TUESDAY: 2 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. With regard to sources of finance, explain the following terms:

Factoring. (2 marks)

Business angel. (2 marks)

2. Analyse three factors that could influence the dividend decision of a firm. (6 marks)

3. Sunlight Limited intends to invest in Project Y or Project Z.

The following are expected net cash flows from the projects:

Project

Y Z

Year Sh. Sh.

0 (12,000,000) (10,000,000)

1 3,000,000 4,000,000

2 3,000,000 3,000,000

3 3,200,000 2,000,000

4 2,000,000 4,000,000

5 1,000,000 2,000,000

The company’s cost of capital is 12%.

Required:

Calculate the profitability index for each project. (8 marks)

Advise the management on the project to invest in. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain three causes of conflict between shareholders and external auditors. (6 marks)

2. Citing three reasons, justify the time preference value for money. (6 marks)

3. The following information relates to Mafuta Safi Ltd.:

Sh.“000”

Purchase of raw materials (all on credit) 6,700

Usage of raw materials 6,500

Sale of finished goods (all on credit) 25,000

Cost of sales (finished goods) 18,000

Average creditors 1,400

Average raw materials inventory 1,200

Average work in progress 1,000

Sh.“000”

Average finished goods inventory 2,100

Average debtors 4,700

Assume a 365 days year.

Required:

The length of the operating cash cycle. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in valuation of securities:

Fair value. (2 marks)

Investment value. (2 marks)

2. In a finance and investment seminar, one of the facilitators’ noted that “Management of debtors is crucial in working capital management”.

With reference to the above statement, discuss three factors that might influence the level of debtors in a firm. (6 marks)

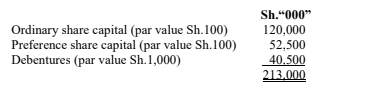

3. The following is the capital structure of Kenland Ltd.:

Additional information:

- The company has paid ordinary dividend of Sh.2.5. The dividend is expected to grow at a constant rate of 10% in the future and floatation cost of 12% of the market price.

- The current market price of one ordinary share of Kenland Ltd. is Sh.120.

- New preference shares can be sold at Sh.140 per share with a dividend of Sh.15 per share and floatation costs of Sh.8 per share.

- The company pays out all its earning as dividends.

- The company will sell 14% debentures with a maturity of 10 years at Sh.1,100 per debenture.

- The par value of the debenture is Sh.1,000.

Corporate tax rate is 30%.

Required:

The cost of ordinary share capital. (2 marks)

The cost of preference share capital. (2 marks)

The cost of debenture capital. (2 marks)

The market weighted average cost of capital. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in finance:

Cryptocurrency. (2 marks)

Block chain technology. (2 marks)

2. Islamic finance and investment has experienced substantial and unprecedented growth in recent years.

With reference to the above statement, discuss four Islamic finance drivers. (8 marks)

3. John Juma borrowed Sh.500,000 on 1 May 2022 from a local bank repayable semi-annually over a two year period.

The interest rate on the loan is 8% per annum.

Required:

A loan repayment schedule for the two year period. (4 marks)

4. Kikwetu Enterprises is considering purchasing a five year Sh.1,000 par value debenture which is currently trading on the securities exchange is at Sh.950. The debenture has a coupon rate of interest of 12% per annum. Kikwetu Enterprises’ required rate of return is 16%.

Required:

The intrinsic value of the debenture. (3 marks)

Advise Kikwetu Enterprises on whether or not to purchase the debenture. (1 mark)

(Total: 20 marks)

QUESTION FIVE

1. Outline four circumstances under which a company would prefer to use short term debt financing compared to other sources of finance. (4 marks)

2. Explain three differences between a firm’s “value maximisation goal” and “profit maximisation goal”. (6 marks)

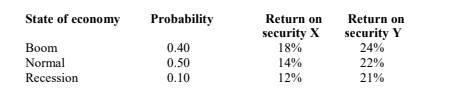

3. The following information relates to returns of two securities under three states of the economy as follows:

Required:

Expected returns on security X and Y. (2 marks)

Standard deviation of returns on security X and security Y. (2 marks)

Kalama Chivuva has invested 20% in security X and 80% in security Y. Determine his expected portfolio return. (1 mark)

Calculate covariance of returns of security X and Y. (3 marks)

Determine the portfolio risk as measured by standard deviation. (2 marks)

(Total: 20 marks)