Some candidates did not perform well in the following questions:

Question no. 3

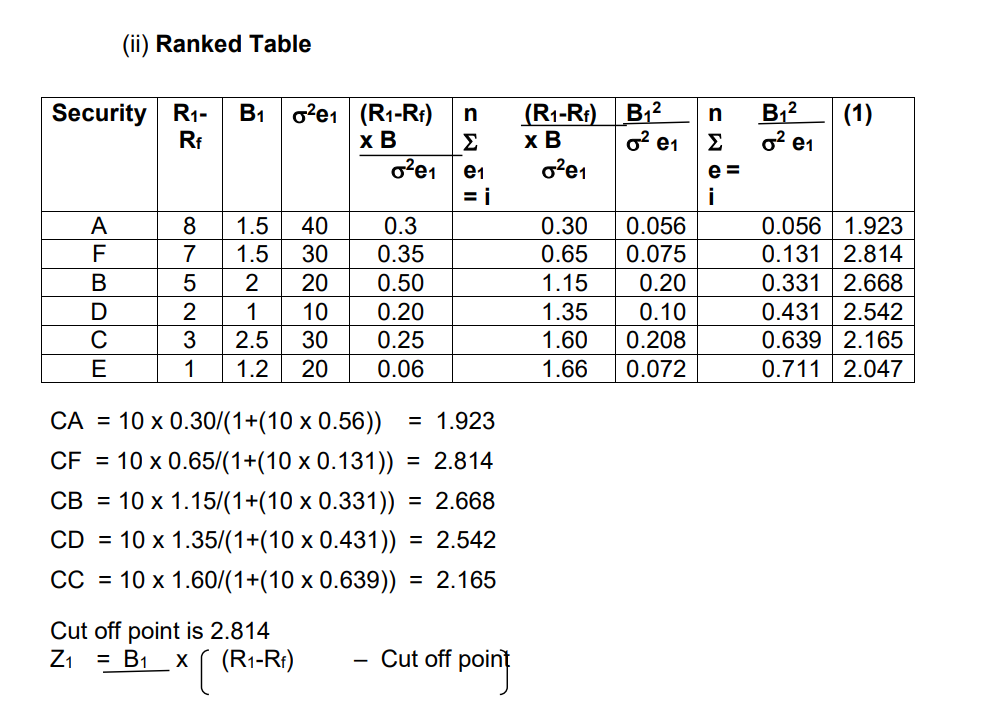

In which candidates were unable to describe two approaches for undertaking stress testing in portfolio risk management. Candidates also had difficulties in calculating a portfolio’s Sortino ratio. In addition, candidates were unable to compute

the excess return to beta ratio, cut-off point and the optimum portfolio from information provided about six securities.

Candidates were expected to include the following in their responses:

Approaches to undertaking stress testing:

Scenario analysis

This is the process of evaluating a portfolio under different states of the world. It involves designing scenarios with deliberately large movements in the key variables that affect the values of a portfolio asset.

Scenario analysis also involves the use of actual extreme events that have occurred in the past.

Stressing models

This is the use of an existing model and applying shocks to the model inputs in some mechanical way. It emphasises a range of possibilities rather than a single set of scenarios. It may involve pushing the prices and risk factors of an underlying model in the most disadvantageous way and then working out the combined effect on the portfolio’s value.

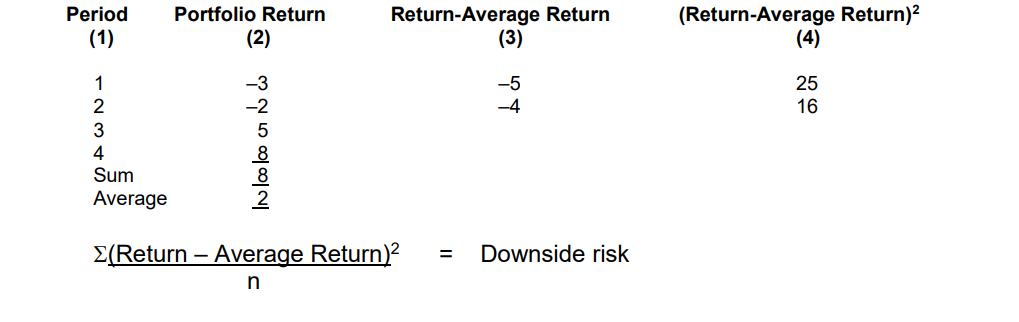

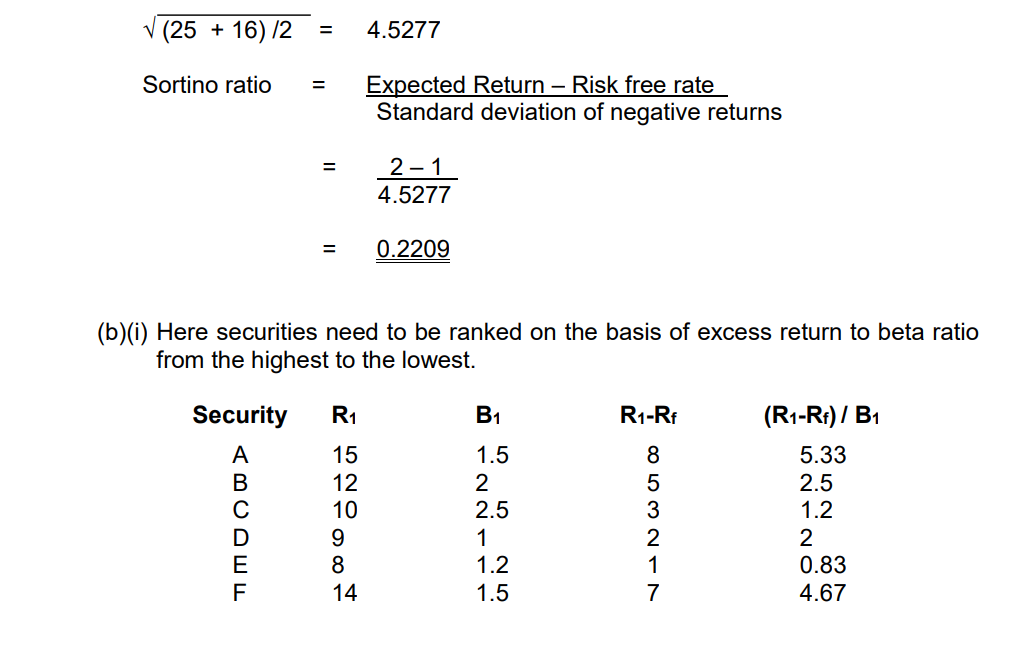

(a) Sortino ratio is the excess return per unit of downside risk.

Downside risk is the risk of negative asset returns

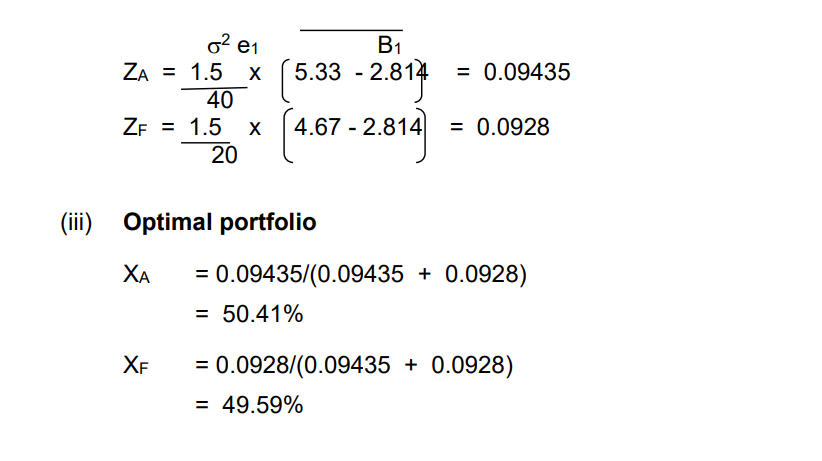

Funds to be invested in security A and F are 50.41% and 49.59% respectively.

Question no.5

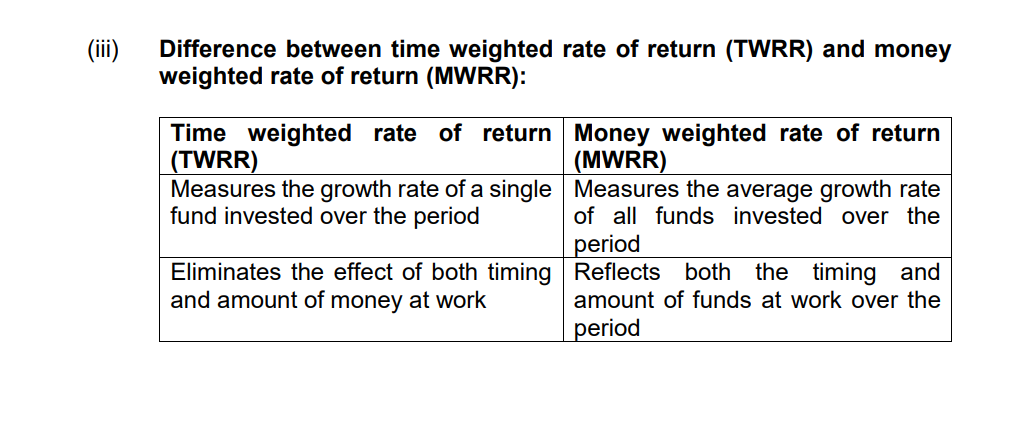

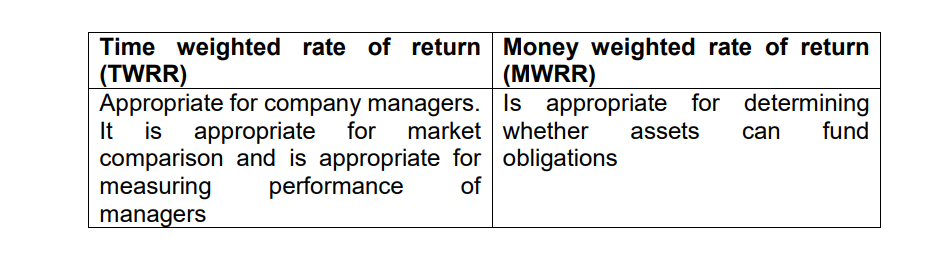

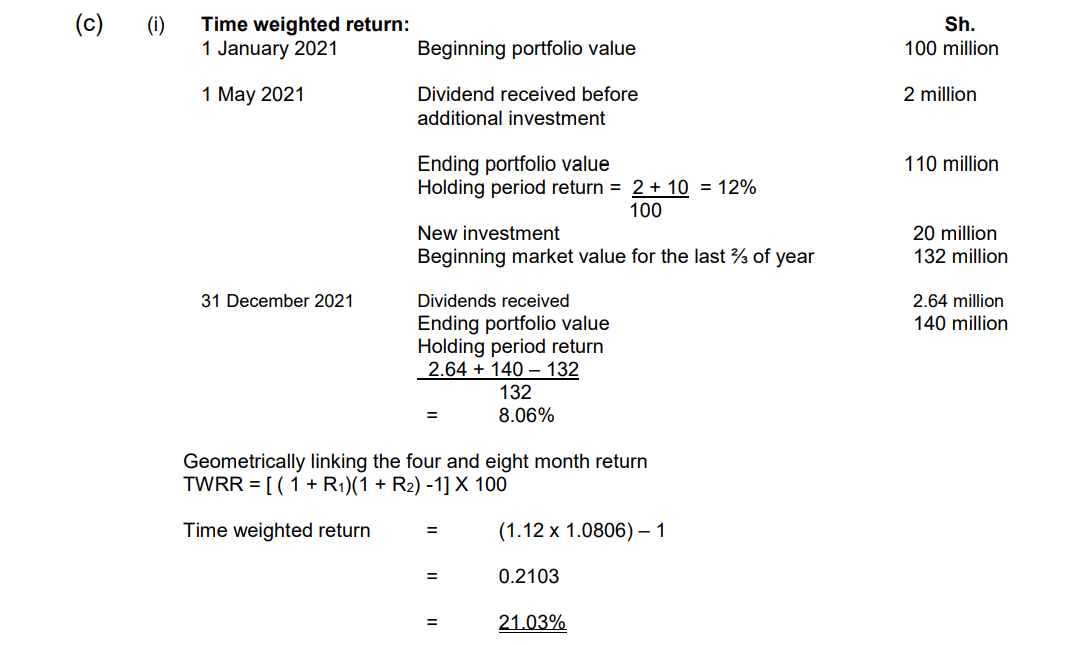

In which candidates were unable to identify the risk category of three investors given their risk aversion coefficients. Candidates had a challenge in computing the information ratio for an investor given some details in the question. In addition, candidates were unable to compute the time weighted rate of return (TWRR) as well as the money weighted rate of return (MWRR). In addition, candidates were unable to outline two differences between TWRR and MWRR.

The following responses were expected:

(a) Category of each investor with reason:

- Paul Wafula is a risk averse investor

Risk averse investors have a risk aversion coefficient of greater than zero, so any increase in risk reduces his/her utility. - Stephen Nabukwesi is a risk neutral investor

This is because risk neutral investors have a risk averse coefficient of zero, so changes in risk do not affect his/her utility. - Solomon Njoroge is a risk lover

Risk lover/taker investors have a negative risk aversion coefficient, creating an inverse situation so that additional risk contributes to an increase in his/her utility.

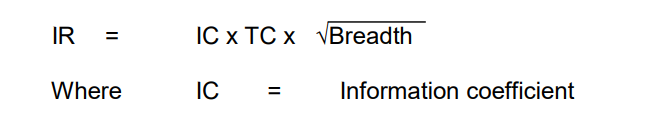

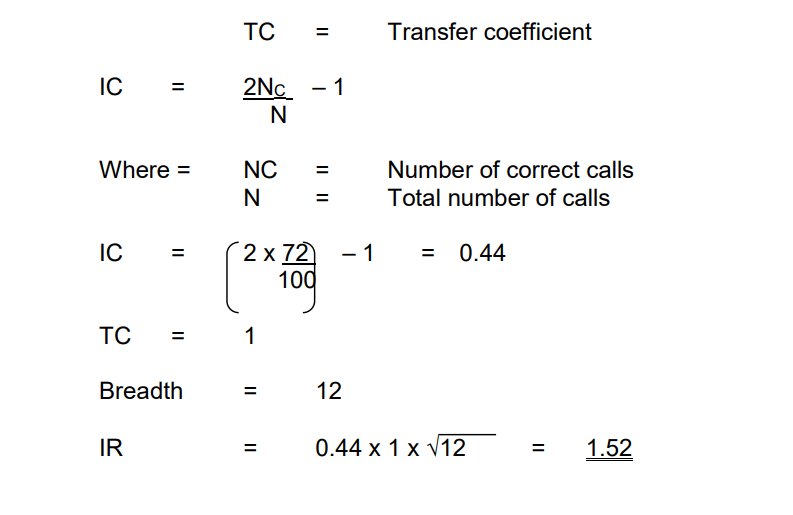

(b) James Mwathi information ratio

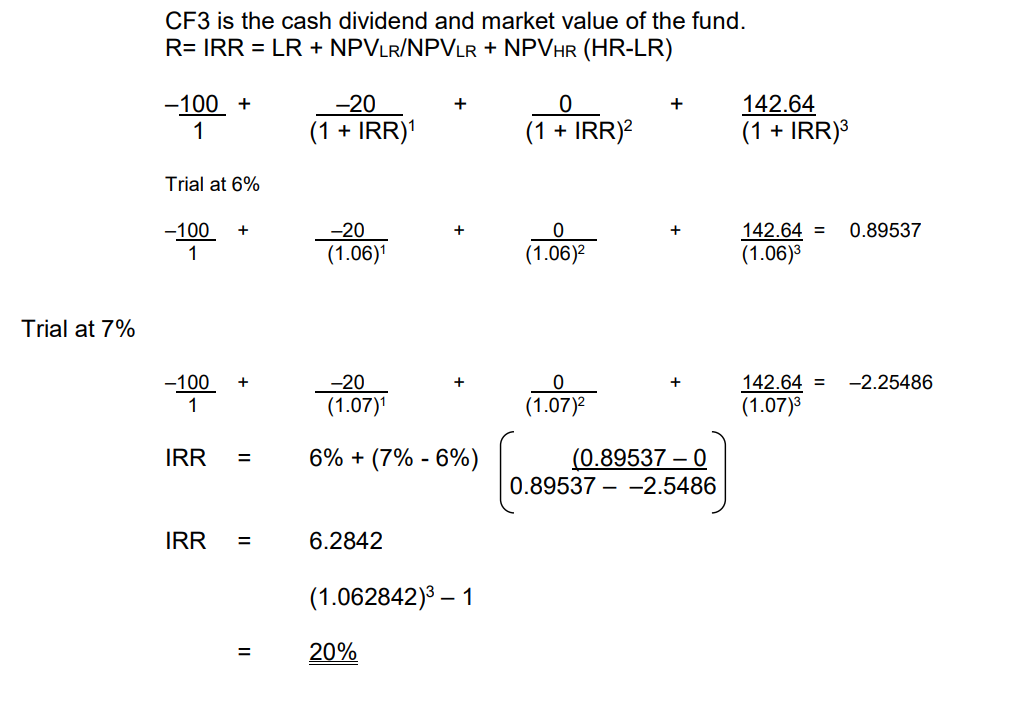

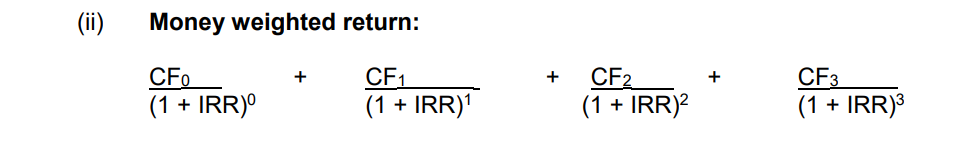

CF0 is the initial investment of Sh.100 million.

CF1 is the net of cash inflow of Sh.2 million dividend and cash outflow of Sh.22 million (dividend reinvested and additional investment of Sh.20 million).

CF2 is equal to 0 as there were no cash inflows at the end of third and fourth month interval