WEDNESDAY: 1 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Highlight five factors that determine bond prices. (5 marks)

2. Discuss three sources of return on investment in a fixed income security. (3 marks)

3. The government has issued a 182-days treasury bill (T-Bill) with a face value of Sh.100,000 and a discount yield of 5.88%.

Assume a 365-day year.

Required:

The price of the T-bill. (4 marks)

The government intends to issue a 5-year bond of Sh.1,000 par value at 8% per annum. The bond will be repaid equally over its life. The maximum required rate of return is 7% per annum.

Required:

The value of the bond. (4 marks)

4. The following information relates to spot rates for bonds with different maturity periods:

Year Spot Rate (%)

1 5

2 6

3 7

4 6

Required:

The forward rate for each of the four years. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Discuss three theories that describe the shape of the term structure of interest rate yield curve. (6 marks)

2. Explain the meaning of the following terms as used in fixed income investments:

Term bond. (2 marks)

Income bonds. (2 marks)

Bond equivalent yield (BEY). (2 marks)

Repos. (2 marks)

Banker’s acceptances. (2 marks)

3. A company enters into a Repo agreement with a bank and it sells Sh.10 million of government bonds with an obligation to repurchase the security in 60 days. The Repo rate is 8.2%

Assume a 365-day year.

Required:

The repurchase price of the bond. (2 marks)

The yield on the repurchase. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe three types of information released by the rating agencies that is useful in assessing the default risk of a bond. (3 marks)

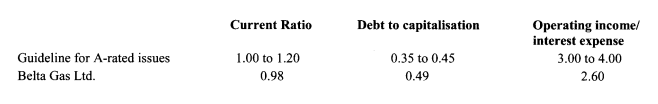

2. An analyst has compiled the following information on the bonds of Belta Gas Ltd. which is currently rated “A”.

Required:

Comment on whether Belta Gas Ltd. is a candidate for a ratings downgrade. (2 marks)

3. An investor purchases a bond on 14 July 2020. The bond has a face value of Sh.100 and a coupon of 4.25%. The first coupon payment date was 28 May 2020 and the next coupon payment date is 4 July 2021. The bond is due on 4 July 2025. Interest rate is 5%.

Assume a 365-day year.

Required:

Calculate the following for the bond:

Dirty price of the bond. (3 marks)

Clean price of the bond. (2 marks)

Macaulay duration. (3 marks)

Modified duration. (2 marks)

Convexity. (3 marks)

The percentage change in present value when interest rates increase by 1%. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. James Obongo owns Bright Ltd. convertible bond. The bond has a par value of Sh.1,000 and a coupon rate of 10% that is paid semi-annually. The bond matures in 12 years. Comparable bonds yield 8%. The bond is convertible into 24 shares of stock. The current market price of Bright Ltd.’s shares is Sh.34 per share, and the bond sells for Sh.1,200.

Required:

The conversion value of the bond. (2 marks)

The investment value of the bond. (4 marks)

The bonds investment premium. (2 marks)

The downside risk percentage of the bond. (2 marks)

2. College Publishing Limited has a Sh.50 million bond issue outstanding. The bond has a 12% coupon rate and 10 years remaining to maturity. This issue, which was sold 5 years ago had floatation costs of Sh.1.5 million that the firm has been amortising on a straight line basis over the 15-year life of the issue. The bond has a call provision which makes it possible for the company to retire the issue now by calling the bond at a 15% call premium.

Investment bankers have assured the company that it can sell a new 10%, 10-year bond to raise additional Sh.50 million required to refund the old bond.

The new bond will be sold two months before the old issue is called. Therefore, for the two months interest will be paid on the new and outstanding bond.

Floatation costs on the new refunding issue will amount to Sh.2.5 million which will be amortised on a straight line basis over the life of the bond.

Corporation tax rate is 30%.

Required:

Using relevant computations, advise the management of the company on whether to refinance the bond. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term “backward induction”. (2 marks)

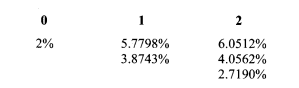

Philip Njoroge is valuing a floating rate security with a par value of Sh.100, three-year life and pays interest based on the annual London Interbank Offered Rate (LIBOR). He has generated the following binomial tree for LIBOR:

1 year forward rates starting in year:

Required:

Determine the value of the cap in a capped floater with a cap of 4%. (5 marks)

2. The prices of zero-coupon bonds with Sh.1 par value are shown below:

Maturity Price (Sh.)

1 0.9615

2 0.9070

3 0.8396

4 0.7629

The default risk of these bonds is similar to the default risk of surveyed banks based an which the swap rate is determined

The government spot rate curve is given below:

Maturity Rate (%)

1 3.05

2 4.10

3 5.25

4 6.45

Required:

Determine the three-year swap spread. (3 marks)

3. The following information relates to an equally weighted treasury portfolio:

Maturity Key rate duration

3 month 0.06

2 year 0.73

5 year 0.34

10 year 3.09

15 year 0.63

20 year 1.22

25 year 2.19

27 year 3.65

Required:

The effective duration of the portfolio for a parallel shift in the yield curve. (2 marks)

The impact on the portfolio of a 25 basis point increase in the 5 year rate and a 50 basis point increase in the 20 year rate, holding other key rates constant. (3 marks)

4. Johnson Mwebesa is evaluating an annual pay 4%, 1 year corporate bond. The recovery rate is 60% and the benchmark rate is 2.50%. The probability of default is 0.99% and the probability of survival is 98.010%. The bond has a par value of Sh.100.

Required:

The present value of expected loss. (5 marks)

(Total: 20 marks)