MONEY IN MODERN ECONOMIES

Money plays a crucial role in modern economies. Without money, trade would be based on barter. In a barter economy, trade requires a double-coincidence of wants – if you have eggs but want cheese you must find somebody who has cheese but wants eggs. With barter the activities of selling and buying cannot be separated. The existence of money facilitates trade, division of labour and therefore economic development.

Money is usually defined by reference to the principal functions it performs:

- A medium of exchange (exchange function)

Money is used as payment for goods and services. Its existence separates the activities of buying and selling and thereby removes the need for a double-coincidence of wants when trading.

- A store of value (asset function)

To be acceptable as a medium of exchange, money must act as a store of value. Money must be a means of storing purchasing power.

- A unit of account

To act as a medium of exchange, money must also act as a unit of account. It must be possible to measure the value of goods and services in terms of money. Without money, national income accounting would be practically impossible.

- A standard of deferred payments

By acting as a unit of account over time, money facilitates the generalised use of credit in modern economies.

Anything that is generally acceptable as payment for goods and services can act as a medium of exchange. Traditionally, money had an intrinsic value, e.g. gold. In modern economies paper money has no intrinsic value and depends crucially on the confidence of the public (confidence in its purchasing power) for its effectiveness. Traditionally the confidence of the public was based on the convertibility of legal tender into gold at a particular rate (gold standard). It would be rare for a modern government to guarantee convertibility.

Payment for goods and services in the modern economy is typically by means of legal tender or bank balances. People will accept payment by cheque (claims on bank balances) but only if they are confident it is convertible into legal tender.

The two important components of money in a modern economy are therefore legal tender and bank balances.

Different measures of the amount of money in the economy can be got by drawing distinctions between cash in circulation and in bank tills, or between different types of bank deposit.

M0: cash in circulation + cash in bank tills + operational deposits of commercial banks held at Central Bank.

M1: cash in circulation + private sector current account deposits (sight deposits) in commercial banks.

M3: 0M1 + private sector deposit accounts (time deposits) in commercial banks

M0 is known as the monetary base. M1 is a narrow definition of money whereas M3 is a broad definition of money. Alternative definitions can be got by including foreign currency deposits or building society deposits, etc.

It can be seen from Table 12.1 that cash is not the dominant form of money in modern economies. For the broad definition (M3) cash can be a very small proportion, bank deposits being by far the largest component (90% or more).

Inflation

Inflation erodes the “real” value of money (i.e. the purchasing power of money)

Measure of inflation (in many countries) it is The Consumer Price Index (CPI) The CPI is a monthly index of the value of a fixed basket of goods which includes mortgages/loans to buy houses.

Inflation prevents money from performing its functions properly

Means of exchange

When inflation is very high (hyperinflation) people no longer want to use money.

Unit of account

When there is inflation money is no longer a stable unit of account because the prices of different products rise by different percentages so relative price and values change.

Standard for Deferred Payment

In a period of inflation debtors gain at the expense of creditors.

- That is an unfair/arbitrary change.

- It makes people/banks reluctant to lend and increases the interest rate.

- Long-term contracts are hard to negotiate.

- Store of Wealth

Inflation erodes the “real” value of money and leads to people holding their wealth in other asset e.g. property, art.

CREDIT CREATION AND THE MONEY SUPPLY

Commercial banks are profit-seeking institutions. To make profits, banks must provide loans to creditworthy borrowers. Banks are financial intermediaries, receiving funds from some groups and advancing funds to other groups.

| Commercial Banks |

Deposits Loans

(Liabilities) (Assets)

Modern commercial banking operates on the principle of fractional reserve banking. The bank only keeps a fraction of its deposit liabilities in liquid form, the greater proportion being advanced as interest earning loans. The bank knows from experience that not all depositors are likely to seek to withdraw all their deposits at any given time. Therefore, only a fraction of liabilities need be held in reserve to meet day-to-day obligations. The fraction of deposit liabilities held in reserve by the bank is known as the Reserve Asset Ratio (RAR). Note: there is a conflict here between the pursuit of profit and the need to maintain adequate liquidity. Excessive reserves suggest that the bank should increase loans in pursuit of profit. However, if reserves are too low, the bank faces the danger of being incapable of meeting its liabilities. Prudent management requires having sufficient liquidity (cash and liquid assets) to meet liabilities as they arise.

Fractional reserve banking leads to the creation of money by profit-seeking commercial banks.

Functions of Commercial Banks

- Providing a payments mechanism – clearing system source of notes and coin for the public.

- Place to store wealth.

- Source of loans and overdrafts.

- Acting as a financial intermediary.

- Exchange for foreign currency.

- Advise and assist customers.

- Help exporters and importers.

- Debt factoring.

- Insurance broker.

- Sell own insurance (subsidiary companies).

- Sell Pensions.

- Share registration service.

- Unit trust business.

Liquidity, Profitability and Security.

The 3 conflicting aims of banks.

Profitability : must be achieved to satisfy the banks’ shareholders. Liquid assets represent ***2% of total assets; near-liquid assets represent 25% – loans, bills, gilt-edged securities, CD’s.

The biggest profits come from lending at higher rates of interest:

- long-term lending is usually at higher interest rates than short term lending.

- Higher risk lending also command higher interest rates.

Liquidity : a bank must have some liquid assets.

- notes and coin to meet demands for cash withdrawals.

- a bank account to settle debts with other banks (done via transfers between banks from

“operational deposits” held with the central bank, The National Bank of Rwanda – NBR.)

- “near-liquid” assets (i.e. quickly changeable into liquid assets) to cover “extra” surges in demand for cash.

- to meet NBR regulations.

Security : banks must be stable and secure, or no one will deposit money with them. So banks must lend wisely with a strong likelihood that the loans will be repaid in full, on time with interest. Often banks get security against a loan (E.g. mortgage backed, assets or life assurance***)

These 3 aspects of bank-lending – profitability, liquidity and security – are evident in a commercial banks asset structure. They also hold property and equipment.

These 3 aspects have to be considered when taking deposits or making loans but they can work against each other.

The biggest returns are earned on long-term, illiquid assets (i.e. long-term and overdraft) and on risky loans

THE CENTRAL BANK

In modern economies central banks (indicated with a capital ‘B’) are invariably public sector institutions. The degree of autonomy enjoyed by the Bank may differ from country to country but ultimately they are all answerable in some measure to the government. Central Banks are primarily regulators rather than profit-maximising institutions.

Typically, the following functions are performed by a Central Bank:

- Sole issuer of legal tender;

- Banker to the clearing banks – the banks keep their operational deposits at the Bank. If one bank is writing a cheque payable to another, it will be drawn on these deposits;

- Banker to the government – the government keeps its accounts at the Bank;

- Supervision of financial system – maintain public confidence in the system by ensuring that banks behave prudently;

- Lender of last resort – if banks are incapable of meeting their liabilities due to a temporary shortage of liquidity, the Bank is usually willing to lend money to banks and, thereby, underwrite public confidence in the financial system. (Note, this function gives rise to a moral hazard dilemma. If the Bank is always prepared to bail out the banks, then they will have less incentive to behave prudently);

Ø Borrows money on behalf of government – issues short term and longer term

government securities. (This in turn gives rise to a need to manage the national debt.

The Bank may or may not be responsible for managing the national debt);

Ø Instrument of government monetary policy – controls the amount of money in the economy, the level of interest rates and the exchange rate of the currency.

. MONETARY POLICY

Too much money in the economy can lead to inflation which undermines the value of the currency. The Central Bank may have a statutory obligation to protect the value of the currency irrespective of government policies (the German Model).

Controlling the amount of legal tender in the economy seems a simple task for any Central Bank given that they are the sole issuer. In practice, the control of the money supply is concerned with the creation of bank deposits by commercial banks. We have seen (Section 12B) that there is a definite relationship between bank deposits, bank liquidity (reserve assets) and the RAR

in the form: ∆D = ∆RA 1 RAR

It is easy to see that, if the Bank wishes to control ∆D, then controlling the amount of reserve assets available to the banks and/or controlling the reserve asset ratio can be effective.

Controlling the Reserve Asset Ratio

The Bank has the power to insist that banks keep a given proportion of their liabilities in the form of liquid reserves. On the other hand, the Bank may leave it to banks to decide their own ‘prudential rate’. If the Bank wishes to restrict the capacity of the banks to create deposits, it could insist on a high minimum reserve asset ratio. The higher the RAR, the smaller is the credit multiplier. For example, an RAR of 10% gives a credit multiplier of 10 whereas an RAR of 20% gives a credit multiplier of 5. A high RAR will mean that, for any given level of reserve assets, there will be less bank deposits and therefore less money in the economy.

Open Market Operations (OMO)

OMO is the practice of buying or selling government securities by the Bank with a view to influencing commercial bank liquidity. For effectiveness, these sales or purchases must be carefully targeted. If the Bank sells government securities to the non-bank private sector, these securities will be paid for by the public by the writing of cheques payable to the Bank to be drawn on accounts in the banks. The banks when honouring these cheques will be required to transfer funds to the Bank resulting in a loss of commercial bank liquidity. For a given RAR, this will result over time in a multiple contraction of commercial bank deposits. An expansionary OMO would entail the Bank buying back securities from the non-bank private sector resulting in an increase in commercial bank liquidity.

An obvious problem with OMO is that it disregards the level of the national debt. If longterm securities are being sold by the Bank, then the national debt is rising and vice versa. In practice governments tend to be concerned to control the level of the national debt in which case the casual issuing of government securities to control the money supply would be inappropriate.

Interest Rates

The process of credit creation, banks lending money, presupposes the existence of willing borrowers. The willingness to borrow will in turn depend on the rate of interest charged. The Bank has the power to influence interest rates and thereby the desired level of borrowing in the economy.

In a modern economy, there is a structure of inter-related interest rates rather than a single rate. The rate charged to a borrower will depend on two factors:

- the duration of the loan and

- the degree of risk attached to the borrower.

The length of the loan and the risk will both have a positive effect on the rate of interest charged.

Short-term rates (up to one year loans) are determined in the money markets whereas longer term rates are determined in the capital markets. The money markets are dominated by financial institutions (including the Bank) borrowing/lending among themselves. The Bank has a determining influence on rates charges in the money markets. The rate at which the Bank is willing to lend money to the money markets determines short-term interest rates and ultimately the whole structure of interest rates in the economy. By raising this Bank rate, the Bank raised the cost of borrowing funds for the commercial banks. This in turn will mean higher rates for those wishing to borrow from commercial banks. The overall effect will be to reduce the amount of borrowing and therefore the expansion of the money supply.

Alternative Instruments of Control

The Bank may resort to alternative means of controlling credit creation. One way is by means of special deposits. This is where the Bank reduces the liquidity of the commercial banks by requiring them to deposit funds in special accounts at the Bank. These funds are not eligible to act as reserve assets. Another way is by means of moral persuasion. The Bank indicates to the banks that it wishes them to curtail lending. Whether or not the banks comply will depend on how the banks expect the Bank to respond to non-compliance.

THE DEMAND FOR MONEY

The demand for money is concerned with the willingness of people to hold non interestearning cash. Besides being a medium of exchange, money functions as a store of value – this is referred to as the asset function of money (Section 12A). However, money may be a relatively poor store of value. During periods of inflation money loses its value. Even without inflation if interest-earning assets exist as an alternative why hold non-interest earning cash. There is an opportunity cost involved in holding money measured in terms of the interest foregone if interest-earning assets were held instead of cash. Holding money is not costless and therefore needs to be justified.

To hold money is to express a preference for liquidity rather than less liquid interest-earning assets. The Keynesian approach to money demand is known as the theory of liquidity preference. The simplest approach is to assume a choice between holding non interestearning cash or interest-earning assets such as government bonds. However, the important point is the trade-off that exists between liquidity and the expected rate of return on less liquid interest-earning assets.

Keynes advanced three motives for holding cash:

- The transactions motive;

- The precautionary motive;

- The speculative motive.

The transactions motive stems from the fact that peoples’ income and expenditure are not perfectly synchronised. For many people income is received periodically in a lump sum whereas expenditure is a continuous flow. People will tend to hold cash to meet ongoing expenditures. As the level of expenditure of an individual will be positively linked to the level of income, it is reasonable to assume that the desired level of cash balances for transactions purposes will be positively linked to the level of income.

Other factors may also have an influence on the desired level of transactions balances. If interest rates are very high, then people may wish to economise on cash holdings. Also the pattern of payments will be a factor: a person paid weekly will hold less cash on average than the same person paid monthly. For example, a worker paid RWF100 per week will have average cash holdings of RWF50 whereas that worker paid RWF400 every four weeks will have average cash holdings of RWF200.

The precautionary motive for holding cash balances stems from the unpredictability of some transactions. People will hold cash balances just in case a need arises. As with transactions balances, the level of precautionary balances is likely to be primarily influenced by the level of income.

The speculative motive stems from the desire to avoid capital losses. Keynes suggested that there would be a tendency to switch out of interest-earning assets and into cash if there was a danger of incurring capital losses on these assets. The key to this analysis is the relationship between market rates of interest and the market value of fixed interest securities.

Governments borrow by issuing (‘gilt-edged’) securities. Assume a government bond with a ‘coupon rate’ of 10% and a nominal value of RWF1000. For simplicity, we will assume that the bond has no redemption date (non-redeemable fixed interest securities are known as perpetuities):

| Nominal value | : RWF1000 | ||

| Annual interest | : RWF 100 |

The government has borrowed RWF1000 at 10% annual interest. The bond is effectively an IOU and ownership of this bond entitles the holder to an annual income of RWF100 into an indefinite future. If market rates of interest fall to 5% then it would require RWF2000 to generate an annual income of RWF100. If market rates of interest were to rise to 20%, it would require only RWF500 to generate an annual income of RWF100. It can be seen, therefore, that the market value of fixed interest securities will move inversely with market rates of interest.

If an investor expects market rates of interest to rise (i.e. bond prices to fall), it would make sense to sell bonds for cash rather than incur the expected capital losses. One obvious problem with this analysis is that any buyer of the bond must have different expectations from the seller regarding future interest rates, i.e. they wouldn’t willingly buy the bond at a price that implied future losses. If everybody in the bond market has the same expectations, then this will be reflected in existing market prices for bonds. In this case there will be nothing to be gained from selling bonds (unless the market underestimates the future rise in interest rates).

If we assume that different investors in the bond market have different expectations regarding future interest rates then speculative buying and selling of bonds will occur. Note: if bonds are being sold, cash is being acquired because cash is regarded as less of a risk. These cash balances are the speculative balances. If we further assume that the higher interest rates are the more likely, investors are to expect a fall and the lower they are the greater the expectation of a rise. Then at high rates (fall anticipated) bond prices will be expected to rise so that holding bonds rather than cash makes sense. At low rates (rise anticipated) bond prices will be expected to fall so that holding cash rather than bonds makes sense.

The speculative demand for money developed by Keynes implies an inverse relationship between the rate of interest and the desired level of speculative money balances. It is likely that transactions and precautionary balances will also be reduced when interest rates are high. The overall result is a demand for money balances that is inversely related to the rate of interest but positively related to the level of income in the economy.

Figure 12.1: The demand for money

In Figure 12.1 each money demand curve is drawn for a different level of income. Both are downward sloping, reflecting the inverse relationship between the rate of interest and desired money balances. As income rises the demand for money rises, which is reflected in the outward shifting demand curve (M0 → M1).

DETERMINATION OF THE RATE OF INTEREST

It can be assumed that the money supply in the economy is determined by the Bank’s monetary policy. This can be illustrated by a vertical supply of money at whatever quantity the Bank decides. Figure 12.2. brings the supply of and demand for money together

Figure 12.2: The equilibrium rate of interest

The equilibrium rate of interest will be determined at the point of intersection of the money supply and money demand curves. If the bank decides on a money supply of M o and if the demand for money in the economy is as represented by MD, then the equilibrium rate of interest in the economy is ro (Figure 12.2).

If the Bank decides on expansionary or contractionary monetary policy then, by implication, it is choosing lower or higher interest rates.

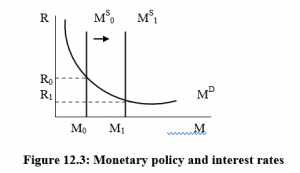

Figure 12.3: Monetary policy and interest rates

Figure 12.3 illustrates how an expansionary monetary policy (e.g. Bank buys government bonds) leads to a shift of the money supply from M o to M 1. As a result – interest rates fall from r o to r 1 and bond prices rise. A contractionary monetary policy (e.g. selling government bonds) would lead to a leftward-shifting money supply a rise in interest rates and therefore a fall in bond prices. A tight monetary policy implies high interest rates whereas a loose monetary policy implies low interest rates.

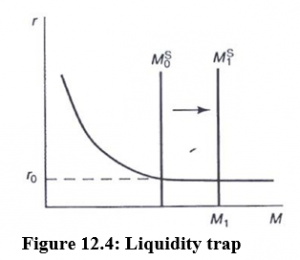

Keynes suggested the possibility of a liquidity trap. At very low rates of interest the opportunity cost (interest forgone) of holding cash will be insignificant. If at a very low rate a change is more likely to mean an upward change then holding speculative cash balances rather than bonds would appear to make sense. At very low rates of interest therefore there may be a potentially limitless level of desired cash holdings. This can be illustrated by a perfectly elastic (horizontal) segment of the money demand curve at very low rates of interest as in Figure 12.4.

Figure 12.4: Liquidity trap

At r0, there is a perfectly elastic demand for money. If the economy is in a liquidity trap, then expanding the money supply (M20 → Ms1) will have no effect on the equilibrium rate of interest which remains at r0. Governments might use an expansionary monetary policy to stimulate economic activity. An expansionary monetary policy means lower interest rates which should stimulate investment and consumption expenditure. However, if the economy is in a liquidity trap as in Figure 12.4, an expansionary monetary policy will not lead to low interest rates and therefore have no effect. Keynesians have traditionally recommended the use of fiscal policy rather than monetary policy as the appropriate method of influencing aggregate demand.

THE QUANTITY THEORY OF MONEY

The quantity theory of money (QTM) is a theory about how much money supply is needed to enable the economy to function. In particular, it is concerned with the impact of a changing money supply on prices. The money value of expenditure in an economy depends on the price of goods and services and the quantity of goods and services purchased. If we let Y stand for the annual quantity of final goods and services purchased and P for the average price of these goods and services then PY is the money value of expenditure on final output.

The money value of expenditure can also be thought of as the amount of money in circulation multiplied by the number of times this money is spent. Letting M stand for the quantity of money and V for the number of times this money is spent annually, then MV is also the money value of expenditure.

These four variables, M, V, P and Y can be defined in such a way as to give us the equation of exchange:

MV = PY [12.2]

The equation of exchange is in fact an identity as V is simply defined as PY/M. V is referred to as the income velocity of circulation of money. Velocity of circulation measures the number of times money changes hands

For example, if P = RWF2; Y = 10,000 units of output and M = RWF4000

RWF4000 (v) = RWF2 x 10,000 => V = 5

The Quantity Theory of money makes certain assumptions:

- The level of output Y clearly has an upper limit determined by available resources of land labour and capital. If we start with the simplifying assumption that the economy is fully employed, then Y can be treated as fixed at its upper limit, indicated by Y*.

- The velocity of circulation, V, depends on how effectively the existing stock of money is being used. This depends on the pattern of payments in the economy and to some extent on the level of interest rates. We saw (Section 12E) that a worker being paid weekly would have lower average cash balances than a worker being paid monthly and that at higher rates of interest there is an incentive to hold less cash. The lower cash holdings are for any given level of nominal GDP, the higher the velocity of circulation needs to be. For simplicity, we will assume that these factors are all constant so that velocity can be treated as a fixed value. Given these assumptions and denoting the constant V with V*, we have:

MV* = PY* [12.3]

Equation [12.3] gives us a simple quantity theory of money. As the Left Hand Side of the equation must equal the Right Hand Side, a rise in M must result in a proportional increase in P. The QTM predicts that an increase in the money supply will cause inflation. As the quantity of money increases, the value of money (its purchasing power) falls.

The simplicity of the Quantity Theory of Money is part of its appeal. However, in its simple form, it is open to a number of criticisms:

- The assumption that Y is fixed at the full employment level may be inappropriate. If there is unemployment in the economy, then an expansionary monetary policy may lead to an increase in real output.

- There is much evidence to suggest that V is subject to significant variability. That being so, the simple link between M and P may be more complex than the simple QTM suggests.

- Logically, it is possible to reverse causation. The QTM assumes that changes in M cause changes in P. What if changes in P cause changes in M? Cost-Push explanations of inflation would tend to argue that the money supply adapts to accommodate changes in prices.

- How is M to be measured? We saw (Section 12A) that there are different measures of money depending on how it is defined. Which measure of M is appropriate for the QTM? Central Banks are sometimes unsure which measure of money to target.

The link between M and P is not as the simple QTM would imply. However, few economists would deny that a rising money supply, particularly if it is rising faster than real output, must eventually cause inflation. The closer the economy is to full employment, the more prone to inflation it is likely to be.

The Four Functions of Money

- Means of exchange (facilitates trade).

- Unit of account (standard measure of value).

- Standard of deferred payment (helps establish a value for “future” payments)

To provide an acceptable standard of deferred payment, money must maintain its value over time. Inflation erodes the value of money. With inflation: –

- Creditors gain at the expense of debtors (bad for long-term contracts)

- Those on fixed incomes lose out.

- Store of value.

Money is a liquid store of value, i.e. a liquid asset.

It is liquid because it can be converted into cash or used to buy goods.

- Without delay

- Without significant penalty or loss of face value (i.e. without loss of capital value of interest)

Commodity Money: Money made from a valuable commodity (gold etc.)

Non-commodity Money: Money whose value is greater than inherent value (token money), e.g. banknotes and coins, bank accounts and cheques).

Non-commodity money is:

More divisible,

More portable

Easier to transfer

Narrow Money: very liquid money balances

Broad Money: Less liquid financial assets but still relatively liquid.

. TAXATION

Functions of Taxation

- To raise revenue – to pay for goods and services and for the upkeep for government administration

- To discourage bad habits – e.g. tax on cigarettes, alcohol.

- To make private firms/people pay for externalities – e.g. pollution.

- To redistribute wealth – tax the better off and pay for social welfare and old age pensions.

- To protect domestic industries from foreign competition – import taxes and export subsidies (reverse taxes).

- To stabilise National income – taxation reduces the effect of the multiplier so it dampens swings in the trade cycle.

- To target particular sections of the economy – e.g. taxes on wealth, capital, income, goods can be used with relative precision to affect specific sectors.

Qualities of a Good Tax System

- Based on the system ability to pay.

- The tax should be certain and understood by all.

- Payment should be related to how and when people receive and spend their income (e.g. PAYE deducted when wages are paid, VAT is charged when goods are bought).

- Cost of collection should be small relative to its yield.

- Should be easily adjustable. E.g. the rates

- Should not harm initiative 7. Evasion should be difficult.

- It should be fair.

Three ways of Levying Taxation.

- Regressive Tax – Takes a higher proportion from the poorer person’s salary than the rich person e.g. VAT TV Licence and road tax.

- Proportional Tax – Takes the same proportion of income in tax from all levels of income earners.

- Progressive Tax – Takes a higher proportion of income in tax as income rises, e.g. the entire system of income tax, those on higher income pay a higher marginal rate of tax. Progressive Tax

Advantages

- They are levied according to ability to pay.

- They help the government redistribute wealth from rich to poor.

- Progressive income and wealth taxes (i.e. direct taxes) help to counteract regressive indirect taxes (VAT etc).

- The progressivity of direct taxes can be adjusted so that its not penalty high on the rich.

Disadvantages

- If progressive taxes are too harsh they can be a disincentive to initiative and effort, e.g. deter working harder, but the evidence on this argument is unclear, sometimes taxes force people to work harder to maintain their incomes despite the tax.

- Higher corporate (company) taxes may reduce investment, research and development, expansion.

- High direct taxes may cause a loss (i.e. emigration) of more skilled workforce abroad.

- High taxes may encourage:

- Tax avoidance (legal) e.g. non-taxable perks.

- Tax evasion (illegal)

- Transfer of wealth abroad to tax havens, etc.

Proportional Taxation Advantage

- It is seen to be fair

Disadvantages

- It’s expensive, needs a large administration to calculate proportional tax liabilities.

- The necessary tax rules are complex.

- It does not help with wealth redistribution. Regressive Tax

Advantage

- Relatively easy to administer and collect usually. Disadvantages

- It is not equitable, the less well off pay a higher percentage of their income.

Types of Tax

Direct Tax paid direct by a person or firm to the revenue authority, e.g. income tax, corporation tax, capital gains tax.

They tend to be progressive or proportional.

Advantages

- Fair and equitable, levied by ability to pay.

- They tend to be stabilisers, take more money out of the system at boom times when incomes and wealth are higher.

- They are hard to pass on and so are less inflationary than indirect taxes.

- Such taxes are clear to the people who have to pay.

Disadvantages

- Direct taxes can cause distortions, especially to incentives to work.

- When levied at a high rate it can affect occupational and geographic mobility.

- High taxes in areas of good employment or in good/well paid industries may deter people moving into these areas.

- High marginal rates, by narrowing differentials in the after tax pay of skilled and unskilled labour, may reduce the incentive to train and cause a shortage of skilled labour.

- High marginal rates may encourage tax avoidance, i.e. finding legal loop holes.

- A direct tax on profits is likely to be disincentive to risk-taking and enterprise and will reduce the ability to invest, by reducing after-tax profits and therefore retained earnings.

Indirect Tax collected from an intermediary who passes the tax onto consumers in the price of goods, e.g. VAT and custom duties on imports.

Indirect taxes tend to be regressive and avoidable, can stop buying the good. Advantages

- Harder to evade than indirect taxes.

- Can be used to encourage or discourage the production or consumption of particular goods.

- It is a flexible instrument of economic policy – the rates can be changed quickly and easily and can take effect immediately.

Disadvantages

- These taxes are “hidden” from the tax payer.

- They can be inflationary, increase the selling price.

- They tend to be regressive.

- They are not impartial, distortions in consumption patterns, e.g. they tend to penalise smokers, drinkers and car drivers most.