WEDNESDAY: 3 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your

workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain three elements of the financial decision-making process. (6 marks)

2. Highlight four roles of a finance manager in an organisation. (4 marks)

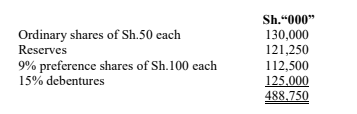

3. The following is an extract from the financial position of Joba Ltd. as at 31 December 2021:

Additional information:

1. The ordinary shares are quoted at Sh.80 per share. Ordinary shareholders expect cash dividend of Sh.8 per share and a dividend growth at the rate of 10% at the end of every year.

2. The preference shares which are unredeemable are quoted at Sh.74 per share and a floatation cost of Sh.2 per share.

3. The debentures are trading at Sh.120 per debenture with a floatation cost of Sh.5 per debenture. The par value of each debenture is Sh.100.

4. The corporate tax rate is 30%.

Required:

The cost of ordinary shares. (2 marks)

The cost of preference shares. (2 marks)

The cost of debentures. (2 marks)

The market weighted average cost of capital (WACC). (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain three goals of alternative investments. (6 marks)

2. Discuss three criticisms of derivative markets. (6 marks)

3. The following information was extracted from the financial statements of Kenland Ltd.:

Earnings per share (EPS) Sh.20

Payout ratio 60%

Internal rate of return (IRR) 16%

Capitalisation rate 12%

Required:

The intrinsic value of a share under:

Gordon’s model. (4 marks)

Walter’s model. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain three types of investments. (6 marks)

2. Examine four reasons why ordinary share capital is attractive to investors. (4 marks)

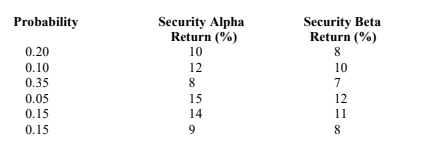

3. The following information relates to the returns forecasted of securities Alpha and Beta trading in the Securities Exchange for the year ended 30 June 2022:

Required:

The expected return on security Alpha. (2 marks)

The expected return on security Beta. (2 marks)

The standard deviations on securities Alpha and Beta. (4 marks)

Based on the relative risk, advise a potential investor on which of the two securities to invest in. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Summarise four advantages of internal rate of return (IRR) investment appraisal technique used in capital budgeting. (4 marks)

2. The following information is a feasibility study of two ventures to be undertaken by Sircho Ltd., a small scale manufacturing company:

1. Project Alfa: The project will cost Sh.100,000 initially and will need an additional Sh.160,000 at the beginning of the 4th year. It is projected that it will generate Sh.80,000 cash per year in year 1 to year 3, and Sh.50,000 per year from year 4 to 6.

2. Project Omega: The project will cost Sh.200,000 initially and Sh.80,000 at the beginning of the 4th year. It will generate Sh.100,000 per annum in year 1 and 2, and Sh.70,000 per annum in years 3 to 6.

The cost of finance for the two ventures is 12%.

Required:

The profitability index (P.I) of the two ventures. (8 marks)

Comment on your results in 2 (i) above. (1 mark)

3. Mdosi Pesa has deposited Sh.100,000 in a fund for 5 years that pays an interest rate of 12% compounded annually. The Fund Manager also advises Mdosi Pesa that compounding can also be done semi-annually and continuously.

Required:

The future value of the fund assuming:

Annual compounding. (2 marks)

Semi-annual compounding. (2 marks)

Continuous compounding. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise four reasons for the Islamic prohibition of interest (riba). (4 marks)

2. Explain three methods of forecasting exchange rates. (6 marks)

3. Outline four reasons why venture capital is not well developed in developing countries. (4 marks)

4. Simon Kirwa obtained a loan of Sh.2,000,000 on 1 January 2022. The rate of interest was fixed at 12% per annum.

The loan is to be repaid semi-annually over a period of three years.

Required:

A loan amortisation schedule. (6 marks)

(Total: 20 marks)