TUESDAY: 5 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

- Explain two types of financial decisions made in a company. (4 marks)

- Discuss four potential causes of conflict between shareholders and the management. (8 marks)

- The management of Daylight Ltd. is in the process of evaluating the company’s dividend policy.

The following information is provided:

- The company paid Sh.1,300,000 million as dividends in the last financial year.

- The profit after tax for the last financial year was Sh.3,900,000 million.

- The company has not issued any preference shares.

- The earnings growth rate has been constant at 10% per annum for the past ten years.

- The expected profits after tax for the current financial year is Sh.5,200,000 million.

- The company anticipates investment opportunities worth Sh.2,800,000 million in the current financial year.

- The capital structure of the company consists of 70% equity and 30% debt.

Required:

The optimal total dividends for the current financial year if the company wishes to adopt each of the following dividend policies:

Residual dividend policy. (2 marks)

Constant payout ratio policy. (2 marks)

Stable predictable dividend policy. (2 marks)

Regular plus extra dividend policy. (2 marks)

(Total: 20 marks)

QUESTION TWO

- Distinguish between an “aggressive” and “conservative” working capital policy of a firm. (4 marks)

- Master Ltd. is a private company which intends to be listed in the Securities Exchange. The company recently paid a dividend of Sh.2.50 per share. This dividend is expected to grow at the rate of 20% for 2 years and then drop to a growth rate of 15% per annum for the next 3 years.

Thereafter the dividend will grow at 10% per annum indefinitely. The required rate of return is 12%.

Required:

The intrinsic value of the company’s share. (6 marks)

3. Salama Limited’s capital structure as at 1 October 2020 was as follows:

Sh.”000″

Ordinary share capital (Sh.10 each) 373,000

Retained earnings as at 1 October 2020 27,000

18% debentures 400.000

800,000

The above capital structure is considered optimal. The company is considering the acquisition of an investment project that will cost Sh.270 million. In order to finance the investment project, the company would be required to raise additional capital.

Additional information:

- The company can obtain additional debentures at an interest rate of 18% per annum.

- The dividend for the year ended 30 September 2021 is expected to be Sh.2.40 per share.

- Additional ordinary shares can be issued on the Securities Exchange at a price of Sh.54 per share net of floatation cost amounting to Sh.6 per share.

- Dividends are expected to grow at a rate of 8% each year for the foreseeable future.

- Corporation tax is 30%.

Required:

Cost of debentures. (2 marks)

Cost of retained earnings. (2 marks)

Cost of ordinary shares. (2 marks)

Amount of money for the investment project to be financed through the issue of new ordinary shares if the company is to maintain the optimal capital structure. (2 marks)

Amount of money for the investment project to be raised through debentures. (2 marks)

(Total: 20 marks)

QUESTION THREE

- Explain two applications of the time value of money concept. (4 marks)

- Citing three reasons, justify why a firm may prefer to raise finance through equity rather than debt finance. (6 marks)

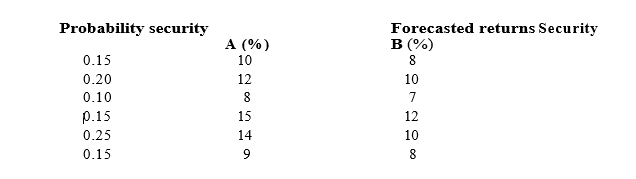

- The following information relates to the forecasted returns of securities A and B and their probabilities during the financial year ending 30 April 2022.

Required:

The expected return of security A and security B. (4 marks)

The standard deviation of security A and security B. (4 marks)

Advise a potential investor on the security to invest in using relative risk. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain four differences between “Islamic banking” and “conventional banking”. (8 marks)

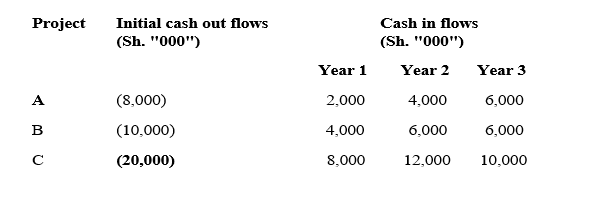

2. Delight Limited is considering its capital budgets for the year 2022. The following information relates to three mutually exclusive projects that the management is contemplating to undertake:

Additional information:

- The firm has a capital budget ceiling of Sh.20 million.

- The cost of capital for Delight Limited is 10% per annum.

Required:

Advise the management on the projects to undertake using each of the following investment appraisal techniques.

Net Present Value (NPV). (6 marks)

Profitability Index (IP). (6 marks)

(Total: 20 marks)

QUESTION FIVE

- Identify four factors that might influence the working capital need of a company. (4 marks)

- Hazyl Ltd. applies the Baumol’s Model to control its cash balances. The firms annual cash requirements are estimated at Sh.4,000,000. It incurs a cost of Sh.20 per transaction when either buying or selling marketable securities in the money market.

The firm’s investment in marketable securities guarantees a return of 10% per annum. There are no minimum cash balances.

Optimal cash balance = 2 FC

Where: F = fixed cost incurred when selling securities to raise cash.

C = Annual cash disbursements.

= Annual interest earned at the marketable securities portfolio.

Required:

The optimal cash balance (3 marks)

Assuming 360 days in a year, determine the cash conversion period. (2 marks)

The average cash balance. (1 mark)

3. Explain the following types of risks in relation to finance and investments.

Political risk. (2 marks)

Technological risk (2 marks)

4. Zenkel Traders borrowed Sh.10,000,000 at an interest rate of 15% per annum from Pesa Bank. The loan is to be repaid in equal annual instalments for the next six years.

Required:

Prepare a loan amortisation schedule. (6 marks)

(Total: 20 marks)