TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Highlight six steps to developing an effective analysis of financial statements. (6 marks)

2. Sustainability investing is an approach to investment where environmental, social or governance factors (ESG) in combination with financial considerations, guide the selection and management of investment.

Required:

In relation to the above statement, discuss three reasons why the disclosure of sustainable information has become an important part and influential consideration for investors. (6 marks)

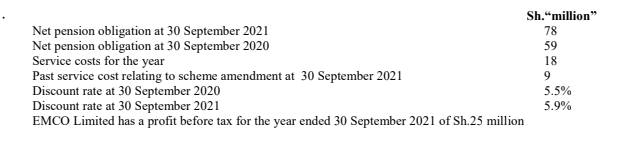

3. The new owners of EMCO Software Limited changed the firm’s pension scheme on 30 September 2021 to include all of its staff. The benefits accrue from the date of their employment, but only vest after two years of additional service from 30 September 2021. The net pension obligation at 30 September 2021 was Sh.78 million which has been updated to include this change. During the year, benefits of Sh.6 million were paid under the scheme and EMCO Limited contributed Sh.10 million to the scheme. These payments had been recorded in the financial statements. The following information relates to the pension scheme:

Required:

Required:

1. Determine the amount to be reported in other comprehensive income (OCI) after remeasurement of the defined benefit obligation. (5 marks)

2. Adjust the profit before tax to account for the remeasurement of the defined benefit obligation. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the term “creative accounting”. (2 marks)

Describe four examples of creative accounting. (4 marks)

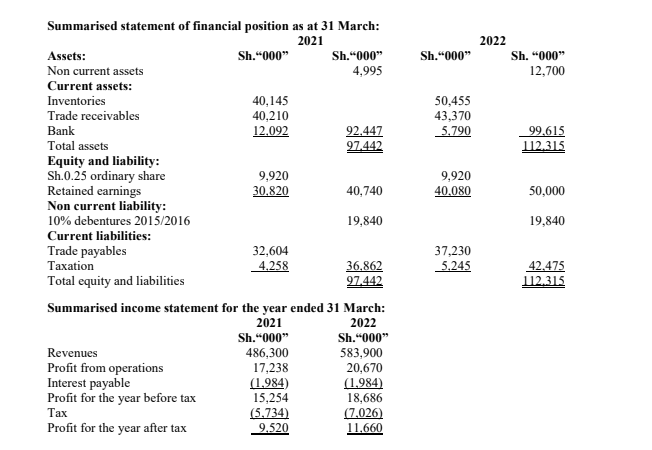

2. The following are summarised financial statements for Babito Ltd. with accounting year ending on 31 March 2021 and 31 March 2022:

Required:

For each year, compute two ratios for each of the following user groups, which are of particular significance to them:

Shareholders. (4 marks)

Creditors. (4 marks)

Internal management. (4 marks)

Examine two advantages of ratio analysis. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Grace Mambo has gathered the following research notes for the following three companies that reflect trends during the last three years:

Nkubu Ltd.

Note 1: Operating income has been much lower than operating cash flow (OCF).

Note 2: Accounts payable has increased, while accounts receivable and inventory have substantially decreased.

Note 3: Although OCF was positive, it was just sufficient to cover capital expenditures, dividends and debt

repayments.

Tororo Ltd.

Note 4: Operating margins have been relatively constant.

Note 5: Growth rate in revenue has exceeded the growth rate in receivables.

Note 6: OCF was stable and positive, close to its reported net income and just sufficient to cover capital expenditures, dividends and debt repayments.

Kisauni Ltd.

Note 7: OCF has been more volatile than that of other industry participants.

Note 8: OCF has fallen short of covering capital expenditure, dividends and debt repayment.

Required:

Citing relevant reasons, determine the company that would be described as having high quality cash flow. (6 marks)

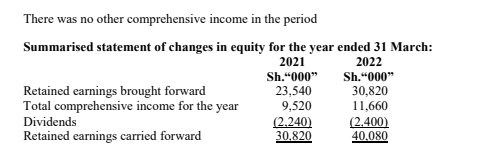

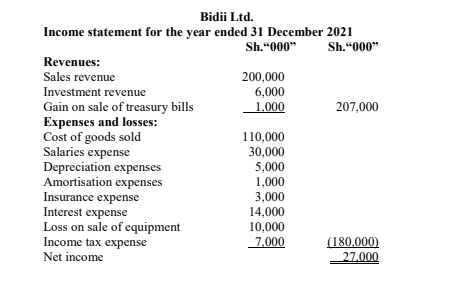

2. The comparative statements of financial position as at 31 December 2021 and 31 December 2020 and the income statement for the year 2021 for Bidii Ltd. are provided below:

Additional information:

1. Investment revenue includes Bidii Ltd.’s Sh.3 million share of the net income of Tobiko Ltd., an equity method investee.

2. Treasury bills were sold during the year 2021 at a gain of Sh.1 million. Bidii Ltd. classifies its investments in Treasury bills as cash equivalents.

3. Equipment that originally cost Sh.60 million and was one half depreciated was rendered unusable. The major components of the equipment were sold for Sh.20 million.

4. Temporary differences between pre-tax accounting income and taxable income caused the deferred tax liability to increase by Sh.1 million.

5. The ordinary shares of Murinduko Ltd. was purchased for Sh.14 million as a long term investment.

6. Land costing Sh.30 million was acquired by paying Sh.15 million in cash and issuing a 13% seven year, Sh.15 million note payable to the seller.

7. New equipment was purchased for Sh.40 million cash.

8. Sh.20 million bonds were issued at face value.

9. On 19 January 2020, Bidii Ltd. issued a 5% stock dividend (1 million shares). The market price of the Sh.10 par value ordinary shares was Sh.14 per share at that time.

10. Cash dividends of Sh.10 million were paid to shareholders.

11. In November 2020, 500,000 ordinary shares were repurchased as treasury stock at a cost of Sh.7 million.

Required:

Statement of cash flows for Bidii Ltd. for the year ended 31 December 2021 using the direct method. (14 marks)

(Total: 20 marks)

QUESTION FOUR

1. In relation to segment reporting:

Explain what is involved in financial reporting for segment of a business enterprise. (2 marks)

Evaluate two accounting difficulties inherent in segment reporting. (4 marks)

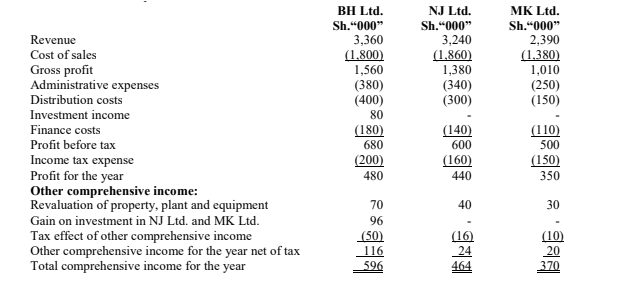

2.The statement of comprehensive income for three entities for the year ended 31 March 2022 are presented below:

Additional information:

1. BH Ltd. acquired a 25% investment in NJ Ltd. on 1 September 2013 for Sh.300,000. The investment was classified as available for sale and the gains earned on it have been recorded within other comprehensive income in BH Ltd.’s individual financial statements. The fair value of the 25% investments at 31 March 2021 was Sh.400,000 and at 1 January 2022 was Sh.425,000. BH Ltd. was not able to exercise significant influence over the financial and operating policies of NJ Ltd.

On 1 January 2022, BH Ltd. acquired an additional 40% of the 1 million Sh.1 equity shares of NJ Ltd. for Sh.680,000. The retained reserves of NJ Ltd. that date were Sh.526,000. The group policy is to value the non-controlling interest at its fair value at the date of acquisition. The non-controlling interest had a fair value of Sh.581,000 at 1 January 2022. NJ Ltd. lost a key customer in February 2022 and BH Ltd.’s directors have decided that goodwill on acquisition is impaired by 10% at 31 March 2022. Impairment

losses are charged to group administrative expenses.

The investment in NJ Ltd. continues to be held as an available for sale asset in BH Ltd. individual financial statements and recorded at its fair value of Sh.1,170,000 at 31 March 2022. The total gains recorded to date in respect of NJ Ltd. are Sh.190,000 of which Sh.90,000 occurred in the year and are included in the other comprehensive income of BH Ltd.

2. BH Ltd. acquired 40% of the equity share capital of MK Ltd. for Sh.334,000 on 1 October 2021. The investment was classified as available for sale and the gains earned on it since its acquisition have been recorded within other comprehensive income in the years in BH Ltd.’s individual financial statements. The fair value of this available for sale assets at 31 March 2022 was Sh.370,000. BH Ltd. exercises significant influence over the financial and operating policies of MK Ltd.

A new competitor has recently entered the market in which MK Ltd. operates and it is likely that this will have an immediate impact on MK Ltd.’s profits in the coming period. As a result, the directors of BH Ltd. have decided that the investment in MK Ltd. should be subject to 10% impairment at 31 March 2021.

3. NJ Ltd. sold goods to BH Ltd. in January 2022 for Sh.200,000. Half of these items remain in BH Ltd.’s inventories at the year end. NJ Ltd. earns a 20% gross margin on all sales.

4. The profits of all the three entities can be assumed to accrue evenly throughout the year. Assume there is no further impact to income tax figures.

5. MK Ltd. paid a dividend of Sh.80,000 to its equity shareholders on 31 March 2022. BH Ltd. included its share of the dividend in investment income.

Required:

Consolidated statement of comprehensive income for BH Ltd. group for the year ended 31 March 2022. (14 marks)

(Total: 20 marks)

QUESTION FIVE

1. Insta Ltd. has several investments in the securities of other companies. The following information regarding these investments is available as at 31 December 2021:

1. Insta Ltd. holds bonds issued by Kanunga Ltd. The bonds have an amortised cost of Sh.320,000 and their fair value at 31 December 2021 is Sh.400,000. Insta Ltd. intends to hold the bonds until they mature on 31 December 2029.

2. Insta Ltd. has invested idle cash in the equity securities of several publicly traded companies. Insta Ltd. intends to sell these securities during the first quarter of 2022, when it needs the cash to acquire seasonal inventory. Those equity securities have a cost basis of Sh.800,000 and a fair value of Sh.920,000 at 31 December 2021.

3. Insta Ltd. has a significant ownership in one of the companies that supplies it with various components. Insta Ltd. owns 6% of the ordinary shares of the supplier and does not have any representation on the supplier’s board of directors, does not exchange any personnel with the supplier and does not consult with the supplier or any of the supplier’s operating, financial or strategic decisions. The cost basis of the investment in the supplier is Sh.1,200,000 and the fair value of the investment at 31 December 2021, is

Sh.1,550,000. Insta Ltd. does not intend to sell the investment in the foreseeable future. The supplier reported net income of Sh.80,000 for the year ended 31 December 2021 and paid no dividends.

4. Insta Ltd. owns some ordinary shares of Solomon Ltd. The cost basis of the investment in Solomon Ltd. is Sh.200,000 and the fair value at 31 December 2021 is Sh.50,000. Insta Ltd. believes the decline in the value of its investment in Solomon Ltd. is permanent and therefore impaired, but Insta Ltd. does not intend to sell its investment in Solomon Ltd. in the foreseeable future.

5. Insta Ltd. purchased 25% of the ordinary shares of Thogoto Ltd. for Sh.900,000. Insta Ltd. has significant influence over the operating activities of Thogoto Ltd. During the year 2021, Thogoto Ltd. reported net income of Sh.300,000 and paid a dividend of Sh.100,000.

Required:

Explain the different rationales for the different accounting and reporting rules for different types of investments in the securities of other companies. (4 marks)

Determine the total effect on Insta Ltd.’s 2021 net income investment in other companies. (4 marks)

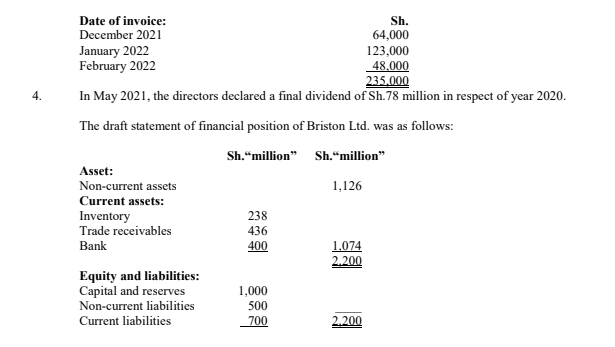

2. Briston Ltd. has just prepared its draft accounts for the year ended 31 December 2021. The external auditor has reviewed these accounts and has advised that these accounts will not be authorised for issue for another three weeks until the following issues are addressed and resolved:

1. In January 2022, a building with a carrying value of Sh.250 million burnt down. It was not insured.

2. In February 2022, inventories with a year-end cost of Sh.79 million were sold for Sh.65 million.

3. In March 2022, a major customer went bankrupt owing Briston Ltd. Sh.235 million. The amount receivable was made up as follows:

Required:

Explain how each of the above four events after the reporting period will be accounted for. (8 marks)

Redraft the statement of financial position to incorporate all of the adjusting events after the reporting period according to, International Accounting Standard, IAS 10-Events after reporting date. (4 marks)

(Total: 20 marks)