WEDNESDAY: 19 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. The promises of the issuer and the rights of the bondholders are set forth in great detail in a bond’s indenture. As part of the indenture, there are affirmative covenants and negative covenants.

In light of the above statement, highlight four affirmative covenants that could be captured in a bond indenture. (4 marks)

2. Assess six types of risks that could be faced by fixed income investors. (6 marks)

3. The following information is provided for three bonds:

Bond A Bond B Bond C

Coupon rate 0% 10% 10%

Maturity years 15 20 20

Maturity value Sh.1,000 Sh.1,000 Sh.1,000

Required yield 9.4% 11% 10%

Par value Sh.1,000 Sh.1,000 Sh.1,000

Required:

The price of each bond, assuming interest is paid semi-annually. (6 marks)

Comment on the results obtained in (c) (i) above. (1 mark)

4. The price of a five year, zero coupon bond is Sh.0.7835 for.Sh.1 par and the price of a two year, zero coupon bond is Sh.0.9426 for Sh.1 par.

Required:

Determine the three year forward rate two years from now. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four classifications of corporate bonds by issuer. (4marks)

2. Consider the following data relating to a convertible bond currently trading at Sh.104.80:

Par value Sh.1,000

Coupon 4.50%

Maturity 15 years

Conversion price Sh.25 per share

The issuer’s shares are currently trading at Sh.19.50.

Required:

The number of shares into which the bond is convertible. (1 mark)

The conversion value. (1 mark)

The conversion premium. (1 mark)

The effective conversion price. (1 mark)

3. A 5% coupon bond matures ten years from now. Its price is Sh.96.23119 and the yield is 5.5%. The modified duration is 7.64498.

Required:

The approximate price change assuming the yield rises or falls by 200 basis points. (1 mark)

The convexity assuming yield changes by 200 basis points. (2 marks)

The net percentage change in the price of the bond. ( 1 mark)

Highlight two limitations of duration as a measure of term structure of a bond and interest rate risk. (2 marks)

4. A corporate bond based on a 30/360 day-count conversion, with a coupon rate of 10% is maturing on 1 March 2022 and is purchased with a settlement date of 17 July 2020. The yield is 6.5%. The bond’s par value is Sh.100.

Required:

The bond’s clean price. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Differentiate between a “credit score” and a “credit rating”. (4 marks)

2. John Kisire, a financial analyst at Kawi Ltd. has gathered some financial information for the year ended

31 December 2020. He has also projected the amounts for the year ending 31 December 2021:

Kawi Ltd.

End of year 2020 2021

Sh. “000” Sh. “000”

Amortisation/depreciation 250 300

Interest expense 350 350

Earnings before interest, tax, depreciation and amortisation (EBITDA) 1,250 800

Kawi Ltd. is a company that specialises in power production.

John Kisire is concerned that the heavy rains and government expansion of geothermal source of power will affect Kawi Ltd.’s bond covenant compliance. The bond covenant requires an EBITDA coverage ratio of 3.5 times and an earnings before interest and tax (EBIT) coverage ratio of 2.0 times.

Required:

Explain whether or not Kawi Ltd. was in compliance with its EBITDA ratio at the end of year 2020. (2 marks)

The amount by which Kawi Ltd. needs to increase the EBIT in order to be compliant with its EBIT ratio for the year ending 31 December 2021. (3 marks)

3. The yields and spot rates for an option-free, 5.25% bond with 3 years to maturity are as shown below:

Maturity (years) Yield to maturity (%) Value Spot rate (%)

1 3.5 100 3.5

2 4.0 100 4.01

3 4.5 100 4.531

Required:

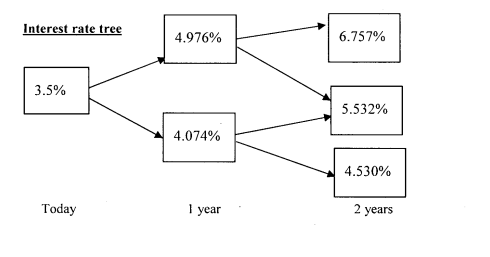

Construct a binomial tree for valuing an option-free bond with three years to maturity and a coupon of 5.25% and determine the value of the option free bond. (7 marks)

4. An investor buys a 10 year bond at Sh.85.503 and sells it in four years. The bond has a coupon rate of 8%. After the bond is purchased, the interest rate goes down from 10.40% to 9.40%. The bond has a par value of Sh.100.

Required:

Calculate the investor’s realised yield. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe how the following factors could affect the value of a callable or putable bond:

Interest rate volatility. (2 marks)

Level of interest rate. (2 marks)

Shape of the yield curve. (2 marks)

2. A 7.5%, 15 year, annual pay option-free Zuraya corporate bond trades at a market price of Sh.95.72 per Sh.100 par. The government spot rate curve is flat at 5%.

Required:

The Z-spread on Zuraya’s corporate bond. (4 marks)

3. The following are the par rates of a government bond:

Year Par rate (%)

1 5.00

2 6.00

3 7.00

Required:

Determine the 3 year spot rate using bootstrapping. (4 marks)

4. The government par curve is provided below:

Maturity (years) Par rate (%)

1 5.00

2 6.00

3 6.50

4 7.00

An analyst has a holding of a 4 year, 5% annual pay, Sh.100 par government bond.

Required:

The value of the government bond. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe two classes of modern term structure models. (4 marks)

2. Caroline Nyawira oversees five fixed income portfolios for one corporate client. Nyawira believes that interest rates will change over the next year, but is uncertain about the extent and direction of this change.

She is confident that the yield curve will change in a non-parallel manner and has assembled the table of key rate durations shown below:

Key rate duration

Issue Value (Sh.”million”) 3 month 2 year 5 year 20 year 30 year

Portfolio 1 100 0.03 0.14 0.49 1.59 4.62

Portfolio 2 200 0.02 0.13 1.47 0 0

Portfolio 3 150 0.03 0.14 0.51 1.64 2.38

Portfolio 4 250 0.06 0 0 0 0

Portfolio 5 300 0.00 0.88 0 0 0

The total value of the portfolio is Sh.1,000,000,000.

The following key rates duration will change while the others will remain constant:

- The 3 month rate increases by 20 basis points.

The 5 year rate increases by 90 basis points.

- The 30 year rate decreases by 150 basis points.

Required:

The new total value of the portfolio after these key rate duration changes. (8 marks)

3. A 3 year, Sh.100 par, zero coupon bond has a hazard rate of 2% per annum. Its recovery rate is 60% and the benchmark rate curve is flat at 3%.

Required:

The bond’s credit valuation adjustment (CVA). (8 marks)

(Total: 20 marks)