TUESDAY: 5 December 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Enumerate FIVE factors to consider when choosing a source of finance. (5 marks)

2. Highlight SIX similarities between preference share capital and debt capital. (6 marks)

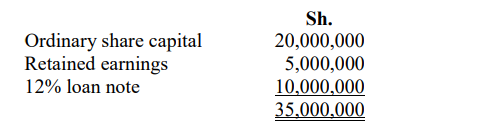

3. The following is the capital structure of Mugune Limited as at 31 December 2022.

Additional information:

1. The company has issued 1,000,000 ordinary shares of Sh.20 par value each. The market value of the

ordinary share is Sh.30.

2. The shareholders expect a dividend of Sh.5 per ordinary share with a growth rate of 10% per annum.

3. The corporation tax rate is 30%.

Required:

The cost of equity. (2 marks)

The cost of the 12% loan note. (2 marks)

The weighted average cost of capital (WACC) for the company using the market value. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight FOUR reasons for the time preference of money. (4 marks)

2. Explain THREE regulatory measures that govern Islamic finance. (6 marks)

3. Ubunifu company is considering an investment in a new project. The project requires an initial investment of Sh.10 million for equipment, Sh.5 million for inventory and Sh.2 million for installation costs. The equipment will be depreciated using straight line depreciation method over 5 years period with no salvage value. The project is expected to generate sales worth Sh.10 million and incur costs of Sh.3 million at the end of each year for the next 5 years. The corporation tax rate is 30%. Assume a discount rate of 10%.

Required:

Total initial cash outlay. (1 mark)

Annual net operating cash flows for each year. (4 marks)

Total terminal cash flow at the end of the project. (2 marks)

Determine whether the project is worthwhile using the discounted payback period approach. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Agency costs refer to the costs incurred to safeguard the shareholders’ interest.

In relation to the above statement, describe THREE types of agency costs. (6 marks)

2. Paul Mwangi has borrowed Sh.1,000,000 from a commercial bank at an interest rate of 12% per annum. The loan shall be repaid over a period of five (5) years. The interest on the loan shall be compounded at the end of each year over the five year period.

Required:

Total amount payable after five years. (2 marks)

Total amount payable after five years assuming interest is compounded semi-annually. (2 marks)

Total amount payable after five years assuming interest is compounded continuously using the formula:

3. A manufacturing company, Zoe Limited, is seeking to assess its working capital operating cycle to improve its liquidity management. The following financial data is available for the company:

1. Average inventory Sh.150 million.

2. Average accounts receivable Sh.100 million.

3. Cost of goods sold (COGS) Sh.500 million.

4. Annual sales Sh.750 million.

5. Average accounts payable Sh.75 million.

Assume 365 days in a year.

Required:

Explain the concept of working capital operating cycle. (2 marks)

Calculate the following components of working capital operating cycle for Zoe Limited.

I. Day sales of inventory (DSI). (1 mark)

II. Day sales outstanding (DSO). (1 mark)

III. Day payables outstanding (DPO). (1 mark)

3. Determine the overall working capital operating cycle (in days) for Zoe Limited. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Identify FOUR causes of business risk. (4 marks)

2. Summarise SIX factors that could influence the dividend policy of a firm. (6 marks)

3. The ordinary shares of Bidii Ltd. are currently selling at sh.100 each at the securities exchange. The company’s price earnings (P/E) ratio is 10 times. Bidi Ltd. adopts a 60% payout ratio as its dividend policy. It is predicted that the company’s earnings and dividends will grow at an annual rate of 15% for the first three years, 10% for the next two years and 6% thereafter in perpetuity. The investors minimum required rate of return is 12%.

Required:

The initial dividend per share (DPS). (2 marks)

The current intrinsic value of the shares. (6 marks)

Advise the investors based on the results in (c) (ii) above on whether to buy or sell the shares of Bidii Ltd.

(2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight FOUR characteristics of capital investments decisions. (4 marks)

2. Enumerate THREE similarities and THREE differences between “accounting” and “finance”. (6 marks)

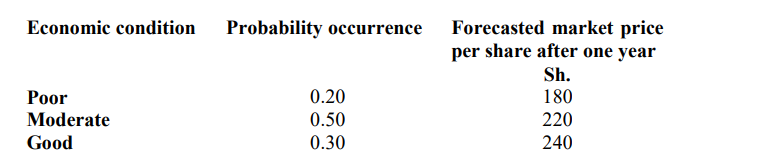

3. Billy Lenz is considering buying shares of Kenfam Limited which are currently selling at the securities exchange for Sh.200 each.

The forecasted market price of each share at the end of one year’s holding period and the corresponding

probability of occurrence are given as follows:

Required:

The expected rate of returns for Kenfam Limited shares. (5 marks)

The standard deviation of the returns for Kenfam shares. (5 marks)

(Total: 20 marks)