MONDAY: 4 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Using a suitable example in each case, explain the meaning of the following types of cost:

Differential costs. (2 marks)

Out of pocket costs. (2 marks)

Sunk costs. (2 marks)

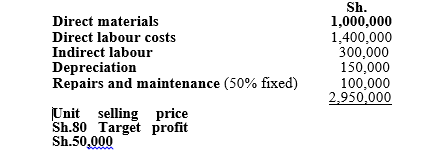

2. Everest Company manufactures a single product branded “solo”.

The following information relates to the month of March 2022 for an output level of 100,000 units:

Required:

Formulate a predictor equation in the form y = a + bx. (6 marks)

Estimate the cost of producing 95,000 units. (2 marks)

Compute the level of sale at which the company will recover all the costs. (2 marks)

Summarise four limitations of the accounts analysis method. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Management accounting system acts as a “decision support system” for providing the right information to the right people at the right time. With reference to the above statement, discuss five characteristics of management accounting that makes it a key tool for decision making. (10 marks)

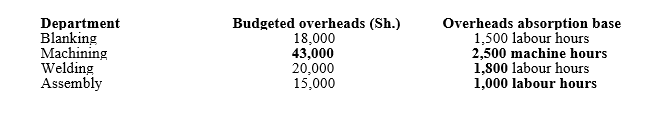

2. Blaze Techz Ltd. manufactures small assemblies to order and has the following budgeted overheads for the year, based on normal activity levels:

Additional information:

- Selling and administration overheads are 20% of factory costs.

- An order for 250 assemblies type XR200, were made as Batch AA5901 and incurred the following costs:

Materials Sh.3,107

Labour: 128 hours Blanking Shop at Sh.10 per hour

452 hours Machining Shop at Sh.11 per hour

90 hours Welding Shop at Sh.10 per hour

175 hours Assembly Shop at Sh.9 per hour

- A special X-ray equipment for testing the welds was hired at Sh.525.

- The time of booking in the machine shop was 643 machine hours.

- Selling price was Sh.I50 per assembly.

Required:

Total cost of the batch. (8 marks)

Unit cost of each assembly. (1 mark)

Profit per assembly. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. Bridge Ltd.’s budget included the following estimated costs for the financial year 2021 with respect to its manufacturing activities.

Sh.”000″

Depreciation on manufacturing equipment 17,200

Cost of manufacturing supplies 3,000

Direct labour cost 86,400

Rent on manufacturing facility 7,600

Direct material cost 74,000

Manufacturing utilities cost 6,000

Maintenance cost for manufacturing facility 5,200

Administrative salaries cost 30,000

The company uses a predetermined overhead absorption rate based on machine hours. It was estimated that machine hours usage for the year 2021 would be 30,000 hours.

Required:

Identify the manufacturing overhead costs that Bridge Ltd. would use to calculate the predetermined overhead rate. (6 marks)

Calculate the predetermined overhead absorption rate. (2 marks)

Assuming that Bridge Ltd., actually used 29,200 machine hours during the financial year 2021, determine the amount of manufacturing overheads it would have applied to the work in progress during the period. (2 marks)

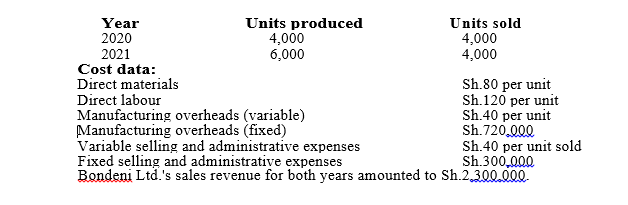

2. Bondeni Manufacturing Ltd. pays its production managers a bonus based on the company’s profitability. During the two most recent years, the company maintained the same cost structure to manufacture its products. The details are provided below.

Required:

Prepare income statements based on absorption costing for the years 2020 and 2021. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. In the context of labour remuneration, summarise five conditions necessary for successful operation of intencive schemes. (5 marks)

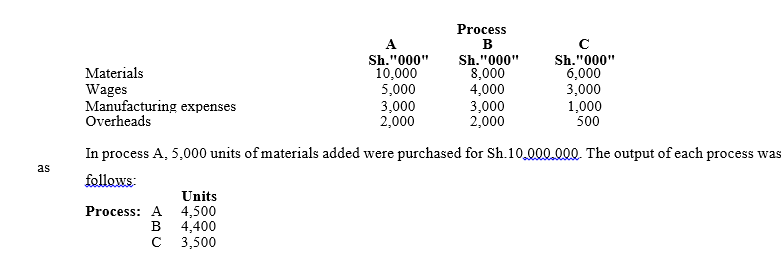

2. In a factory, three processes are employed. The output of process A is transferred to process B and the output of process B to process C. It has been the experience that the wastage of process A is 2%, process B 5% and process C 10%. The scrap value of wastage in process A and B is Sh.200 per unit while process C wastage is Sh.500 per unit.

The expenses incurred in the month of March 2022 were as follows:

Required:

- Process A account (5 marks)

- Process B account. (5 marks)

- Process C account. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain five limitations of cost-volume-profit (CVP) analysis. (5 marks)

2.Pendo Ltd. which manufactures product “wye” has prepared the following sales budget for the first five months of the year 2022:

Additional information:

- Inventory of finished goods at the end of every month is to be equal to 25% of the sales estimate for the next month.

- On 1 January 2022, there were 2,700 units of the product “wye” on hand.

- There is no stock of work-in-progress at the end of any month.

- Every unit requires two types of materials in the following quantities: Material A: 4kgs Material B: Skgs

- Materials equal to one half of the requirements for the next month’s production are to be in hand at the end of every month. This requirement was met on 1 January 2022.

Required:

Prepare the following budgets for the quarter ended 31 March 2022:

- Production budget. (6 marks)

- Materials purchases budget. (9 marks)

(Total: 20 marks)