Credit creation separates a bank from other financial institutions. In simple terms, credit creation is the expansion of deposits. And, banks can expand their demand deposits as a multiple of their cash reserves because demand deposits serve as the principal medium of exchange. In this article, we will talk about credit creation.

he two most important aspects of credit creation are:

- Liquidity – The bank must pay cash to its depositors when they exercise their right to demand cash against their

- Profitability – Banks are profit-driven enterprises. Therefore, a bank must grant loans in a manner which earns higher interest than what it pays on its

The bank’s credit creation process is based on the assumption that during any time interval, only a fraction of its customers genuinely need cash. Also, the bank assumes that all its customers would not turn up demanding cash against their deposits at one point in time.

Basic Concepts of Credit Creation

- Bank as a business institution – Bank is a business institution which tries to maximize profits through loans and advances from the

- Bank Deposits – Bank deposits form the basis for credit creation and are of two types:

- Primary Deposits – A bank accepts cash from the customer and opens a deposit in his This is a primary deposit. This does not mean credit creation. These deposits simply convert currency money into deposit money. However, these deposits form the basis for the creation of credit.

- Secondary or Derivative Deposits – A bank grants loans and advances and

instead of giving cash to the borrower, opens a deposit account in his name. This is the secondary or derivative deposit. Every loan crates a deposit. The creation of a derivative deposit means the creation of credit.

- Cash Reserve Ratio (CRR) – Banks know that all depositors will not withdraw all deposits at the same time. Therefore, they keep a fraction of the total deposits for meeting the cash demand of the depositors and lend the remaining excess CRR is the percentage of total deposits which the banks must hold in cash reserves for meeting the depositors’ demand for cash.

- Excess Reserves – The reserves over and above the cash reserves are the excess These reserves are used for loans and credit creation.

- Credit Multiplier – Given a certain amount of cash, a bank can create multiple times credit. In the process of multiple credit creation, the total amount of derivative deposits that a bank creates is a multiple of the initial cash

Credit creation by a single bank

There are two ways of analyzing the credit creation process:

- Credit creation by a single bank

- Credit creation by the banking system as a whole

In a single bank system, one bank operates all the cash deposits and cheques.

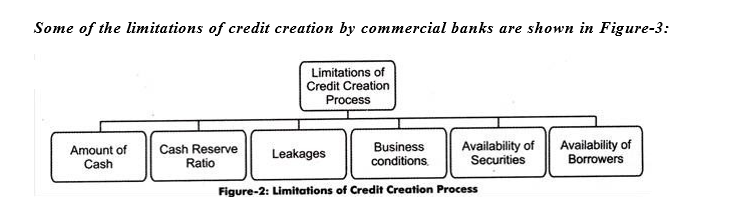

The limitations of credit creation process (as shown in Figure-3) are explained as follows:

1. Amount of Cash:

Affects the creation of credit by commercial banks. Higher the cash of commercial banks in the form of public deposits, more will be the credit creation. However, the amount of cash to be held by commercial banks is controlled by the central bank.

The central bank may expand or contract cash in commercial banks by purchasing or selling government securities. Moreover, the credit creation capacity depends on the rate of increase or decrease in CRR by the central bank.

2. CRR:

Refers to reserve ratio of cash that need to be kept with the central bank by commercial banks. The main purpose of keeping this reserve is to fulfill the transactions needs of depositors and to ensure safety and liquidity of commercial banks. In case the ratio falls, the credit creation would be more and vice versa.

3. Leakages:

Imply the outflow of cash. The credit creation process may suffer from leakages of cash.

The different types of leakages are discussed as follows:

- Excess Reserves:

Takes place generally when the economy is moving towards recession. In such a case, banks may decide to maintain reserves instead of utilizing funds for lending. Therefore, in such situations, credit created by commercial banks would be small as a large amount of cash is resented.

Currency Drains:

Imply that the public does not deposit all the cash with it. The customers may hold the cash with them which affects the credit creation by banks. Thus, the capacity of banks to create credit reduces.

4. Availability of Borrowers:

Affects the credit creation by banks. The credit is created by lending money in form of loans to the borrowers. There will be no credit creation if there are no borrowers.

5. Availability of Securities:

Refers to securities against which banks grant loan. Thus, availability of securities is necessary for granting loan otherwise credit creation will not occur. According to Crowther, “the bank does not create money out of thin air; it transmutes other forms of wealth into money.”

6. Business Conditions:

Imply that credit creation is influenced by cyclical nature of an economy. For example, credit creation would be small when the economy enters into the depression phase.

This is because in depression phase, businessmen do not prefer to invest in new projects. In the other hand, in prosperity phase, businessmen approach banks for loans, which lead to credit creation.

In spite of its limitations, we can conclude that credit creation by commercial banks is a significant source for generating income.

The essential conditions for creation of credit are as follows:

- Accepting the fresh deposits from public

- Willingness of banks to lend money

- Willingness of borrowers to

Process of credit creation

commercial bank has two types of deposits, and the two processes have been discussed below. Once is ‘Loan Creations from Deposit’ and another ‘Deposit Creation through Loan. So stay with us and achieve your required information from here. Also, we have additional info for you. These are the primary functions of commercial banks and the Characteristics of commercial banks.

Loan Creation from Deposit

The commercial banks will pay back the people’s lazy money through various deposits and refund them. But the depositors do not take all the money at the same time.

Occasionally, according to the needs taken. So, without taking all the money deposited by the bank, the profits earned by investing in some profitable sectors can be made from some portion of the bank. Thus, the bank creates debt deposits by making and contracting loans. Through these actions, the commercial banks make loans from deposits so that it called ‘Loan Creation from Deposit’. After all, it is the first process of credit creation by the commercial bank through loan creation from the deposit.

Deposit Creation through Loan

Deposit Creation through Loan is the second process of credit creation by a commercial bank. However, in 5 ways, commercial banks create deposits through debt. So come to the point and justify these 5 ways

1. Investment

Commercial banks invest money in shares, bonds, securities etc. Since it is deposited in any bank, the bank creates a debt deposit from that deposit. So investment is the first ways of deposit creation through loan.

2. Loan at call & loan payable at short notice

The commercial bank offers only the demands of borrowers and short-term loans

through current accounting. The borrowers pick up the money as needed. Therefore, the bank makes a loan deposit by repaying it from that money. So the loan at call and loan payable at short notice is the second way of deposit creation through loan.

3. Bill Discounting

Bill discounting is the third way of the deposit creation through loan. The commercial bank exchanges the bill by purchasing the Bill with an interest. So this check is deposited in any bank. And from there it made the bank debt deposits. Therefore, all these activities are involved with bill discounting.

4. Purchasing Assets

Since commercial banks are purchasing the assets and paying them through check, as a result they help in generating credit deposits. The person who sells the wealth will not pick up the money and take it slowly through the check. As a result, debt deposits will be created. Therefore, the purchasing assets are the fourth number of the way from deposit creation through loan.

5. Through Bank Overdraft

Bank provides Bank Overdraft credit for the needs of the customers. The loan will also be credited to the credit bank in the form of the amount of loan deposited. The overall process of the bank is managed to generate credit deposits.

However, we coming at the end of the page. I hope, I completed explaining the process of credit creation by commercial banks successfully. Overall have completed the two process loan creation from the deposit and the deposit creation through a loan. If you want to know the additional information, then comment on yourselves.

Limitations on Credit Creation by Banks

- Amount of cash:

The credit creation power of banks depends upon the amount of cash they possess. The larger the cash, the larger the amount of credit that can be created by banks.

Image Courtesy: brunswickplantationliving.com/wp-content/uploads/2013/07/credit- limit.jpg

The amount of cash that a bank has in its vaults cannot be determined by it. It depends upon the primary deposits with the bank. The bank’s power of creating credit is thus limited by the cash it possesses.

2. Proper securities:

An important factor that limits the power of a bank to create credit is the availability of adequate securities. A bank advances loans to its customers on the basis of a security, or a bill, or a share, or a stock or a building, or some other type of asset. It turns ill-liquid form of wealth into liquid wealth and thus creates credit. If proper securities are not available with the public, a bank cannot create credit. As pointed out by Crowther, “Thus the bank does not create money out of thin air it transmutes other forms of wealth into money.”

3. Banking habits of the people:

The banking habits of the people also govern the power of credit creation on the part of banks. If people are not in the habit of using cheques, the grant of loans will lead to the withdrawal of cash from the credit creation stream of the banking system. This reduces the power of banks to create credit to the desired level.

4. Minimum legal reserve ratio:

The minimum legal reserve ratio of cash to deposits fixed by the central bank is an important factor which determines the power of banks of creates credit. The higher this ratio (RRr), the lower the power of banks to create credit; and the lower the ratio, the higher the power of banks to create credit.

5. Excess reserves:

The process of credit creation is based on the assumption that banks stick to the required reserve ratio fixed by the central bank. If banks keep more cash in reserves than the legal reserve requirements, their power to create credit is limited to that extent. If Bank A of our example keeps 25 per cent of Rs 1000 instead of 20 per cent, it will lend Rs 750 instead of Rs 800. Consequently, the amount of credit creation will be reduced even if the other banks in the system stick to the legal reserve ratio of 20 per cent.

6. Leakages:

If there are leakages in the credit creation stream of the banking system, credit expansion will not reach the required level, given the legal reserve ratio. It is possible that some persons who receive cheques do not deposit them in their bank accounts, but withdraw the money in cash for spending or for hoarding at home. The extent to which the amount of cash is withdrawn from the chain of credit expansion, the power of the banking system to create credit is limited.

7. Cheque clearances:

The process of credit expansion is based on the assumption that cheques drawn by commercial banks are cleared immediately and reserves of commercial banks expand and contract uniformly by cheque transactions. But it is not possible for banks to receive and draw cheques of exactly equal amount. Often some banks have their reserves increased and others reduced through cheque clearances. This expands and contracts credit creation of the part of banks. Accordingly, the credit creation stream is disturbed.

8. Behaviour of other banks:

The power of credit creation is further limited by the behaviour of other banks. If some of the banks do not advance loans to the extent required of the banking system, the chain of credit expansion will be broken. Consequently, the banking system will not be “loaned up”.

9. Economic climate:

Banks cannot continue to create credit limitlessly. Their power to create credit depends upon the economic climate in the country. If there are boom times there is optimism.

Investment opportunities increase and businessmen take more loans from banks. So credit expands. But in depressed times when the business activity is at a low level, banks cannot force the business community to take loans from them. Thus the economic climate in a country determines the power of banks to create credit.

10. Credit control policy of the central bank:

The power of commercial banks to create credit is also limited by the credit control policy of the central bank. The central bank influences the amount of cash reserves with banks by open market operations, discount rate policy and varying margin requirements. Accordingly, it affects the credit expansion or contraction by commercial banks.

How the central bank controls credit creation?

The four important methods used by the Central Bank for Credit Control are as follows:

1. Bank Rate or Discount Rate Policy:

The bank rate or the discount rate is the rate fixed by the central bank at which it rediscounts first class bills of exchange and government securities held by the commercial banks. The bank rate is the interest rate charged by the central bank at which it provides rediscount to banks through the discount window. The central bank controls credit by making variations in the bank rate.

If the need of the economy is to expand credit, the central bank lowers the bank rate. Borrowing from the central bank becomes cheap and easy. So the commercial banks will borrow more. They will, in turn, advance loans to customers at a lower rate. The market rate of interest will be reduced.

This encourages business activity, and expansion of credit follows which encourages the rise in prices. The opposite happens when credit is to be contracted in the economy. The central bank raises the bank rate which makes borrowing costly from it. So the banks borrow less. They, in turn, raise their lending rates to customers.

The market rate of interest also rises because of the tight money market. This discourages fresh loans and puts pressure on borrowers to pay their past debts. This discourages business activity. There is contraction of credit which depresses the rise in price. Thus lowering the bank rate offsets deflationary tendencies and raising the bank rate controls inflation.

Limitations of Bank Rate Policy:

The efficacy of the bank rate policy as an instrument of controlling credit is limited by the following factors:

1. Market Rates do not change with Bank Rate:

The success of the bank rate policy depends upon the extent to which other market rates of interest change along with the bank rate. The theory of bank rate policy pre- supposes that other rates of interest prevailing in the money market change in the direction of the change in the bank rate. If this condition is not satisfied, the bank rate policy will be totally ineffective as an instrument of credit control.

2. Wages, Costs and Prices Not Elastic:

The success of the bank rate policy requires elasticity not only in interest rates but also in wages, costs and prices. It implies that when suppose the bank rate is raised wages, costs and prices should automatically adjust themselves to a lower level. But this was possible only under gold standard. Now-a-days the emergence of strong trade unions has made wages rigid during deflationary trends. And they also lag behind when there are inflationary tendencies because it takes time for unions to get a wage rise from employers. So the bank rate policy cannot be a success in a rigid society.

3. Banks do not approach Central Bank:

The effectiveness of the bank rate policy as a tool of credit control is also limited by the behaviour of the commercial banks. It is only if the commercial banks approach the central bank for rediscounting facilities that this policy can be a success. But the banks keep with them large amounts of liquid assets and do not find it necessary to approach the central bank for financial help.

4. Bills of Exchange not used:

As a corollary to the above, the effectiveness of the bank rate policy depends on the existence of eligible bills of exchange. In recent years, the bill of exchange as an instrument of financing commerce and trade has fallen into disuse. Businessmen and banks prefer cash credit and overdrafts. This makes the bank rate policy less effective for controlling credit in the country.

5. Pessimism or Optimism:

The efficacy of the bank rate policy also depends on waves of pessimism or optimism among businessmen. If the bank rate is raised, they will continue to borrow even at a higher rate of interest if there are boom conditions in the economy, and prices are expected to rise further. On the other hand, a reduction in the bank rate will not induce them to borrow during periods of falling prices. Thus businessmen are not very sensitive to changes in interest rates and they are influenced more by business expectations.

6. Power to Control Deflation Limited:

Another limitation of the bank rate policy is that the power of a central bank to force a reduction in the market rates of interest is limited. For instance, a lowering of bank rate below 3 per cent will not lead to a decline in the market rates of interest below 3 per cent. So the bank rate policy is ineffective in controlling deflation. It may, however, control inflationary tendencies by forcing an increase in the market rates of interest.

7. Level of Bank Rate in relation to Market Rate:

The efficacy of the discount rate policy as an instrument of credit control depends upon its level in relation to the market rate. If in a boom the bank rate is not raised to such an extent as to make borrowing costly from the central bank, and it is not lowered during a recession so as to make borrowing cheaper from it, it would have a destabilizing effect on economic activity.

8. Non-Discriminatory:

The bank rate policy is non-discriminatory because it does not distinguish between productive and unproductive activities in the country.

9. Not Successful in Controlling BOP Disequilibrium:

The bank rate policy is not effective in controlling balance of payments disequilibrium in a country because it requires the removal of all restrictions on foreign exchange and movements of international capital.

2. Open Market Operations:

Open market operations are another method of quantitative credit control used by a central bank. This method refers to the sale and purchase of securities, bills and bonds of government as well as private financial institutions by the central bank. But in its narrow sense, it simply means dealing only in government securities and bonds.

There are two principal motives of open market operations. One to influence the reserves of commercial banks in order to control their power of credit creation. Two to affect the market rates of interest so as to control the commercial bank credit.

Its method of operation is as follows. Suppose the central bank of a country wants to control expansion of credit by the commercial banks for the purpose of controlling inflationary pressures within the economy. It sells government securities in the money market amounting to, say, Rs 10 crores.

The latter give the central bank cheques for this amount drawn against the commercial banks in which the public have their accounts. The central bank reduces this amount in their accounts with it. This applies equally if the commercial banks have also purchased securities from the central bank.

The sale of securities in the open market has thus reduced their cash holdings with the central bank. This tends to reduce the actual cash ratio of the commercial banks by Rs. 10 crores. So the banks are forced to curtail their lending.

Limitations of Open Market Operations:

The effectiveness of open market operations as a method of credit control is dependent upon the existence of a number of conditions the absence of which limits the full working of this policy.

1. Lack of Securities Market:

The first condition is the existence of a large and well-organized security market. This condition is very essential for open market operations because without a well- developed security market the central bank will not be able to buy and sell securities on a large scale, and thereby influence the reserves of the commercial banks. Further, the central bank must have enough saleable securities with it.

2. Cash Reserve Ratio Not Stable:

The success of open market operations also requires the maintenance of a stable cash- reserve ratio by the commercial bank. It implies that when the central bank sells or buys securities, the reserves of the commercial banks decrease or increase accordingly to maintain the fixed ratio. But usually the banks do not stick to the legal minimum reserve ratio and keep a higher ratio than this. This makes open market operations less effective in controlling the volume of credit.

3. Penal Bank Rate:

According to Prof. Aschheim, one of the necessary conditions for the success of open market operations is a penal bank rate. If there is no penal discount rate fixed by the central bank, the commercial banks can increase their borrowings from it when the demand for credit is strong on the part of the latter. In this situation, the scale of securities by the central bank to restrict monetary expansion will be unsuccessful. But if there is a penal rate of discount, which is a rate higher than the market rates of interest, the banks will be reluctant to approach the central bank for additional financial help easily.

4. Banks Act Differently:

Open market operations are successful only if the people also act the way the central bank expects them. When the central bank sells securities, it expects the business community and financial institutions to restrict the use of credit. If they simultaneously start dishoarding money, the act of selling securities by the central banks will not be a success in restricting credit. Similarly, the purchase of securities by the central bank will not be effective if people start hoarding money.

5. Pessimistic or Optimistic Attitude:

Pessimistic or optimistic attitude of the business community also limits the operation of open market policy. When the central bank purchases securities and increases the supply of bank money, businessmen may be unwilling to take loans during a depression because of the prevailing pessimism among them.

As aptly put by Crowther, banks may place plenty of water before the public horse, but the horse cannot be forced to drink, if it is afraid of loss through drinking water. On the other hand, if businessmen are optimistic during a boom, the sale of securities by the central bank to contract the supply of bank money and even the rise in market rates cannot discourage them from getting loans from the banks. On the whole, this policy is more successful in controlling booms than depressions.

6. Velocity of Credit Money not Constant:

The success of open market operations depends upon a constant velocity of circulation of bank money. But the velocity of credit money is not constant. It increases during periods of brisk business activity and decreases in periods of falling prices. Thus a policy of contracting credit by the sale of securities by the central bank may not be successful by increased velocity of circulation of bank credit.

Despite these limitations, open market operations are more effective than the other instruments of credit control available with the central bank. This method is being successfully used for controlling credit in developed countries where the securities market is highly developed.

3. Variable Reserve Ratio:

Variable reserve ratio (or required reserve ratio or legal minimum requirements), as a method of credit control was first suggested by Keynes in his Treatise on Money (1930) and was adopted by the Federal Reserve System of the United States in 1935.

Every commercial bank is required by law to maintain a minimum percentage of its deposits with the central bank. The minimum amount of reserve with the central bank may be either a percentage of its time and demand deposits separately or of total deposits. Whatever the amount of money remains with the commercial bank over and above these minimum reserves is known as the excess reserves.

It is on the basis of these excess reserves that the commercial bank is able to create credit. The larger the size of the excess reserves, the greater is the power of a bank to create credit, and vice versa. It can also be said that the larger the required reserve ratio, the lower the power of a bank to create credit, and vice versa.

When the central bank raises the reserve ratio of the commercial banks, it means that the latter are required to keep more money with the former. Consequently, the excess reserves with the commercial banks are reduced and they can lend less than before.

Limitations of Variable Reserve Ratio:

The variable reserve ratio as a method of credit control has a number of limitations.

1. Excess Reserves:

The commercial banks usually possess large excessive reserves which make the policy of variable reserve ratio ineffective. When the banks keep excessive reserves, an increase in the reserve ratio will not affect their lending operations. They will stick to the legal minimum requirements of cash to deposits and at the same time continue to create credit on the strength of the excessive reserves.

2. Clumsy Method:

It is a clumsy method of credit control as compared with open market operations. This is because it lacks definiteness in the sense that it is inexact and uncertain as regards changes not only in the amounts of reserves but also the place where these changes can be made effective. It is not possible to tell “how much of active or potential reserve base” has been affected by changes in the reserve ratio. Moreover, the changes in reserves involve far larger sums than in the case of open market operations.

3. Discriminatory:

It is discriminatory and affects different banks differently. A rise in the required reserve ratio will not affect those banks which have large excess reserves. On the other hand, it will hit hard the banks with little or no excess reserves. This policy is also discriminatory in the sense that non-banking financial intermediaries like co-operative societies, insurance companies, building societies, development banks, etc. are not affected by variations in reserve requirements, though they compete with the commercial banks for lending purposes.

4. Inflexible:

This policy is inflexible because the minimum reserve ratio fixed by the central banks is applicable to banks located in all regions of the country. More credit may be needed in one region where there is monetary stringency, and it may be superfluous in the other region. Raising the reserve ratio for all banks is not justified in the former region though it is appropriate for the latter region.

5. Business Climate:

The success of the method of credit control also depends on the business climate in the economy. If the businessmen are pessimistic about the future, as under a depression, even a sizable lowering of the reserve ratio will not encourage them to ask for loan. Similarly, if they are optimistic about profit expectations, a considerable rise in the variable ratio will not prevent them from asking for more loans from the banks.

6. Stability of Reserve Ratio:

The effectiveness of this technique depends upon the degree of stability of the reserve ratio. If the commercial banks are authorized to keep widely fluctuating ratio, say between 10 per cent to 17 per cent and change in the upper or lower limit will have no effect on the credit creation power of the banks.

7. Other Factors:

The reserve ratio held by the commercial banks is determined not only by legal requirements but also by how much they want to hold in relation to their deposits in addition to such requirements. This, in turn, will depend upon their expectations about future developments, their competition with other banks, and so on.

8. Depressive Effect:

The variable reserve ratio has been criticized for exercising a depressive effect on the securities market. When the central bank suddenly directs the commercial banks to increase their reserve ratios, they may be forced to sell securities to maintain that ratio. This widespread selling of securities will bring down the prices of securities and may even lead to an utter collapse of the bond market.

9. Rigid:

It is rigid in its operations because it does not distinguish between desired and undesired credit flows and can affect them equally.

10. Not for Small Changes:

This method is more like an axe than a scalpel. It cannot be used for day-to- day and week-to-week adjustments but can be used to bring about large changes in the reserve positions of the commercial banks. Thus it cannot help in ‘fine tuning’ of the money and credit systems by making small changes.

4. Selective Credit Controls:

Selective or qualitative methods of credit control are meant to regulate and control the supply of credit among its possible users and uses. They are different from quantitative or general methods which aim at controlling the cost and quantity of credit. Unlike the general instruments, selective instruments do not affect the total amount of credit but the amount that is put to use in a particular sector of the economy.

The aim of selective credit control is to channelize the flow of bank credit from speculative and other undesirable purposes to socially desirable and economically useful uses. They also restrict the demand for money by laying down certain conditions for borrowers.

They therefore, embody the view that the monopoly of credit should in fact become a discriminating monopoly. Prof. Chandler defines selective credit controls as those measures “that would influence the allocation of credit, at least to the point of decreasing the volume of credit used for selected purposes without the necessity of decreasing the supply and raising the cost of credit for all purposes.” We discuss below the main types of selective credit controls generally used by the central banks in different countries.

Regulation of Margin Requirements:

This method is employed to prevent excessive use of credit to purchase or carry securities by speculators. The central bank fixes minimum margin requirements on loans for purchasing or carrying securities. They are, in fact, the percentage of the value of the security that cannot be borrowed or lent. In other words, it is the maximum value of loan which a borrower can have from the banks on the basis of the security (or collateral).

For example, if the central bank fixes a 10 per cent margin on the value of a security worth Rs 1.0, then the commercial bank can lend only Rs 900 to the holder of the security and keep Rs 100 with it. If the central bank raises the margin to 25 per cent, the bank can lend only Rs 750 against a security of Rs 1.0. If the central bank wants to curb speculative activities, it will raise the margin requirements. On the other hand, if it wants to expand credit, it reduces the margin requirements.

Its Merits:

This method of selective credit control has certain merits which make it unique.

- It is non-discriminatory because it applies equally to borrowers and Thus it limits both the supply and demand for credit simultaneously.

- It is equally applicable to commercial banks and non-banking financial

- It increases the supply of credit for more productive

- It is a very effective anti-inflationary device because it controls the expansion of credit in those sectors of the economy which breed

- It is simple and easy to administer since this device is meant to regulate the use of credit for specific

But the success of this technique requires that there are no leakages of bank credit for non-purpose loans to speculators.

Its Weaknesses:

However, a number of leakages have appeared in this method over the years.

- A borrower may not show any intention of purchasing stocks with his borrowed funds and pledge other assets as security for the loan. But it may purchase stocks through some other source.

- The borrower may purchase stocks with cash which he would normally use to purchase materials and supplies and then borrow money to finance the materials and supplies already purchased, pledging the stocks he already has as security for the

- Lenders, other than commercial banks and brokers, who are not subject to margin requirements, may increase their security loans when commercial banks and brokers are being controlled by high margin Further, some of these non-regulated lenders may be getting the funds they lent to finance the purchase of securities from commercial banks themselves.

Despite these weaknesses in practice, margin requirements are a useful device of credit control.

Regulation of Consumer Credit:

This is another method of selective credit control which aims at the regulation of consumer instalment credit or hire-purchase finance. The main objective of this instrument is to regulate the demand for durable consumer goods in the interest of economic stability. The central bank regulates the use of bank credit by consumers in order to buy durable consumer goods on instalments and hire-purchase. For this purpose, it employs two devices: minimum down payments, and maximum periods of repayment.

Suppose a bicycle costs Rs 500 and credit is available from the commercial bank for its purchase. The central bank may fix the minimum down payment to 50 per cent of the price, and the maximum period of repayment to 10 months. So Rs 250 will be the minimum which the consumer will have to pay to the bank at the time of purchase of the bicycle and the remaining amount in ten equal instalments of Rs 25 each. This facility will create demand tor bicycles.

The bicycle industry would expand along with the related industries such as tyres, tubes, spare parts, etc. and thus lead to inflationary situation in this and other sectors of the economy. To control it, the central bank raises the minimum down payment to 70 per cent and the maximum period of repayment to three installments. So the buyer of a bicycle will have to pay Rs 350 in the beginning and remaining amount in three installments of Rs 50 each. Thus if the central bank finds slump in particular industries of the economy, it reduces the amount of down payments and increases the maximum periods of repayment.

Reducing the down payments tends to increase the demand for credit for particular durable consumer goods on which the central bank regulation is applied. Increasing the maximum period of repayment, which reduces monthly payments, tends to increase the demand for loans, thereby encouraging consumer credit. On the other hand, the central bank raises the amount of down payments and reduces the maximum periods of repayment in boom.

The regulation of consumer credit is more effective in controlling credit in the case of durable consumer goods during both booms and slumps, whereas general credit controls fail in this area. The reason is that the latter operate with a time lag. Moreover, the demand for consumer credit in the case of durable consumer goods is interest inelastic. Consumers are motivated to buy such goods under the influence of the demonstration effect and the rate of interest has little consideration for them.

But this instrument has its drawbacks.

It is cumbersome, technically defective and difficult to administer because it has a narrow base. In other words, it is applicable to a particular class of borrowers whose demand for credit forms an insignificant part of the total credit requirements. It, therefore, discriminates between different types of borrowers. This method affects only persons with limited incomes and leaves out higher income groups. Finally, it tends to malallocate resources by shifting them away from industries which are covered by credit regulations and lead to the expansion of other industries which do not have any credit restrictions.

Rationing of Credit:

Rationing of credit is another selective method of controlling and regulating the purpose for which credit is granted by the commercial banks. It is generally of four types. The first is the variable portfolio ceiling. According to this method, the central bank fixes a ceiling on the aggregate portfolios of the commercial banks and they cannot advance loans beyond this ceiling. The second method is known as the variable capital assets ratio. This is the ratio which the central bank fixes in relation to the capital of a commercial bank to its total assets. In keeping with the economic exigencies, the central bank may raise or lower the portfolio ceiling, and also vary the capital assets ratio.

Rationing of credit has been used very effectively in Russia and Mexico. It is, therefore, ‘a logical concomitant of the intensive and extensive planning adopted in regimented economies.’ The technique also involves discrimination against larger banks because it restricts their lending power more than the smaller banks. Lastly, by rationing of credit for selective purposes, the central bank ceases to be the lender of the last resort.

Therefore, central banks in mixed economies do not use this technique except under extreme inflationary situations and emergencies.

Direct Action:

Central banks in all countries frequently resort to direction action against commercial banks. Direction action is in the form of “directives” issued from time to time to the commercial banks to follow a particular policy which the central bank wants to enforce immediately. This policy may not be used against all banks but against erring banks.

For example, the central bank refuses rediscounting facilities to certain banks which may be granting too much credit for speculative purposes, or in excess of their capital and reserves, or restrains them from granting advances against the collateral of certain commodities, etc. It may also charge a penal rate of interest from those banks which want to borrow from it beyond the prescribed limit. The central bank may even threaten a commercial bank to be taken over by it in case it fails to follow its policies and instructions.

But this method of credit suffers from several limitations which have been enumerated by De Kock as “the difficulty for both central and commercial bank to make clear-cut distinctions at all times and in all cases between essential and non-essential industries, productive and unproductive activities, investment and speculation, or between legitimate and excessive speculation or consumption; the further difficulty of controlling the ultimate use of credit by second, third or fourth parties; the dangers involved in the division of responsibility between the central bank and commercial bank for the soundness of the lending operations of the latter; and the possibility of forfeiting the whole-hearted and active co-operations of the commercial banks as a result of undue control and intervention.”

Moral Suasion:

Moral suasion in the method of persuasion, of request, of informal suggestion, and of advice to the commercial bank usually adopted by the central bank. The executive head of the central bank calls a meeting of the heads of the commercial banks wherein he explains them the need for the adoption of a particular monetary policy in the context of the current economic situation, and then appeals to them to follow it. This “jawbone control” or “slaps on the wrist” method has been found to be highly effective as a selective method of credit control in India, New Zealand, Canada and Australia, though it failed in the USA.

Its Limitations:

Moral suasion is a method “without any teeth” and hence its effectiveness is limited.

- Its success depends upon the extent to which the commercial banks accept the central bank as their leader and need accommodation from

- If the banks possess excessive reserves they may not follow the advice of the central bank, as is the case with the commercial banks in the

- Further, moral suasion may not be successful during booms and depressions when the economy is passing through waves of optimism and pessimism The bank may not heed to the advice of the central bank in such a situation.

- In fact, moral suasion is not a control device at all, as it involves cooperation by the commercial banks rather than their

It may, however, be a success where the central bank commands prestige on the strength of the wide statutory powers vested in it by the government of the country.

Publicity:

The central bank also uses publicity as an instrument of credit control. It publishes weekly or monthly statements of the assets and liabilities of the commercial bank for the information of the public. It also publishes statistical data relating to money supply, prices, production and employment, and of capital and money market, etc. This is another way of exerting moral pressure on the commercial bank. The aim is to make the public aware of the policies being adopted by the commercial bank vis-a-vis the central bank in the light of the prevailing economic conditions in the country.

It cannot be said with definiteness about the success of this method. It presupposes

the existence of an educated and knowledgeable public about the monetary phenomena. But even in advanced countries, the percentage of such persons is negligible. It is, therefore, highly doubtful if they can exert any moral pressure on the banks to strictly follow the policies of the central bank. Hence, publicity as an instrument of selective credit control is only of academic interest.

Limitations of Selective Credit Controls:

Though regarded superior to quantitative credit controls, yet selective credit controls are not free from certain limitations.

1. Limited Coverage:

Like general credit controls, selective credit controls have a limited coverage. They are only applicable to the commercial banks but not to non-banking financial institutions. But in the case of the regulation of consumer credit which is applicable both to banking and non-banking institutions, it becomes cumbersome to administer this technique.

2. No Specificity:

Selective credit controls fail to fulfill the specificity function. There is no guarantee that the bank loans would be used for the specific purpose for which they are sanctioned.

3. Difficult to distinguish between Essential and Non-Essential Factors:

It may be difficult for the central bank to distinguish precisely between essential and non-essential sectors and between speculative and productive investment for the purpose of enforcing selective credit controls. The same reasoning applies to the commercial banks for the purpose of advancing loans unless they are specifically laid down by the central bank.

4. Require Large Staff:

The commercial banks, for the purpose of earning large profits, may advance loans for purposes other than laid down by the central bank. This is particularly so if the central bank does not have a large staff to check minutely the accounts of the commercial banks. As a matter of fact, no central bank can afford to check their accounts. Hence selective credit controls are liable to be ineffective in the case of unscrupulous banks.

5. Discriminatory:

Selective controls unnecessarily restrict the freedom of borrowers and lenders. They also discriminate between different types of borrowers and banks. Often small borrowers and small banks are hit harder by selective control than big borrowers and large banks.

6. Misallocation of Resources:

Selective credit controls also lead to misallocation of resources when they are applied to selected sectors, areas and industries while leaving others to operate freely. They place undue restrictions on the freedom of the former and affect their production.

7. Not Successful in Unit Banking:

Unit banks being independent one-office banks in the USA operate on a small scale in small towns and meet the financial needs of the local people. Such banks are not affected by the selective credit controls of the FRS (central bank of the USA) because they are able to finance their activities by borrowing from big banks. So this policy is not effective in unit banking