WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

This paper has two sections. SECTION I has twenty (20) short response/computational questions. SECTION II has three computational questions. ALL questions are compulsory. Marks allocated to each question are shown at the end of the question. Any assumptions made must be clearly and concisely stated.

SECTION I – 40 MARKS

- State the accounting equation. (2 marks)

- Identify the accounting concept that assumes that an entity will continue in business in the foreseeable future. (2 marks)

- Highlight two causes of depreciation of assets such as buildings, furniture and fittings. (2 marks)

- Match the source document with the journal in which it is entered:

Source document Journal

Sales invoice Sales returns

Receipt Purchases

Credit note Sales

Goods received note Cash book.

(2 marks)

- Explain the term “capital expenditure”. (2 marks)

- Define “error of omission”. (2 marks)

- A business has the following balances:

Sh.

Land 1,000,000

Machinery 200,000

Cash 10,000

Debentures 200,000

Required:

The value of the owner’s equity. (2 marks)

- Outline two items that might be credited to the sales ledger control account. (2 marks)

- List two qualities of useful accounting information. (2 marks)

- Classify each of the following items as either an asset or a liability:

Accounts receivable.

Pre-paid rent.

Machinery.

Lighting accrued.

(2 marks)

- The following balances were extracted from the books of Zed Ltd. on 30 September 2021:

Sh.

Accrued administrative expenses (1 October 2020) 972,800

Cash paid for administrative expenses during the year ended 30 September 2021 3,100,000

Accrued administrative expenses (30 September 2021) 704,600

Required:

Administrative expenses account. (2 marks)

- Explain why the government might need accounting information. (2 marks)

- State two classes of ledger accounts. (2 marks)

- As at 1 July 2020, Julia had a rent pre-payment of Sh.600,000. She paid Sh.3,600,000 during the year ended 30 June 2021.

Required:

The rent charged to the statement of profit or loss for the year ended 30 June 2021. (2 marks)

- The following information relates to BZ Enterprises for the month of November 2021:

Sh.

Adjusted bank balance 490,000

Uncredited cheques 75,000

Unpresented cheques 120,000

Required:

Bank reconciliation statement. (2 marks)

- K K purchased a motor vehicle for Sh.1,500,000 by cheque.

Required:

Post the transaction in the relevant ledger accounts. (2 marks)

- Identify the ledger in which the account of each of the following can be found:

Furniture. (1 mark)

Robert, a debtor. (1 mark)

- The following balances were extracted from the books of Happy House Ltd. as at 30 September 2021:

Sh.

Motor vehicles 2,300,000

Inventory 150,000

Cash 220,000

Furniture 550,000

Required:

Total non-current assets. (1 mark)

Total current assets. (1 mark)

- Highlight two contents of a partnership deed. (2 marks)

- State the term used to describe the difference between cost price of an asset and net book value of the asset. (2 marks)

SECTION II

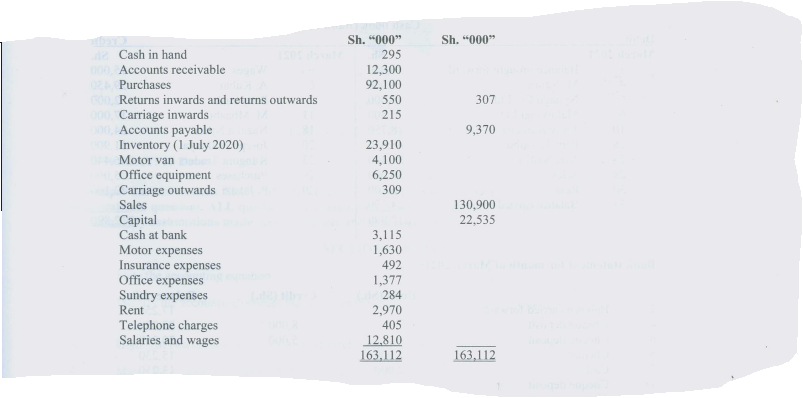

- Thomas Haki’s trial balance as at 30 June 2021 is as follows:

Additional information:

Inventory as at 30 June 2021 was valued at Sh.27,475,000.

Required:

Statement of profit or loss for the year ended 30 June 2021. (12 marks)

Statement of financial position as at 30 June 2021. (8 marks)

(Total: 20 marks)

- Leah Loa started a business on 1 September 2021 with Sh.2,000,000 that she deposited in a business bank account. She made the following transactions during the month of September 2021:

September 2021

2 Withdrew Sh.500,000 from the bank for business use.

4 Purchased goods on credit from Tom for Sh.600,000 and Jane for Sh.400,000.

6 Purchased furniture for Sh.180,000 paying by cheque.

7 Paid rent by cheque Sh.120,000.

9 Sold goods on credit as follows:

King Sh.250,000 and Paul Sh.190,000

12 Paid Tom his account by cheque.

16 Paid wages Sh.60,000 by cash.

22 King paid his account by cash.

25 Paid for painting of the shop Sh.25,000 in cash.

26 Sold goods in cash for Sh.150,000 and received the money. She used it for her personal needs.

Required:

Post the accounting entries in the appropriate ledger accounts and balance them as at 30 September 2021. (15 marks)

Trial balance as at 30 September 2021. (5 marks)

(Total: 20 marks)

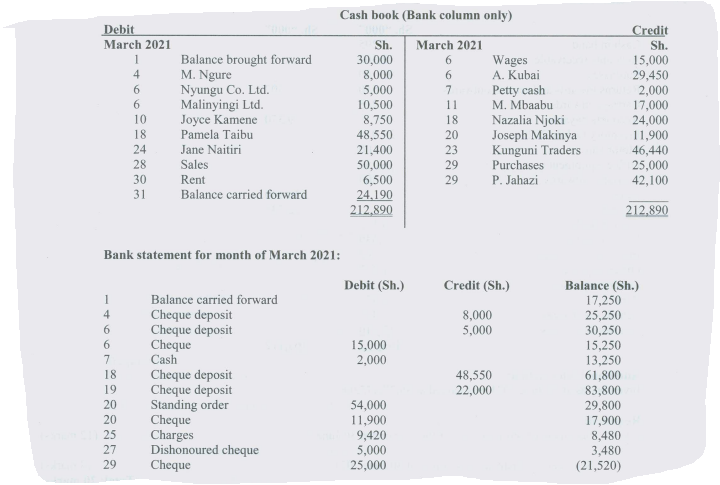

- Antony Muga is a small trader. The bank balance in the cash book and the balance as per the bank statement for Antony Muga for the month of March 2021 are as follows:

Required:

Adjusted cash book for March 2021. (10 marks)

Bank reconciliation statement as at 31 March 2021. (10 marks)

(Total: 20 marks)