IAS 12 – INCOME TAXES

IAS 12, Income Taxes, deals with taxes on income, both current tax and deferred tax. Income tax accounting is complex, and preparers and users find some aspects difficult to understand and apply. These difficulties arise from exceptions to the principles in the current standard, and from areas where the accounting does not reflect the economics of the transactions.

Objective

The objective of IAS 12 is to prescribe the accounting treatment for income taxes.

Definitions

Accounting profit

This is the net profit (or loss) for the reporting period before deducting tax expense.

Taxable Profit

This is the profit (or loss) for a period, determined in accordance with the local tax authority’s rules, upon which income taxes are payable.

Tax Expense

Tax in the statement of profit or loss may consist of three elements:

- Current tax expense

- Adjustments to tax charges of prior periods (over/under provisions) Transfers to/from deferred tax.

CURRENT TAX

This is the amount of income tax payable (or recoverable) to tax authorities in relation to the current trading activities and the taxable profit (or loss) for the current period.

Measurement of Current Tax

The current tax expense for a period is based on the taxable and deductible amounts that will be shown on the tax return for the current year.

IAS 12 requires any unpaid tax in respect of the current or prior periods to be recognised as a liability. Conversely, any excess tax paid in respect of current or prior periods over what is due should be recognised as an asset to the extent it is probable that it will be recoverable.

The tax rate to be used in the calculation for determining a current tax asset or liability is the rate that is expected to apply when the asset is expected to be recovered, or the liability to be paid. These rates should be based upon tax laws that have already been enacted (are already part of law) or substantively enacted (have already passed through sufficient parts of the legal process that they are virtually certain to be enacted) by the reporting date.

Accounting for Current Tax

In most jurisdictions, tax is paid several months after the end of the accounting period. At the period end, an estimated amount is accrued based on the year‘s profits:

Dr Income tax e xpense (P&L) estimated tax charge

Cr Tax payable (liability in SOFP) estimated tax charge

When the tax is actually paid some months later, it is recorded by:

Dr Tax payable (SFP) amount paid

Cr Cash amount paid.

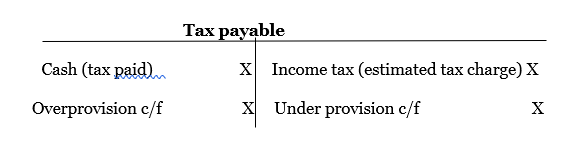

Since the amount paid is likely to differ from the estimated tax charge originally accrued, a balance is left on the tax payable account:

An overprovision arises where the actual tax paid is less than the estimated tax charge. This reduces the following year‘s tax charge in the statement of profit or loss.

An underprovision arises where the actual tax paid is more than the estimated charge. This increases the following year‘s tax charge in the statement of profit or loss.

Recognition of current tax

Normally, current tax is recognised as income or expense and included in the net profit or loss for the period. However, where tax arises from a transaction or event which is recognised as other comprehensive income recognised directly in equity (in the same or a different period) rather than in profit or loss, then the related tax should also be reported as other comprehensive income or reported directly in equity. An example of such a situation is where, under IAS 8, an adjustment is made to the opening balance of retained earnings due to either a change in accounting policy that is applied retrospectively, or to the correction of a material error. Any related tax is therefore also recognised directly in equity.

Presentation

Statement of financial position, tax assets and liabilities should be shown separately. Current tax assets and liabilities may be offset, only under the following conditions.

- The entity has a legally enforceable right to set off the recognised amounts.

- The entity intends to settle the amounts on a net basis, or to realise the asset and settle the liability at the same time.

The tax expense (income) related to the profit or loss from ordinary activities should be shown on the face of the statement of profit or loss and other comprehensive income as part of profit or loss for the period.

Summary: Accounting for Current Tax

- Current taxes include tax payable for current period and adjustment of under/over provision of prior periods

- Current taxes are to be treated as an expense

- If the tax expense and the provision at the end of the year are greater than the payment, the shortfall in the payment will be disclosed as a current tax liability and vice versa.

DEFERRED TAX

A mismatch can occur because International Financial Reporting Standards (IFRS) recognition criteria for items of income and expense are different from the treatment of items under tax law. Deferred taxation accounting attempts to deal with this mismatch. The IAS 12 standard is based on the temporary differences between the tax base of an asset or liability and its carrying amount in the financial statements.

Tax Base

This is the amount attributed to an asset or liability for tax purposes, based on the expected manner of recovery.

IAS 12 focuses on the future tax consequences of recovering an asset only to the extent of its carrying amount at the date of the financial statements. Future taxable amounts arising from recovery of the asset will be capped at the asset’s carrying amount.

For example, a property may be revalued upwards but not sold, creating a temporary difference because the carrying amount of the asset in the financial statements is greater than the tax base of the asset. The tax consequence is a deferred tax liability.

Tax base-Asset

The tax base of an asset is the value of the asset in the current period for tax purposes. This is either;

- The amount that will be tax deductible in the future against taxable economic benefits when the carrying amount of the asset is recovered, or

- If those economic benefits are not taxable, the tax base is equal to the carrying amount of the asset.

Tax base-Liability

- The tax base of a liability is its carrying amount less any amount that will be tax deductible in the future.

- For revenue received in advance, the tax base of the resulting liability is its carrying amount less any amount of the revenue that will not be taxable in future periods.

Revenue received in advance.

The tax base of the recognised liability is its carrying amount, less revenue that will not be taxable in future periods

Unrecognised items.

If items have a tax base but are not recognised in the statement of financial position, the carrying amount is nil

Tax bases not immediately apparent.

If the tax base of an item is not immediately apparent, the tax base should effectively be determined in such as manner to ensure the future tax consequences of recovery or settlement of the item is recognised as a deferred tax amount

Consolidated financial statements.

In consolidated financial statements, the carrying amounts in the consolidated financial statements are used, and the tax bases determined by reference to any consolidated tax return (or otherwise from the tax returns of each entity in the group).

CASES OF NO DEFERRED TAX

IAS 12 states that in the following circumstances, the tax base of an asset or liability will be equal to its carrying amount:

- Accrued expenses that have already been deducted in determining an entity’s tax liability for the current or earlier periods.

- A loan payable that is measured at the amount originally received and this amount is the same as the amount repayable on final maturity of the loan. Accrued income that will never be taxable.

ACCOUNTING FOR DEFERRED TAX

Deferred tax liabilities are the amounts of income taxes payable in future periods in respect of taxable temporary differences.

In simple terms, deferred tax is tax that is payable in the future. However, to understand this definition more fully, it is necessary to explain the term ‗taxable temporary differences‘.

Deferred tax assets are the amounts of income taxes recoverable in future periods in respect of:

- Deductible temporary differences

- The carry forward of unused tax losses

- The carry forward of unused tax credits

A deferred tax asset is recognised to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be used. This also applies to deferred tax assets for unused tax losses carried forward.

This is an application of prudence concept.

Reassessment of unrecognised deferred tax assets

For all unrecognised deferred tax assets, at each reporting date an entity should reassess the availability of future taxable profits and whether part or all of any unrecognised deferred tax assets should now be recognised. This may be due to an improvement in trading conditions which is expected to continue.

TEMPORARY DIFFERENCES

Temporary differences are differences between the carrying amount of an asset or liability in the SOFP and its tax base.

Temporary differences may be of two types:

- Taxable temporary differences are temporary differences that will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled.

IAS 12 requires that a deferred tax liability is recorded in respect of all taxable temporary differences that exist at the year-end – this is sometimes known as the full provision method.

Within financial statements, non-current assets with a limited economic life are subject to depreciation. However, within tax computations, non-current assets are subject to capital allowances (also known as tax depreciation) at rates set within the relevant tax legislation. Where at the year-end the cumulative depreciation charged and the cumulative capital allowances claimed are different, the carrying value of the asset (cost less accumulated depreciation) will then be different to its tax base (cost less accumulated capital allowances) and hence a taxable temporary difference arises.

Examples

A taxable temporary difference occurs when:

- Depreciation or amortisation is accelerated for tax purposes

- Development costs capitalised in the statement of financial position deducted against taxable profit when the expenditure was incurred

- Interest income is included in the statement of financial position when earned, but included in taxable profit when the cash is actually received

- Prepayments in the statement of financial position deducted against taxable profits when the cash expense was incurred

- Revaluation/Fair value adjustment of assets with no adjustment of the tax base.

- Deferred tax on impairment where these adjustments are ignored for tax purposes until the asset is sold.

- Deductible temporary differences are temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled.

A deferred tax asset (DTA) shall be recognised for all deductible temporary differences to the extent it is probable that taxable profit will be available against which the deductible temporary difference can be utilised.

Provisions, accrued product warranty costs for which the taxation laws do not permit the deduction until the company actually pays the claims. This is a deductible difference as its taxable profits for the current period will be higher than those in future, when they will be lower.

Calculation of Deferred taxes

Deferred tax assets and deferred tax liabilities can be calculated using the following formulae:

Temporary difference = Carrying amount – Tax base

Deferred tax asset or liability = Temporary difference x Tax rate

The following formula can be used in the calculation of deferred taxes arising from unused tax losses or unused tax credits:

Deferred tax asset = Unused tax loss or unused tax credits x Tax rate

Measurement of deferred tax assets and liabilities

Deferred tax is provided in full for all temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements.

Tax rates

- Measurement shall be at the tax rates expected to apply to the period when the asset is realised or liability is settled.

- The rates used shall be those enacted or substantially enacted by the end of the reporting period.

- Measurement depends upon the expectations about the manner in which the recovery of tax asset or settlement of tax liability will take place.

- Deferred tax expense is recognized as an expense in statement of profit or loss. If the tax relates to items that are credited or charged directly to equity, then this current tax and deferred tax shall also be charged or credited directly to

- A change in tax rates or tax laws, a reassessment of the recoverability of deferred tax assets or a change in the expected manner of recovery of an asset have tax consequences that are recognised in profit or loss, except to the extent that they relate to items previously charged or credited outside profit or loss.

- The measurement of deferred tax liabilities and deferred tax assets reflects the tax consequences of the manner in which the entity expects to recover or settle the carrying amount of its assets and liabilities. The expected manner of recovery for land with an unlimited life is always through sale, but for other assets the manner in which management expects to recover the asset, either through use or sale or both, should be considered at each date of the financial statements.

- Where the tax rate or tax base is impacted by the manner in which the entity recovers its assets or settles its liabilities (e.g. whether an asset is sold or used), the measurement of deferred taxes is consistent with the way in which an asset is recovered or liability settled

- Where deferred taxes arise from revalued non-depreciable assets (e.g. revalued land), deferred taxes reflect the tax consequences of selling the asset

- Deferred taxes arising from investment property measured at fair value under IAS 40 Investment Property reflect the rebuttable presumption that the investment property will be recovered through sale

- If dividends are paid to shareholders, and this causes income taxes to be payable at a higher or lower rate, or the entity pays additional taxes or receives a refund, deferred taxes are measured using the tax rate applicable to undistributed profits

Discounting

- In the case of deferred tax assets and liabilities, the values are not to be discounted. Deferred tax assets and liabilities should not be discounted because the complexities and difficulties involved will affect reliability and comparability would be affected.

However that where carrying amounts of assets or liabilities are discounted (e.g. a pension obligation), the temporary difference is determined based on a discounted value.

RECOGNITION OF DEFERRED TAX IN THE FINANCIAL STATEMENTS

The deferred tax amount calculated is recorded as a deferred tax balance in the statement of financial position with a corresponding entry to the tax charge, other comprehensive income or goodwill.

Principles of recognition

As with current tax, deferred tax should normally be recognised as income or an expense amount within the tax charge, and included in the net profit or loss for the period. Only the movement in the deferred tax asset / liability on the statement of financial position is recorded:

Dr Tax charge X

Cr Deferred tax liability X

Or

Dr Deferred tax asset X

Cr Tax charge X

Note that the recognition of a deferred tax asset may be restricted

Therefore, the movement in the deferred tax liability in the year is recorded in the statement of profit or loss where:

- an increase in the liability, increases the tax expense a decrease in the liability, decreases the tax expense.

The closing figures are reported in the Statement of Financial Position as the deferred tax liability.

Exceptions to recognition in profit or loss

- Deferred tax relating to items dealt with as other comprehensive income (such as a revaluation) should be recognised as tax relating to other comprehensive income within the statement of comprehensive income.

- Deferred tax relating to items dealt with directly in equity (such as the correction of an error or retrospective application of a change in accounting policy) should also be recognised directly in equity.

- Deferred tax resulting from a business combination is included in the initial cost of goodwill (This is covered in more detail later in the chapter).

- Initial recognition of an asset or liability in a transaction that is not a business combination and that affects neither accounting profit nor taxable profit.

- Investments in subsidiaries, branches, associates and joint ventures where certain criteria apply.

Where it is not possible to determine the amount of current/deferred tax that relates to other comprehensive income and items credited/charged to equity, such tax amounts should be based on a reasonable pro rata allocation of the entity’s current/deferred tax.

COMPONENTS OF DEFERRED TAX

Deferred tax charges will consist of two components:

- Deferred tax relating to temporary differences.

- Adjustments relating to changes in the carrying amount of deferred tax assets/ liabilities (where there is no change in temporary differences), eg changes in tax rates/ laws, reassessment of the recoverability of deferred tax assets, or a change in the expected recovery of an asset

Common scenarios

There are a number of common examples which result in a taxable or deductible temporary difference. This list is not, however exhaustive.

TAXABLE TEMPORARY DIFFERENCES

Accelerated capital allowances

- These arise when capital allowances for tax purposes are received before deductions for accounting depreciation are recognised in the statement of financial position (accelerated capital allowances).

- The temporary difference is the difference between the carrying amount of the asset at the reporting date and its tax written down value (tax base).

- The resulting deferred tax is recognised in profit or loss.

Interest revenue

- In some jurisdictions interest revenue may be included in profit or loss on an accruals basis, but taxed when received.

- The temporary difference is equivalent to the income accrual at the reporting date as the tax base of the interest receivable is nil.

- The resulting deferred tax is recognised in profit or loss.

Development costs

- Development costs may be capitalised for accounting purposes in accordance with IAS 38 while being deducted from taxable profit in the period incurred (i.e. they receive immediate tax relief).

- The temporary difference is equivalent to the amount capitalised at the reporting date as the tax base of the costs is nil since they have already been deducted from taxable profits. The resulting deferred tax is recognised in profit or loss.

Revaluations to fair value-property, plant and equipment

IFRS permits or requires some assets to be revalued to fair value, e.g. property, plant and equipment under IAS 16.

Temporary difference

In some jurisdictions a revaluation will affect taxable profit in the current period. In this case, no temporary difference arises as both carrying value and the tax base are adjusted.

In other jurisdictions, including the UK, the revaluation does not affect taxable profits in the period of revaluation and consequently, the tax base of the asset is not adjusted. Hence a temporary difference arises.

This should be provided for in full based on the difference between carrying amount and tax base.

An upward revaluation will therefore give rise to a deferred tax liability, even if:

- The entity does not intend to dispose of the asset

- Tax due on any future gain can be deferred through rollover relief

This is because the revalued amount will be recovered through use which will generate taxable income in excess of the depreciation allowable for tax purposes in future periods.

Manner of recovery

The carrying amount of a revalued asset may be recovered

- Through sale, or

- Through continued use.

The manner of recovery may affect the tax rate applicable to the temporary difference, and / or the tax base of the asset.

Recording deferred tax

As the underlying revaluation is recognised as other comprehensive income, so the deferred tax thereon is also recognised as part of tax relating to other comprehensive income. The accounting entry is therefore:

Dr Tax on other comprehensive income X

Cr Deferred tax liability X

Non-depreciated revalued assets

Recovery of Revalued Non-Depreciable Assets requires that deferred tax should be recognised even where non-current assets are not depreciated (e.g. land). This is because the carrying value will ultimately be recovered on disposal.

Revaluations to fair value – other assets

IFRS permit or require certain other assets to be revalued to fair value, for example:

Certain financial instruments under IFRS 9 Investment properties under IAS 40

Where the revaluation is recognised in profit or loss (e.g. fair value through profit or loss instruments, investment properties) and the amount is taxable / allowable for tax, and then no deferred tax arises as both the carrying value and the tax base are adjusted.

Where the revaluation is recognised as other comprehensive income (e.g. financial assets at fair value through other comprehensive income) and does not therefore impact taxable profits, then the tax base of the asset is not adjusted and deferred tax arises. This deferred tax is also recognised as other comprehensive income.

Retirement benefit costs

In the financial statements, retirement benefit costs are deducted from accounting profit as the service is provided by the employee. They are not deducted in determining taxable profit until the entity pays either retirement benefits or contributions to a fund. Thus a temporary difference may arise.

- A deductible temporary difference arises between the carrying amount of the net defined benefit liability and its tax base. The tax base is usually nil.

- The deductible temporary difference will normally reverse.

- A deferred tax asset is recognised for this temporary difference to the extent that it is recoverable, that is sufficient profit will be available against which the deductible temporary difference can be utilised.

- If there is a net defined benefit asset for example when there is a surplus in the pension plan, a taxable temporary difference arises and a deferred tax liability is recognised.

Under IAS 12, both current and deferred tax must be recognised outside profit or loss if the tax relates to items that are recognised outside profit or loss. This could make things complicated as it interacts with IAS 19 Employee benefits.

IAS 19 allows a choice of accounting policy regarding recognition of actuarial gains and losses:

- In profit or loss either in the period in which they occur or deferred on a systematic basis In other comprehensive income in the period in which they occur.

It may be difficult to determine the amount of current and deferred tax that relates to items recognised in profit or loss or in other comprehensive income. As an approximation, current and deferred taxes are allocated on an appropriate basis, often pro rata.

Deferred tax movement relating to the actuarial losses

IAS 12 Income Taxes requires deferred tax relating to items charged or credited to other comprehensive income to be recognised in other comprehensive income hence the amount of the deferred tax movement relating to the actuarial losses charged directly to OCI must be split out and credited directly to OCI.

Dividends receivable from overseas companies

- Dividends received from UK companies are not taxable on other UK companies. Dividends received from overseas companies, however, are.

- Overseas dividends receivable may be included in profit or loss on an accruals basis, but taxed when received.

- The temporary difference is equal to the dividend receivable (asset) at the reporting date, as the tax base of the dividend receivable is nil.

- The calculation of deferred tax should take into account any double taxation relief which may be available.

- The deferred tax arising is recognised in profit or loss.

DEDUCTIBLE TEMPORARY DIFFERENCES

Tax losses

Where tax losses arise, the manner of recognition of these in the financial statements depends upon how they are expected to be utilised.

- If losses are carried back to crystallise a refund, then a receivable is recorded in the statement of financial position and the corresponding credit is to the current tax charge.

- If losses are carried forward to be used against future profits or gains, then they should be recognised as deferred tax assets to the extent that it is probable that future taxable profit will be available against which the losses can be used.

Unused tax credits carried forward against taxable profits will also give rise to a deferred tax asset to the extent that profits will exist against which they can be utilised.

Recognition of deferred tax asset

The existence of unused tax losses is strong evidence that future taxable profit may not be available. The following should be considered before recognising any deferred tax asset:

- Whether an entity has sufficient taxable temporary differences against which the unused tax losses can be offset

- Whether it is probable that the entity will have taxable profits before the unused tax losses expire

- Whether the tax losses result from identifiable causes which are unlikely to recur

- Whether tax planning opportunities are available to create taxable profit Group tax relief

Where the acquisition of a subsidiary means that tax losses which previously could not be utilised, can now be utilised against the profits of the subsidiary, a deferred tax asset may be recognised in the financial statements of the parent company. This amount is not taken into account in calculating goodwill arising on acquisition.

Provisions

- A provision is recognised for accounting purposes when there is a present obligation, but it is not deductible for tax purposes until the expenditure is incurred

- In this case, the temporary difference is equal to the amount of the provision, since the tax base is nil Deferred tax is recognised in profit or loss

Share based payments

Share-based transactions may be tax deductible in some jurisdictions. However, the amount deductible for tax purposes does not always correspond to the amount that is charged to profit or loss under IFRS 2.

In most cases it is not just the amount but also the timing of the expense allowable for tax purposes that will differ from that required by IFRS 2.

For example an entity recognises an expense for share options granted under IFRS 2, but does not receive a tax deduction until the options are exercised. The tax deduction will be based on the share price on the exercise date and will be measured on the basis of the options’ intrinsic value ie the difference between market price and exercise price at the exercise date. In the case of share-based employee benefits under IFRS 2 the cost of the services as reflected in the financial statements is expensed and therefore the carrying amount is nil.

The difference between the carrying amount of nil and the tax base of share-based payment expense received to date is a deferred tax asset, provided the entity has sufficient future taxable profits to utilise this deferred tax asset

The deferred tax asset temporary difference is measured as:

$

Carrying amount of share-based payment expense 0

Less: tax base of share-based payment expense (X)

(estimated amount tax authorities will permit as a deduction in future periods, based on year end information)

Temporary difference (X)

Deferred tax asset at X% X

If the amount of the tax deduction (or estimated future tax deduction) exceeds the amount of the related cumulative remuneration expense, this indicates that the tax deduction relates also to an equity item.

The excess is therefore recognised directly in equity. The diagrams below show the accounting for equitysettled and cash-settled transactions.

DEFERRED TAX ARISING FROM A BUSINESS COMBINATION

Fair value adjustments on consolidation

IFRS 3 requires assets acquired on acquisition of a subsidiary or associate to be recognized at their fair value rather than their carrying amount in the individual financial statements of the subsidiary. The fair value adjustment does not, however, have any impact on taxable profits or the tax base of the asset. This is much like a revaluation in an individual company’s accounts.

Therefore, an upwards fair value adjustment made to an asset will result in the carrying value of the asset exceeding the tax base and so a taxable temporary difference will arise.

The resulting deferred tax liability is recorded in the consolidated accounts by:

Dr Goodwill (group share)

Cr Deferred tax liability

Undistributed profited of subsidiaries, branches, associated and joint ventures

- The carrying amount of, for example, a subsidiary in consolidated financial statement is equal to the group share of the net assets of the subsidiary plus purchased goodwill.

- The tax base is usually equal to the cost of the investment.

- The difference between these two amounts is a temporary difference. It can be calculated as the parent‘s share of the subsidiary‘s post acquisition profits which have not been distributed. Recognition of deferred tax

A deferred tax liability should be recognized on the temporary difference unless:

- The parent / investor / venture is able to control the timing of the reversal of the temporary difference, and

- It is probable that the temporary difference will not reverse (i.e. the profits will not be paid out) in the foreseeable future.

This can be applied to different levels of investment as follows:

- Subsidiary

As a parent company can control the dividend policy of a subsidiary, deferred tax will not arise in relation to undistributed profits.

- Associate

An investor in an associate does not control that entity and so cannot determine its dividend policy. Without an agreement requiring that the profits of the associate should not be distributed in the foreseeable future, therefore, an investor should recognize a deferred tax liability arising from taxable temporary differences associated with its investment in the associate. Where an investor cannot determine the exact amount of tax, but only a minimum amount, then the deferred tax liability should be that amount.

- Joint venture

In a joint venture, the agreement between the parties usually deals with profit sharing. When a venture can control the sharing of profits and it is probable that the profits will not be distribute in the foreseeable future, a deferred liability is not recognized.

Changes in foreign exchange rates

Where a foreign operation‘s taxable profit or tax loss (and therefore the tax base of its non-monetary assets and liabilities) is determined in a foreign currency, changes in the exchange rate give rise to taxable or deductible temporary differences.

These relate to the foreign entity‘s own assets and liabilities, rather than to the reporting entity‘s investment in that foreign operation, and so the reporting entity should recognize the resulting deferred tax liability or asset, both these are probable:

- That the temporary difference will reverse in the foreseeable future, and

- That taxable profit will be available against which the temporary difference can be utilized.

DEDUCTIBLE TEMPORARY DIFFERENCES

Unrealised profits on intra-group trading

- From a tax perspective, one group company selling goods to another group company is taxed on the resulting profit in the period that the sale is made.

- From an accounting perspective no profit is realized until the recipient group company sells the goods to a third party outside the group. This may occur in a different accounting period from that in which the initial group sale is made.

- A temporary difference therefore arises equal to the amount of unrealized intra-group profit. This is the difference between:

- Tax base, being cost to the recipient company (i.e. cost to selling company plus unrealized intragroup profit on sale to the recipient company)

- Carrying value to the group, being the original cost to the selling company, since the intra-group profit is eliminated on consolidation

- Deferred tax is provided on consolidation

Fair value adjustments

IFRS 3 requires assets and liabilities acquired on acquisition of a subsidiary or associate to be brought in at their fair value rather than the carrying amount. The fair value adjustment does not, however, have any impact on taxable profits or the tax base of the asset.

Therefore a fair value adjustment which increases a recognized liability or creates a new liability will result in the tax base of the liability exceeding the carrying value and so deductible temporary difference will arise.

A deductible temporary difference also arises where an asset‘s carrying amount is reduced to a fair value less than its tax base.

The resulting deferred tax asset is recorded in the consolidated accounts by:

Dr Deferred tax asset X

Cr Goodwill X

Deferred tax assets of an acquired subsidiary

Deferred tax assets of a subsidiary may not satisfy the criteria for recognition when a business combination is initially accounted for but may be realized subsequently.

These should be recognized as follows:

- If recognized within 12 months of the acquisition date and resulting from new information about circumstances existing at the acquisition date, the credit entry should be made to goodwill. If the carrying amount of goodwill reduced to zero, any further amounts should be recognized in profit or loss.

- If recognized outside the 12 months ‗measurement period‘ or not resulting from new information about circumstances existing at the acquisition date, the credit entry should be made to profit or loss.

PRESENTATION AND DISCLOSURE

Presentation

Current tax assets and current tax liabilities can only be offset in the statement of financial position if the entity has the legal right and the intention to settle on a net basis.

Deferred tax assets and deferred tax liabilities can only be offset in the statement of financial position if the entity has the legal right to settle current tax amounts on a net basis and the deferred tax amounts are levied by the same taxing authority on the same entity or different entities that intend to realise the asset and settle the liability at the same time.

The amount of tax expense (or income) related to profit or loss is required to be presented in the statement(s) of profit or loss and other comprehensive income.

The tax effects of items included in other comprehensive income can either be shown net for each item, or the items can be shown before tax effects with an aggregate amount of income tax for groups of items (allocated between items that will and will not be reclassified to profit or loss in subsequent periods).

Disclosure

IAS 12 requires the following disclosures:

- Major components of tax expense (tax income). Examples include:

- Current tax expense (income) o Any adjustments of taxes of prior periods

- Amount of deferred tax expense (income) relating to the origination and reversal of temporary differences

- Amount of deferred tax expense (income) relating to changes in tax rates or the imposition of new taxes

- Amount of the benefit arising from a previously unrecognised tax loss, tax credit or temporary difference of a prior period

- Write down, or reversal of a previous write down, of a deferred tax asset o Amount of tax expense (income) relating to changes in accounting policies and corrections of errors.

IAS 12 further requires the following disclosures:

- Aggregate current and deferred tax relating to items recognised directly in equity

- Tax relating to each component of other comprehensive income

- Explanation of the relationship between tax expense (income) and the tax that would be expected by applying the current tax rate to accounting profit or loss (this can be presented as a reconciliation of amounts of tax or a reconciliation of the rate of tax)

- Changes in tax rates

- Amounts and other details of deductible temporary differences, unused tax losses, and unused tax credits

- Temporary differences associated with investments in subsidiaries, branches and associates, and interests in joint arrangements

- For each type of temporary difference and unused tax loss and credit, the amount of deferred tax assets or liabilities recognised in the statement of financial position and the amount of deferred tax income or expense recognised in profit or loss

- Tax relating to discontinued operations

- Tax consequences of dividends declared after the end of the reporting period

- Information about the impacts of business combinations on an acquirer’s deferred tax assets Recognition of deferred tax assets of an acquiree after the acquisition date.

Other required disclosures:

- Details of deferred tax assets

- Tax consequences of future dividend payments.

In addition to the disclosures required by IAS 12, some disclosures relating to income taxes are required by IAS 1 Presentation of Financial Statements, as follows:

- Disclosure on the face of the statement of financial position about current tax assets, current tax liabilities, deferred tax assets, and deferred tax liabilities

- Disclosure of tax expense (tax income) in the profit or loss section of the statement of profit or loss and other comprehensive income (or separate statement if presented).

Deferred tax and the framework

As we have seen, IAS 12 considers deferred tax by taking a balance sheet approach to the accounting problem by considering temporary differences in terms of the difference between the carrying values and the tax values of assets and liabilities – also known as the valuation approach. This can be said to be consistent with the IASB Framework‘s approach to recognition within financial statements. However, the valuation approach is applied regardless of whether the resulting deferred tax will meet the definition of an asset or liability in its own right.

Thus, IAS 12 considers the overriding accounting issue behind deferred tax to be the application of matching – ensuring that the tax consequences of an item reported within the financial statements are reported in the same accounting period as the item itself.

For example, in the case of a revaluation surplus, since the gain has been recognised in the financial statements, the tax consequences of this gain should also be recognised – that is to say, a tax charge. In order to recognise a tax charge, it is necessary to complete the double entry by also recording a corresponding deferred tax liability.

However, part of the Framework‘s definition of a liability is that there is a ‗present obligation‘. Therefore, the deferred tax liability arising on the revaluation gain should represent the current obligation to pay tax in the future when the asset is sold. However, since there is no present obligation to sell the asset, there is no present obligation to pay the tax.

Therefore, it is also acknowledged that IAS 12 is inconsistent with the Framework to the extent that a deferred tax asset or liability does not necessarily meet the definition of an asset or liability.