Some candidates did not perform well in the following questions:

Question no. 2 (c)

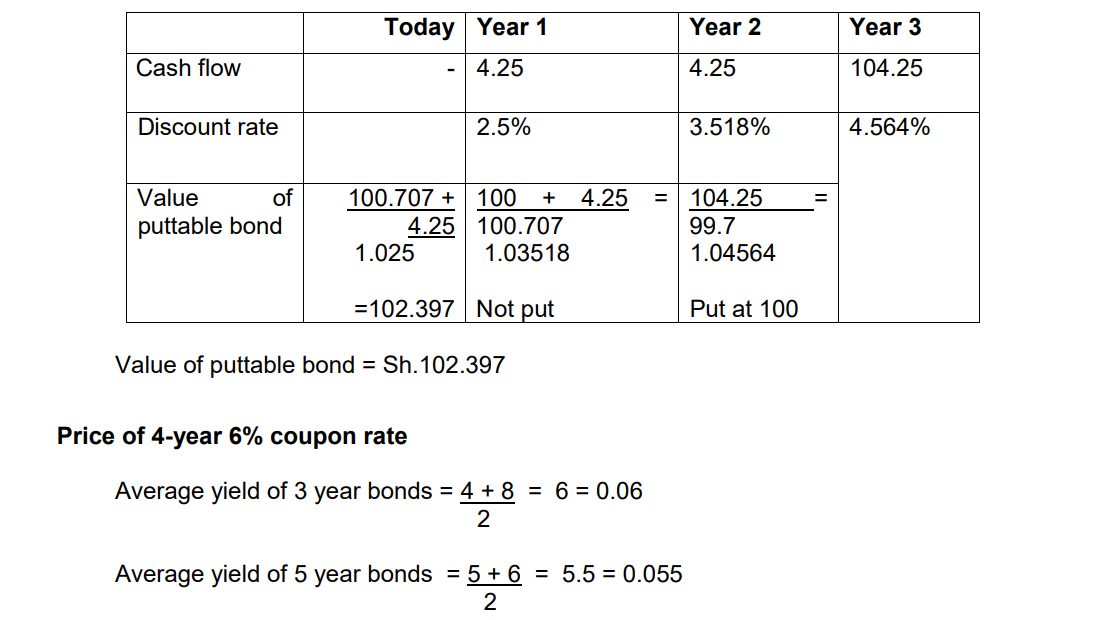

Where candidates were unable to value a particular bond with a put option. Candidates were expected to use the interest rate model (backward induction valuation model) to value bonds with a put option. In addition, candidates had challenges

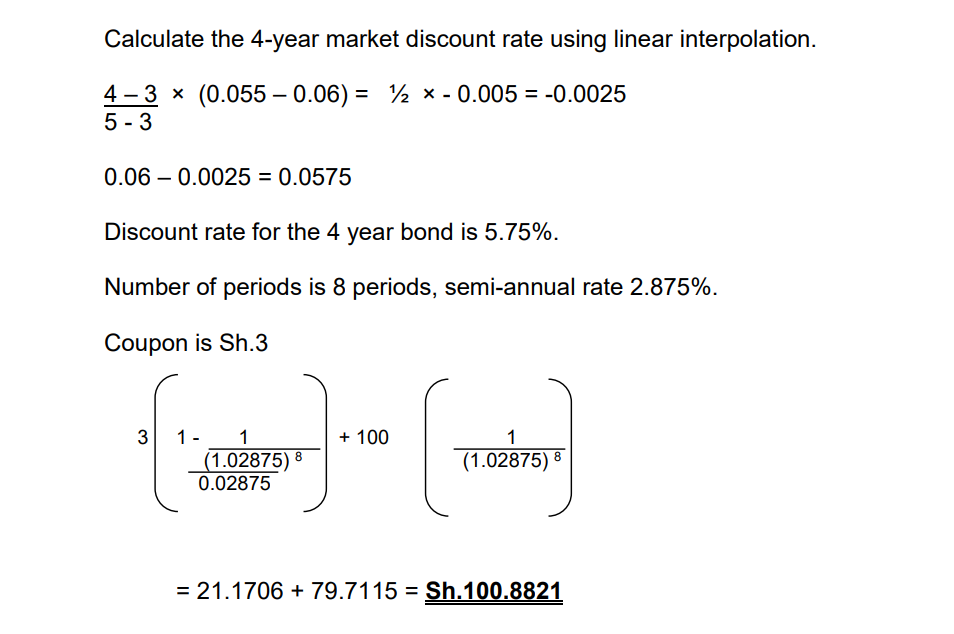

in determining the price of a semi-annual coupon bond. Candidates were expected to use matrix pricing to value the illiquid bond.

The expected response was as follows:

Note: The investor lends money and exercises the put option when the value of the bonds future cash flows is lower than the exercise price i.e. par value in this case.

Valuation of 3-year 4.25% annual coupon Bond puttable at par one year and two years from now under zero volatility

Question no. 3 (c) and (d)

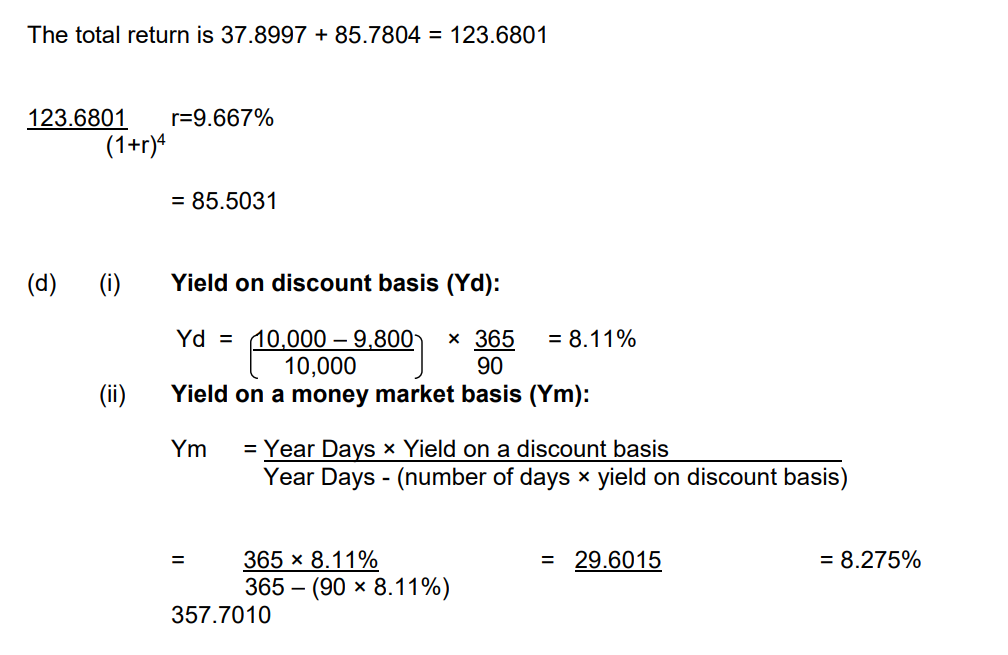

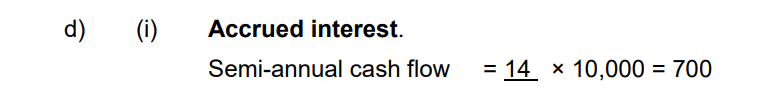

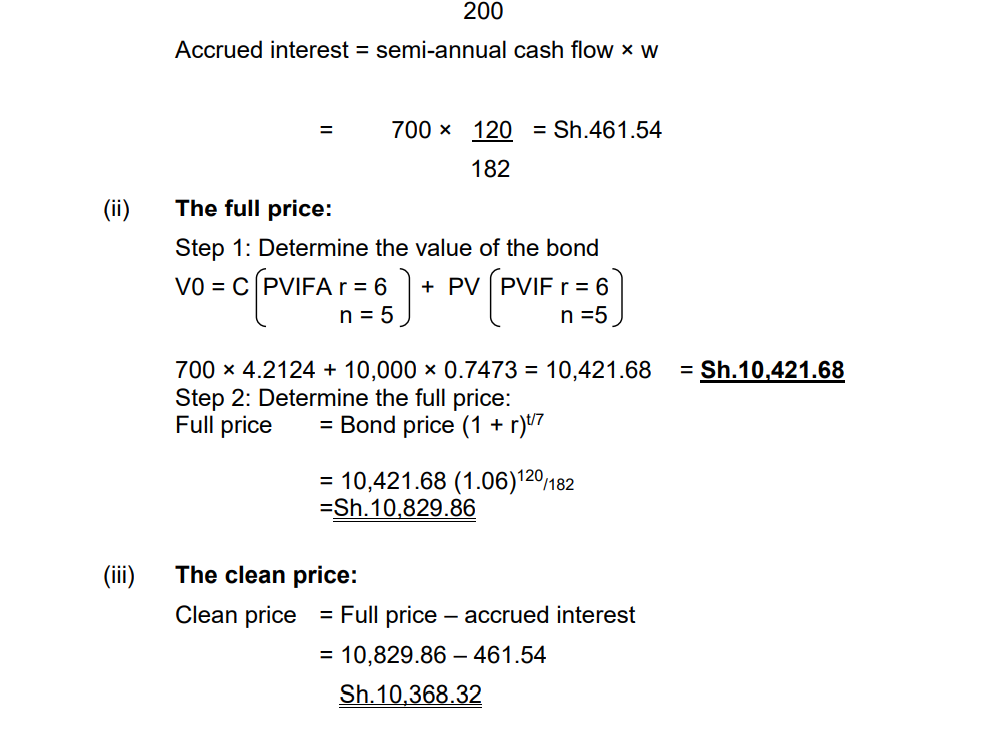

In which candidates were unable to compute the return of a bond given a government’s spot rates and swap spreads. In addition, candidates had challenges in calculating the accrued interest, the dirty price and clean price when the bond is sold between coupon dates.

The expected responses were as follows:

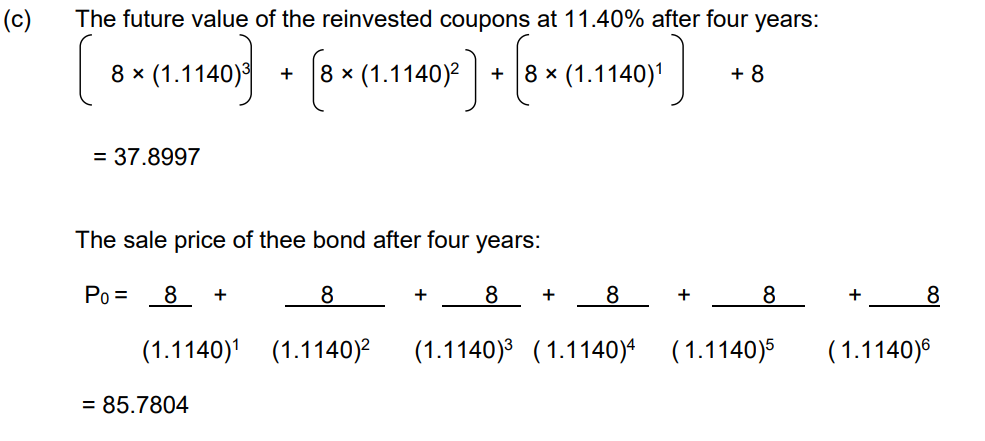

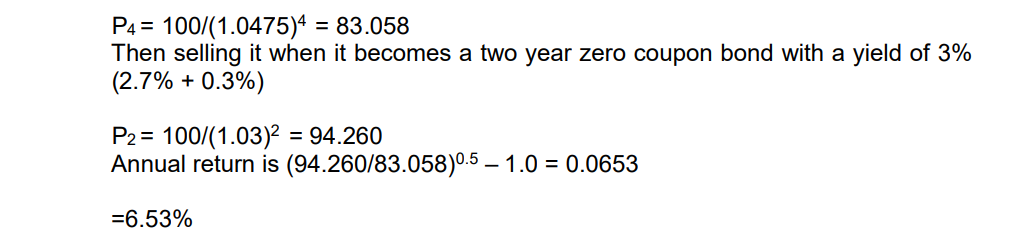

(c ) Investor’s return:

The four-year swap rate (fixed leg of an interest rate swap) can be used as an indication of the four-year corporate yield.

Riding the yield curve by purchasing a four year zero coupon bond with a yield of 4.75%

Question no. 5

In which candidates were unable explain the term “lattice” and describe the concept of backward induction valuation in relation to bonds with embedded options.

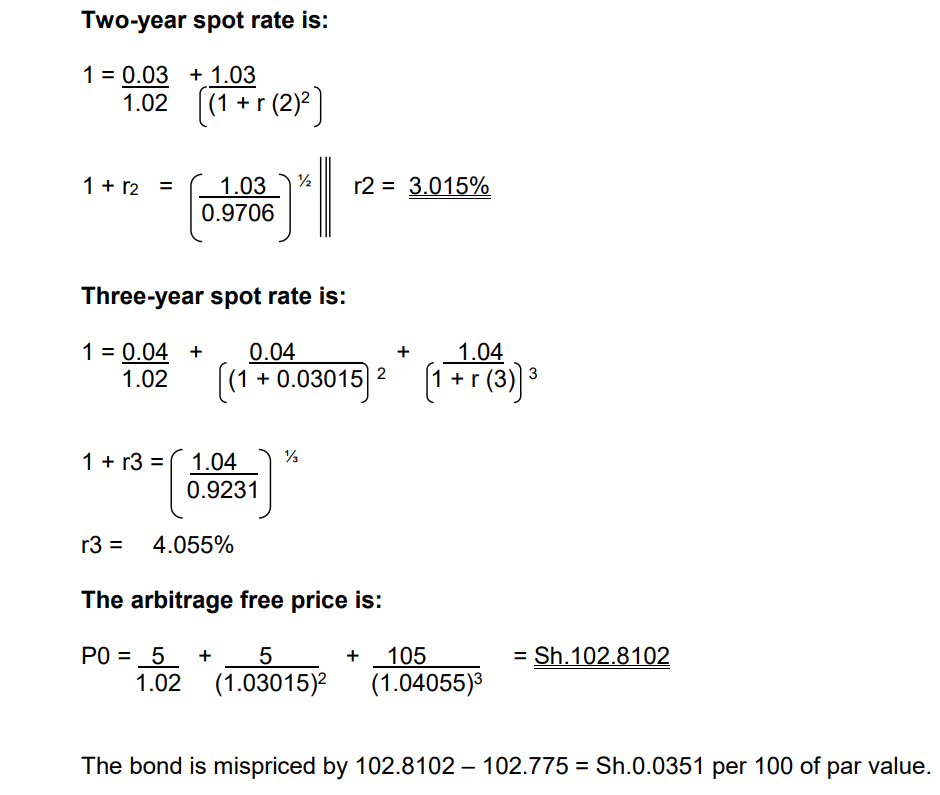

Candidates were unable to perform bootstrapping calculations which are the key requirement in determining whether an arbitrage opportunity exists in the framework of bond valuation. In addition, candidates were unable to calculate the reinvestment return and bond yields on a money market discount basis.

The expected responses were as follows:

(a) (i) The lattice is a representative of a model. It captures the distribution rates over time. Information in the lattice includes interest rates and cash flows over the life of the bond.

Example of a lattice is the binomial model, an interest rate lattice, trinomial model.

(ii) Backward induction valuation is a methodology used to find the value of a bond in a particular node of the binomial tree.

Valuation starts at maturity and the nodes are filled in with the values then work back the values one period from maturity. Continue like this until value of bond at the present time is found.

(b) One-year spot rate is 2% which is the same as the one-year par rate