MONDAY: 4 April 2022. Afternoon paper. Time Allowed: 3 hours.

This paper is made up of a hundred (100) Multiple Choice Questions. Answer ALL the questions by indicating the letter (a, b, c or d) that represents the correct answer. Do NOT write anything on this paper.

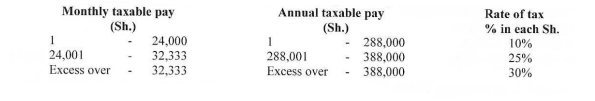

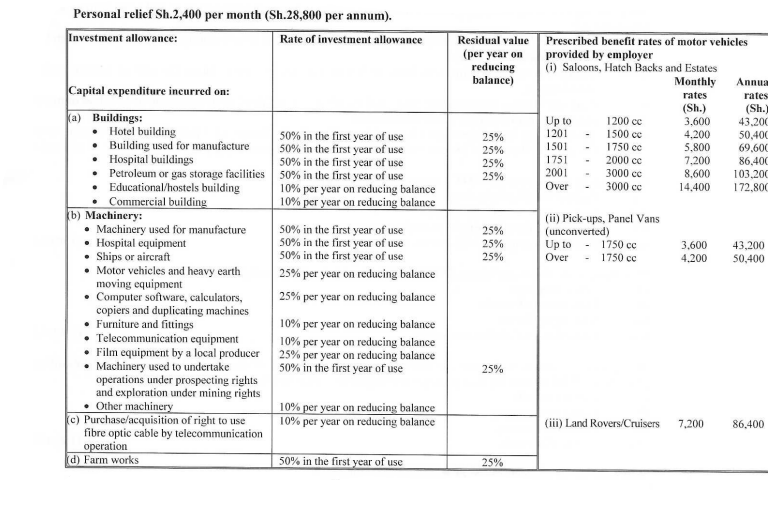

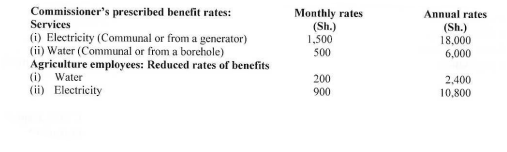

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

- Which one of the following statements explains the meaning of Pay As You Earn (PAYE)?

(a) Tax charged on locally manufactured goods.

(b) Tax levied on goods imported into a country.

(c) Tax charged on incomes earned by limited company.

(d) Tax charged on the incomes of an individual. ( 1 mark)

- What is the meaning of the term “Tax”?

(a) It is compulsory contributions by persons to the state to enable it meet its obligations and service delivery.

(b) It is a voluntarily contributions by persons to the state to enable it meet its expenses.

(c) It is a compulsory contribution by individuals to registered organisations for purpose of saving.

(d) It is a contribution by persons to the state for the purpose of development of health system. (1 mark)

- Under classification of taxes, identify which one of the following is NOT used for tax classification:

(a) By base.

(b) By rates.

(c) By volume.

(d) By effect. ( I mark)

- Which of the following factors DOES NOT influence tax shifting?

(a) Elasticity of demand and supply.

(b) Purpose of the product.

(c) Nature of the market.

(d) Geographical location. (1 mark)

- Which of the following statements DOES NOT explain the meaning of a resident in regard to an individual for tax purposes?

(a) A person who has no permanent home in Kenya and was in Kenya during the year of income under consideration for any period.

(b) A person who has a permanent home in Kenya and was in Kenya during the year of income under consideration.

(c) A person who has no permanent home in Kenya but was in Kenya for an aggregate of 183 days or more during the year of income under consideration.

(d) A person who has no permanent home in Kenya but was in Kenya for a period averaging to more than 122 days for the year of income under consideration and two preceding years. (1 mark)

- Which one of the following is NOT a way of tax avoidance?

(a) Claim allowable deductions.

(b) Claiming investment allowances.

(c) Overstating the allowable expenses.

(d) Investing in countries with low tax rates. ( 1 mark)

- Which one of the following factors DOES NOT influence taxable capacity?

(a) Level of income.

(b) Distribution of wealth.

(c) Size of population.

(d) Education level of the community. (1 mark)

- An optimal tax system is the one that fulfills most of the principles of taxation. Which one of the following principles is NOT among the four principles advocated by Adam Smith?

(a) Canon of equity.

(b) Canon of simplicity.

(c) Canon of economy.

(d) Canon of certainty. ( 1 mark)

- Which one of the following is NOT a purpose of levying tax?

(a) To raise the revenue.

(b) To stabilise the economy.

(c) To protect local industries.

(d) To increase population. ( 1 mark)

- The following are functions of a revenue authority EXCEPT.

(a) File tax on behalf of the tax payer.

(b) Training the tax payers and recruiting of tax agents.

(c) Enforcing measures to collect the tax evaded.

(d) Act as agent of the government in relation to tax collection. (1 mark)

- All of the following are measures used by the customs and excise duty departments of your country to prevent dumping EXCEPT.

(a) Establishment of the advisory committee to recommend to the minister the imposition of antidumping or countervailing measures on investigated products imported into the country.

(b) Prohibition and restriction of all imports from time to time.

(c) Pre-shipment and pre-verification of exports done by qualified and reputable inspection firms and institutions of regular off-shore inspections.

(d) Collusion between customs officers and importers are policed strictly and heavily penalised. ( I mark)

- Which of the following strategy CANNOT be used by revenue authority to enhance tax compliance?

(a) Creating awareness by the revenue authority on the roles of taxes and the civic duty to pay taxes.

(b) Increasing the rates of various taxes for example customs duty and VAT.

(c) Enhancing efficiency in tax collection for example requiring PIN in some transactions.

(d) Providing more tax incentives for example tax reliefs and allowances. (1 mark)

- Binding assessments are assessment which are final and conclusive. Which among the following is NOT a binding assessment?

(a) Assessment determined by local committee.

(b) Assessment made and no appeal has been made.

(c) Assessment made and no objection has been raised within the statutory period.

(d) Assessment awaiting determination by local committee. (1 mark)

- Leah Kerubo obtained a loan amounting to Sh.3,000,000 from the employer, Letto Limited at an interest rate of 8% per annum while the market rate was 12% per annum. What is the fringe benefit tax per month?

(a) Sh.3,000.

(b) Sh.10,000.

(c) Sh.12,000.

(d) Sh.6,000. ( 1 mark)

- Which one of the following is NOT a disadvantage of indirect taxes imposed in your country?

(a) Lack of civic consciousness.

(b) Feed inflation.

(c) Uncertain revenue.

(d) It is imposed on wide range of businesses. (1 mark)

- Which one of the following circumstances DOES NOT qualify for a refund of value added tax (VAT) paid?

(a) VAT paid on bad debts.

(b) VAT paid in error.

(c) Death of the tax payer soon after VAT payment.

(d) Overpayments resulting from the withholding VAT system. (1 mark)

- Which one of the following is NOT a characteristic of tax?

(a) It has a direct reward.

(b) It is usually levied where there is an income.

(c) Tax rates differ from one country to another.

(d) There are penalties due to failure to pay tax. (1 mark)

- Which of the following statements is NOT true about stamp duty?

(a) It is levied by the government on certain transactions and documents.

(b) The rate of stamp duty on properties in urban areas is 4% and 2% in rural areas.

(c) It is paid in advance and the tax payer does not get a direct reward.

(d) Its purpose is to legalise the transaction. (I mark)

- The following instruments are chargeable to stump duty. Which is NOT?

(a) Title deeds.

(b) Mortgage agreements.

(c) Insurance policies.

(d) Letter of allotment of shares. ( 1 mark)

- Which one of the following is NOT a cause of tax evasion?

(a) High tax rates.

(b) Adequate collection points.

(c) Complexity of tax system.

(d) Low levels of income. ( I mark)

- The following are methods of tax evasion EXCEPT?

(a) Under declaration of the taxable income.

(b) Claiming expenses one is not entitled to.

(c) Investing outside the country.

(d) Overstating the allowable expenses. (1 mark)

- Which of the following is NOT a criteria of taxing income in Kenya?

(a) The income must have been earned in Kenya.

(b) The services must have been rendered in Kenya.

(c) The payment of services must have been rendered in Kenya.

(d) The tax payer must have a permanent residence. (1 mark)

- Resident in relation to a body corporate means the following EXCEPT?

(a) The company was incorporated in Kenya under the Kenyan laws and regulations.

(b) The management and control of the business was exercised in Kenya during the year of income under consideration.

(c) The management and control of the business was not exercised in Kenya during the year of income under consideration.

(d) The body corporate has been declared by the cabinet secretary of finance to be a resident through the Kenyan gazette. (1 mark)

- The following are advantages of withholding tax EXCEPT?

(a) Enhances compliance.

(b) It protects the health of citizens.

(c) It is economical.

(d) It reduces chances of tax evasion. (1 mark)

- The following are sources of government revenue EXCEPT?

(a) Donations and grants.

(b) Fines and penalties.

(c) Insurances.

(d) Taxes. (I mark)

- Which one of the following building is NOT considered for investment allowance purposes?

(a) Residential building.

(b) Commercial building.

(c) Hotel building.

(d) Educational building. (1 mark)

- The following documents must accompany a self-assessment return, EXCEPT?

(a) A set of audited final accounts.

(b) Tax computation schedule.

(c) Documents to support withholding tax.

(d) Single business permit. (1 mark)

- The following are obligations of a registered person for value added tax (VAT) EXCEPT?

(a) To file VAT returns on due dates.

(b) To enforce payment of VAT charged.

(c) To keep proper books and records.

(d) To issue a tax invoice after each supply. ( I mark)

- It is mandatory to have personal identification number (PIN) for the following transaction EXCEPT?

(a) Land transactions.

(b) Registration of motor vehicle.

(c) Application of insurance cover.

(d) Registration of birth. (I mark)

- The following information should be contained in a VAT tax invoice EXCEPT?

(a) The name of person serving the customer.

(b) Name, address and VAT registration number of the person making supply.

(c) The serial number and date of the invoice.

(d) Total value of supplies and total amount of VAT charged. (1 mark)

- Which one of the following is NOT a drawback of investment allowances?

(a) Enjoyed mostly by manufacturers thereby discriminating other economic players.

(b) Enjoyed mostly by the poor thereby reducing the gap between the rich and the poor.

(c) Investors close shop and move to other destinations once the tax incentive cease.

(d) Results in loss of revenue for the government as it reduces tax payable. ( I mark)

- Which of the following omissions DOES NOT constitute an offence under the pay as you earn (PAYE) regulations?

(a) Failure to deduct PAYE.

(b) Failure to file returns.

(c) Failure to remit PAYE deducted by 20th of next month.

(d) Failure to have operational PAYE system. (1 mark)

- The following are circumstances under which a late objection could be accepted by the commissioner EXCEPT?

(a) When the tax payer is sick to the extent to which he/she cannot handle his/her tax matters.

(b) When the tax payer was out of the country.

(c) When the tax payer is held in a police custody.

(d) When the tax payer has no power in the office. ( 1 mark)

- The following are areas the commissioner of domestic taxes can get information regarding chargeable income EXCEPT?

(a) Self-confession.

(b) Public media.

(c) Act of God.

(d) Informers such as friends. (1 mark)

- The following are offences under the value added tax (VAT) Act EXCEPT?

(a) Failure to register when eligible.

(b) Failure to supply taxable goods.

(c) Failure to issue a tax invoice.

(d) Failure to keep proper records. (1 mark)

- Which among the following actions that the revenue authority should undertake to recover overdue tax?

(a) Holding property of the tax payer as security for the unpaid tax.

(b) Ask the bank to freeze the bank accounts of defaulters.

(c) Issue of distrait order where the assets of the tax payer are auctioned to recover the tax due and payable.

(d) The commissioner can jail the tax payer for the tax due and payable. (1 mark)

- Which one of the following is NOT a type of tax assessment?

(a) Self-assessment.

(b) Default assessment.

(c) Amended assessment.

(d) Appealed assessment. ( 1 mark)

- Housing benefit might be taxed under certain circumstances. Among the following, which one DOES NOT qualify for housing benefit not to be taxed?

(a) Housing was provided for better performance of duties for example caretaker of a building.

(b) Housing was necessary for such kind of employment for example school matron.

(c) Housing was provided for security reason for example soldiers in barracks.

(d) Housing was provided due to position or rank. ( I mark)

- Which one of the following is NOT an option available to the Commissioner upon receiving a valid objection?

(a) Amend the assessment in light of the objection.

(b) Keep the documents and not respond to the tax payer.

(c) Amend the assessment in light of the objection with some adjustment.

(d) Refuse to amend and confirm the assessment. ( 1 mark)

- The following changes must be notified the Commissioner within 14 days by the tax payer EXCEPT?

(a) Change of address of the place of the business.

(b) Additional premises to be used for the purposes of the business.

(c) Additional machinery and motor vehicle for business use.

(d) Change of business or trading name. (1 mark)

- Which one of the following statement DOES NOT explain when valued added tax (VAT) is due and payable?

(a) When the goods are manufactured and packed ready for distribution.

(b) When goods or services are supplied to the customer.

(c) When an invoice is issued in respect of the supply.

(d) When part or full payment for the supply is made. (1 mark)

- The following conditions must be fulfilled for passage to be excluded from taxation of an employee’s income EXCEPT?

(a) The employee must not be a citizen of Kenya.

(b) The employee must be recruited or engaged from outside Kenya.

(c) The employee must get travel allowances from the employer.

(d) The employee must be solely in Kenya for the purpose of serving the employer. (I mark)

- The income of a taxable person can be assessed on another person under the following circumstances EXCEPT?

(a) When a taxable person is insane.

(b) When a taxable person is a minor.

(c) When a taxable person is deceased.

(d) When a taxable person is illiterate. ( I mark)

- Agricultural employees housing benefit is 10% of employment income. Which of the following circumstances can lead to change the rate to I5%?

(a) If the director is not a whole time service director.

(b) If employee is housed in a leased building.

(e) If employee is housed outside the farm or plantation.

(d) If employee has his own house. (1 mark)

- Which one of the following is NOT a circumstance under which a taxpayer may be exempted from paying instalment taxes?

(a) Total tax payable in any year of income is below Sh.40,000.

(b) Income other than employment income is less than one third of total income.

(c) Tax payer is subject to turnover tax.

(d) Individual’s only source of income is employment, and all taxes have been paid in full through PAYE tax. (I mark)

- Which of the following class of asset matches its rate of investment allowance?

(a) Hotel building – 25% first year of use.

(b) Telecommunication equipment – 10% per year reducing balance.

(c) Ship or aircraft -10% first year of use.

(d) Motor vehicle – 12.5% per year reducing balance. (1 mark)

- Tera Limited started operations in 2020 after incurring various capital expenditures among them a Toyota pick-up which was purchased at a cost of Sh.2,400,000 on 1 August 2020. What was its wear and tear deduction for the year 2021?

(a) Sh.600,000.

(b) Sh.450,000.

(c) Sh.1,200,000.

(d) Sh.300,000. (1 mark)

- The following arguments are in favour of introduction of capital gains tax (CGT) in an economy EXCEPT?

(a) It ensures that there is equity in taxation.

(b) It helps in curbing inflation.

(c) It increases chances of tax avoidance.

(d) Increases government revenue. ( I mark)

- Which one of the following is NOT a limitation of value added tax (VAT)?

(a) High tax avoidance and evasion where invoicing is not strictly enforced.

(b) Enforcement of VAT is simple and easy to audit.

(c) Its discriminatory where some goods and services are not vatable.

(d) It requires many statutory records which are complicated to process. ( 1 mark)

- For the purpose of computing housing benefit, employees are classified into three categories. Which one of the following is NOT one of the categories?

(a) Ordinary employee and a whole time service director.

(b) Agricultural employee.

(c) Directors other than whole time service director.

(d) Ordinary employee and low income employee. ( 1 mark)

- Which of the following are direct taxes?

(i) Income Tax.

(ii) Capital gain tax.

(iii) Corporate tax.

(iv) Value added tax.

(a) i, ii, iii and iv.

(b) i and iii only

(c) i, ii and iii only.

(d) i and iv only. ( I mark)

- Which of the following actions is practiced by tax evaders?

(a) Claiming investment allowance.

(b) Operating with income that are tax exempt.

(c) Use of debt capital where interest is tax allowable instead of equity capital.

(d) Overstating expenses. (1 mark)

- Hezron Kamau is a sole trader preparing accounts annually to 31 December. He used his motor car for business purposes throughout the whole year ended 31 December 2021. The car had cost him Sh.3,136,000 in the year 2021. What is the wear and tear allowance that he could claim in respect of the motor car for the year ended 31 December 2021?

(a) Sh.3,136,000.

(b) Sh.3,000,000.

(c) Sh.750,000.

(d) Sh.784,000. (1 mark)

- Manula Transport Ltd. provides for the wear and tear allowance on all assets. During the year ended 31 December 2021, the company purchased a saloon car for director at a cost of Sh.3,400,000. What is the wear and tear allowance for the acquired salon car for the year ended 31 December 2021?

(a) Sh.750,000.

(b) Sh.850,000.

(c) Sh.340,000

(d) Sh.1,275,000. ( I mark)

- The following are factors that determine the extent to which the incidence of tax could be shifted EXCEPT?

(a) Type of government.

(b) Type of market.

(c) Type of tax.

(d) Geographical coverage of tax. (1 mark)

- Which of the following is NOT a role of the revenue authority in your country?

(a) Administers and enforces written laws and specific provisions concerning assessment, collection and accounting for all revenue.

(b) Educate taxpayers thus increasing the role of compliance.

(c) Introduce new taxes to increase collection of revenue.

(d) Facilitate distribution of income through socially acceptable ways by effectively enforcing tax laws affecting income in various ways. (1 mark)

- A company prepared financial statements for the year ended 31 December 2021. By which date should the company pay its corporation tax liability for the accounting period of ended 31 December 2021 to avoid incurring interest and penalties?

(a) By 20 January 2022.

(b) By 30 April 2022.

(c) By 30 June 2022.

(d) By 31 January 2022. (1 mark)

- A company had the following expenses from its accounts for the year ended 31 December 2021:

Sh.

Legal fee in respect to debt collection 80,000

Depreciation of machinery 120,000

Staff entertainment 90,000

Gift of food to clients 60,000

How much should the company add back to its accounting profits to arrive at its tax adjusted profit?

(a) Sh.270,000.

(b) Sh.260,000.

(e) Sh.180,000.

(d) Sh.210,000. (1 mark)

- Ruth pays Sh.8,000 to her registered pension scheme, while her employer contributes Sh.10,000. Which of the following statements is TRUE?

(a) Ruth’s taxable employment income is reduced by Sh.18,000.

(b) Ruth has a taxable benefit of Sh.10,000 and her taxable income is reduced by Sh.8,000.

(c) Ruth has a tax-exempt benefit of Sh.10,000 and her taxable income is reduced by Sh.8,000.

(d) Ruth has a taxable benefit of Sh.18,000. (1 mark)

- A sole trader who is registered for value added tax (VAT) made sales at standard rate valued at Sh.100,000 exclusive of VAT. In February 2022, a trade discount of 20% is applied to the value of Sh.100,000. How much VAT must the sole trader charge on the sales?

(a) Sh.16,000.

(b) Sh.19,200.

(c) Sh.12,800.

(d) Sh.O. (I mark)

- In regard to value added tax (VAT) which of the following statement is TRUE?

(a) When a trader ceases to make taxable supplies, they must notify the commissioner of domestic tax within 30 days and the company will be deregistered from the day of notification.

(b) Trader making taxable supplies with a turnover below the VAT registration threshold can voluntarily register for VAT at any time.

(c) Traders can voluntarily deregister if at any time their turnover was below the VAT deregistration threshold in the last 12 months.

(d) Traders do not pay VAT on purchases if they are not registered for VAT. (1 mark)

- Imran is an employee of Tibabu Hospital which prepares accounts annually to 31 May each year. Imran is entitled to a bonus on 31 May 2021 in relation to the accounting period ended 31 May 2021. The bonus was paid to him on 30 June 2021 but expensed in the company accounts on 15 May 2021, on which date was the bonus credited as being received by Imran for tax purposes?

(a) 31 December 2021.

(b) 31 May 2021.

(c) 15 May 2021.

(d) 30 June 2021. (1 mark)

- Which one of the following is NOT a limitation of a single tax system?

(a) It reduces the amount of revenue collected.

(b) Does not promote capital accumulation because of diversity of taxes in all income and savings.

(c) It encourages inequalities.

(d) It is based on estimates and therefore cannot meet the need of modern government. (1 mark)

- What is the tax position of benefit in kind received from employer?

(a) It is allowable deduction up to Sh.36,000 per annum.

(b) It is a taxable benefit up to Sh.36,000 per annum.

(c) It is a tax-free benefit.

(d) It is a tax-free benefit if it does not exceed Sh.36,000 per annum. (1 mark)

- Abdul received pension income of Sh.360,000 during the year ended 31 December 2021. He also received savings interest of Sh.40,000 in the year ended 31 December 2021. How much is the taxable income for the year 2021?

(a) Sh.400,000.

(b) Sh.O.

(c) Sh.360,000.

(d) Sh.60,000. ( 1 mark)

- David Mulei gave a business gift to a client. The cost of the gift was Sh.8,500, which would normally sell for Sh.10,200. The amount was exclusive of VAT@16%. How much output VAT should David include in the VAT returns in respect of the gift?

(a) Sh.1,632.

(b) Sh.1,360.

(c) Sh.O.

(d) Sh.272. ( I mark)

- What is the minimum turnover limit for a taxpayer wishing to register for value added tax (VAT) purposes?

(a) Sh.5,000,000 inclusive of VAT per annum.

(b) Sh.5,000,000 exclusive of VAT per annum.

(c) Between Sh.5,000,000 and Sh.5,000,000 per annum.

(d) Sh.5,000,000 exclusive of VAT per month. (1 mark)

- Faith Molaa is employed by Atta Flour Ltd. She was provided with a car by the employer to use for official business and private purposes. The car had cost the company Sh.800,000 in the year 2020. The car has an engine capacity of 2,200cc. What is Faith’s taxable benefit in respect to the use of the motor car for the year ended 31 December 2021?

(a) Sh.192,000.

(b) Sh.103,200.

(c) Sh.800,000.

(d) Sh.88,800. (1 mark)

- Which of the following is NOT an appellant body for tax purposes?

(a) Commissioner.

(b) Local Committee.

(c) Tax tribunal.

(d) High Court. ( I mark)

- Chale Ltd.’s trading profit for the period ended 31 December 2021 has been arrived at after deducting the following items:

Sh.

A loss on sale of van used in business 200,000

Legal fees relating to trading transactions 150,000

A donation to a political party 40,000

What amount should be added back to the trading profit when calculating the tax adjusted profits?

(a) Sh.390,000.

(b) Sh.190,000.

(c) Sh.240,000.

(d) Sh.3 50,000. ( I mark)

- Which one of the following is NOT treated as an employee taxable income when computing pay as you earn (PAYE)?

(a) End of year bonus paid to all employees.

(b) Leave allowance.

(c) Benefits in kind amounting to Sh.24,000 in a year.

(d) Sales commission paid to salesman. ( 1 mark)

- After how long will input tax under VAT become forfeited if it is NOT claimed?

(a) 3 months.

(b) 12 months.

(c) 6 months.

(d) 9 months. ( 1 mark)

- Rodgers Mwema earned an annual salary of Sh.420,000 and received free meals from the company amounting to Sh.72,000 during the year ended 31 December 2021. What is Rodger’s total taxable income for the year ended 31 December 2021?

(a) Sh.420,000.

(b) Sh.492,000.

(c) Sh.72,000.

(d) Sh.456,000. (1 mark)

- The following are obligations of a registered person for value added tax (VAT) purposes EXCEPT?

(a) Display VAT certificate of registered in a clearly visible place with the business premises.

(b) Charge VAT in all the supplies made.

(c) Issue serial numbered tax invoices or cash sale receipts generated by ETR.

(d) File correct VAT returns within the stipulated period. (1 mark)

- Kisuki Ltd. had the following expenses in their financial statement for the accounting period ended 31 December 2021:

- Entertainment for directors.

- Motor vehicle purchased for business.

- Entertainment for customers.

- Meals to employees of the company.

On which of the above items could be treated as allowable expenses?

(a) 1,2,3 and 4.

(b) 1,2 and 3 only.

(c) 3 and 4 only.

(d) 2,3 and 4 only. (1 mark)

- Alex Lugali is a registered VAT trader dealing in standard rate supplies. In the month of July 2021, he made sales of Sh.800,000 and purchased stock from an unregistered supplier for VAT purposes for Sh.460,000. Both amounts are exclusive of VAT. What is the VAT payable or claimable by Alex Lugali for the month of July 2021?

(a) Sh.54,400.

(b) Sh.128,000.

(c) Sh.73,600.

(d) Sh.O. ( 1 mark)

- During the year ended 31 December 2021 Kilome Trading Ltd. incurred the following expenses:

Sh.

Staff refreshments 118,400

Penalty for the late renewal of licence 5,400

Maintenance cost 32,000

What is the total allowable expenses for Kilome Trading Ltd. for income tax purposes in respect of the expenses incurred during the year?

(a) Sh.118,400.

(b) Sh.123,800.

(c) Sh.150,400.

(d) Sh.156,400. ( I mark)

- Which of the following benefits provided by an employer to an employee is NOT exempted from tax?

(a) Benefit in kind not exceeding Sh.36,000.

(b) Insurance premiums paid by employer on behalf of the employee.

(c) School fees paid by employer on behalf of employees children and treated as disallowable expense in the company’s books of accounts.

(d) Employer contribution to a registered pension scheme on behalf of an employee. ( I mark)

- What is the due date for payment of the first instalment of a company income tax for a company which prepared accounts to 31 December 2021?

(a) 31 December 2021.

(b) 20 January 2022.

(c) 20 April 2022.

(d) 30 June 2022. ( 1 mark)

- Peter had the following results in respect of the year ended 31 December 2021:

Sh.

Commercial rental business profit 252,000

Commercial farming business loss 550,000

What is the taxable income if any chargeable to Peter for the year ended 31 December 2021?

(a) Sh.252,000.

(b) Sh.298,000.

(c) Sh.O.

(d) Sh.802,000. (1 mark)

- John Busira received a monthly residential rental income of Sh.10,000. During the year ended 31 December

2021, his gross rental income was Sh.120,000.

Determine his tax payable for the year of income 2021:

(a) Sh.12,000.

(b) Sh.36,000.

(c) NIL.

(d) Sh.24,000. (1 mark)

- Which one of the following conditions is CORRECT with respect to medical benefit?

(a) It is a tax-free benefit to employee provided the employee is employed on permanent basis.

(b) It is a tax-free benefit to employee provided the employee contributes to the scheme.

(c) It is a taxable benefit.

(d) It is a tax-free benefit provided the scheme is not discriminatory. ( I mark)

- Eunice Lambela received a basic salary of Sh.900,000 and a house allowance of Sh.100,000 in the year 2021. The employer paid on her behalf insurance premiums amounting to Sh.60,000. While Eunice also paid an equal amount. What is the taxable income chargeable to tax on Eunice for the year 2021?

(a) Sh.900,000.

(b) Sh.1,000,000.

(c) Sh.1,060,000.

(d) Sh.1,120,000. ( 1 mark)

- Which of the following taxes is an example of indirect taxes?

(a) Value added tax.

(b) Corporation tax.

(c) Withholding tax.

(d) Income tax. (1 mark)

85.During the year ended 31 December 2021, Miika wholesalers made the following tax payments to the revenue authority.

- Pay as you earn (PAYE) Sh.162,000.

- Value added tax (VAT) Sh.230,115.

- Corporate tax Sh.55,600.

- Advance tax Sh.22,000.

Determine the amount of tax paid as indirect taxes.

(a) Sh. 392,115.

(b) Sh.230,115.

(c) Sh.77,600.

(d) Sh.162,000. (1 mark)

- Solomon Keita is a sales executive with a XYZ company, He was paid an annual basic salary of Sh. 216,000 and an entertainment allowance of Sh. 60,000. He incurred total cost of Sh. 18,000 entertaining customers. What is the total amount of Keita’s employment income assessable to tax for the year ended 31 December 2021?

(a) Sh. 276,000.

(b) Sh.216,000.

(c) Sh.294,000.

(d) Sh.258,000. ( I mark)

- For the financial year ended 31 December 2021, James Saida incurred the following expenses in relation to his business:

- Repair of a leaking roof costing Sh.10,000.

- Renovation of the office premises costing Sh.20,000.

- Lorry maintenance expenses of Sh.15,000.

What is the amount of James Saida’s deductible expenses for the year ended 31 December 2021?

(a) Sh.25,000.

(b) Sh.45,000.

(c) Sh. 30,000.

(d) Sh.35,000. ( I mark)

- Which of the following is NOT true about tax point in relation to VAT?

(a) Earlier of when the goods are supplied or service rendered.

(b) Earlier of when the invoice is issued_

(c) Earlier of when an order is received.

(d) Earlier of when payment partly or whole amount. ( 1 mark)

- Benard Kaka is a music composer, during the year ended 31 December 2021 he earned royalties amounting to Sh. 600,000 from his music composition. He had incurred Sh. 250,000 on producing the music album during that year. What is the amount of withholding tax payable on the royalties in the year ended 31 December 2021 given that Benard is a Kenyan resident?

(a) Sh. 17,500.

(b) Sh. O.

(c) Sh. 30, 000.

(d) Sh. 42, 500. (1 mark)

- Mr. Mutua received a basic salary of Sh. 650,000 in the year 2021. He also received a medical allowance of Sh. 100,000. He received a pension income of Sh. 240,000 per annum from a previous employer. How much income is taxable on Mutua for the year 2021?

(a) Sh. 650,000.

(b) Sh. 750,000.

(c) Sh. 990,000.

(d) Sh.890,000. (1 mark)

- Sylvia Adhiambo is registered for VAT. On 1 October 2021, she imported a machine at a cost of Sh.400,000. She paid freight charges of Sh.50,000, insurance on transit of Sh.30,000 and import duty of Sh.20,000. Determine the amount that is chargeable to VAT on the above machine?

(a) Sh.400,000.

(b) Sh.500,000.

(c) Sh.480,000.

(d) Sh.430,000. (1 mark)

- Which of the following explains the tax position for earnings of a person with disability with exemption certificate from revenue authority?

(a) His/her earnings up to Sh.50,000 per month is exempted from tax.

(b) His/her earnings not exceeding Sh.I50,000 per month is exempted from tax.

(c) His/her earnings are fully exempted from tax.

(d) His/her earnings not exceeding Sh.100,000 per month is exempted from tax. ( 1 mark)

- Which one of the following is NOT a relief against gross tax liability?

(a) Insurance relief.

(b) Personal relief.

(c) Affordable housing relief.

(d) Bad debt relief. ( I mark)

- Individuals in Kenya are required to file self-assessment returns every year. The due date for the submission of the self-assessment returns for the year ended 31 December 2021 is on or before?

(a) 31 January 2022.

(b) 30 April 2022.

(c) 30 June 2022.

(d) 31 July 2022. ( I mark)

- Which of the following transactions DO NOT require Personal Identification Number (PIN)?

(a) When registering a motor vehicle.

(b) When applying for Value Added Tax (VAT).

(c) When applying for insurance cover.

(d) When applying for adoption deeds. ( I mark)

- Which one of the following is NOT a condition for a valid objection?

(a) It must mention the officer who did the assessment.

(b) It must be made in writing.

(c) It must specify the ground for objection.

(d) It must be made within 30 days from the date of service of an assessment. (1 mark)

- What is the tax position on house furniture provided by an employer to an employee provided with a furnished house by employer?

(a) It is a tax-free benefit.

(b) The taxable amount is 2% per month on the cost of furniture.

(c) The taxable amount is I% per month on the cost of the furniture.

(d) The taxable amount is the value of the furniture. ( I mark)

- What are the rates applicable in the capital gains tax (CGT)?

(a) 5% not final tax.

(b) 10% final tax.

(c) 5% final tax.

(d) 10% not final tax. ( 1 mark)

- Interest paid on loan acquired to purchase, construct or renovate own residential house is allowable up to a set limit of?

(a) Sh.240,000 per annum.

(b) Sh.96,000 per annum.

(c) Sh.300,000 per annum.

(d) Sh.150,000 per annum. (1 mark)

- Penina Dale has residential rental property, during the month of 31 December 2021 she received rental income amounting to Sh.800,000. She incurred the following expenses during the month of December: Repair and maintenance cost of Sh. 200,000, advertisement cost of Sh.80,000 and installed a fire exit at a cost of Sh.50,000. Determine the tax payable if any on residential income in the month of December 2021?

(a) Sh.80,000.

(b) Sh.141,000.

(c) Sh.240,000.

(d) Sh.156,000. ( I mark)