MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2018/2019 ACADEMIC YEAR

FIRST YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

MASTERS IN BUSINESS ADMINISTRATION

COURSE CODE: MBA 8101

COURSE TITLE: FINANCI AL MANAGEMENT

DATE: 7TH MAY, 2019 TIME: 1430 – 1730 HRS

INSTRUCTIONS TO CANDIDATES

Question ONE is compulsory

Answer any other THREE Questions

MBA 8101: Financial Management Page 2

QUESTION ONE

(a) Define agency relationship from the context of a public limited company and

briefly explain how this arises. (5 marks)

(b) Highlight the various measures that would minimize agency problems between

the owners and the management. (10 marks)

(c) In a company, an agency problem may exist between management and

shareholders on one hand and the debt holders (creditors and lenders) on the

other because management and shareholders, who own and control the

company, have the incentive to enter into transactions that may transfer wealth

from debt holders to shareholders. Hence the need for agreements by debt

holders in lending contracts. State and explain any four actions or transactions by

management and shareholders that could be harmful to the interests of debt

holders (sources of conflict). (10 marks)

QUESTION TWO

Although profit maximization has long been considered as the main goal of a firm,

shareholder wealth maximization is gaining acceptance amongst most companies as

the key goal of a firm.

Required:

(i) Distinguish between the goals of profit maximization and shareholder wealth

maximization. (4 marks)

(ii) Explain three limitations of the goal of profit maximization. (6 marks)

(iii) Describe four non-financial objectives that a company might pursue that have

the effect of limiting the achievement of the financial objectives. (5 marks)

MBA 8101: Financial Management Page 3

QUESTION THREE

(a) Briefly explain the importance of capital budgeting in a business organization.

(4 marks)

(c) Several methods exist for evaluating investment projects under capital budgeting.

Identify and explain three features of an ideal investment appraisal method.

(6 marks)

(d) In evaluating investment decisions, cash flows are considered to be more

relevant than profitability associated with the project. Explain why this is the case.

(5 marks)

QUESTION FOUR

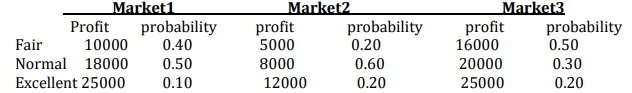

Pwani ltd is planning advertising campaigns in three different markets. The

estimates of probability associated profits in each of the three markets are

provided bellow;

Required;

(i)Compute the expected value and standard deviation of profits resulting

from advertising campaigns in each of the market areas. (10 marks)

(ii)Rank the three markets according to riskiness using the coefficient of

variations. (5 marks)

QUESTION FIVE

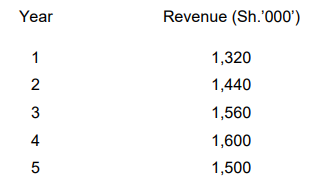

A proposal to purchase a new lathe machine is to be subjected to these initial screening

processes. The machine will cost Sh.2,200,000 and has an estimated useful life of five

years at the end of which the disposal value will be zero. Sales revenue to be

generated by the new machine is estimated as follows:

Additional operating costs are estimated to be Sh.700,000 per annum. Tax rates may

be assumed to be 35% payable in the year in which revenue is received. For taxation

purpose the machine is to be written off as a fixed annual rate of 20% on cost.

The financial accounting statements issued by the company in recent years shows that

profits after tax have averaged 18% on total assets.

Required:

Present a report which will indicate to management whether or not the proposal to

purchase the lathe machine meets each of the selection criteria. (15 marks)