INTERNATIONAL RISK

This involves the foreign exchange risk which is the uncertainty of the outcome that arises because of unpredictability of the exchange rate movement. There are normally three types of foreign exchange risks:

- Transaction exposure risk

- Translation exposure risk

- Economic exposure risk

Transaction Risk – It is the risk that the movement in exchange rate will affect the value of domestic currency and the future cash flows arising from the transaction already entered into by the company involving the foreign currency.

Translation Risk – This affects the financial statement of the firm because of the changes in the reporting currency. This risk arises because the firm must periodically consolidate their financial statements with their foreign subsidiaries dominated in foreign currency into a single set of FOS using the domestic currency. This is fundamentally an accounting problem that has no cash flow impact, however, there are several stakeholders interested in the financial statement of the firm.

Economic exposure risk – Is the risk that results from the possibility that the changes in the value of the currency may have a long-term financial effect on the value of the firm. For example, consider a UK firm with a 3-year project in Kenya that is expected to generate an annual cash flow of Ksh.800m each year.

This fluctuation of the equivalent UK£ over the three year period as a result of fluctuations in exchange rates is what is known as the economic exposure risk.

Methods of managing the foreign exchange risk

There are several methods of managing the foreign exchange risk. The most common method will include:

- Invoicing in the domestic currency

- Do nothing

- Matching

- Leading and lagging

- Use of futures and forward contracts

- Use of options

- Use of swaps

- Use of money market hedge.

(a) Invoicing in the domestic currency

In this case a Kenyan exporter, may decide to invoice a customer in Kenya Shillings hence eliminating the uncertainty about the future Kenya Shillings to be received. The problem with this method is that the foreign exchange risk does not disappear but it is transferred to the customer. This method is only possible if:

- The exporter is allowed by the customer to do so.

- The exporter has the monopoly powers as the only supplier of the product and hence he can dictate the terms and condition.

(b) Do nothing

This is where the company will accept the chance that it will bear the risk of the adverse movements in exchange rate over the period in question. This can be done if:

- The amount of money involved is relatively small in relation to the business of the firm.

- If the company exports the exchange rate to move in his favour.

(c) Matching

This involves the creation of a liability if there is an asset receivable or the creation of an asset if there is a liability payable. For example, if a company Is to receive some money where its major concern is the appreciation of the local currency then the company can borrow abroad (creating a liability). In this case, the reduction in the amount receivable (asset) will be compensated by the reduction in the amount payable (liability) and vice versa.

(d) Leading and Lagging

This occurs when an investor postpones payment or receipts of the cash flow when he discovers that the exchange rate is not in his favour. For example a debtor can postpone payment if he anticipates that in the future he will make loss payment as a result of the exchange rate fluctuation and vice-versa.

(e) Use of future and forward contract

The future and forward contracts are used as hedging techniques to avoid the fluctuation in the exchange rate. The exchange rate is the price of one currency in exchange of another currency. The currencies may be quoted in two ways i.e.

- Indirect quote

- Direct quote

Indirect Quote: This refers to the amount of the foreign currency required for every one unit of the domestic currency e.g. UShs./JShs., TShs./KShs.

Direct Quote: This refers to the amount of the domestic currency required for every one unit of the foreign currency e.g. KSh./£, KSh./$, KSh./€.

For reason of buying or selling the currencies, the difference between the two prices is known as the spread.

The interpretation of the price depends on whether the quote is direct or indirect quote and the buying or selling is always on the perspective of the bank.

NB: In the case of an indirect quote, the bank buys high and sells low e.g. assume the spot rate is as follows ___ USh./KSh., ___ 22.15 – 24.15.

In the case of a direct quote, the bank buys low and sells high e.g. assume the spot rate is ___ KSh./£, ___ 138 ___ 142.

In determining the forward rate from the spot rate, the forward rate is normally quoted at a discount or premium relative to the spot rate. The general rule of calculating the forward rate from the spot rate is:

- Subtract the premium from the spot rate in order to obtain the forward rate.

- Add the discount to the spot rate in order to determine the forward rate.

A Kenyan company has imported goods from Uganda and has been invoiced Uganda Shillings 600M payable in six months time. The current exchange rate is as follows:

USh. /KSh. (spot rate) = 20.15 – 20.65

6 months forward (premium) 1.10 – 1.25

Determine the six-month forward exchange rate and the amount payable in six months time in Kenya Shillings.

| USh./KSh. (Spot rate) | 20.15 | 20.65 |

| 6 months forward (premium) | 1.10 – | 1.25 – |

| 6 months forward rate | 19.05 | 19.40 |

This is an indirect quote and in the case of an indirect quote, the bank buys high and sells low.

The Kenyan importer will be required to make payments in Ugandan Shillings in 6 months time. Hence, he will go to the bank to buy the Ugandan currency and hence, the bank will sell to him at:

1KSh. = USh.19.05.

? USh.600m

600M * 1 / 19.05 = Ksh 31.5m

From the forward exchange rate determined above, less amount of Ugandan shilling will be required in the future compared to the spot rate, this means that, the Uganda Shilling is appreciating while the Kenya shilling is depreciating.

A company faced with a foreign exchange risk can enter into a bidding agreement to buy or sell a specified quantity of the currency at a specified exchange rate and the future date. For example, a Kenyan exporter has exported goods to Tanzania and invoices the customer TZSh.500M payable in 3 months time. The following data is also available:

TSh./KSh. (spot rate) 12.50 – 12.90

3 months forward (discount) 1.20 – 1.10

Determine the equivalent of Ksh. receivable in 3 months time.

| TSh./KSh. (Spot rate) | 12.50 | 12.90 |

| 3 months forward (premium) | 1.20+ | 1.10+ |

| 3 months forward rate | 13.70 | 14.00 |

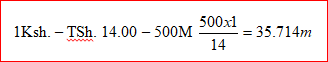

This is an indirect quote and in the case of an indirect quote the bank buys high and sells low. The forward rate would be the Kenyan exporter will receive Tz currency that he will sell to the bank and hence the bank will buy at:

Forward contract offer the following 2 advantages:

- Create certainty in the cash in flows and outflows hence assisting in cash budgeting.

- It guarantees the profit margin on any export since the exchange rate is fixed in advance.

(f) Use of Option

An option is a financial contract which gives one party the right but not an obligation to exercise the contract at some future date at a predetermined price, known as the exercise price (E). The party that has a right and not an obligation will be required to pay a non-refundable commitment fee known as the premium. There are normally two types of options i.e.:

(i) Call option

(ii) Put option

Call Option: This is an option that gives the buyer the right but not an obligation, to buy a specific number of the underlying security at a predetermined future date at a predetermined exercise price. Since in this case, the buyer is the one who has a right, he will be required to pay the premium. The value of the call option is calculated using the formula:

Vc = Max (MPS – E, O) MPS = Market price of security

Profit/Loss = Vc – Premium.

Example:

Consider a call option with the following characteristics:

- Exercise price is Sh.100.

- The premium per call option is Sh.10

- The time remaining to maturity is 3 months.

Assume the following market prices of the underlying security and the expiry date of the option and calculate the value of the call option.

| MPS | VC = Max (MPS-E, 0) | Profit/Loss VC – Premium |

| 80 | Max (80 – 100,0) = 0 | 0 – 10 = -10 |

| 90 | Max (90 – 100,0) = 0 | 0 – 10 = -10 |

| 100 | Max (100 – 100,0) = 0 | 0 – 10 = -10 |

| 110 | Max (110 – 100,0) = 10 | 10 – 10 = 0 |

| 120 | Max (120 – 100,0) = 20 | 20 – 10 = 10 |

| 130 | Max (130 – 100,0) = 30 | 30 – 10 = 20 |

| 140 | Max (140 – 100,0) = 40 | 40 – 10 = 30 |

Options are normally zero-sum games i.e. the gain to one individual is exactly equal to the loss to the other individual. Because of this the call option can be represented diagrammatic as shown below

In this case, the losses are limited to the premium while the profits are limited. Therefore through the use of an option contract, the investor is able to reduce the risk to a given specific level. An option is said to be:

- In the money: If it were exercised today, then profits will be realized.

- Out of the money: If it were exercised today then losses will be realized.

- At the money: If it were exercised today then no process of profit which will be realized i.e. at the break-even point.

Put Option – This is an option that gives the seller a right but not an obligation to sell a specific number of the underlying financial security at some future date at a pre-determined price, known as the exercise price. In this case, the seller will be required to pay the premium. The value of the put option is calculated using the formula:

Vp = Max (E – MPS, 0)

Profit/Loss = Vp – Premium

Example

Consider a put option with the following characteristic:

- Exercise price is Sh.50

- Premium per put option is Sh.5

- The time remaining 2 expiry is 6 months

Assume the following market price of the underlying security at the expiry date of the option and calculate the value of the put option and profit and loss and represent it graphically.

| MPS | VC = Max (MPS-E,0) | Profit/Loss VC – Premium |

| 20 | Max (50 – 20,0) = 30 | 30 – 5 = 25 |

| 40 | Max (50 – 40,0) = 10 | 10 – 5 = 5 |

| 45 | Max (50 – 45,0) = 5 | 5 – 5 = 0 |

| 50 | Max (50 – 50,0) = 0 | 0 – 5 = -5 |

| 60 | Max (50 – 60,0) = 0 | 0 – 5 = -5 |

| 100 | Max (50 – 100,0) = 0 | 0 – 5 = -5 |

(g) Use of SWAPS

A SWAP is a financial arrangement between two parties to exchange the cash flows, relating to a specific underlying obligation e.g. a Kenyan firm may wish to invest in the U.S market but it might borrow expensively in the US market because its credit worth is not known in the US market. Such a company can arrange a SWAP with a US company which also intends to borrow in the Kenyan market i.e. the Kenyan firm and the US firm will borrow on behalf of each other in their respective capital market, at the end of the specified period, the two companies will pay each other an amount that has been incurred on behalf of each other. There are normally two types of swaps i.e.:

- Interest rate swap

- Currency swap

Interest rate swap: Occurs when the two companies can borrow at different interest rate e.g. assume that firm A intends to borrow a long-term loan at a fixed interest rate. However, due to the company’s poor performance last year it can borrow at a fixed rate from a commercial bank at 15.5% p.a, also firm A can borrow at a variable rate equal to the base leading rate plus 0.5%. Further assume that there is firm B that due to its good performance last year can borrow at a fixed rate of 14% p.a. and at a variable rate equal to base leading rate. This information can be represented diagrammatically as shown below:

| Firm | Fixed rate | Variable rate |

| A | 15.5% | Base leading rate + 0.5% |

| B | 14.0% | Base leading rate |

Assume the amount to borrow is Sh.1m and determine how the two companies can use a swap to reduce their interest charges. A swap can be organized as follows:

- Firm A will request firm B to borrow on his behalf the Sh.1m at a fixed interest rate of 14% p.a while firm A will borrow the same amount on behalf of firm B at a variable interest rate = base lending rate + 0.5%.

- At the end of the period from A will pay firm B the interest expense incurred on his behalf which will be equal 14.0% of 1M = Sh.140,000.

- However, firm B will compensate firm A an interest expense equal to base lending rate x Sh.1m. Therefore firm A will incur an extra expense of borrowing on behalf of firm B which will be equal (0.5% x 1M = Sh.5, 000), therefore the total cost of this swap arrangement for firm A will be (140,000 + 5,000 = Sh.145, 000). However, if there was no swap arrangement, it could cost the firm A (15.5% x 1m = Sh.155,000). Therefore the gain to the swap arrangement will be (155,000 – 145,000 = 10,000)

Currency swap: This is similar to an interest rate swap, but the underlined obligations are different currencies e.g. consider a Ugandan firm which intend to borrow Kenya shilling to finance an investment project in Kenya. If the Ugandan company is not known in the Kenyan market, it will have to pay higher interest rate than the Kenyan firm would do in the Kenyan market. To arrange for a swap, the Ugandan company will identify a Kenyan firm having similar problems of borrowing Ugandan shillings. The two companies will then arrange the following swap:

- The Kenyan company will borrow Kenyan shilling and the Uganda firm will borrow an equivalent Ugandan shilling and the two firms will exchange currencies at the prevailing spot rate.

- The Ugandan firm will agree to pay the Kenyan firm the annual interest expense on the Kenyan loan and in return the Kenyan firm will also pay the Ugandan firm, the annual interest on the Uganda

- At the end of the period, the two companies will swap back, the principle amount of the loan; this will be at the prevailing spot rate or at the pre-determined exchange rate in order to avoid the foreign exchange rate fluctuation.

By using this swap arrangement, each company has taken advantage of the other company’s credit worthiness in its respective capital market hence reducing its financing.

There are several risks associated with saps, some of them include:

- Credit risk – is the risk that the counter part to the swap arrangement may default to call out its obligation before the end of the swap period. This risk can be reduced by having a reputable bank as an intermediary to the swap arrangement.

- Market risk is the risk that the interest rate or exchange rate will move unfavorably against the company after the company has committed itself to the swap arrangement.

- Mismatch risk – This is the risk that the bank that has been used as an intermediary may not be able to cull out its obligations if the other party to the swap arrangement default.

- Sovereign risk – This is the risk associated with the country in whose currency a swap has been arranged. It includes political instability and the possibility of exchange rate controls being introduced by the government.

Advantages of Swap

- Enables the company to access capital market which the company is not able to approach directly.

- By the use of swaps the company is able to be charged favourable interest rates.

- Swaps are flexible since they can be arranged for any amount of money for different period.

(h) Use of money market hedge

A money market is a market where companies and individuals can borrow and lend money as short as overnight period and as long as 12 month period. The borrowing and lending interest rate in the money market is always quoted in nominal terms i.e per annum interest rate adjusted for inflation. Therefore if the borrowing or lending is less than 12 months, it has to be converted into an equivalent period e.g if the interest rate is 10% p.a then at 3 months interest rate will be (3/12 x 10% = 2.5%).

The money market hedge uses the matching principle i.e. for every current asset (amount receivable) a corresponding current liability (amounts payable) has to be created by borrowing. Also for every current liability a corresponding current asset has to be created by depositing some money. For example, suppose a Kenyan company has exported goods to Tanzania and he has invoiced the customer Tanzanian shillings 900m on a 3 months credit, other relevant data is as follows:

TSh./KSh. (spot) 15.58 – 15.62

3 months forward TSh./KSh. 15.84 – 15.88

Money market interest rates:

| Deposit | Loan | |

| TSh. | 7% | 9% |

| KSh. | 5% | 8% |

Required:

Evaluate the forward market and the money market hedge and recommend the best alternative to the Kenyan exporter.

Alternative 1:

Forward market

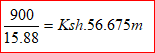

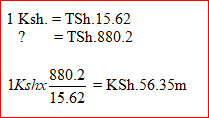

This is an indirect quote and in the case of an indirect quote the bank buys high and sells low. The Kenyan exporter will receive Tanzania shilling in 3 months time that he will sell to the bank and hence the bank will buy at:

1Ksh. = TSh.15.88

? = TSh.900m

Alternative 2

Money market hedge

This method always uses the spot rate. In this case, the Kenyan exporter has a short term asset i.e. amount receivable from export in 3 months time. He will therefore hedge using this method as follows:

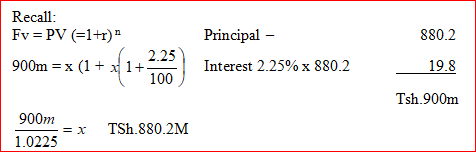

- Create a current liability by borrowing an amount from Tanzania at an interest rate of 9% p.a. therefore the interest rate for 3 months will be (3/12 x 9 = 2.75%). The amount borrowed plus the accrued interest for 3 months will be equal to the amount receivable from the exports in 3 months time that will be equal to 900M. Therefore the amount to borrow will be:

2. The TSh.880.2M borrowed is converted immediately at the spot rate into Kenya shilling.

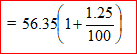

- This money is deposited in the Kenyan bank earning an interest rate of 5% p.a. therefore the interest rate for 3 months will be (3/12 x 5 = 1.25%). Therefore the value of these funds after 3 months will be:

FV = PV (1 + r) n

= 56.35(1.0125)

= Sh.57.054m

- In 3 month’s time, when the TSh.900m export is received it will be used to pay off the TSh.880.2m borrowed plus the accrued interest which by then will have totaled to TSh.900m. The comparison will then be made as follows.

| Hedging technique | Amount receivable (KSh.) |

| Forward contract | 56.675m |

| Money market hedge | 57.054m |

Select the money market hedge since it promises higher returns.

Example 2

Suppose a Kenyan importer has imported from Tanzania, and has been invoiced TSh.280M payable in 6 months time. The following data is also available:

| TSh./KSh. (Spot) | 15.24 | 15.25 |

| 6 months forward TSh./KSh. | 14.98 | 15.03 |

| Money market interest rate | Deposit | Loan |

| TSh. | 5% | 9% |

| KSh. | 9% | 10% |

Evaluate the forward market and the money market hedging technique and recommend the best alternative.

Alternative 1

Forward Market:

Indirect quote – bank buys high and sells low.

In this case the Kenyan importer will require the Tanzania currency in six months time in order to make payment. Therefore the importer will go to the bank to buy the Tanzania Shilling hence the bank will sell.

1KSh. = TSh.14.98

? = TSh.280m

Amount to be:

![]()

= KSh.18.692m