MONDAY: 4 April 2022. Morning paper.

Time Allowed: 3 hours.

This paper is made up of a hundred (100) Multiple Choice Questions. Answer ALL the questions by indicating the letter (a, b, c or d) that represents the correct answer. Do NOT write anything on this paper.

- If shares are sold by a company for more than their par value, they are said to have been issued at a:

(a) Discount.

(b) Premium.

(c) Bonus.

(d) Surplus. (1 mark)

- Working capital is:

(a) Current assets minus current liabilities.

(b) Total assets minus total liabilities.

(c) Current assets minus total liabilities.

(d) Total assets minus current liabilities. (I mark)

- Invoices received for goods purchased on credit from suppliers would first be entered in the:

(a) Purchases day book.

(b) Sales day book.

(c) Purchases account.

(d) Sales account. ( I mark)

- The total of the discount column on the credit side of a three-column cash book is taken to the:

(a) Debit of discount-allowed account.

(b) Debit of discount-received account

(c) Credit of discount-allowed account.

(d) Credit of discount-received account. (1 mark)

- A trader buys goods for Sh.5,000 less 20% trade discount. How much does the trader pay?

(a) Sh.5,000.

(b) Sh.4,500.

(c) Sh.4,000.

(d) Sh.3,600. (I mark)

- Returns inward appearing in the trial balance is deducted from:

(a) Purchases.

(b) Sales.

(c) Returns outward.

(d) None of the above. (1 mark)

- Which of the following accounts is not a personal account?

(a) XYZ Ltd.

(b) Mrs. Atieno.

(c) Returns inward.

(d) KamashTrading Ltd. (1 mark)

- A company’s sales for the year amounted to Sh.39,000 and its cost of sales was Sh.21,000 and operating expenses Sh.5,000. What is the net profit?

(a) Sh.18,000.

(b) Sh.55,000.

(c) Sh.13,000.

(d) Sh.16,000. (I mark)

- Voting rights at company meetings are normally held by:

(a) Ordinary shareholders.

(b) Preference shareholders.

(c) Debenture holders.

(d) Ordinary and preference shareholders. (1 mark)

- Depreciation is provided on:

(a) Current assets.

(b) Intangible assets.

(c) Property, plant and equipment.

(d) Liabilities. (1 mark)

- A credit balance in the bank account in a firm’s ledger indicates a:

(a) Long-term liability.

(b) Current asset.

(c) Current liability.

(d) Fixed asset. (1 mark)

- A manager is entitled to a commission of 5% of profit. Calculate the manager’s commission, if the profit is Sh.2,100,000.

(a) Sh.100,000.

(b) Sh.105,000.

(c) Sh.111,000.

(d) Sh.115,000. (1 mark)

- Profit = Capital at the end + ? — Capital introduced — Capital in the beginning:

(a) Sales.

(b) Drawings.

(c) Net Purchases.

(d) Gross profit. (1 mark)

- Outstanding income is:

(a) An asset.

(b) A liability.

(c) An expense.

(d) An income. (1 mark)

- Choose the correct chronological order of ascertainment of profits.

(a) Operating Profit, Net Profit, Gross Profit.

(b) Operating Profit, Gross Profit, Net Profit.

(c) Gross Profit, Net Profit, Operating Profit.

(d) Gross Profit, Operating Profit, Net Profit. (1 mark)

- Net sales during the year 2021 is Sh.285,000. Gross profit is 25% on sales. Find out the cost of goods sold?

(a) Sh. 285,000.

(b) Sh. 213,750.

(c) Sh. 71,250.

(d) Sh. 0. (1 mark)

Use the following information to answer question 17 and 18: Cost of new machine purchased = Sh.120,000

Installation expenses = Sh.30,000

Estimated life of machine = 5 years

Residual value after 5 years = Sh.25,000

- Calculate depreciation on the machine:

(a) Sh.24,000.

(b) Sh.54,000.

(c) Sh.30,000.

(d) Sh.25,000. (1 mark)

- The company started production with this machine from 1 October 2021. The company closes its accounts on 31 December every year. Find the adjusted value of the machine on 31 December 2021.

(a) Sh.143,750.

(b) Sh.125,000.

(c) Sh.175,000.

(d) Sh.300,000. (1 mark)

- A trial balance will not show:

(a) A casting error in cash account.

(b) The omission of a transaction from the day books.

(c) An entry on the wrong side of an account.

(d) A reversal of figures in a balance carried forward. (1 mark)

- The following entry appeared in the last statement of financial position of a company:

Machinery cost Sh.I0,000.

Accumulated depreciation Sh.4,000.

It is the practice of the company to depreciate machinery at the rate of 20% per annum on reducing balance basis. The figure that will appear for accumulated depreciation in the next statement of financial position will be:

(a) Sh.1,200.

(b) Sh.4,800.

(c) Sh.5,200.

(d) Sh.6,000. (1 mark)

- A credit balance in a partner’s current account is part of the firm’s:

(a) Current liabilities.

(b) Capital.

(c) Long-term liabilities.

(d) Assets. (1 mark)

- Which of the following describes the practical framework of bookkeeping?

(a) Classifying, recording and summarising.

(b) Reporting, analysing and interpreting.

(c) Classifying, analysing and interpreting.

(d) Recording, summarising and reporting. (1 mark)

- Which of the following principles assumes that a business will continue for a long time?

(a) Historical cost.

(b) Periodicity.

(e) Objectivity.

(d) Going concern. (1 mark)

- The following balances refer to Ron and Sons Ltd:

Machinery Sh.20,000, cash in hand Sh.2,000, land and buildings Sh.200,000, bank loan Sh.50,000, creditors Sh.5,000, debtors Sh.10,000. What is the company’s capital?

(a) Sh.55,000.

(b) Sh.177,000.

(c) Sh.232,000.

(d) Sh. 287,000. (1 mark)

- Which of the following items is not found in the current accounts of partnership business?

(a) Drawings.

(b) Goodwill.

(c) Interest on capital.

(d) Partners’ salary. (1 mark)

- Alex bought furniture on credit from Chanel Furniture Limited, which of the following journal entries will be made for this transaction in Alex’s books?

(a) Debit furniture credit cash.

(b) Debit purchases credit Alex.

(c) Debit Alex credit purchases.

(d) Debit furniture and credit Chanel Furniture Limited. (1 mark)

- Long-term liabilities normally include:

(a) Proprietor’s capital.

(b) Loan secured by debentures.

(c) Bank overdraft.

(d) Trade creditors. ( I mark)

- The main purpose of the day books is to:

(a) Speed up the location of errors.

(b) Provides a check on ledger postings.

(c) Summarises entries of a similar type.

(d) Provides totals for control accounts. (1 mark)

- Goodwill is a:

(a) Fictitious assets.

(b) Tangible assets.

(c) Intangible assets.

(d) Expenses. ( I mark)

- Copies of credit notes issued would be entered in the:

(a) Returns inward day book.

(b) Sales day book.

(c) Returns outward day book.

(d) Purchases day book. ( I mark)

- Debentures are normally listed in the company’s statement of financial position under:

(a) Issued capital.

(b) Reserves and provisions.

(c) Long-term liabilities.

(d) Current liabilities. (1 mark)

- A firm’s liabilities include:

(a) Prepaid rent.

(b) Trade debtors.

(c) Bank overdraft.

(d) Trade investments. (I mark)

- Which of the following require knowledge of subjects other than accountancy?

(a) Recording of financial transactions.

(b) Calculation of profits and losses.

(c) Summaries of financial position.

(d) Guidance on financial policy. (1 mark)

- The totals of the purchases journal are posted to the:

(a) Debit of purchases account.

(b) Debit of the personal accounts concerned.

(c) Credit of sales account.

(d) Credit of the personal accounts concerned. (1 mark)

- Discount allowed will appear on the:

(a) Debit side of trading account.

(b) Credit side of the statement of profit and loss.

(c) Credit side of the sales account.

(d) Debit side of the statement of profit and loss. (1 mark)

- In the three-column cash book at the end of the accounting period:

(a) Cash, bank and discount columns are balanced.

(b) Cash and bank columns are balanced and the discount columns are totalled.

(c) The cash column is balanced, and bank and discount columns are totalled.

(d) Cash, bank and discount columns are totalled. (1 mark)

- The primary objective of the trading account is to show the:

(a) Overall trading profit or loss for the period concerned.

(b) Net trading profit or loss for the period concerned.

(c) Profit or loss on the turnover of goods sold in the period.

(d) Difference between income earned and expenditure incurred in the period. (1 mark)

- The main purpose of a bank reconciliation statement is to:

(a) Ensure the cash book (bank columns) and the bank statement show the same balance.

(b) Explain the difference between the cash book balance and the bank statement.

(c) Ascertain the correct balance at the bank.

(d) Update the cash book. ( 1 mark)

- A statement of affairs is similar to a:

(a) Bank statement.

(b) Statement of account.

(c) Bank reconciliation statement.

(d) Statement of financial position. ( I mark)

- A business operates its petty cash by using the imprest system. At the beginning of the month, the petty cashier was given Sh.100,000 out of which she spent Sh.80,000. How much will she be reimbursed?

(a) Sh.20,000.

(b) Sh.80,000.

(c) Sh.100,000.

(d) Sh.180,000. ( 1 mark)

- The purchases day book records are:

(a) Payments to customers.

(b) Credit purchases from suppliers.

(c) Credit purchases of fixed assets.

(d) All purchases of goods for resale. (1 mark)

- Real accounts records deal with:

(a) Intangible assets.

(b) Creditors and debtors.

(c) Commodities.

(d) Liabilities. (1 mark)

- A bank statement is a:

(a) Copy of the customer’s account in the books of his bank.

(b) Copy of the bank’s account in the books of the customer.

(c) Certified statement of the balance of the bank account.

(d) Warning to the customer that he has overdrawn his account. (1 mark)

- The right side of a ledger account is:

(a) The balance of an account.

(I)) The debit side.

(c) The credit side.

(d) Blank. (1 mark)

- The purchase of a motor car on credit from Toy Automotive Company for use in a firm should be recorded as:

(a) Debit maintenance of vehicle expense, Credit Toy Automotive Company.

(b) Debit purchases, Credit Toy Automotive Company.

(c) Debit motor vehicle, Credit Toy Automotive Company.

(d) Debit motor vehicle, Credit Cash. (1 mark)

- Determine the balance carried forward in the following ledger account:

Cash Account

Sh. Sh.

Capital 40,000 Drawings 10,000

Sales 15,000 Purchases 20,000

Balance carried forward

(a) Sh. 10,000.

(b) Sh. 25,000.

(c) Sh. 30,000.

(d) Sh. 55,000. (1 mark)

- Which of the following entries will be entered in the general journal?

(a) Sold goods on credit.

(b) Goods purchased and paid by cash.

(c) Investment made by the owner.

(d) Purchase goods on credit. (1 mark)

- In the first month of operations, the total of the debit entries to the cash account amounted to Sh. 3,000 and the total of the credit entries to the cash account amounted to Sh.1,800. The cash account has a:

(a) Sh.1,800 credit balance.

(b) Sh.3,000 debit balance.

(c) Sh.1,200 debit balance.

(d) Sh.1,800 credit balance. (1 mark)

- Current liabilities are such obligation which are to be satisfied:

(a) Within two years.

(h) Within one year.

(c) Within three years.

(d) Less than five years. (1 mark)

- Sales are equal to:

(a) Cost of goods sold + gross profit.

(b) Cost of goods sold — Gross profit.

(c) Gross profit = cost of goods sold.

(d) Purchases. (1 mark)

- A ledger is called a book of:

(a) Primary entry.

(b) Original entry.

(c) Final entry.

(d) None of the above. ( I mark)

- A ledger account is prepared from:

(a) Events.

(b) Transactions.

(c) Journal.

(d) None of the above. (1 mark)

- The debit balance of a personal account indicates:

(a) Amount receivable.

(b) Amount payable.

(c) Cash in hand.

(d) None of the above. ( I mark)

- The balance of cash account indicates:

(a) Net income.

(b) Cash in hand.

(c) Total cash received.

(d) Total cash paid. (1 mark)

- The trial balance shows:

(a) Both debit and credit balance.

(b) Only debit balance.

(c) Only credit balance.

(d) None of the above. (1 mark)

- The balance on the debit side of bank column in cash book indicates:

(a) Total amount withdrawn from bank.

(b) Total amount deposited in the hank.

(c) Cash at bank.

(d) Loan paid. (1 mark)

- The balance of the cash column of the cash book is always:

(a) Debit.

(b) Credit.

(c) Both (a) and (b).

(d) Neither (a) nor (b). (1 mark)

- The balance of petty cash book is:

(a) A liability.

(b) An expense.

(c) A gain.

(d) An asset. ( I mark)

- The petty cash book is used for recording:

(a) Loan payment.

(b) Sales receipts.

(c) Huge cash payment.

(d) Petty cash payments. ( I mark)

- The cash book in book keeping records:

(a) All receipts and payments in cash.

(b) All cash and credit sale of goods.

(c) All credit and cash purchase of goods.

(d) All cash and bank transactions. (l mark)

- Cash discount is provided on:

(a) Prompt payment.

(b) Large quantities.

(c) Purchase.

(d) None of the above. (1 mark)

- The debit balance as per the bank column cash book of ABC Traders on 31 December 2021 was Sh.1,500,000. As at 31 December 2021, cheques deposited, but not cleared, amounted to Sh.100,000 and cheques issued but not presented amounted to Sh.150,000. Balance as per the bank should be:

(a) Sh.1,750,000.

(b) Sh.1,550,000.

(c) Sh.1,650,000.

(d) Sh.250,000. ( I mark)

- A business has assets of Sh.100,000 and liabilities of Sh.20,000. What is the amount of capital the business has?

(a) Sh.120,000.

(b) Sh.80,000.

(c) Sh.100,000.

(d) Sh.20,000. ( I mark)

- Capital will reduce by:

(a) Purchase of goods on credit

(b) Selling the goods for cash

(c) Furniture purchase for personal use

(d) Purchase of goods in cash. (I mark)

- Liabilities increase by:

(a) Purchasing goods on credit.

(b) Rent due.

(c) Taking of bank loan.

(d) All of the above. ( I mark)

- Business transactions are recorded:

(a) In chronological order.

(b) Weekly.

(c) At the end of month.

(d) Per annum. (1 mark)

- The credit balance of bank account indicates:

(a) Bank balance.

(b) Amount payable to bank.

(c) Amount payable by the bank.

d) None of the above. (1 mark)

- Which of the following accounts will invariably have a debit balance?

(a) Account receivable.

(h) Account payable.

(c) Current account of partner.

(d) Bank account. (1 mark)

- Which of the following accounts will invariably have credit balance?

(a) Current account of proprietor.

(h) Account receivable.

(c) Account payable.

(d) None of the above. ( I mark)

- Personal account of a customer is likely to have:

(a) Only debit entries.

(b) Only credit entries.

(c) Both debit and credit entries.

(d) No debit or credit entries. ( I mark)

- Ledger is a book in which:

(a) Real and nominal accounts are maintained.

(b) Real and personal accounts are maintained.

(c) Real, personal and nominal accounts are maintained.

(d) Personal and nominal accounts are maintained. (I mark)

- Which of the following is a book of prime entry and part of the double-entry system?

(a) The trial balance.

(b) The petty cash book.

(c) The sales day book.

(d) The purchase ledger. (1 mark)

- Nominal account having debit balance represents:

(a) Income/gain.

(b) Expenses/loss.

(c) Cash.

(d) Assets. (I mark)

- When the total of debit and credit are equal, it represents:

(a) Debit balance.

(b) Credit balance.

(c) Nil balance.

(d) Current balance. (1 mark)

- Which of the following account is increased by credit entries?

(a) Sales return account.

(b) Bank overdraft

(c) Goodwill account.

(d) Purchases account. (1 mark)

- The process of transferring the debit and credit items from a journal to their respective account in the ledger is referred to as?

(a) Balancing.

(b) Posting.

(c) Arithmetic.

(d) Entry. ( I mark)

- The liabilities of a firm are Sh.300,000 and capital is S11.700.000. What is the value of the assets?

(a) Sh.700,000.

(b) Sh.1,000,000.

(c) Sh.400,000.

(d) Sh.300,000. ( I mark)

- Which of the following will cause the owner’s equity to increase?

(a) Expense.

(b) Drawings.

(c) Revenue.

(d) Loss. (1 mark)

- Total assets of a business are Sh.1,300,000 and net worth is Sh.800,000. What is the value of liabilities?

(a) Sh.2,100,000.

(b) Sh.500,000.

(c) Sh.800,000.

(d) Sh.460.000. (1 mark)

- A sole proprietor made sales worth Sh.120,000. He incurred Sh.50,000 for the sale. How much gross profit did he earn?

(a) Sh.50,000.

(b) Sh.70,000.

(c) Sh.120,000.

(d) Sh.170,000. (1 mark)

- A trail balance is prepared:

(a) After preparation financial statements.

(b) After recording transactions in subsidiary hooks.

(c) After posting to ledger is complete.

(d) After posting to ledger is complete and accounts have been balanced. (1 mark)

- A trial balance shows the:

(a) Final position of accounts.

(b) Standard position of accounts.

(c) Working position of accounts.

(d) Current position of accounts. (I mark)

- Trial balance is considered as the connecting link between accounting records and preparation of financial statements. It provides a basis for:

(a) Auditing accounting reports.

(b) Accuracy of the ledger account.

(c) Further processing of accounts.

(d) All of the above. (1 mark)

- Agreement of trial balance is affected by:

(a) One sided errors only.

(b) Two sided errors only.

(c) Both (a) and (b).

(d) Debit side errors only. (1 mark)

- What will be the effect on trial balance if Sh. 2,000 received as rent and correctly entered in the cash book, but not posted to rent account’?

(a) Debit side of trial balance will exceed by Sh.2,000.

(b) Debit side of trial balance will decrease by Sh.2,000.

(c) Credit side of trial balance will decrease by Sh.2,000.

(d) Credit side of trial balance will exceed by Sh.2,000. (1 mark)

- Minimum number of members in the case of a public company is:

(a) 4.

(b) 5.

(c) 6.

(d) 7. ( I mark)

- Asha’s Accessory Shop started the year with total assets of Sh.210,000 and total liabilities of Sh. 120,000. During the year, the business recorded Sh.330,000 in revenues, Sh.165,000 in expenses. The net income reported by Asha’s Accessory Shop for the year was:

(a) Sh.120,000.

(b) Sh.150,000.

(c) Sh.195,000.

(d) Sh.165,000. ( I mark)

- Rodgers Company compiled the following financial information as at 31 December 2021:

- Sales revenue Sh.1,120,000

- Ordinary share capital Sh.240,000

- Buildings Sh.320,000

- Operating expenses Sh.1,000,000

- Cash Sh.280,000

- Dividends Sh.80,000

- Inventory Sh.40,000

- Accounts payable Sh. 160,000

- Accounts receivable Sh.120,000

- Retained earnings, 1 January 2021 Sh. 600,000

What is the value of Rogers Company’s assets as at 31 December 2021?

(a) Sh.1,880,000.

(b) Sh.1,360,000.

(c) Sh.640,000.

(d) Sh.760,000. ( I mark)

- As at I January 2021, Atieno’s shop had a balance in its retained earnings account of Sh.100,000. During the year Atieno’s shop had revenues of Sh.80,000 and expenses of Sh.45,000. In addition, the business paid cash dividends of Sh.20,000. What is the balance on retained earnings as at 31 December 2021 for Atieno’s shop?

(a) Sh.100,000

(b) Sh.115,000

(c) Sh.135,000

(d) Sh.155,000. (1 mark)

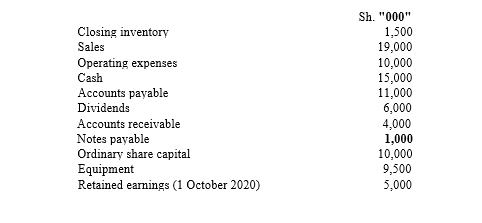

- Use the following information for Light Ltd. for the year ended 30 September 2021 to answer question 90 — 92:

Calculate Light Ltd.’s net income:

(a) Sh.7,500,000.

(b) Sh. 9,000,000.

(c) Sh.8,000,000.

(d) Sh. I ,400,000. (1 mark)

- Calculate Light Ltd.’s retained earnings:

(a) Sh.8,000,000.

(b) Sh.1,800,000.

(c) Sh.1,400,000.

(d) Sh.300,000. ( I mark)

- Calculate Light Ltd.’s total assets:

(a) Sh.8,000,000.

(b) Sh.36,000,000.

(c) Sh.15,000,000.

(d) Sh.30,000,000. (1 mark)

- The art of recording all business transactions in a systematic manner in a set of books is referred to as:

(a) Accounting.

(b) Bookkeeping.

(c) Ledger.

(d) Journalising. ( I mark)

- The person, firm or institution who does not pay the price in cash for the goods purchased or the services received is called:

(a) Creditor.

(b) Proprietor.

(c) Debtor.

(d) Merchant. ( I mark)

- Cash, goods or assets invested by the proprietor in the business for earning profit is called:

(a) Profit.

(b) Capital.

(c) Non-current assets.

(d) Current assets. (1 mark)

- The concession given on cash transactions is called:

(a) Trade discount.

(b) Cash discount.

(c) Cash sale.

(d) Cash purchases. (1 mark)

- Jared Kigen sold goods to Norton Mosomi on 19 October 2021 for Sh.60,000. The credit terms are 21/2% cash discount if payment is received within 14 days. If payment was received on 25 October 202 1 , then the correct amount and the discount received respectively would he:

(a) Sh.60,000 , Sh.250.

(b) Sh.61,500 , Sh.60,000.

(c) Sh.58,500 , Sh.1,500.

(d) Sh.46,000 Sh.24,000. ( I mark)

- Carriage outward in accounting is included as:

(a) Direct incomes.

(b) Cost of sale.

(c) Expenses.

(d) Production cost. (1 mark)

- A company that issues shares to raise funds results in:

(a) Decrease in cash.

(b) Increase in cash.

(c) Increase in equity.

(d) Increase in liabilities. (1 mark)

- When the purchase value of assets is more than net book value of an asset it is known as?

(a) Appreciated liabilities.

(h) Appreciated revenue.

(c) Depreciation.

(d) Appreciation. (I mark)