year before 2015/16. Miranda does not work during 2015/16. Miranda is married to Walter who is UK resident in 2015/16. They own a house in the UK which is available to them for the whole of 2015/16. On 6 April 2015, Miranda bought an overseas apartment where she spent 285 days during 2015/16. The remaining 80 days were spent in her UK house.

Miranda is leaving the UK. She does not satisfy any of the automatic overseas tests since she spends 16 days or more in the UK and does not work overseas. She does not satisfy any of the automatic UK tests since she spends less than 183 days in the UK, has an overseas home in which she is present for at least 30 days and does not work in the UK.

The ‘sufficient ties’ test is therefore relevant. Miranda has three UK ties:

- Close family in the UK (spouse);

- Available accommodation in the UK in which she spent at least one night in the tax year; (iii) More than 90 days spent in the UK in both of the previous two tax years.

Miranda spends between 46 and 90 days in the UK in 2015/16. These three ties are therefore sufficient to make her UK resident in 2015/16.

- Norman has not been resident in the UK in any tax year before 2015/16. He has not spent more than 90 days in the UK prior to 2015/16. On 6 April 2015, he arrived in the UK and went to stay at the home of his adult son for the first 160 days in the tax year 2015/16. Norman also has an overseas house in which he spent the remainder of the tax year 2015/16. Norman did not work in 2015/16 and his close family (which definition does not include his adult son) are not UK resident in 2015/16.

Norman is arriving in the UK. He does not satisfy any of the automatic overseas tests since he spends 46 days or more in the UK and does not work overseas. He does not satisfy any of the automatic UK tests as he spent less than 183 days in the UK, has an overseas home in which he is present for at least 30 days and does not work in the UK.

The ‘sufficient ties’ test is therefore relevant. Norman spends between 121 and 182 days in the UK during 2015/16 and so he would need two UK ties to be UK resident for that tax year. Since Norman has only one tie with the UK in 2015/16 (available accommodation with a close relative in which he spends at least 16 nights), he is therefore not UK resident for the tax year 2015/16.

Exam focus UK tax residence status was tested in June 2015 Question 1(a) Jodie. The examiner commented that this point part of the question ‘was generally answered well, with many candidates demonstrating a strong knowledge of these aspects of the syllabus. In particular, candidates knew how to determine the number of ties that needed to be satisfied and were able to describe the ties and relate them to the facts of the question.’

1.1.7 Splitting the tax year

FAST FORWARD In general, an individual is either resident or non-resident for the whole of a tax year. However, in certain circumstances, the tax year may be split into UK and overseas parts.

Strictly, each tax year must be looked at as a whole. The general principle is that an individual is UK resident or non-UK resident either for a whole tax year or not at all.

However an individual may be able to split a tax year into UK and overseas parts in some circumstances. The split year treatment can only apply for a year in which an individual is UK resident under the usual rules. Where the tax year is split, the individual is taxed as a UK resident for the UK part and as a non-UK resident for the overseas part.

The split year treatment can be used by an individual arriving in the UK if that individual is non-UK resident in the year prior to the split year and if one of the following circumstances applies:

- The individual comes to the UK, acquires a home in the UK, and does not have sufficient ties to the UK in order to be UK resident prior to acquiring the UK home (the UK part starts when the individual acquires the UK home), or

- The individual comes to the UK to work full-time for a period of at least a year and does not have sufficient ties to the UK in order to be UK resident prior to starting that work (the UK part starts when the individual starts the UK work), or

- The individual returns to the UK following a period where the individual has worked full-time overseas (the UK part starts when the individual ceases working overseas), or

- The individual returns to the UK following a period where the individual’s partner (spouse, civil partner or someone with whom the individual lives as spouse or civil partner) has worked full-time overseas (the UK part starts on the later of the individual’s partner ceasing working overseas and the individual joining the partner in the UK).

The split year treatment can be used by an individual leaving the UK if that individual is UK resident in the tax year prior to the spilt year and non-UK resident in tax year following the split year and if one of the following circumstances applies:

- The individual leaves the UK to begin full-time work overseas and meets similar, but modified, conditions in the third automatic overseas test above (the overseas part starts when the individual starts the overseas work); or

- The individual’s partner leaves the UK to begin full-time work overseas and the individual leaves the UK in order to continue living together with that partner (the overseas part starts on the later of when the partner starts the overseas work and the individual joining the partner overseas); or

- The individual leaves the UK in order to live overseas, ceases to have any UK home, spends a minimal amount of time in the UK, and establishes certain links with the overseas country by, for example, becoming resident there (the overseas part starts when the individual ceases to have a home in the UK).

1.1.8 Examples

- Wolfgang has never been resident in the UK and has no UK ties before 1 July 2015 when he arrives in the UK from Germany. He rents out his flat in Germany on a two year lease from that date. He

enters into a 12 month lease on a flat in London from 1 July 2015 when he starts living there. Wolfgang does not work.

Wolfgang is entitled to use split year treatment for 2015/16 since he is UK resident in 2015/16 (under the automatic UK tests as he spends more than 183 days in the UK), he was non-UK resident for 2014/15, he acquires a home in the UK during 2015/16, and spent no time in the UK between 6 April and 1 July 2015 so could not have been UK resident prior to acquiring the home (ie ties test irrelevant).

Wolfgang’s overseas part of the tax year 2015/16 starts on 6 April 2015 and ends on 30 June 2015. The UK part of the tax year 2015/16 starts on 1 July 2015 (the day he acquires his home in the UK) and ends on 5 April 2016.

- Bruce has always been UK resident. He leaves the UK and begin a three year full-time contract overseas on 15 October 2015. He will not visit the UK during the period of the contract.

Bruce can split the tax year 2015/16 because he is UK resident in 2015/16 (spends more than 183 days in the UK), he was UK resident in 2014/15, he will be non-UK resident in 2016/17

(automatically because he works full-time overseas in that tax year and does not spend more than 90 days in the UK during that tax year), and he is leaving the UK to begin full-time work overseas.

The UK part of the tax year 2015/16 starts on 6 April 2015 and ends 14 October 2015. The overseas part of the tax year 2015/16 starts on 15 October 2015 and ends on 5 April 2016.

| The detailed rules in the statutory residence test are quite complex, especially those in regard to what constitutes work and having a home in the UK, as well as details of the split year cases. These more complex aspects are not examinable at Paper P6(UK). |

Exam focus point

| 1.2 Domicile | 12/10 |

FAST FORWARD

An individual is domiciled in the country which is the individual’s permanent home.

An individual is domiciled in the country which is the individual’s permanent home. Domicile is distinct from nationality or residence. An individual may be resident in more than one country, but can be domiciled in only one country at a time.

Individuals acquire a domicile of origin at birth; this is normally the domicile of their father (or that of their mother if their father died before they were born or their parents were unmarried at their birth) and therefore not necessarily the country where they were born. Individuals retain this domicile until they acquire a different domicile of dependency (if, while they are under 16, their father’s domicile changes) or domicile of choice. A domicile of choice can be acquired only by individuals aged 16 or over.

To acquire a domicile of choice individuals must sever their ties with the country of their former domicile and settle in another country with the clear intention of making their permanent home there. Long residence in another country is not in itself enough to prove that individuals have acquired a domicile of choice: there has to be evidence that they firmly intend to live there permanently.

2 Liability to UK income tax: basic principles 12/11

2.1 Overview

FAST FORWARD

Generally, a UK resident is liable to UK income tax on UK and overseas income as it arises. An individual who is UK resident but not UK domiciled is liable to UK income tax on income arising in the UK and may be entitled to be taxed on overseas income on the remittance basis. A non-UK resident is liable to UK income tax only on income arising in the UK.

Generally, a UK resident individual is liable to UK income tax on UK and overseas income as it arises (the arising basis).

Under the remittance basis, an individual who is UK resident but not UK domiciled is liable to UK income tax on overseas income only to the extent that it is brought (remitted) to the UK. The individual may be subject to the remittance basis charge (see later in this chapter). If the remittance basis does not apply (for example, if it is not claimed – see later in this chapter), overseas income is taxed on an arising basis. An individual who is UK resident but not UK domiciled is liable to UK income tax on UK income on an arising basis.

A non-UK resident is liable to UK income tax only on income arising in the UK.

The diagram below provides a broad summary of how an individual is taxed, based on the individual’s residence and domicile status.

2 Individuals resident and domiciled in the UK

2.2.1 Overseas income: general principles

Individuals who are resident and domiciled in the UK are taxable on their overseas income on an arising basis (ie it is irrelevant whether or not the income is remitted to the UK). Double taxation relief may be available if the income is also taxed in the country in which it arises (see later in this chapter).

Overseas income is identified and taxed in broadly the same way as UK income, but the points set out below should be noted. We consider the rules relating to employment income later in this chapter.

2.2.2 Overseas property business

An individual who receives rents and other income from property overseas is treated as carrying on an overseas property business. The income from the overseas property business is liable to income tax in the same way as income from a UK property business, and is calculated in the same way. If an individual has both a UK and an overseas property business, the profits must be calculated separately.

If a loss arises in an overseas property business, it may be carried forward and set against future income from the overseas property business, as soon as it arises.

The special treatment of furnished holiday lettings does not apply to overseas properties other than those in the European Economic Area.

2.2.3 Overseas dividends

Overseas dividends are dividends from non-UK companies. The income is taxable in the year it arises as it is taxed in the same way as UK dividend income, ie at 10% if it falls below the basic rate limit, at 32.5% if it falls between the basic rate limit and the higher rate limit and at 37.5% thereafter.

A dividend from an overseas company is received with a 10% non-refundable tax credit, where the taxpayer holds less than 10% of the shares in that company. If the taxpayer owns 10% or more of the shares in the overseas company, the non-refundable tax credit will also be applicable, provided the company is resident in country which has a double-taxation treaty with the UK which contains a non-discrimination provision which provides that that the country does not tax foreigners more heavily than its own nationals.

2.3 Individuals resident but not domiciled in the UK 6/13, 12/14

2.3.1 Remittance basis

An individual who is UK resident but not UK domiciled may be taxed on overseas income on the remittance basis.

If the remittance basis does not apply, the individual is taxable in the same way as an individual who is UK resident and domiciled (ie on an arising basis on both UK and overseas income).

Where the remittance basis applies, all income from the relevant source is treated as non-savings income. It is taxed in the same way as other non-savings income ie at 20% in the basic rate band, 40% in the higher rate band and thereafter at 45%.

We consider the rules relating to the remittance of employment income later in this chapter.

2.3.2 What is a remittance?

An individual makes a remittance of non-UK income where they have use or enjoyment of that income in the UK.

Clearly, this definition includes remittances in the form of cash. However, it also covers:

- using non-UK income to settle a non-UK debt where the money was borrowed in the UK or was borrowed overseas and brought into the UK

- money, property and services acquired with non-UK income and brought into the UK. There are exemptions for:

- personal effects such as clothes, shoes, jewellery and watches

- assets costing less than £1,000

- assets brought into the UK for repair and restoration

- assets in the UK for less than a total period of 275 days.

Remittance of non-UK income is also exempt from UK income tax if it is brought into the UK in order to:

- acquire shares in or make a loan to a trading company or a member of a trading group, or pay the remittance basis charge (see later in this chapter).

2.3.3 Automatic application of remittance basis

If an individual, who is entitled to be taxed on the remittance basis on overseas income, has unremitted non-UK income and gains of less than £2,000 arising in a tax year, the remittance basis will apply to that individual automatically without the need for a claim to be made.

| The remittance basis was tested in June 2013 Question 3(b)(i) Lin, Nan and Yu. The examiner commented that ‘One particular area of confusion related to the automatic applicability of the remittance basis where unremitted income and gains are less than £2,000; many candidates thought the rule related to the level of remitted income and gains.’ |

Exam focus point

The individual can disapply the remittance basis for a tax year if they wish by giving HMRC notice in their self assessment tax return for that year. They will then be taxed on an arising basis on overseas income arising in that tax year.

The remittance basis will also apply automatically in a tax year if an individual:

- is UK resident but is not UK domiciled in that year

- has no UK income or gains other than taxed investment income not exceeding £100

- does not remit income or gains to the UK in the year

- has been UK resident in not more than six out of the nine tax years immediately preceding that year or is under the age of 18 throughout the year

2.3.4 Claiming the remittance basis

In a particular tax year, any other individual who is entitled to be taxed on the remittance basis must make a claim if they wish for that basis to apply to their overseas income. The claim is made on the individual’s self assessment tax return. If a claim is not made, the individual is taxed on their overseas income on an arising basis.

An individual who makes a claim for the remittance basis is not entitled to the personal allowance.

This does not apply to an individual who is entitled to the remittance basis without a claim (see above).

An individual who makes a claim for the remittance basis is also not entitled to the annual exempt amount against chargeable gains. We deal with overseas aspects of Capital Gains Tax later in this Text.

2.3.5 Example: remittance basis

Claudia has been UK resident for five years, but is not domiciled in the UK. In 2015/16, she has UK source income of £30,000 and overseas income of £5,000, of which she has remitted £1,000 to the UK. Claudia is not entitled to the remittance basis automatically because she has unremitted overseas income of £(5,000 – 1,000) = £4,000.

Claudia should not make a claim for the remittance basis to apply to her overseas income in 2015/16. This is because she would lose her entitlement to the personal allowance of £10,600. Since this exceeds the amount of unremitted overseas income, she would pay less UK tax by having her overseas income taxed on the arising basis.

2.3.6 The remittance basis charge

FAST FORWARD

An individual who claims the remittance basis and is a long term UK resident is required to pay the Remittance Basis Charge on unremitted income and gains.

An individual is liable to the Remittance Basis Charge if they:

- claim the remittance basis for the tax year; and

- are aged 18 or over in the tax year; and

- have been UK resident for at least seven of the nine tax years preceding that tax year.

The Remittance Basis Charge is a charge on non-UK income and gains not remitted to the UK. The individual remains liable to UK tax on their UK source income and non-UK income remitted to the UK in the usual way. We deal with chargeable gains later in this Text.

The amount of the Remittance Basis Charge in a tax year depends on the length of time the individual has been resident in the UK.

- An individual who has been resident for 17 of the 20 tax years preceding that tax year has a Remittance Basis Charge of £90,000.

- An individual who has been resident for 12 of the 14 tax years preceding that tax year (but not yet 17 of the last 20 tax years) has a Remittance Basis Charge of £60,000.

- An individual who has been resident for seven of the nine tax years preceding that tax year (but not yet 12 of the last 14 tax years) has a Remittance Basis Charge of £30,000.

| The amounts of the Remittance Basis Charges and the periods for which they apply will be given in the tax rates and allowances in the exam. |

Exam focus point

The Remittance Basis Charge is treated as UK income tax or CGT paid on an arising basis and so should be available for double taxation relief, for example in the country in which the non-UK income or gains arises.

The individual is required to nominate unremitted non-UK income and gains on which the Remittance Basis Charge applies. If the unremitted income or gains are later remitted to the UK, that income or gains will not be taxed again. However, there are ordering rules which treat other untaxed income and gains as being remitted before nominated income and gains.

If the individual does not nominate sufficient non-UK income or gains to cover the relevant Remittance Basis Charge, there is an additional element added to ensure that the full tax charge is imposed.

2.3.7 Choosing whether or not to use the remittance basis

In each tax year, the individual can chose whether or not to claim the remittance basis. This will be an important decision if the individual would be liable to the remittance basis charge and will depend on:

- the extent of their unremitted non-UK income and gains;

- the effect of the loss of the personal allowance and the annual exempt amount against chargeable gains.

Nathan has been resident in the UK for tax purposes since 2006/07 but is not UK domiciled.

In 2015/16, he has the following income:

UK trading income £10,000 Non-UK trading income £90,000

He remits £10,000 of his non-UK trading income into the UK.

You are required to advise Nathan whether or not he should claim the remittance basis in 2015/16.

Remittance basis

Nathan has been resident in the UK for nine tax years before 2015/16, so the Remittance Basis Charge is £30,000, if the remittance basis is claimed.

| Non-savings | |

| Income | |

| £ | |

| UK trading income | 10,000 |

| Non-UK trading income remitted | 10,000 |

| Taxable income (no personal allowance) His income tax liability will therefore be: | 20,000 |

| £20,000 20% | 4,000 |

| Remittance Basis Charge | 30,000 |

| 34,000 |

Worldwide income

| Non-savings | |

| Income | |

| £ | |

| UK trading income | 10,000 |

| Non-UK trading income | 90,000 |

| Net income | 100,000 |

| Less personal allowance | (10,600) |

| Taxable income

His income tax liability will therefore be: |

89,400 |

| £ | |

| £31,785 20% | 6,357 |

| £57,615 40% | 23,046 |

| 29,403 |

Therefore Nathan should not claim the remittance basis for 2015/16.

2.4 Individuals not resident in the UK 6/15

2.4.1 Personal allowances for non-UK residents

In general, non-UK residents are not entitled to personal allowances. However, some individuals are entitled to allowances despite being non-UK resident including:

- Citizens of the European Economic Area

- Individuals resident in the Isle of Man and the Channel Islands.

2.4.2 Limit on income tax liability for non-UK residents

There is a limit on the income tax liability of an individual who is not resident in the UK (but not where the tax year is split as described above). The tax cannot exceed the sum of:

- The tax liability if the individual was taxed on all income, apart from disregarded income, without a personal allowance; and

- The tax deducted at source from disregarded income (including tax credits on dividends).

Disregarded income includes UK savings and dividend income, but does not include non-savings income such as trading, employment or property income.

2.4.3 Savings income and non-UK residents

Interest that arises on UK government ‘Free of Tax to Residents Abroad’ (FOTRA) securities (broadly UK Treasury Stock) is not taxable if received by an individual who is not resident in the UK.

Bank and building society interest can be received gross (and so there will be no UK tax liability on this income) if the recipient is not resident in the UK and makes a declaration on Form R105.

3 Employment overseas and non-residents employed in the UK

3.1 Chargeability of employment income

FAST FORWARD

The residence and domicile status of an employee (and, in some cases, whether they carry out their duties in the UK or outside it) determine the tax treatment of their earnings.

3.1.1 Individual resident and domiciled in the UK

A resident and domiciled individual is taxed on their general earnings on a receipts basis (see Chapter 4) whether the duties of the employment are carried out in the UK or outside it.

However, if the individual can split the tax year as described earlier in this chapter, any earnings relating to the overseas part of that year, as determined on a ‘just and reasonable’ basis, are not taxable unless they relate to duties performed in the UK.

3.1.2 Individual resident but not domiciled in the UK

The general rules is that a UK resident, but not UK domiciled individual, is usually taxed on all general earnings on the receipts basis, wherever the duties of their employment are carried out.

There are two special rules where the individual’s income from non-UK duties may be taxable on the remittance basis. These are where either:

- The individual has been non-UK resident for any three consecutive years out of the previous five tax years; or

- The earnings are ‘chargeable overseas earnings’ which are those where:

– The duties of the employment are performed wholly outside of the UK; and – The employer is based outside the UK.

If split year treatment applies, the amount of earnings relating to non-UK duties taxable on the remittance basis is the amount attributable to the UK part of the year, as determined on a ‘just and reasonable’ basis; the amount attributable to the overseas part of the year is not taxable in the UK.

If the remittance basis is claimed or is automatic, only those earnings relating to non-UK duties remitted to the UK are chargeable in the UK. The usual receipts basis applies to earnings relating to UK duties.

3.1.3 Individual not resident in the UK

A non resident is taxed on their general earnings in respect of UK duties on the receipts basis. There is no UK income tax on earnings in respect of non-UK duties.

3.1.4 Taxation of employment income – summary

| Residence status of employee

|

Duties performed wholly or partly in the UK

in the UK outside the UK |

Duties performed wholly outside the UK

|

|

| Resident and domiciled in the UK | Taxable on receipts basis | Taxable on receipts basis | Taxable on receipts basis |

| Resident in the UK but not UK domiciled | Taxable on receipts basis | Taxable on receipts basis EXCEPT non-

UK resident for three consecutive years out of the previous five tax years, when taxable on remittance basis if claimed/ automatic |

Taxable on receipts basis EXCEPT non-UK resident for three

consecutive years out of the previous five tax years OR employer based outside UK, when taxable on remittance basis if claimed/ automatic |

| Not resident in the UK | Taxable on receipts basis | Not taxable in the UK | Not taxable in the UK |

3.2 Travel and subsistence expenses for employment overseas 6/12

FAST FORWARD

Individuals working overseas may claim certain deductions for travel and subsistence expenses.

3.2.1 Travel expenses incurred by the employee

Travel expenses relating to employment duties overseas (whether or not reimbursed by the employer) may be deducted from earnings in certain circumstances.

- A deduction is allowed for starting and finishing travel expenses. Starting travel expenses are those incurred by the employee in travelling from the UK to take up employment overseas and finishing travel expenses are those incurred by the employee in travelling to the UK on the termination of the employment. Three conditions need to be met:

- The duties of the employment are performed wholly outside the UK (incidental UK duties are ignored)

- The employee is resident in the UK

- If the employer is based outside the UK, the employee is domiciled in the UK.

If the travel is only partly attributable to the taking up or termination of the employment, the deduction applies only to that part of the expenses.

- There is also a deduction from earnings from an employment for travel expenses where an employee has two or more employments and the duties of at least one of them are performed overseas. The following conditions must be met:

- The travel is for the purpose of performing duties of the employment at the destination

- The employee has performed duties of another employment at the place of departure

- The place of departure or the destination or both are outside the UK

- The duties of one or both of the employments are performed wholly or partly outside the UK

- The employee is resident in the UK

- If the employer is based outside the UK, the employee is domiciled in the UK.

3.2.2 Travel expenses borne by employer

There are a number of deductions which may be made from a individual’s earnings where an amount has been included in those earnings in respect of provision of (or reimbursement of expenses relating to) travel overseas. The allowable deduction is generally equal to the amount included in the earnings. Note that these deductions do not apply where the employee incurs such costs but does not receive reimbursement.

- The first deduction relates to the provision of travel facilities for a journey made by the employee. This deduction applies in two circumstances:

- The employee is absent from the UK wholly and exclusively for the purpose of performing the duties of one or more employments, the duties can only be performed outside the UK and the journey is from a place outside the UK to the UK or a return journey following such a journey

- The duties of the employment are performed partly outside the UK, the journey is between the UK and the place the non-UK duties are performed, the non-UK duties can only be performed there and the journey is made wholly and exclusively for the purpose of performing the duties or returning after performing them.

The deduction only applies from earnings which are chargeable because the individual is UK resident but not from ‘chargeable overseas earnings’ (employer based outside UK/non-domiciled employee/non-UK duties). This is because the overseas earnings are taxed on the remittance basis.

- There is also a deduction for the provision of travel facilities for a journey made by the employee’s spouse/civil partner or child (aged under 18 at the beginning of the outward journey) or the reimbursement of expenses incurred by the employee on such a journey. The following conditions need to be met:

- The employee is absent from the UK for a continuous period of at least 60 days for the purpose of performing the duties of the employment

- The journey is between the UK and the place outside the UK that the duties are performed

- The employee’s spouse/civil partner/child is either accompanying the employee at the beginning of the period of absence or visiting the employee during that period or is returning to the UK after accompanying or visiting the employee.

A deduction is not allowed for more than two outward and two return journeys by the same individual in a tax year.

Again, the deduction only applies from earnings which are chargeable because the individual is UK resident, but not from ‘chargeable overseas earnings’ taxed on the remittance basis.

- There are also rules which apply to non-domiciled employee’s travel costs and expenses where duties are performed in the UK. The deduction is only from earnings for duties performed in the UK.

The first deduction applies to the provision of travel facilities for a journey made by the employee or the reimbursement of expenses incurred by the employee for such a journey. The conditions that must be met are:

- The journey ends on or during the period of 5 years beginning with a qualifying arrival date (see below)

- The journey is made from the country outside the UK where the employee normally lives to the UK in order to perform the duties of the employment or to that country from the UK after performing such duties.

If the journey is only partly for such a purpose, the deduction is equal to so much of the included journey as is properly attributable to that purpose.

- A ‘qualifying arrival date’ is a date on which the individual arrives in the UK to perform UK duties where either:

- The individual has not been in the UK for any purpose during the two years ending the day before that date, or

- The individual was not UK resident in either of the two tax years before the tax year in which the date falls.

Note that the second condition relates to tax years but the first condition does not.

| Note carefully the rules under which relief is given. In particular, the costs must be borne by the employer. Note also the limits on journeys for spouses/civil partners/children. |

Exam focus point

3.2.3 Overseas accommodation and subsistence costs and expenses

A deduction from earnings from an employment is allowed if:

- The duties of the employment are performed wholly outside the UK (incidental UK duties ignored)

- The employee is resident in the UK

- If the employer is based outside the UK, the employee is domiciled in the UK

- The earnings include an amount in respect of the provision of accommodation or subsistence outside the UK to enable the employee to perform the duties of the employment or the reimbursement of such expenses incurred by the employee.

The deduction is equal to the amount included in the earnings.

3.3 Overseas pensions

For persons taxed on the arising basis (but not those on the remittance basis), only 90% of the amount of a overseas pension is taxed.

3.4 Tax planning when employed overseas

|

3.4.1 General considerations

The following points highlight the pitfalls and planning possibilities to be considered when going to work overseas.

- Insurance policies are available to cover the risk of extra tax liabilities should an early return to the UK be necessary.

- If the employer bears the cost of board and lodging overseas this will represent a tax-free benefit.

The employee may visit home as many times as they like without the costs being taxed as benefits. Likewise, for absences of 60 days or more, travelling expenses for a spouse/civil partner and minor children are also tax-free if paid or reimbursed by the employer. Up to two return visits per individual per tax year are allowed.

- Where the remittance basis applies it may be advisable to keep funds overseas separate so that it can be proved that sums remitted to the UK are capital (not subject to income tax) or income from a specific source.

- Having established non-residence in the UK, any UK investments should be reviewed to ensure they are still tax effective. Bank and building society interest, otherwise paid net, may be paid gross where the deposit-taker is given a written declaration that the recipient is not resident in the UK.

- Consider carefully the tax system in the overseas country concerned and the terms of any double taxation agreement. The UK has such agreements with most countries: they contain rules on where income and gains are to be taxed, and on other matters (see below).

3.4.2 The OECD Model Agreement

Most double taxation agreements follow fairly closely the Organisation for Economic Co-operation and Development (OECD) Model Double Taxation Agreement. Under that Model, someone who is resident in country R but is employed in country E will normally be taxed on the earnings in country E. They may only be taxed on the earnings in country R if:

- They are in country E for less than 184 days in total in any 12 month period starting or ending in the year,

- The employer is not resident in country E, and

- The earnings are not borne by a permanent establishment or fixed base which the employer has in country E.

If an individual resident in country R is a director of a company resident in country D, their director’s fees may be taxed in country D.

4 Overseas trades

FAST FORWARD

Profits of an overseas trade are computed as for UK trades. However, the remittance basis may apply for non-UK domiciled individuals.

4.1 General principles

If a UK resident trader has a business which is conducted wholly or mainly overseas, the trade profits are chargeable to income tax. The trade profits are calculated in the same way as are UK trade profits, and the basis periods are determined in the same way also.

If the trader is not domiciled in the UK then the trader may claim the remittance basis or it may apply automatically under the usual rules.

A trader who is not UK resident is only taxable in the UK on UK income. The profits of trades carried on overseas by non-residents are therefore not liable to UK income tax. Where an individual who carries on a trade wholly or partly overseas becomes or ceases to be UK resident, the profits of the trade carried on overseas will become or cease to be liable to UK income tax respectively. To ensure that only the overseas profits which arise whilst the trader is UK resident are taxed there is a deemed cessation and recommencement of the trade. This rule also applies to a partner who changes residence if the partnership is carrying on a trade wholly or partly overseas.

This deemed cessation and recommencement does not prevent any losses that were being carried forward from before the change from being set off against profits arising after the change.

Under the OECD Model Agreement, a resident of country R trading in country T is taxable in country T on their profits only if they have a permanent establishment there (see later in this text). A resident of country R carrying on a profession in country P is taxable in country P on their profits only if they have a fixed base regularly available to them in country P.

The general rule for overseas traders doing business with UK customers is that they are trading in the UK (and therefore liable to UK tax on their profits) if contracts are concluded in the UK.

4.2 Travel expenses

A deduction is available against trade profits income for travel expenses incurred by UK domiciled individuals who carry on a trade wholly outside the UK and who travel to and from the UK. So long as the taxpayer’s absence overseas is wholly and exclusively for the purposes of their trade then any travel expenses to and from the UK together with the cost of board and lodging at the overseas location are deductible. If the taxpayer’s absence is for a continuous period of 60 days or more, the cost of up to two visits in any tax year by their spouse/civil partner and/or children under 18 is also deductible.

No deduction is however given for these travel expenses where the trade profits are taxed on a remittance basis. Instead the trader should arrange and pay for the travel whilst overseas, thus avoiding the need to remit that amount to the UK.

4.3 Overseas losses

A loss sustained in a trade (or profession or vocation) carried on overseas can be relieved in the same manner as UK trade losses against general income or under early trade losses relief.

However, if relief is sought for a loss in a trade which is wholly carried on overseas, the income which the loss can be set against is restricted to:

- Overseas trade profits

- Overseas pensions

- Overseas earnings

5 Double taxation relief (DTR)

FAST FORWARD

Double taxation relief may be available to reduce the burden of taxation. It is generally given by reducing the UK tax charged by the overseas tax suffered.

5.1 Introduction

As we have seen, UK tax applies to the worldwide income of UK residents and the UK income of non-residents.

When other countries adopt the same approach it is clear that some income may be taxed twice:

- Firstly in the country where it arises

- Secondly in the country where the taxpayer resides

Double taxation relief (DTR) as a result of international agreements may avoid the problem, or at least diminish its impact.

5.2 Double taxation agreements

Typical provisions of double taxation agreements based on the OECD Model are:

- Total exemption from tax is given in the country where income arises in the hands of, for example visiting diplomats and teachers on exchange programmes

- Preferential rates of withholding tax are applied to, for example, payments of rent, interest and dividends. The usual rate is frequently replaced by 15% or less

- DTR is given to taxpayers in their country of residence by way of a credit for tax suffered in the country where income arises. This may be in the form of relief for withholding tax only or, given a holding of specified size in a overseas company, for the underlying tax on the profits out of which dividends are paid

- There are exchanges of information clauses so that tax evaders can be chased internationally

- There are rules to determine a person’s residence and to prevent dual residence (tie-breaker clauses)

- There are clauses which render certain profits taxable in only one rather than both of the contracting states

- There is a non-discrimination clause so that a country does not tax foreigners more heavily than its own nationals

5.3 Unilateral relief

If no relief is available under a double taxation agreement, UK legislation provides for unilateral relief. However, unilateral relief is not available if relief is specifically excluded under the terms of a double tax agreement.

Overseas income must be included gross (ie including overseas tax) in the UK tax computation. The overseas tax is deducted from the UK tax liability (this is credit relief) but the relief cannot exceed the UK tax on the overseas income so the taxpayer bears the higher of:

- The UK tax

- The overseas tax

The UK tax on the overseas income is the difference between:

- The UK tax before DTR on all income including the overseas income The UK tax on all income except the overseas income In both cases, we take account of tax reducers.

| Question | Double tax relief | |

| A UK resident and domiciled individual has the following income for 2015/16.

|

£ | |

| UK salary | 36,615 | |

| Interest on overseas loan stock (net of overseas tax at 5%) | 4,750 | |

| Overseas rents (net of overseas tax at 60%)

Assuming that maximum DTR is claimed, show the UK tax liability. |

1,500

|

|

| Answer | ||

| Non-savings | Savings | ||||

| income | income | Total | |||

| £ | £ | £ | |||

| Salary | 36,615 | ||||

| Overseas interest £4,750 100/95 | 5,000 | ||||

| Overseas property business £1,500 100/40 | 3,750 | ||||

| Net income | 40,365 | 5,000 | 45,365 | ||

| Less personal allowance | (10,600) | ||||

| Taxable income

|

29,765 | 5,000 | 34,765 | ||

| Non-savings income | £ | ||||

| £29,765 20% | 5,953 | ||||

| Savings income | |||||

| £2,020 20% | 404 | ||||

| £2,980 40% | 1,192 | ||||

| 8,7,549 | |||||

| Less double taxation relief | |||||

| Interest | 250 | ||||

| Rents (see below) | 1,346 | ||||

| (1,596) | |||||

| UK tax liability | 5,953 |

Since the rents are taxed more highly overseas, these should be regarded as the top slice of UK taxable income. Taxable income excluding the rents is £31,015 and the UK tax on this is:

| Non-savings income | £ | ||

| £26,015 20% | 55,203 | ||

| Savings income | |||

| £5,000 20% | 1,000 | ||

| 6,203 |

The UK tax on the rents is £1,346 (£7,549 – 6,203). Since overseas tax of £2,250 (60% of £3,750) is greater, the DTR is the smaller figure of £1,346. Overseas interest was taxed overseas at the rate of 5% (£250). Since the UK rate (20%) is clearly higher, the DTR given is £250.

Where there is no point in claiming this credit relief, perhaps because loss relief has eliminated any liability to UK tax, the taxpayer may elect for expense relief instead. No credit is given for overseas tax suffered, but only the income after overseas taxes is brought into the tax computation.

If overseas taxes are not relieved in the year in which the income is taxable in the UK, no relief can be obtained in any earlier or later year.

Taxpayers who have claimed relief against their UK tax bill for taxes paid overseas must notify HMRC in writing of any changes to the overseas liabilities if these changes result in the DTR claimed becoming excessive. This rule applies to all taxes not just income tax.

| | An individual may be both or either resident and domiciled in the UK. |

| | An individual will automatically not be UK resident if he meets any of the automatic overseas tests. An individual, who does not meet any of the automatic overseas tests, will automatically be UK resident if he meets any of the automatic UK tests. An individual who has not met any of the automatic overseas tests nor any of the automatic UK tests will be UK resident if he meets the sufficient ties test. |

| | In general, an individual is either resident or non-resident for the whole of a tax year. However, in certain circumstances, the tax year may be split into UK and overseas parts. |

| | An individual is domiciled in the country which is the individual’s permanent home. |

| | Generally, a UK resident is liable to UK income tax on UK and overseas income as it arises. An individual who is UK resident but not UK domiciled is liable to UK income tax on income arising in the UK and may be entitled to be taxed on overseas income on the remittance basis. A non-UK resident is liable to UK income tax only on income arising in the UK. |

| | An individual who claims the remittance basis and is a long term UK resident is required to pay the Remittance Basis Charge on unremitted income and gains. |

| | The residence and domicile status of an employee (and, in some cases, whether they carry out their duties in the UK or outside it) determine the tax treatment of their earnings. |

| | Individuals working overseas may claim certain deductions for travel and subsistence expenses. |

| | Profits of an overseas trade are computed as for UK trades. However, the remittance basis may apply for non-UK domiciled individuals. |

| | Double taxation relief may be available to reduce the burden of taxation. It is generally given by reducing the UK tax charged by the overseas tax suffered. |

Chapter roundup

Quick quiz

- What are the three automatic UK tests?

- On what basis is a UK resident who is not domiciled in the UK taxed on overseas income?

- How will a overseas dividend be taxed on a higher rate UK resident taxpayer if that taxpayer is:

- domiciled in the UK

- not domiciled in the UK and makes a remittance basis claim?

- How much is the Remittance Basis Charge?

- What earnings for duties outside the UK are taxed on a remittance basis?

- How many return journeys by John’s family can an employer pay for tax free for John if he is working overseas for 100 days?

- What is the maximum amount of credit relief that can be given for overseas tax on overseas income?

Answers to quick quiz

- (a) The individual spends 183 days or more in the UK during a tax year.

- During at least one period of 91 consecutive days, at least 30 days of which fall in the tax year, the individual has a home in the UK in which the individual is present (no matter for how short a time) for at least 30 days in the tax year and either the individual has no home overseas or has an overseas home or homes in each of which the individual is present (again, no matter for how short a time) for fewer than 30 days in the tax year.

- The individual works full-time, without a significant break, in the UK during a 365-day period, some of which falls within that tax year. A significant break from UK work is defined as for the third automatic overseas test, but in terms of UK, rather than overseas, work.

- On the remittance basis if a claim is made or the individual has unremitted income/gains not exceeding £2,000 in the tax year. Otherwise on the arising basis.

- (a) On an arising basis as dividend income liable to tax at 32.5%.

- On a remittance basis as non-savings income liable to tax at 40%.

- £30,000 if the individual has been resident in the UK for seven of the previous nine tax years,

£60,000 if the individual has been resident in the UK for 12 of the previous 14 tax years, £90,000 if the individual has been resident in the UK for 17 of the previous 20 tax years.

- Individual resident but not domiciled in the UK and either:

- Non-resident for any three consecutive years out of the previous five tax years; or

- Chargeable overseas earnings (duties of the employment are performed wholly outside of the UK, and employer is based outside the UK).

- Two

- The lower of:

- UK tax on the overseas income, and

- The overseas tax on the overseas income

| Number | Level | Marks | Time |

| Q11 | Introductory | 20 | 39 mins |

One thought on “Overseas aspects of income tax”