Financial institutions are needed to resolve the problems of imperfect markets. They receive requests from surplus and deficit units on what securities are to be sold. They use this requests to match up buyers and sellers of securities in this markets. However financial institutions in order to provide for divisibility, they may at times un-bundle the securities by spreading them across several investors until the entire amount is sold.

Without financial institutions, transaction costs and information cost would be expensive and prohibitive.

ROLE OF DIPOSITORY INSTITUTIONS

Depository institutions accept deposits from surplus units or savers and provide credit to deficit units or borrowers through loans and purchase of securities.

The importance of depository institutions in the financial market includes the following;

- They offer deposit accounts that can accommodate the amounts and liquidity characteristics desired by most savers.

- They package funds received from deposits to provide loans of the sizes and maturity desired by

- They accept the risks on loans provided

- They have more expertise than most individual surplus units in assessing the credit worthiness of deficit units

- They diversify their loans among numerous deficit units and therefore they can absorb defaulted loans better than individual surplus units

The importance of depository institutions can be appreciated if we consider what would happen if the institutions were not there.

Role of commercial banks as depository Institutions.

Commercial banks are the most dominant depository institutions. They offer a wide range of deposit accounts. They transfer the deposits to deficit units through loans, advances, overdrafts, letters of credit, letters of guarantee and they can also buy debt securities. Commercial banks serve both private and public. Their services are utilized by households, businesses and government.

Savings institutions

These institutions are also called thrift institutions. They include; savings and loans (S&L) and savings banks. Like commercial banks, S&L offer depository facilities to

surplus units they then channel these surplus to deficit units. S&L concentrates on residential mortgage loans unlike commercial banks who concentrate on commercial loans

Credit unions

These institutions differ from commercial banks and savings institutions in that they are

- Nonprofit making organizations,

- Restrict their credit to the credit union members who share a common bond g. common employer, common business, common geographical location etc. they use most of their funds to advance loans to their members (these are normally referred to as savings and credit organizations. Examples include Mwalimu Saco Nakuru

Role of non-depository financial institutions

None depository financial institutions generate funds from other sources other than deposits. But also play a major role in financial intermediation. These institutions include:

· Finance companies

Most finance companies obtain funds from issuing securities then lend the money to individuals and small businesses. Although the functioning of finance companies overlap those of depository institutions, each type of institution concentrates on a particular segment of the financial market. Many large finance companies are owned by multinational corporations

· Mutual funds

These types of companies sell shares to surplus units and use these funds to buy a portfolio of securities. The Kenyan capital market is still in its infancy and such companies are not very common. Some mutual funds concentrate their investment in capital market securities, such as stocks or bonds. Others Known as money market mutual funds concentrate in the money market securities.

· Security firms

Securities firms use their information sources to act as brokers, executing securities transactions between two parties. In order to ease the securities trading process the transactions are normally in multiples of 100 shares and the delivery procedure is somewhat standard. Brokers earn their profits by charging a brokerage fee by differentiating between bid and asking prices. Small or unique transactions are likely to have a higher commission due to time taken to complete the transactions. Securities firms also provide investment banking services. Securities firms also underwrite new issues for government and private companies. Securities firms also act as dealers in which case they i.e. they can make a market for a specific security by adjusting their portfolio inventory.

Securities firms also provide investment banking services which include advisory services on mergers and other forms of corporate restructuring. And also execute the change in the firm’s capital structure by placing the securities issued by the firm.

Insurance companies

They provide insurance services to individuals and other firms that reduce the financial burdens associated with death illness and damage to properties including theft.

Insurance companies charge premiums in exchange of the insurance that they provide. The funds collected in form of premiums, is invested (mainly in stocks or bonds issued by companies or bonds issued by the government) by the insurance companies until the funds are required to pay for the risks insured when it happens.

Pension funds

The working population, know very well that their energy to work is limited. To guard themselves against the eventuality, employers and employees save for old age where they contribute periodically. Such funds are available for a long time i.e. until retirement. The pension funds manage the funds until they are required when the employee retires. The money saved is normally invested in securities and bonds issued by corporations and governments. This way they pension savings are used to finance the deficit units thus acting as intermediaries.

The Features of Central Bank:

The features or natures of central bank are as follows –

1. Single Organization:

In a country there has only one central bank exist. In the world, there has been no existence of two or more central bank in any country. So central bank can be called as single organization. For this reason, it does not require to compete with other banks.

2. Legal entity:

Central bank is established by the special act of Government. As a result, legal entity of central bank is much more strong than other banks. This strong legal entity gives special privilege to other banks.

3. Nature ownership:

The ownership of central bank can be fully government or joint venture of government and private ownership. But the reality said that government owned central bank is maximum in the world.

4. Difference in objective:

Because the operations of the central bank are such as profoundly to affect the monetary and credit situation, they cannot be undertaken solely for the purpose of making profit. The profit motive should only be a secondary consideration, and not the primary motive for central banking operations.

5. Note issue:

The issue of note is the most important function of a central bank. In fact, the practical experience shown that the central bank is the most suitable and appropriate medium for the issue of note.

6. Control:

In the present century, central bank has become as part of the economic set up in a country. All over the world, Central bank is under the control of government particularly it has been work under the direction of department of finance or treasury.

7. Relation with Govt.:

The central bank is closely related to the government as its banker and the financial adviser. It is generally an organ of the government and performing the banking operations of government. Central bank represents the government not only in country but also the outside of the country as well.

8. Guardian of the money market:

An effective monetary management requires a centralized country over both currency and credit. Being in close and intimate contact with the money market a central bank is in a position to know best when and to what extent to expand or to contract currency and credit to meet the changing requirements of the money market.

9. Banker and controller of other banks:

The central bank functions as a banker’s bank. It also controls and regulates the cameral bank and other financial institutions. For effective control central bank prescribes different rules and regulations and it is mandatory to maintain these rules by other banks.

10. Lender of the last Resort:

As a lender or the resort central bank provides rediscounts and advances to the commercial banks in times of credit stringency. It also gives loan to the govt. when requires.

11. Controller of Foreign Exchange:

The central bank maintains the foreign exchange reserves of the country and attempts to stability in the exchange rates.

Functions of Central Bank

- Bank of Issue:

Central bank now-a-days has the monopoly of note-issue in every country. The currency notes printed and issued by the central bank are declared unlimited legal tender throughout the country.

Central bank has been given exclusive monopoly of note-issue in the interest of uniformity, better control, elasticity, supervision, and simplicity. It will also avoid the possibility of over-issue by individual banks.

The central banks, thus, regulate the currency of country and the total money-supply in the economy. The central bank has to keep gold, silver or other securities against the notes issued. The system of note-issue differs from country to country.

The main objects of the system of currency regulation in general are to see that:

- People’s confidence in the currency is maintained,

- Its supply is adjusted to demand in the

Thus, keeping in view the aims of uniformity, elasticity, safety and security, the system of note-issue has been varying from time to time.

Banker, Agent and Adviser to the Government:

Central bank, everywhere, performs the functions of banker, agent and adviser to the government.

“The central bank operates as the government’s banker, not only because it is more convenient and economical to the government, but also because of the intimate connection between public finance monetary affairs.”

As banker to the government, it makes and receives payments on behalf of the government. It advances short-term loans to the government to tide over difficulties.

It floats public loans and manages the public debts on behalf of the government. It keeps the banking accounts and balances of the government after making disbursements and remittances. As an adviser to the government it advises the government on all monetary and economic matters. The central bank also acts as an agent to the government where general exchange control is in force.

2. Custodian of Cash Reserves:

All commercial banks in a country keep a part of their cash balances as deposits with the central bank, may be on account of convention or legal compulsion. They draw during busy seasons and pay back during slack seasons. Part of these balances is used for clearing purposes. Other member banks look to it for guidance, help and direction in time of need.

It affects centralization of cash reserves of the member banks. “The centralization of cash reserves in the central bank is a source of great strength to the banking system of any country. Centralized cash reserves can at least serve as the basis of a large and more elastic credit structure than if the same amount were scattered amongst the individual banks.

It is obvious, when bank reserves are pooled in one institution which is, moreover, charged with the responsibility of safeguarding the national economic interest, such reserves can be employed to the fullest extent possible and in the most effective manner during periods of seasonal strain and in financial crises or general emergencies…the centralization of cash reserves is conducive to economy in their use and to increased elasticity and liquidity of the banking system and of the credit structure as a whole.”

3. Custodian of Foreign Balances:

Under the gold standard or when the country is on the gold standard, the management of that standard, with a view to securing stability of exchange rate, is left to the central bank.

After World War I, central banks have been keeping gold and foreign currencies as reserve note-issue and also to meet adverse balance of payment, if any, with other countries. It is the function of the central bank to maintain the exchange rate fixed by the government and manage exchange control and other restrictions imposed by the state. Thus, it becomes a custodian of nation’s reserves of international currency or foreign balances.

4. Lender of Last Resort:

Central bank is the lender of last resort, for it can give cash to the member banks to strengthen their cash reserves position by rediscounting first class bills in case there is a crisis or panic which develops into ‘run’ on banks or when there is a seasonal strain. Member banks can also take advances on approved short-term securities from the central bank to add to their cash resources at the shortest time.

This facility of turning their assets into cash at short notice is of great use to them and promotes in the banking and credit system economy, elasticity and liquidity.

Thus, the central bank by acting as the lender of the last resort assumes the responsibility of meeting all reasonable demands for accommodation by commercial banks in times of difficulties and strains.

De Kock expresses the opinion that the lending of last resort function of the central bank imparts greater liquidity and elasticity to the entire credit structure of the country. According to Hawtrey, the essential duty of the central bank as the lender of last resort is to make good a shortage of cash among the competitive banks.

5. Clearing House:

Central bank also acts as a clearing house for the settlement of accounts of commercial banks. A clearing house is an organization where mutual claims of banks on one another are offset, and a settlement is made by the payment of the difference. Central bank being a bankers’ bank keeps the cash balances of commercial banks and as such it becomes easier for the member banks to adjust or settle their claims against one another through the central bank.

Suppose there are two banks, they draw cheques on each other. Suppose bank A has due to it Rs. 3,000 from bank B and has to pay Rs. 4,000 to B. At the clearing house, mutual claims are offset and bank A pays the balance of Rs. 1,000 to B and the account is settled. Clearing house function of the central bank leads to a good deal of economy in the use of cash and much of labour and inconvenience are avoided.

6. Controller of Credit:

The control or adjustment of credit of commercial banks by the central bank is accepted as its most important function. Commercial banks create lot of credit which sometimes results in inflation.

The expansion or contraction of currency and credit may be said to be the most important causes of business fluctuations. The need for credit control is obvious. It mainly arises from the fact that money and credit play an important role in determining the level of incomes, output and employment.

According to Dr. De Kock, “the control and adjustment of credit is accepted by most economists and bankers as the main function of a central bank. It is the function which embraces the most important questions of central banking policy and the one through which practically all other functions are united and made to serve a common purpose.”

Thus, the control which the central bank exercises over commercial banks as regards their deposits, is called controller of credit.

7. Protection of Depositors Interests:

The central bank has to supervise the functioning of commercial banks so as to protect the interest of the depositors and ensure development of banking on sound lines.

The business of banking has, therefore, been recognized as a public service necessitating legislative safeguards to prevent bank failures.

Legislation is enacted to enable the central bank to inspect commercial banks in order to maintain a sound banking system, comprising strong individual units with adequate financial resources operating under proper management in conformity with the banking laws and regulations and public and national interests.

Features of commercial banks

- ownership

Commercial banks can be formed on the basis of any ownership, such as a proprietorship, partnership or company. If it is formed on a partnership basis, its membership will be up to 10 people. If formed as a company, then it has to be formed according to the law of 1994. Ownership is the best characteristic of the commercial bank. It’s a first and the best feature of the bank. It works look like the Bank of America Hialeah.

2. Taking Deposit

One of the main features of the commercial bank is to take the savings of people’s money through different types of accounts. People can open their accounts according to their convenience and submit their accumulated money to the bank. These accounts are the current accounts, savings accounts, and permanent accounts.

3. Encourage to Savings

A prominent feature of the commercial bank is that people are more interested in saving through extensive publicity. This ensures that more saving storage is collected. It is possible to form capital in the country. Encourage saving is the most effective characteristics of a commercial bank. Increasing the attractiveness of the customer’s mind has resulted in an increase in the amount of storage.

4. Creation of Medium of Exchange

Although the commercial bank does not introduce money or currency, it is one of the characteristics of creating a medium of exchange through Checks, Hundi, Pay Orders, Traveler Checks, and Certificates etc. As a result, the customers of the bank do not have the risk of carrying cash. This is the biggest opportunity for the customers of the commercial bank. So the creation of the medium of exchange characteristic is more popular.

5. Collection of saving and formation of Capital

The bank helps in building the necessary capital for the country by collecting human money and scattered savings from different areas of the country and which was later invested in profitable and developing sectors. So the collection of saving and formation of capital is another best characteristic of the commercial bank.

6. Maintain Liquidity

It is a special feature of commercial banks. The depositor may seek the refund of his deposit at any time. With the request of the bank, the bank will always keep the liquidity necessary for the bank to meet the depositor’s demand. They keep a part of the deposit money from depositor as liquidity, and the rest is invested in different sectors. All these activities are called maintain liquidity characteristic the of commercial bank.

7. Management & Operation

Did you know before about the management & operation characteristics the of commercial bank? If yes, then well. On the other hand, follow mindfully. Commercial banks are operated according to the prevailing banking laws and organizational regulations in every country. If the branch is a bank then it is managed according to the direction of a central office. So it is a management and operation characteristics the of commercial bank.

8. Investment and Sanction of Loan

Invest is the king of making money more. Commercial banks save apart from savings collected as liquidity and the remaining money is invested in a lucrative sector and short -term lending. From the reserved liquidity, the bank fulfills the daily claims of the depositors. Thus, the commercial banks are benefited through investment and lending. And according to the management for investment and sanction of loan, the commercial bank has been benefited.

9. Creation of Loan Deposits

Without a bank loan services, the bank cannot maintains money heavily. So the creation of loan deposits is another best characteristic of a commercial bank. Commercial banks do not only provide short-term loans. One of the key features of the commercial bank is to ensure the use of indigenous currency, mobilization of currency, and investment through the creation of credit money by creating innovative ways.

Functions of commercial banks

- Accepting Deposits:

Banks attract the idle savings of people in the form of deposits. These deposits may be of any of the following types:

2. Demand deposits, also known as current accounts:

These are repayable on demand without any notice. Usually no interest is paid on them, because the bank cannot utilize short-term deposits, and must, therefore, keep almost cent per cent reserve against them. On the other hand, a little commission is charged for the services rendered. Occasionally, however, a small interest is paid to people who keep large balances.

3. Fixed Deposits or Time Deposits:

These deposits can be withdrawn only after the expiry of the period for which these deposits have been made. Higher interest is paid on them—the rate rising with the length of the period and the amount of deposit. The usual rate in India today varies between 6 per cent and 110 per cent, depending upon the time-period for which deposits are made.

4. Savings Bank Deposits:

These deposits stand midway between current and fixed accounts. These deposits are not as freely withdraw-able as current accounts. One or two withdrawals up to a limit of one-fourth of the deposit but not more than Rs. 1,000 are generally allowed in a week. The rate of interest is less than that on the Fixed Deposits.

5. Giving Loans:

But receiving of deposits is not the whole story about a bank’s functions. If that were so, how could a bank pay interest? Hence, after collecting money by way of deposits, a bank invests it or lends it out. Money is lent to businessmen and traders usually for short periods only. This is so because the bank must keep itself ready to meet the demands of the depositors, who have deposited money for short periods.

6. By allowing an Overdraft:

Customers of standing are given the right to overdraw their accounts. In other words, they can get more than they have deposited, but they have to pay interest on the extra amount which has to repaid within a short period. The amount of permissible over-draft varies with the financial position of the borrower.

7. By Creating a Deposit:

Cash credit is another way of lending by the banks. When a person wants a loan from a bank, he has to satisfy the. manager about his ability to repay, the soundness of the venture and his honesty of purpose. In addition, the bank may require a tangible security, or it may be satisfied with the borrower’s personal security.

Usually such security is accepted as can be easily disposed of in the market, e.g., government securities or shares of approved concerns. Then details about time and rate of interest are settled and the loan is advanced. A borrower rarely wants to draw the whole amount of his loan in cash. Usually he opens a current account with that amount the bank, if he already has not got an account with this bank.

Now it is exactly as if that sum had been deposited by him. This is how a deposit is ‘created’ by a bank. That is why it is said “every loans creates a deposit.” A cheque book is given to the borrower with the right to draw cheques up to the full amount of the loan, but interest is charged on the whole sum even though only a part is withdrawn. After the period, for which the money has been borrowed, is over, the borrower returns the amount with interest to the bank. Banks make most of their profits thus by giving loans.

8. Discounting Bills:

The discounting of bills by a bank is another way of lending money. The banks purchase these bills through bill-brokers and discount; companies of discount them directly for the merchants. These bills provide a very liquid asset (i.e., an asset which can be easily turned into cash). The banks immediately any cash for the bill after deducting the, discount (interest), and wait for the bill to mature when they get back its full value.

The investment in bills is considered quite safe, because a bill beats the security of two businessmen, the drawer as well as the drawer, so that if one proves dishonest or fails, the bank can claim the money from the other. This is regarded as the best investment by the banks. It is liquid, lucrative and safe. That is why it is said that a good bank manager knows the difference between a bill and a mortgage.

9. Remitting Funds:

Banks remit funds-for their customers through bank draft to any place where they have branches or agencies. This is the cheapest way of sending money. It is also quite safe. Funds can also be remitted to foreign countries.

11. Safe Custody:

Ornaments and valuable documents can be kept in safe deposit with a bank, in its strong room fitted with lockers, on payment of a small sum per year. Thus the risk of theft is avoided.

12. Agency Functions:

The bank works as an agent of their constituents. They receive payments on their behalf. They collect rents, dividends on shares, etc. They pay insurance premia and make other payments as instructed by their depositors. They accept bills of exchange on behalf of their customers. They pass bills of lading or railway receipts to the purchasers of goods when they pay for them. This amount is passed on to the suppliers of goods.

13. References:

They provide references about the financial position of their customers when required. They supply this information confidentially. This is done when their customers want to establish business connections with some new firms within or outside the country.

14. Letters of Credit:

In order to help the travelers, the banks issue letters of credit travelers’ cheques. A man going on a tour takes with him a letter of credit from his bank. It is mentioned there that he can be paid sums up to a certain limit. He shows this letter to banks in other places which make the payment to him and debit the bank which has issued the letter of credit.

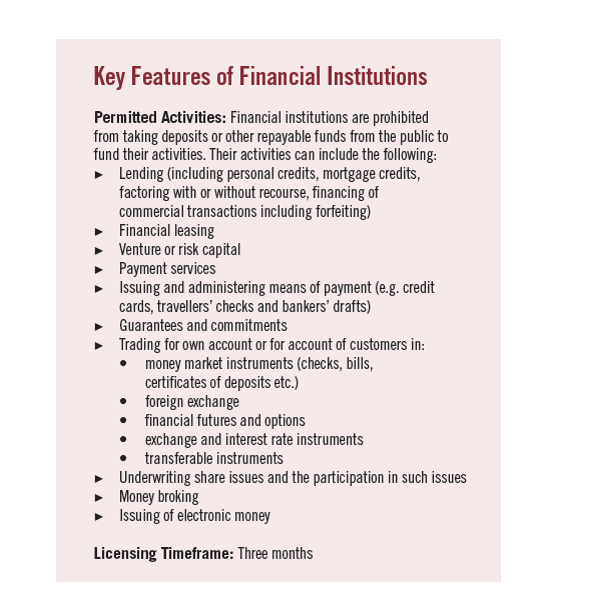

Key Features of Financial Institutions

Financial institutions provide financing, facilitate economic transactions, issue funds, offer insurance and hold deposits for businesses and individuals. Financial institutions are private or public organizations that serve as an intermediary between savers and borrowers of funds. The two primary types of financial institutions are credit unions or depository banks and non-depository mutual funds and insurance companies. Banks and equity markets are the fundamental institutions in most financial systems.

Depository banks and credit unions provide private and commercial loans for individuals and businesses. These financial institutions also hold deposits and issue certificates for investments. Non-depository financial institutions, such as insurance companies,

collect funds by selling policies or units to the public. These institutions provide returns to their investors in the form of benefits, dividends and/or profit payouts. Non- depository financial institutions are critical in mitigating risk for businesses and consumers.

Financial institutions fuel the economy by issuing credit, which comes in the form of loans, mortgages and credit cards, to allow individuals and businesses to purchase goods and services, homes, attend college, start a business, etc. Financial institutions also serve as direct providers of liquidity through demand deposits and credit lines.

Financial institutions, through processing transactions and purchasing and selling large volumes of securities, play a fundamental role in the equity markets.