TUESDAY: 2 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your

workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain four benefits of having a well written investment policy statement (IPS) in portfolio management. (4 marks)

2. Propose three actions that the chairman of an investment committee could implement in order to improve its effectiveness. (3 marks)

3. Explain three determinants of required rate of return of an investment. (6 marks)

4. Perigon Investment firm employs different financial analysts who devise and implement various trading strategies.

Martin Biko, a portfolio manager at the firm is trying to evaluate three trading strategies that have been used for different periods of time by three financial analysts as follows:

• Kepha believes that he can predict share price movements based on earnings announcements. In the last 100 days, he has earned a return of 6.2%.

• Thomas has been very successful in predicting daily movements of the Kenya Shillings and the US dollar based on carry trade. In the last four weeks, he has earned 2% after accounting for all transaction costs.

• Lisa follows the fashion industry and luxury retailers. She has been investing in these companies for the last three months. Her return is 5%.

Assume that a year has 365 days or 52 weeks.

Required:

Annual rate of return for Kepha. (2 marks)

Annual rate of return for Thomas. (2 marks)

Annual rate of return for Lisa. (2 marks)

Advise Martin Biko on the best performing financial analyst. (1 mark)

(Total: 20 marks)

QUESTION TWO

1. Outline two consequences of the confirmation bias in the financial markets. (2 marks)

2. Describe five investor personality types as postulated by Bailard, Biehl and Kaiser Five Way Model. (5 marks)

3. In the context of behavioural finance, discuss two heuristic driven biases that impair judgement of the investors when considering investment opportunities. (4 marks)

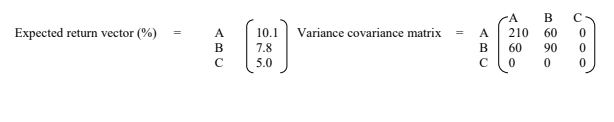

4. You are provided with the following expected return vector and variance-covariance matrix for three assets, A, B and C held by Nancy Wamuyu:

Nancy Wamuyu’s risky portfolio is split equally 50 – 50 between the two risky assets.

Required:

Identify the risk free asset. Give a reason for your answer. (2 marks)

Compute the expected return and standard deviation of the portfolio. (4 marks)

Given that the weight of the risk free asset is 25%, compute the portfolio expected return and portfolio standard deviation. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Outline five assumptions of the Markowitz Portfolio Theory. (5 marks)

2. Describe three reasons why domestic investors should consider constructing global investment portfolio.(3 marks)

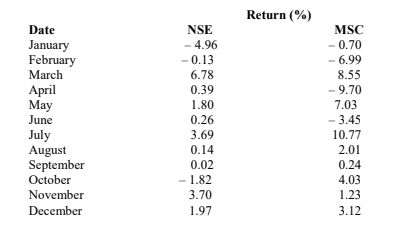

3. The monthly total returns for NSE (the stock market index) and MSC, a listed company are presented below:

The returns are computed using month end closing prices and includes dividend payment.

Required:

Calculate the following:

Standard deviation of MSC. (3 marks)

Standard deviation of NSE. (3 marks)

Correlation coefficient of MSC and NSE index. (2 marks)

The beta for MSC. (2 marks)

The intercept between MSC and the NSE index. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe three document classification systems as used in portfolio management. (6 marks)

2. Pamela Mboya claims that her information coefficient is 0.20 on monthly bets on 10 stocks in the banking industry. Her bets have a correlation coefficient of 0.45 as opposed to being truly independent.

Required:

Information ratio assuming independent bets. (3 marks)

Information ratio if bets are correlated. (3 marks)

Reduction in the information ratio. (2 marks)

3. Private wealth managers leverage their expectation in various fields to help high network individuals (HNI) manage their wealth effectively.

Required:

In relation to the above statement, discuss three major services offered by private wealth management firms. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Assess three factors that could affect the extent of asset allocation when constructing a portfolio for an individual investor. (6 marks)

2. Tropical Limited’s share is expected to increase in value from Sh.50 to Sh.100 over a five year period. The applicable capital gain tax rate is 5%.

Required:

Calculate the expected after tax value of the share in five years. (2 marks)

3. Simon Njoroge invests Sh.1,500,000 in a tax deferred account (TDA). The pretax return is 11% and the tax rate is 15%.

Required:

Determine the after tax balance in the account after 20 years. (2 marks)

4. Outline four principles of an effective risk management in relation to portfolio management. (4 marks)

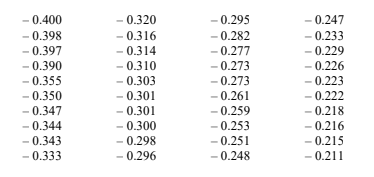

5. Simon Mwakirunge has a portfolio of shares whose market value is Sh.10 million. He performed a Monte Carlo simulation to estimate the value at risk (VaR) for his portfolio. He chose to perform this simulation using a normal distribution of returns for the portfolio, with an expected annual return of 14.8% and a standard deviation of 20.5%. He generated 700 random outcomes of annual return for this portfolio of which the worst 40 outcomes are given below.

The outcomes have been ranked from the highest loss of Sh. – 0.400 to the lowest loss of Sh. – 0.211.

Required:

Using the above information, compute the following:

5 per cent annual VaR. (3 marks)

1 per cent annual VaR. (3 marks)

(Total: 20 marks)