MONDAY: 4 December 2023. Afternoon Paper. Time Allowed: 3 hours

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Highlight FOUR arguments against introduction of a management accounting system in a business organisation. (4 marks)

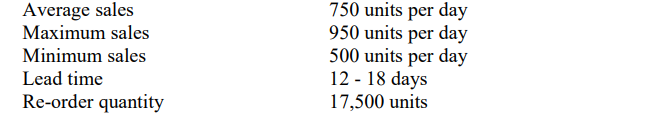

2. Sauti Electronics is a popular car radio retailer. The following information was obtained from one of its outlets:

Required:

Determine the following:

The level of stock that a replenishment order will be required. (2 marks)

The minimum level of stock possible. (2 marks)

The maximum level of stock possible. (2 marks)

The average level of stock. (2 marks)

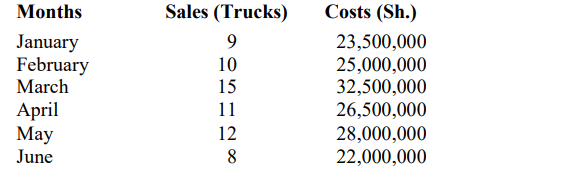

3. Rolly Motors Ltd. is a manufacturer of quality trucks which they sell at Sh.3,500,000 each. The cost of the company can be separated into fixed and variable costs.

The following is a budgeted data for the first six months of the year 2024:

Fixed costs for the six months have been spread evenly over the period under review to arrive at the monthly projections.

Required:

Calculate the total fixed costs for the period using high-low method. (4 marks)

Determine break-even-point (BEP) in units and sales revenue. (4 marks)

(Total: 20 marks)

QUESTION TWO

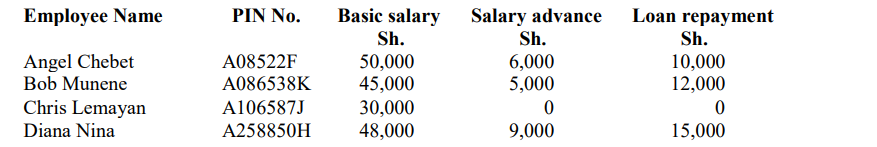

1. Chanzo Ltd. operates a factory which has four operators working in department RPM400. The company uses time rate system of labour remuneration to compensate its workers.

The data about the four employees for the month of November 2023 is as follows:

Additional information:

1. Affordable housing levy (AHL) tax of 1.5% is charged on gross income per month.

2. NSSF is deducted at a rate of 5% of the gross income

3. NHIF is deducted at a rate of 3% of the basic pay.

4. PAYE is charged at a rate of 30% of gross income.

5. Housing allowance is provided at a rate of 15% of the basic pay.

6. Gross income is the total of basic pay plus house allowance but before any deductions.

Required:

Prepare a payroll to show the take-home net pay for the month of November 2023 for the four operators. (8 marks)

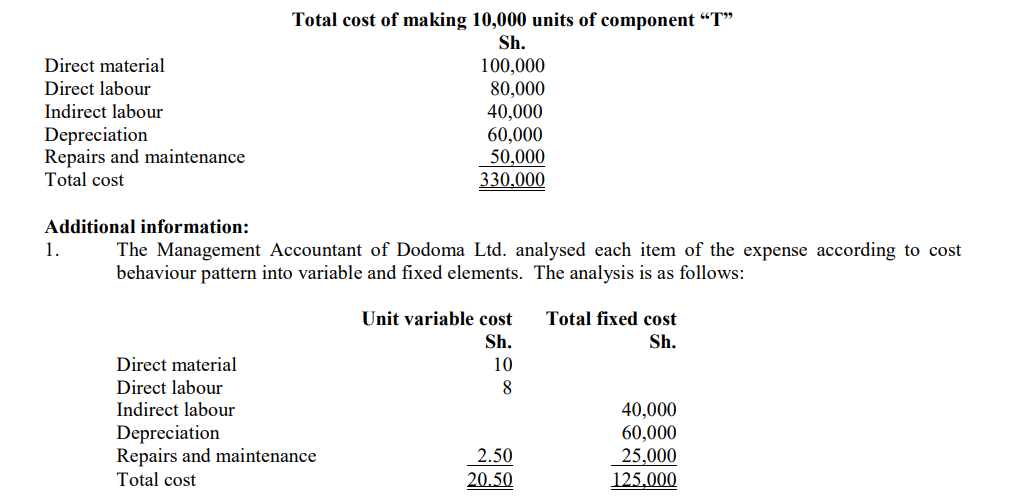

2. Dodoma Ltd. has submitted the following data relating to component “T” that it currently manufactures:

2. Dodoma Ltd. has determined that Sh.30,000 of fixed indirect labour cost is an unavoidable cost even if component “T” is outsourced.

3. RVD Ltd. has offered to supply 10,000 units of component “T” to Dodoma Ltd. for Sh.16 per unit.

4. All variables costs are avoidable costs if component “T” is bought from RVD Ltd.

Required:

Advise Dodoma Ltd. whether to make or buy component “T” from RVD Ltd. (8 marks)

Summarise FOUR overriding considerations to be met before accepting “make” or “buy” decision.

(4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain FOUR features of service costing. (8 marks)

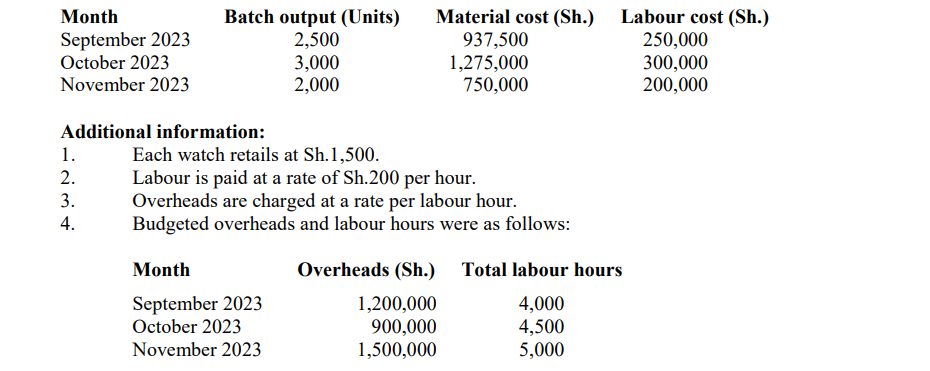

2. The following information relates to the books of Digital Watches Ltd. that produced watches in batches during the three months of September, October and November 2023:

Required:

Total profit per batch for each month. (6 marks)

Cost per watch. (3 marks)

Profit per watch. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Identify SIX types of costs classified by function. (6 marks)

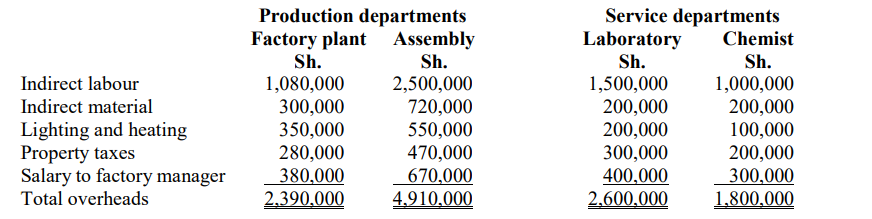

2. Dawa Ltd. is a pharmaceutical company which manufactures antibiotic drugs. Dawa Ltd. has two production departments namely; factory plant and assembly department. The company has also two service departments namely; laboratory that deals with efficacy and chemist that is concerned with stocking of the drugs.

The overhead analysis sheet showing primary allocation of overheads analysed to production and service

departments are as follows:

Additional information:

1. Budgeted direct labour hours were 23,780 hours for factory plant department and 15,050 hours for assembly department.

2. The budgeted direct labour rate per hour is Sh.300 in factory plant department and Sh.510 in the assembly department.

3. The total overheads of the service departments are to be apportioned to production departments as follows:

Laboratory: 50% to Factory plant department

30% to Assembly department

20% to Chemistry department

Chemist: 60% to Factory plant department

30% to Assembly department

10% to Laboratory department

Required:

Secondary apportionment of service department total overheads using stepwise method. (8 marks)

Compute the overhead absorption rate (OAR) for each production department. (2 marks)

A special order of antibiotics capsules has been received from a customer. The management accountant

has estimated the costs as follows:

Direct material Sh. 225,000

Direct labour: Factory plant 300 direct labour hours

Assembly 160 direct labour hours

Required:

Calculate the total cost of the special order. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe the following types of functional budgets:

Sales budget. (2 marks)

Production budget. (2 marks)

Material purchases budget. (2 marks)

Cash budget. (2 marks)

2. Summarise FOUR applications of marginal costing. (4 marks)

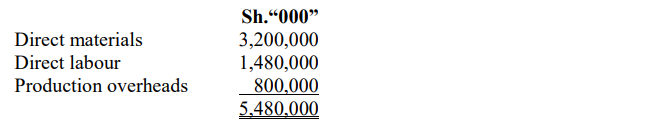

3. AMA Ltd. is a company that concentrates wholly on the production of refined vegetable oils for exports and domestic markets. In the year ended 31 August 2023, the company produced 100,000 tonnes of oil out of which 90,000 tonnes were sold.

The balance was returned to store. The production cost was as follows:

Additional information:

1. 60% of the production overheads are fixed.

2. The average selling price for each tonne of oil was Sh.80,000.

3. Selling and administration expenses for the year amounted to Sh.1,200,000,000 of which Sh.300,000,000 were fixed.

4. There was no opening or closing stock of work-in-progress.

Required:

Statement of profit or loss for the year ended 31 August 2023 under direct costing method. (6 marks)

Minimum number of tonnes of oil that must be produced and sold in order to breakeven. (2 marks)

(Total: 20 marks)