Definition of a group reorganisation

A group reorganisation (or restructuring) is any of the following:

- the transfer of shares in a subsidiary from one group entity to another

- the addition of a new parent entity to a group

- the transfer of shares in one or more subsidiaries of a group to a new entity that is not a group entity but whose shareholders are the same as those of the group’s parent

- the combination into a group of two or more companies that before the combination had the same shareholders

- the acquisition of the shares of another entity that itself then issues sufficient shares so that the acquired entity has control of the combined entity.

Reasons for a reorganisation

There are a number of reasons why a group may wish to reorganise.

These include the following.

- A group may wish to list on a public stock exchange. This is usually facilitated by creating a new holding company and keeping the business of the group in subsidiary entities.

- The ownership of subsidiaries may be transferred from one group company to another. This is often the case if the group wishes to sell a subsidiary, but retain its trade.

- The group may decide to transfer the assets and trades of a number of subsidiaries into one entity. This is called divisionalisation and is undertaken in order to simplify the group structure and save costs.

The details of divisionalisation are not examinable at P2.

- There may be corporate tax advantages to reorganising a group structure, particularly if one or more subsidiaries within the group is loss-making.

- The group may split into two or more parts; each part is still owned by the same shareholders but is not related to the other parts. This is a demerger and is often done to enhance shareholder value. By splitting the group, the value of each part is realised whereas previously the stock market may have undervalued the group as a whole. The details of demergers are not examinable at P2.

- An unlisted entity may purchase a listed entity with the aim of achieving a stock exchange listing itself. This is called a reverse acquisition.

Types of group reorganisation

There are a number of ways of effecting a group reorganisation. The type of reorganisation will depend on what the group is trying to achieve.

New holding company

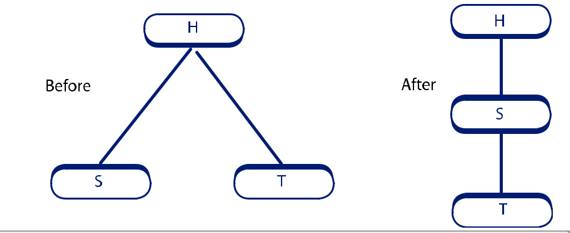

A group might set up a new holding entity for an existing group in order to improve co-ordination within the group or as a vehicle for flotation.

- H becomes the new holding entity of S.

- Usually, H issues shares to the shareholders of S in exchange for shares of S, but occasionally the shareholders of S may subscribe for shares in H and H may pay cash for S.

IFRS 3 excludes from its scope any business combination involving entities or businesses under ‘common control’, which is where the same parties control all of the combining entities/businesses both before and after the business combination.

As there is no mandatory guidance in accounting for these items, the acquisition method should certainly be used in examination questions.

Change of ownership of an entity within a group

This occurs when the internal structure of the group changes, for example, a parent may transfer the ownership of a subsidiary to another of its subsidiaries.

The key thing to remember is that the reorganisation of the entities within the group should not affect the group accounts, as shareholdings are transferred from one company to another and no assets will leave the group.

The individual accounts of the group companies will need to be adjusted for the effect of the transfer.

The following are types of reorganisation:

- Subsidiary moved up

This can be achieved in one of two ways.

- S transfers its investment in T to H as a dividend in specie. If this is done then S must have sufficient distributable profits to pay the dividend.

- H purchases the investment in T from S for cash. In practice the purchase price often equals the fair value of the net assets acquired, so that no gain or loss arises on the transaction.

Usually, it will be the carrying value of T that is used as the basis for the transfer of the investment, but there are no legal rules confirming this.

A share-for-share exchange cannot be used as in many jurisdictions it is illegal for a subsidiary to hold shares in the parent company.

- Subsidiary moved down

This reorganisation may be carried out where there are tax advantages in establishing a ‘sub-group’, or where two or more subsidiaries are linked geographically.

This can be carried out either by:

- a share-for-share exchange (S issues shares to H in return for the shares in T)

- a cash transaction (S pays cash to H).

- Subsidiary moved along

This is carried out by T paying cash (or other assets) to S. The consideration would not normally be in the form of shares because a typical reason for such a reconstruction would be to allow S to be managed as a separate part of the group or even disposed of completely. This could not be achieved effectively were S to have a shareholding in T.

If the purpose of the reorganisation is to allow S to leave the group, the purchase price paid by T should not be less than the fair value of the investment in U, otherwise S may be deemed to be receiving financial assistance for the purchase of its own shares, which is illegal in many jurisdictions.

Reverse acquisitions

Definition

A reverse acquisition occurs when an entity obtains ownership of the shares of another entity, which in turn issues sufficient shares so that the acquired entity has control of the combined entity.

Reverse acquisitions are a method of allowing unlisted companies to obtain a stock exchange quotation by taking over a smaller listed company.

For example, a private company arranges to be acquired by a listed company. This is effected by the public entity issuing shares to the private company so that the private company’s shareholders end up controlling the listed entity. Legally, the public entity is the parent, but the substance of the transaction is that the private entity has acquired the listed entity.

Assessment of group reorganisations

Previous examination questions testing group reorganisations have provided a scenario with a group considering a number of reorganisation options. The questions have then asked for an evaluation and recommendation of a particular proposal.

In order to do this, you will need to consider the following:

- the impact of the proposal on the individual accounts of the group entities

- the impact of the proposal on the group accounts

- the purpose of the reorganisation

- whether there is any impairment of any of the group’s assets

- whether any impairment loss should be recognised in relation to the investment in subsidiaries in the parent company accounts.

Group reorganisations and separate financial statements

IAS 27 Separate Financial Statements details the accounting treatment of investments in subsidiaries, associates and joint ventures when separate (non-consolidated) financial statements are produced.

In separate financial statements, investments in subsidiaries, associates and joint ventures can be measured:

- at cost

- in accordance with IFRS 9 Financial Instruments

- using the equity method.

A parent may reorganise the structure of its group by establishing a new entity as its parent. In this case, as long as certain criteria are met, the

new parent records the cost of the original parent in its separate financial statements as the carrying amount of ‘its share of the equity items shown in the separate financial statements of the original parent at the date of the reorganisation’ (IAS 27, para 13). The criteria that must

be met are as follows:

- ‘The new parent obtains control of the original parent by issuing equity instruments in exchange for existing equity instruments of the original parent

- The assets and liabilities of the new group and the original group are the same immediately before and after the reorganisation

- The owners of the original parent before the reorganisation have the same absolute and relative interests in the net assets of the original group and the new group immediately before and after the reorganisation’ (IAS 27, para 13).

The above rule also applies when an entity that is not a parent establishes a new entity as its parent.

1 Chapter summary