THURSDAY: 2 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. As a financial research analyst, discuss five sources of information that one could use to assess the risks faced by a company. (10 marks)

2. Toiz Ltd. is a manufacturer of toys. The company’s annual report for the year 2020 contained the following footnote under Accounting Policies:

Promotional displays: The company’s investment in promotional displays is carried at cost less applicable amortisation. Amortisation is provided using the straight line method on an individual display basis over the estimated period of benefit (approximately 30 months).

Toiz Ltd. provided the following financial information for the years ended 31 December:

2019 2020

Sh.”000″ Sh.”000″

Promotional displays 8,451 10,099

Total assets 140,609 166,656

Shareholders’ equity 78,337 92,612

Sales 327,013 387,301

Net income 17,509 14,467

Tax rate is 30%.

Required:

Explain two reasons why Toiz Ltd. might have chosen to capitalise the cost of promotional displays rather than expense them. (4 marks)

Calculate the effect of capitalisation of promotional displays on the following reported amounts for the year ended 31 December 2020:

- Net income. (2 marks)

- Shareholders’ equity. (2 marks)

- Return on assets. (2 marks)

(Total: 20 marks)

QUESTION TWO

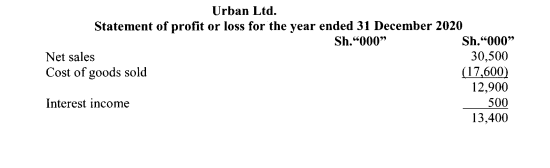

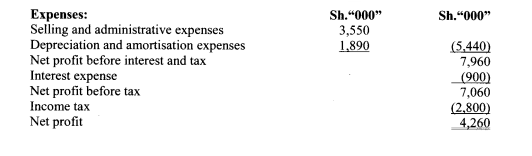

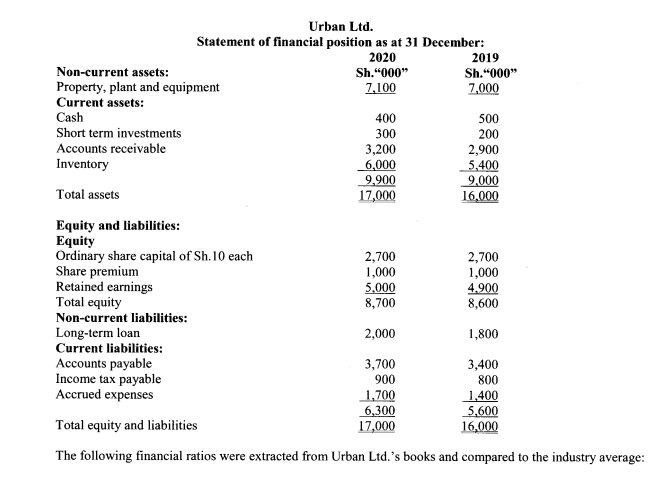

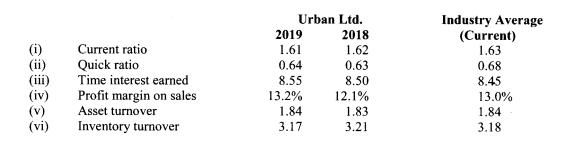

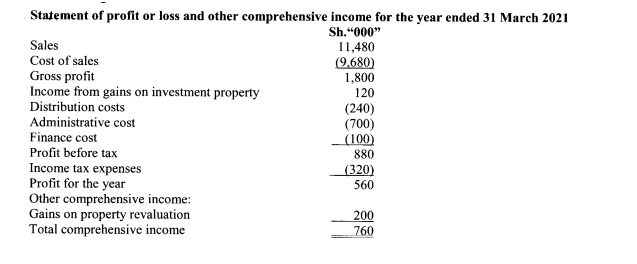

The following financial statements were extracted from the books of Urban Ltd:

Required:

1. Urban Ltd.’s ratios for the year ended 31 December 2020 as presented above. (6 marks)

2. Using each of the ratios calculated in (a) above, analyse Urban Ltd.’s financial stability and operating efficiency. (12 marks)

3. Highlight two limitations of ratio analysis. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight four criteria that must be met in order to recognise revenue earned at the point of sale. (4 marks)

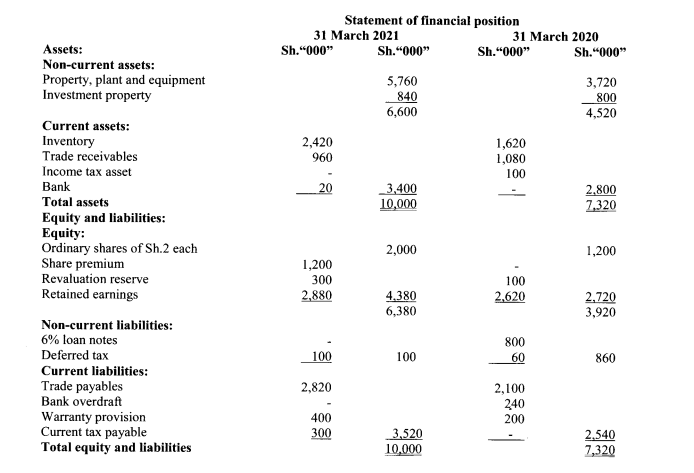

2. The following are extracts from the financial statements of Jolly Ltd.

Additional information:

- An item of plant with a carrying amount of Sh.480,000 was sold at a loss of Sh.180,000 during the year ended 31 March 2021. Depreciation of Sh.560,000 was charged (to cost of sales) for property, plant and equipment in the year ended 31 March 2021. There are no purchases or sales of investment property during the year.

- The 6% loan notes were redeemed early incurring a penalty payment of Sh.40,000. This amount was charged as an administrative expense in the income statement.

- There was an issue of shares on 1 October 2020. There was no bonus issue during the year.

- Jolly Ltd. gives a twelve month warranty on some of the products it sells. The amount shown in current liabilities warranty provision is an accurate assessment based on past experience of the amount of claims likely to be made in respect of warranties outstanding at each year end. Warranty costs are included in cost of sales.

- A dividend of Sh.0.3 per share was paid on 1 January 2021.

Required:

Statement of cash flows for the year ended 31 March 2021 in accordance with International Accounting Standard (IAS) 7, “Statement of Cash Flows”. (16 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss three barriers that could hinder harmonisation of international financial reporting standards. (6 marks)

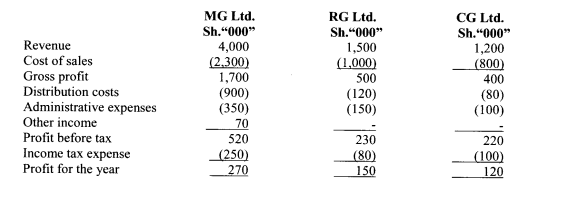

2. The income statements for MG Ltd., RG Ltd and CG Ltd. for the year ended 31 December 2020 are shown below:

Additional information:

- MG Ltd. acquired 70% of the ordinary share capital of RG Ltd. on 1 January 2019 for Sh.8,200,000. At the date of acquisition, the net assets of RG Ltd. were assessed to have a fair value of Sh.10,000,000. The only fair value adjustment required on acquisition related to depreciable assets (see note 2 below). The group policy is to value non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest at the date of acquisition was Sh.2,200,000.

- At the date of acquisition, depreciable assets of RG Ltd. with a remaining useful life of 6 years, had a fair value of Sh.240,000 more than their book value. The group policy is to depreciate non-current assets on a straight line basis over the remaining economic useful life. Depreciation is to be charged to administrative expenses.

- No impairment of goodwill arose in the year ended 31 December 2019. However, an impairment, review conducted on 31 December 2020 showed goodwill being impaired by 15%. Impairment losses are to be charged to administrative expenses.

- MG Ltd. acquired 40% of the ordinary share capital of CG Ltd. on 1 October 2020. MG Ltd. is now able to exercise significant influence over the operating and financial policies of CG Ltd.

- During the year ended 31 December 2020, MG Ltd. and RG Ltd. paid ordinary dividends of Sh.300,000 and Sh.100,000 respectively. Income from investments is included within other income.

- RG Ltd. sold goods to MG Ltd. on 1 November 2020 with a sales value of Sh.140,000. Half of these goods remained in MG Ltd.’s inventories at the year end. RG Ltd. makes 20% profit margin on all sales.

Required:

Consolidated income statement for the MG group for the year ended 31 December 2020. (14 marks)

(Total: 20 marks)

QUESTION FIVE

1. Evaluate two challenges that a financial analyst might encounter when using the equity method to account for associates and jointly controlled entities. (4 marks)

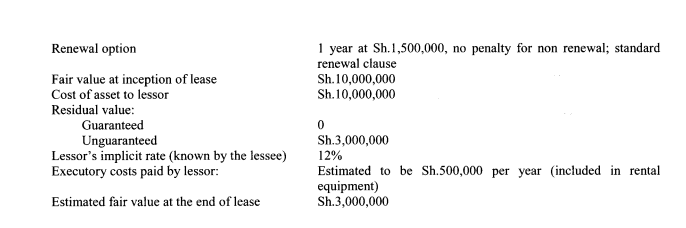

2. Big Guy company is evaluating a lease arrangement being offered by Systemia Company for use of a computer system. The lease is non-cancellable, and in no case does Big Guy Company receive title to the computers during or at the end of the lease term. The lease will commence on 1 January 2022 with the first rental payment due on 1 January 2022.

Additional information relating to the lease is as follows:

Yearly rental Sh.3,557,250

Lease term 3 years

Estimated economic life 5 years

Purchase option Sh.3,000,000 at the end of 3 years, which approximates fair value

Required:

Using the four criteria for capitalisation of leases, analyse the above lease arrangement. (6 marks)

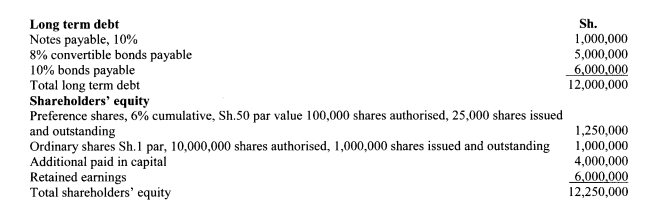

3. The following financial information was extracted from the books of Jaxx Ltd.:

Additional information:

- Options were granted on 1 January 2020 to purchase 200,000 shares at Sh.15 per share. Although no options were exercised during the financial year 2020, the average price per ordinary share during the financial year 2020 was Sh.20 per share.

- Each bond was issued at face value. The 8% convertible bond will convert into ordinary shares at 50 shares per Sh.1,000 bond. The bonds were exercisable after 5 years and were issued in 2019.

- The preference shares was issued in 2019.

- There are no preference dividend in arrears; however, preference dividends were not declared in the year ended 31 December 2020.

- The 1,000,000 ordinary shares were outstanding for the entire year 2020.

- The net income for the year ended 31 December 2020 was Sh.1,500,000 and the tax rate is 30%.

Required:

For the year ended 31 December 2020, calculate the following:

Basic earnings per share (BEPS). (2 marks)

Diluted earnings per share (DEPS). (6 marks)

4. Explain how the conversion feature of convertible debt has value:

To the issuer. (1 marks)

To the purchaser. (1 mark)

(Total: 20 marks)