Introduction

This Co-op Accounting and Audit Toolkit provides a simple method for identifying, collecting, recording, analysing and reporting on performance for small scale co-operatives.

Co-operatives are owned and controlled by their members and members are individuals, families and other co-operatives who trade with the co-operative. Members receive dividends from the net profit and have a vote in general meetings about any issues that are raised.

The impact co-operatives have on their local communities and local economy is far greater than that of private business. Because the members receive the bulk of net profits it is much more widely distributed than the profits from a private business that are just distributed to a few people and often not spent locally. The multiplier effect of profits being distributed by co-operatives to local

members/residents means that the impact a co-operative has is felt more acutely than a private business that is why co-operatives should measure and account for their impact more rigorously.

The Co-op Accounting and Audit has been designed as a ‘light touch’ approach to what can sometimes be a complex and complicated process for members of small scale co-operatives and provides a way of engaging members more fully in the affairs of the co-operative.

All co-operatives should have a Co-operative Business Plan describing what the co-operative does, how it is managed and what the plans are for the future. Co-op Accounting and Audit will measure against this plan. For further information on how to develop your business plan please see our Co- operative Management and Planning Toolkit or see your local National Registrar of Co-operatives in the country for advice they should also be able to assist you with developing the plan.

The Co-op Accounting and Audit method uses a poster on which all the information is displayed and where progress is written up as it happens. This enables members to write in their thoughts, comments and ideas about the co-operative and how it might be improved. The Co-op Accounting and Audit poster is a tool to use in creating good governance – openness is a key operational principle for good governance.

The poster is a way of starting to gather data on a regular and systematic basis, which can be extended over time. Most of the data is already known and most is already collected, however it is often recorded in different forms and can be difficult to bring it all together. The poster is designed to be a single record of the relevant information to help the management and members of co-

operatives understand what the plans are for the year and how the co-operative is performing in relation to the plans.

Triple Bottom Line

The triple bottom line is described using different terminology by different business sectors and agencies; however there are three core elements in common. Social Audit uses the heading commercial, social, and environmental; the UN uses profit, people, and planet; and in this Toolkit the headings of Strong Co-operatives, Strong People, and Strong Communities are used. These headings

fundamentally underpin the same inclusive approach, where the interdependence of the parts combine in creating a more responsible and sustainable system of organisational performance and measurement.

Co-operatives need to be able to plan and manage these three key parts of a good organisation. Commercial functions need to be profitable but also of good and honest quality; social wealth needs to be developed through common ownership and the members and employees participating in the co-operative, and the opportunities the co-operative provides; and, community and environmental

responsibility should be a result of the way the co-operative looks to mitigate their environmental cost to society in the way they operate their processes, package and transport goods, and produce and use energy, and in the effects on the community as a result of the co-operatives’ actions.

Co-operative Accounting and Audit is designed to bring together the three dimensions of performance, the triple bottom line, that combine to form best operational practice and good governance: financial, social and environmental, and which provide the foundation for self- assessment. For a fuller description of the triple bottom line please go to Annex 1.

Finance

Private sector businesses report to their shareholders on their financial performance. Co-operatives report to their members on their financial performance but also need to report on the achievement of social and environmental plans.

Shareholders are often removed from the businesses and are unaffected by operational performance, while members of co-operatives are intimately associated with the operations of their co-operatives and as local residents are affected by their impact.

It is suggested that the Co-op Accounting and Audit is used at the same time as the financial audit; providing a full picture of performance. The financial audit provides information relevant for shareholders, while social accounting and audit provides information relevant for society.

1.2 The way Co-operatives are structured

Co-operatives are legally registered bodies, in many countries there is a Co-operative Act governed by the National Registrar of Co-operatives, or similar, or they are under the guidance of the government’s business registration body.

Co-operatives are commercial trading organisations; they have limited liability which means that the co-operative, and not the individual members, is liable for any debt.

- Co-operatives differ from private business in who the shareholder is, the amount of votes each shareholder has and how profits are distributed.

- Shareholders in co-operatives are individuals or other registered co-operatives; they are trading partners, either as an individual or as another registered co-operative. They are called members, who own and control the co-operative.

- Each member has one share that carries one vote in any decision making.

- Voting is based on one member one vote – regardless of the amount of share value held.

- Members invest in the co-operative by purchasing a share, the amount invested and the interest paid will be decided by each co-operative.

- Net profits are distributed according to the rules, most co-operatives retain about 25% to 35% that is paid into a reserve fund and the remainder is distributed as dividends to members in proportion to the amount of trade each member has transacted with the co-operative in the year the profit was made and for social and environmental purposes.

- There is a definition of a primary co-operative and a secondary co-operative:

- The members of a primary co-operative are individual traders and customers

- The members of a secondary co-operative are primary co-operatives

- One sort of co-operative is the Savings and Loans Co-operative. This co-operative trades in money; it receives savings from members and lends funds to members against the amount saved. Eligibility for membership is based on living or working in a defined geographical area – individuals and other co-operatives can be members of a Savings and Loans Co-operative Society.

- When a Co-operative registers itself it does so using a model set of Rules (By-Laws) to which it adds the details of who can be members; the main social and commercial objectives; and the commercial activities it will undertake.

How Co-operatives are managed

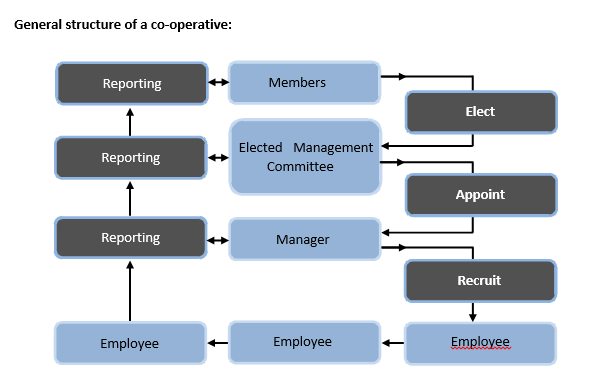

Management structures vary depending on the size of the co-operative: below is a generic diagram for a small to medium sized co-operative using an organisational structure that can be found across Europe, Africa, Asia, the South Pacific and the Caribbean; and to a lesser extent the Americas. In many countries enterprise size is defined as:

Micro: 0 to 5 employees

Small: 6 to 10 employees

Medium: 11 to 50 employees

Large: 51+ employees

Members

- Members are defined in the Co-operative Rules: they are usually traders and customers who they sell goods to, and buy from, the co-operative.

- Sometime members are defined as community citizens, employees and anyone else the co- operative wishes to be members.

- Membership is voluntary: no one has to be a member.

- Members elect, from the membership, individuals who wish to be Management Committee members.

The Management Committee

- Any member can be elected onto the Management Committee.

- Election is for a two year period after which they have to stand down; but they can stand for re-election for the next period.

- It is suggested that the Management Committee should meet, at least, every two months and is responsible for the overall management of the co-operative, strategic planning, investment decisions, governance and managing the manager.

The Manager

- The manager is recruited and supervised by the Management Committee and reports to body for his/her actions.

- The manager manages the day to day operations of the co-operative and is responsible for financial accounting and all work carried out by the employees.

- The manager can be a member of the co-operative. The Employees

- Employees are recruited by the manager and are supervised by him/her in their work.

- Employees can be members of the co-operative.

- What is Co-operative Accounting and Audit

Co-op Accounting and Audit is a tool for tracking and improving performance; for reporting to members and for justifying the use of investment. The driving principle is one of openness and good governance.

Undertaking a Co-op Accounting and Audit should be a learning experience. Measuring the performance of a co-operative enables those involved to learn from the relationship between the plan and the actual: what was the intention and what actually happened? Comparing the actuals with the plans enables management to understand what has happened and how it can be improved.

Therefore it is essential that the process of measuring performance starts with plans against which the co-operative can compare, understand, and learn from, results. Measuring performance without plans means that you are unable to compare: you will know the figure, but you don’t know if it’s a good or bad figure.2

The process of planning, accounting and auditing should be an on-going cycle of learning from experience and using that learning as the starting point for the next planning stage.

The operational principles for Co-op Accounting and Audit are:

Independence: the Co-op Accounting and Audit should be objective and have an external person involved in the final annual evaluation

Credibility: the results should be trusted and believed

Usefulness: the process and results should be of benefit to management and members, and provide evidence for decision making

When the three quality elements are evident then co-operatives can use the findings to improve performance, members can see what has happened with their assets and all those involved can learn from the experience and take the learning forward to new initiatives.

2.1 Plan for the Results you want to achieve

Results are the changes which occur as an effect of an action. We use the word ‘results’ to distinguish between what a co-operative plans and delivers, and what happens as a result of that delivery.

The benefit of using the ‘planned and actual’ method is that co-operatives are able to link final results with the initial investment and planned actions. Analysis of this results chain will show what worked well and what needs improving and provide valuable lessons learned for future planning and implementation. The planned and actual approach will also enable the manager to identify where and when a problem arose and help them find solutions. For example; a co-operative has a plan to diversify its product range and it puts the necessary expenditure and actions to implement the plan in place. The product range is successfully diversified; however, what it really wants to measure is if their expenditure and actions have achieved the required result. The result, in this example, would be to increase sales, increase turnover and finally to increase profits. Therefore the result it is planning for is ‘increased profits’ and that is what should be measured.

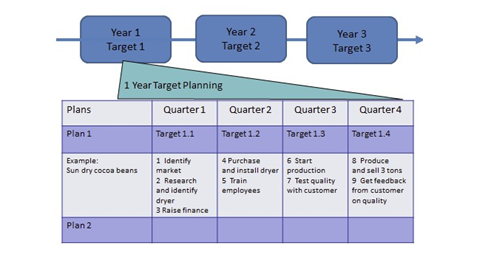

It is best to plan over a number of years in a strategic way. It usually takes more than one year to make investments work so plan for as long as it will take to achieve a result. Have a clear end statement of what will be achieved and then for each of the years put in the key targets that are expected to be reached. Then, for the first year put in a more detailed plan with quarterly targets. The example below shows how you set out a three year plan with one year quarter targets which can be used to measure performance during that period.

It is good practice to plan for the end result and then work backwards to lay out the necessary actions, these should include indicators, at certain times, to provide the targets against which actual progress and performance can be measured.

Some plans and actions will be to deliver or do something; but some plans will be to achieve benefit for a target group of people.

For example, if co-operative members think that some children in their community are not doing enough sport they may decide to provide some sports equipment. These are the delivery actions, but the result is achieved when the children are spending more time playing sport. When planning it is important to be clear about what the result should be. Is it a set of delivery actions with targets,

or is it result of the set of delivery actions when a benefit is expected to have been achieved?

2.2 The Key Concepts of Co-operative Accounting and Audit

The terms ‘Accounting and Audit’ are used in a business context in the way that the terms ‘Monitoring and Evaluation’ are used in a project and programme context.

Co-operative Accounting is to Monitor and Manage Performance

Co-operatives are managed and kept on track by accounting for the results achieved against the plans: accounting is an internal management responsibility and should be undertaken by the manager and members of the Management Committee.

- Accounting is not a check to keep external bodies happy but a mechanism to help manager achieve plans on schedule or change them to match changing realities.

- Accounting enables progress in relation to the plans to be measured.

- Accounting involves the collection, recording, analysis, communication and use of information about the co-operative’s on-going progress.

- The results of accounting are used to report progress to members and are a key source of data for audits; for the purpose of management decision making.

Co-operative Audit is to Understand Actual Results

The Audit is when the assessment of the co-operative’s results is undertaken and any lessons learnt are identified and disseminated widely. An Audit may be undertaken by a sub-committee of the Co- operative’s Management Committee including an ordinary member, and include the person undertaking the financial audit.

- The Co-operative Audit should be undertaken at the end of the financial year; at the same time as the audit of the financial records.

- The Audit should be clearly focused on trying to understand how the co-operative operated and how successful it was in achieving its stated plans.

- The Audit will help the co-operative learn lessons, both positive (what worked well and why) and negative (what went wrong and why).

- The conclusions, recommendations and lessons learnt should be presented to members.

- The information from one year’s Audit of progress will form the beginning of the next year‘s plans.