Myron Gordon proposed a model of stock valuation using the dividend capitalization approach. His model is based on the following assumptions:

- Retained earnings represent the only source of financing for the firm. Thus, like the Walter model the Gordon model ties investment decision to dividend decision

- The rate of return on the firm’s investment is constant.

- The growth rate of the firm is the product of its retention ratio and its rate of return. This assumption follows the first two assumptions.

- The cost of capital for the firm remains constant and it is greater than the growth rate.

- The firm has a perpetual life.

- Tax does not exist.

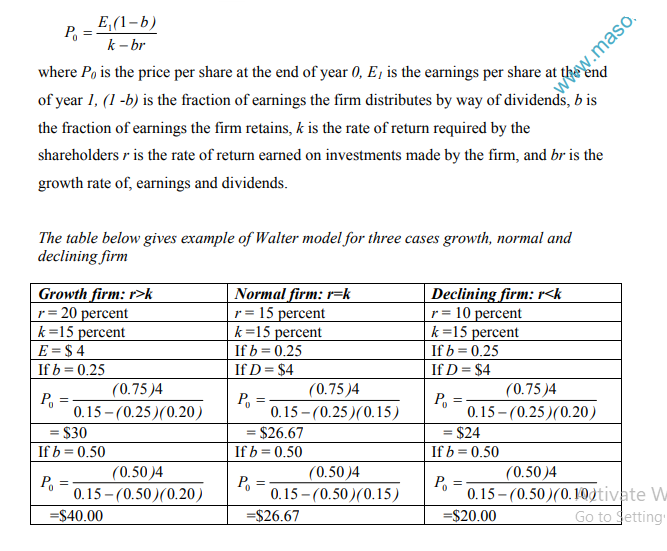

Valuation Formula Gordon’s valuation formula is:

Implications

- When the rate of return is greater than the discount rate (r > k), the price per share increases as the dividend payout ratio decreases

- When the rate of return is equal to the discount rate (r = k), the price per share remains unchanged in response to variations in the dividend payout ratio.

- When the rate of return is less than the discount rate (r< k), the price per share increases as the dividend payout ratio increases

Thus the basic Gordon model leads to dividend policy implications as that of the alter model:

- The optimal payout ratio for a growth firm (r > k) is nil.

- The payout ratio for a normal firm is irrelevant.

- The optimal payout ratio for a declining firm (r < k) is 100 percent.

Share this: