MONDAY: 1 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain three users of management accounting information. (6 marks)

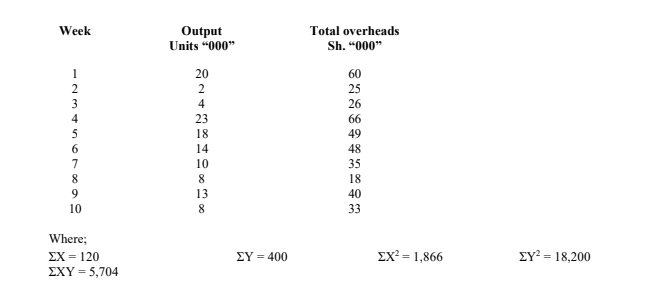

2. Unik Ltd. a leading manufacturer of ceramic tiles is preparing its cost estimation for the master budget. A cost accountant has derived the following data on a weekly output of standard size tiles from a factory:

Required:

Using the least squares regression method, formulate a predictor equation in the form y = a + bx. (6 marks)

In week 11, the factory planned to produce 25,000 standard size tiles. Estimate the total cost of producing this quantity. (2 marks)

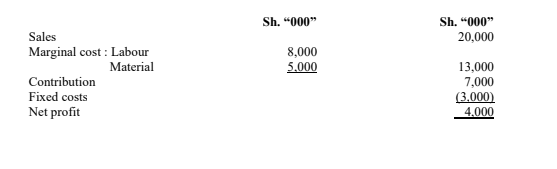

3. Jikaze Ltd. is currently operating at full capacity and it manufactures and sells brooms for local market. Currently, the production volume is 100,000 brooms per annum with the following cost structure:

Additional information:

- Each broom is currently sold at Sh.200.

- An opportunity has arisen to supply 30,000 brooms per annum at Sh.180 each.

- Acceptance of this special order will incur extra fixed costs of Sh.800,000 per annum for the hire of additional machinery.

- Jikaze Ltd. will pay an overtime premium of 20% for the extra direct labour.

Required:

Advise Jikaze Ltd. on whether the offer should be accepted or rejected. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight four causes of labour turnover in an organisation. (4 marks)

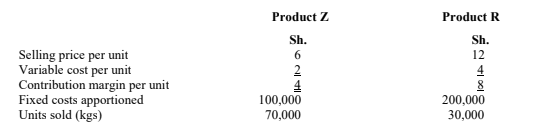

2. Zara Ltd. produces two products namely; Z and R. The following information relates to the budget for the year ended

30 June 2022:

Required:

Calculate the break-even points of each product. (4 marks)

The break-even point of product Z to achieve a target profit of Sh.60,000. (2 marks)

The margin of safety of product R. (2 marks)

The product to produce based on the break-even point calculated in 2 (i) above. (2 marks)

3. Malipo Ltd. pays its employees using time-rate system. The following information is available with respect to employee number EMP003 for the month of March 2022:

- Monthly salary:

- Basic Salary Sh.20,000

- Commuter allowance 25% of basic salary

- House rent allowance Sh.6,500 per month

- Leave salary allowance earned Sh.15,000

- Non-cash benefits received from place of work was worth Sh.6,500 per month.

- Number of working hours in the month of March 2022 was 200 hours.

Required:

Calculate the cost of labour per day of 8 working hours. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following types of costs:

Product costs. (2 marks)

Opportunity cost. (2 marks)

Conversion costs. (2 marks)

2. Outline four limitations of process costing. (4 marks)

3. Maridadi Ltd. produces a product that passes through two distinct processes. The following information was obtained from the accounts of the company for the month of July 2022:

Particulars Process A Process B

Sh. Sh.

Direct materials 78,000 59,400

Direct wages 60,000 90,000

Production overheads 60,000 90,000

At the beginning of the month of July 2022, 3,000 units of Sh.30 each were introduced to process A. There were no stock of materials or work-in-progress.

The output of each process passes directly to the next process and finally to the finished stock account.

The following additional data was obtained:

Process Output Percentage of normal loss to Scrap value of normal

input loss per unit

(Sh.)

Process A 2,850 5% 20

Process B 2,520 10% 40

Required:

Process A account. (5 marks)

Process B account. (5 marks)

(Total: 20 marks)

QUESTION FOUR

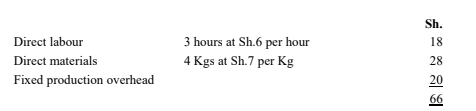

1. RH Ltd. manufactures and sells a single product branded “Zed”. Currently it uses absorption costing to determine profits and inventory values. The budgeted production cost per unit is as follows:

Additional information:

- Normal output volume is 16,000 units per year and the volume is used to establish the fixed overhead absorption rate for each year.

- The costs relating to sales, distribution and administration are as follows:

Variable 20 % of sales value

Fixed Sh.180,000 per year

- There were no units of finished goods inventory at 1 October 2021. Fixed overhead expenditure is spread evenly throughout the year.

- The selling price per unit is Sh.140.

- For the two six-monthly periods, the number of units to be produced and sold were budgeted as follows:

Six months ending Six months ending

31 March 2022 30 September 2022

Units Units

Production 8,500 7,000

Sales 7,000 8,000

- RH Ltd. is considering whether to abandon absorption costing and use marginal costing instead for profit reporting and inventory valuation.

Required:

1. Statement of profit or loss for each of the six-month periods using:

Marginal costing. (8 marks)

Absorption costing. (8 marks)

2. A statement reconciling the profits as per the marginal costing and absorption costing in 1 above. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Distinguish between the following terms as used in management accounting:

“Avoidable costs” and “unavoidable costs”. (4 marks)

“Cost control” and “cost reduction”. (4 marks)

2. The following information relates to Erica Ltd:

- The company had a cash balance of Sh.540,000 at the beginning of the month of October 2021.

- Creditors give a credit period of one month.

- Salaries are paid in the current month.

- Fixed cost are paid one month in arrears and include a charge of Sh.100,000 per month with respect to depreciation.

- Credit sales are settled as follows:

- 40% in the month of sale.

- 45% one month after the month of sale.

- 12% two months after the month of sale.

The balance represents bad debts.

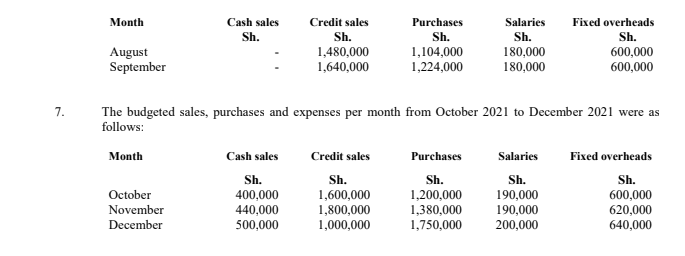

- The actual sales, purchases and expenses for the month of August 2021 and September 2021 were as follows:

Required:

A cash budget for the months of October 2021 to December 2021. (12 marks)

(Total: 20 marks)