Miller and Modigliani (MM, hereafter) have advanced the view that the value of a firm solely on its earning power and is not influenced by the manner in which its Earnings are split between dividends and retained earnings. This view, referred to as the

“dividend irrelevance” theorem, is presented in their celebrated 1961 article. In this article MM constructed their argument on the following assumptions.

- Capital markets are perfect and investors are rational: information is freely available, transactions are instantaneous and costless, securities are divisible, and no investor can influence market prices.

- Floatation costs are nil.

- There are no taxes.

- Investment opportunities and future profits of firms are known with certainty (MM drop this assumption later).

- Investment and dividend decisions are independent.

The substance of MM argument may be stated as follows: If a company retains earnings instead of giving it out as dividends, the shareholder enjoys capital appreciation equal to the amount of earnings retained. If it distributes earnings by way of dividends instead of retaining it, the shareholder enjoys dividends equal in value to the amount by which his capital would have appreciated had the company chosen to retain its earnings. Hence, the division of earnings between dividends and retained earnings is irrelevant from the point of the shareholders.

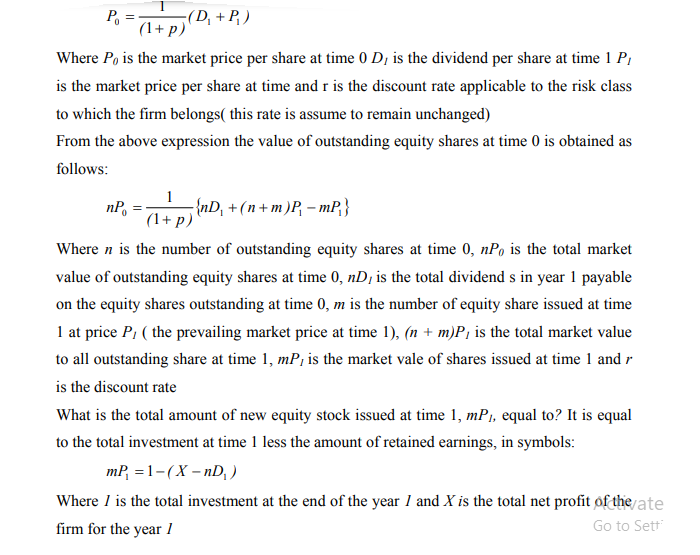

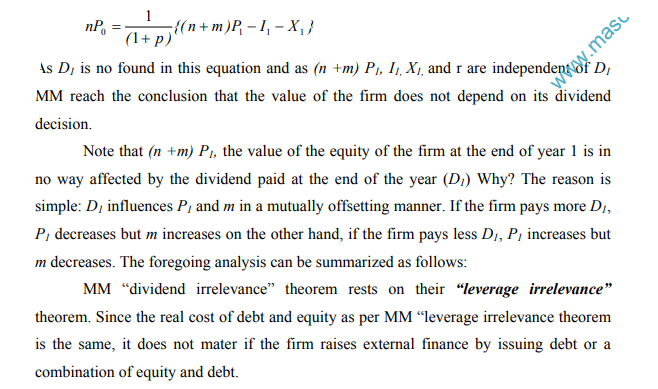

To prove their argument MM begin with the simple valuation model:

There is no conflict between the dividend capitalization approach to valuation advocated earlier and the MM “dividend irrelevance” theorem. MM “dividend irrelevance” theorem does not imply that the value of an equity share is not equal to the present value of future stream of dividends expected from its ownership. It merely says that even though the dividend policy of the firm may influence the timing and magnitude of dividend payments it cannot change the present value of total stream of dividends.

Criticisms of MM Position

Information about Prospects- In a world of uncertainty the dividends paid by the company, based as they are on the judgment of the management about future, convey information about the prospects of the company.

Uncertainty and Fluctuations- Due to uncertainty, share prices tend to fluctuate, sometimes rather widely. When share prices fluctuate, conditions for conversion of current income into capital value and vice versa may not be regarded as satisfactory by

investors. Some investors who wish to enjoy more current income may be reluctant to sell a portion of their shareholding in a fluctuating market. Such investors would naturally prefer, and value more, a higher payout ratio. Some investors who wish to get

less current income may be hesitant to buy shares in a fluctuating market. Such investors would prefer, and value more, a lower payout ratio.

Offering of Additional Equity at Lower Prices- MM assume that a firm can sell additional at the current market price. In practice, firms following the advice and suggestions of merchant bankers offer additional equity at a price lower than the current market price. This practice of ‘underpricing’ mostly due to information asymmetry and other market imperfections ceteris paribus, makes a shilling of retained earnings more valuable than a shillings of dividends. This is because a higher pay out ration will lead to a greater dilution of the value of equity.

Transaction Costs- In the absence of transaction costs, current income (dividends) and capital gains are alike-a shilling of capital value can be converted into a shilling of current income and vice versa. In such a situation if a shareholder desires current income shares) greater than the dividends received, he can sell a portion of his capital equal in value to the additional current income sought. Likewise, if he wishes to enjoy income less than the dividends paid, he can buy additional shares equal in value difference between dividends received and the current income desired. In the real s however, transaction costs are incurred. Due to transaction costs, shareholders who have preference for current income would prefer a higher payout ratio and shareholders who have preference for deferred income would prefer a lower payout ratio.

Differential Rates of Taxes- MM assume that the investors are indifferent between a shilling of dividends and a shilling of capital appreciation. This assumption is true when the rate of taxation is the same for current income and capital gains. In the real world, the effective tax on capital gains is lower than that for current income. Due to this difference, investors may prefer capital gains to current income.

Unwise Investments- MM assume that firms, rational as they are, do not invest beyond the point where the rate of return is equal to the cost of capital. In practice, however many firms invest in sub-marginal projects because of easy availability of internally generated funds. If a firm has such a tendency, its dividend policy matters. Its shareholders would benefit if liberal dividends are paid and would suffer if modest dividends are paid.

The thrust of the above criticisms is that the dividend policy of the firm matters preference of investors for current income, the difficulty in converting capital value into current income, and the possibility of imprudent investments, suggest that a liberal layout