MONDAY: 4 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

- Explain three qualities of useful accounting information needed for decision making. (6 marks)

- Outline four benefits of using Electronic Fund Transfer (EFT) when making payments to suppliers, compared to a cheque. (4 marks)

- Explain five end users of accounting information, indicating clearly their areas of interest. (10 marks)

(Total: 20 marks)

QUESTION TWO

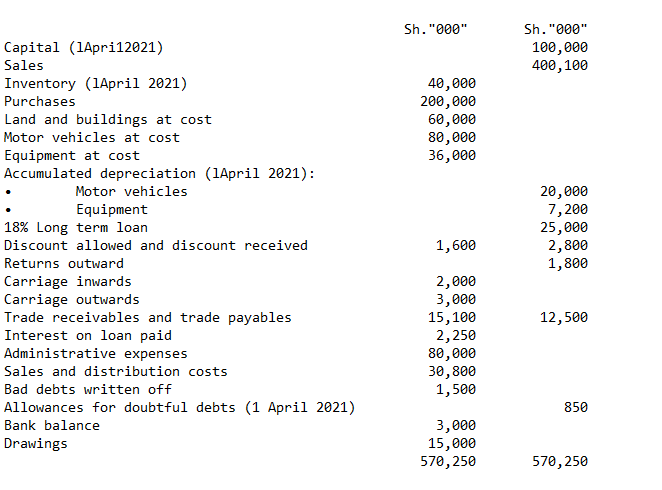

John Ndambuki, a sole trader extracted the following trial balance as at 31 March 2022:

Additional information:

1. As at 31 March 2022, the closing inventory was valued at Sh.38,000,000.

2. The administrative expenses outstanding as at 31 March 2022 was Sh.1,000,000.

3. The sales and distribution costs paid in advance as at 31 March 2022, amounted to Sh.800,000.

4. As at 31 March 2022 the half year interest on loan was still owing. 5. Alex Musau, a debtor had retuned goods on 25 March 2022 worth Sh.100,000 at selling price. No record was made in either trade receivables account or sales account. These goods were included in the closing inventory above.

6. The allowances for doubtful debts be maintained at 5% on trade receivables.

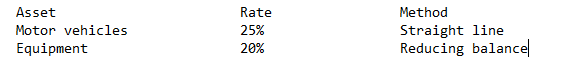

7. Depreciation is to be provided as follows:

Required:

- Statement of profit or loss for the year ended 31 March 2022. (12 marks)

- Statement of financial position as at 31 March 2022. (8 marks)

(Total: 20 marks)

QUESTION THREE

- Explain three factors that cause property, plant and equipment (PPE) to depreciate. (6 marks)

- The trial balance of JJ Enterprise as at 31 December 2021 showed a difference which was posted to a suspense account. Draft final accounts for the year ended 31 December 2021, were prepared showing a net profit of Sh.94,480,000.

The following errors were subsequently discovered:

1. Sales of Sh.700,000 to J. Kim had been debited to J. Kern.

2. A payment of Sh.650,000 for rates had been entered on the debit side of the rates account as Sh.850,000.

3. The sales journal had been undercast by Sh.4,000,000.

4. Purchases from J. Thara amounting to Sh.1,530,000 had been received on 31 December 2021 and included , in the closing inventory at that date, but the invoice had not been entered in the purchases journal.

5. Repairs to a machine, amounting to Sh.780,000 had been charged to machinery account.

6. A cheque for Sh.3,000,000 being rent received from JK which had not been invoiced, had only been entered in the cashbook.

Required:

- Journal entries without narratives, necessary to correct the above errors. (6 marks)

- Show the effect of each of these adjustments on the net profit in the draft financial statements and the correct profit or loss for the year ended 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION FOUR

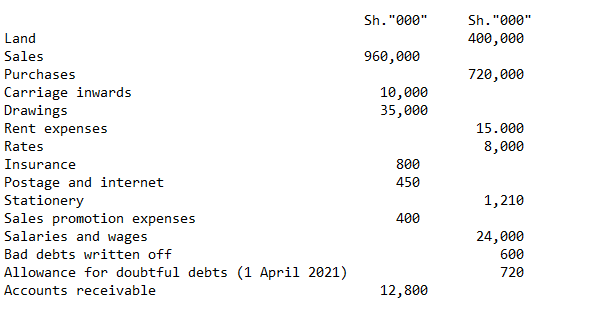

Wiseman operates an electronic retail shop. Currently, he has not employed an accountant and therefore using his limited knowledge in accounting.

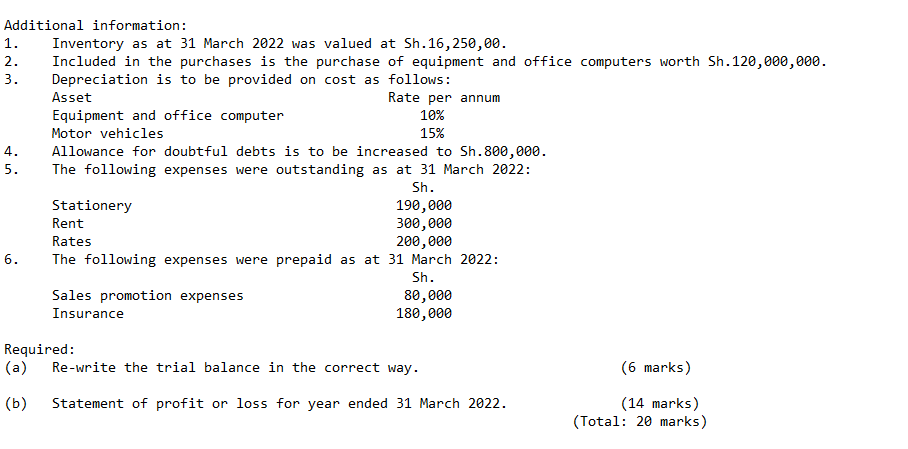

He prepared his trial balance for the year ended 31 March 2022 as follows:

QUESTION FIVE

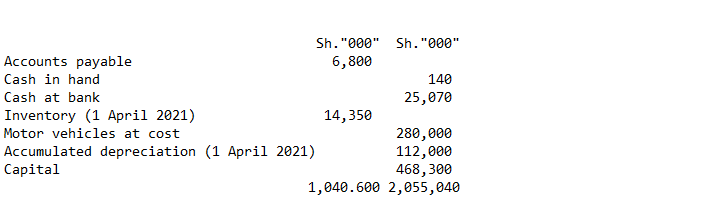

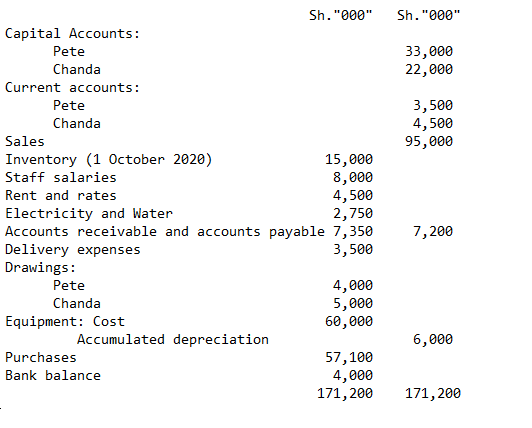

Pete and Chanda are in partnership sharing profit and losses in the ratio of 3:2 respectively.

Their trial balance on 30 September 2021 was as follows:

Additional information:

1. The closing inventory as at 30 September 2021 was valued at Sh.20,000,000.

2. During the financial year ended 30 September 2021, goods worth Sh.1,500,000 were destroyed by fire. Insurance company accepted the claim amounting to Sh.1,000,000.

3. As at 30 September 2021, electricity paid in advance amounted to Sh.250,000.

4. The partnership agreement provided the following:

sh.”000″

Annual salaries: Pete 1,000 Chanda 2,000

Interest on drawings: Pete 100 Chanda 150

Interest on capital: Pete 3,300 Chanda 2,200

5. Pete guaranteed Chanda that his total income from the partnership shall not be less than Sh.9,000,000 in any year.

6. Depreciation is to be charged on equipment at the rate of 10% on reducing balance basis.

Required:

- Statement of profit or loss for the year ended 30 September 2021. (9 marks)

- Partners’ current accounts. (5 marks)

- Statement of financial position as at 30 September 2021. (6 marks)

(Total 20 marks)