(a) Explain four conditions to be met by a tax payer for an objection to be valid. (8 marks)

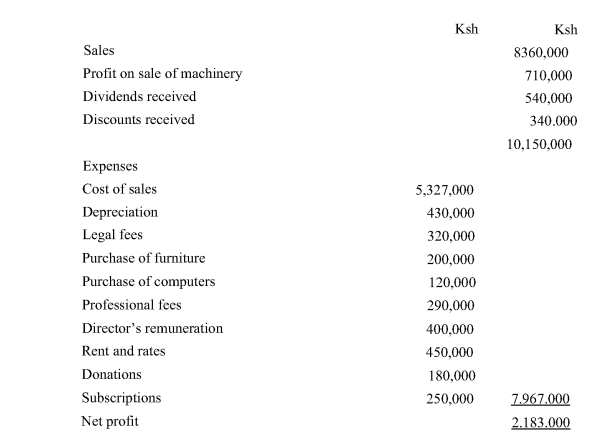

(b) Mwalulu Limited operates a supermarket in Nairobi. The following income statement relates to business for the year ended 31 December 2017.

Additional information:

Legal fees include Ksh 130,000 for defending a directors against corruption.

Professional fees include Ksh 90,000 paid to a tax consultant.

Donations include Ksh 100,000 paid to a political party and Ksh 80,000 paid to children’s home.

¢ Subscriptions comprises of Ksh 130,000 paid to a trade association and Ksh 120,000

to a non-governmental organisation.

* Capital allowances were agreed at Ksh 395,000 with the commissioner of Domestic Taxes. ) Prepare a statement of adjusted taxable profits for the year ended 31 December

2017.

(ii) Calculate the tax payable (if any) for the year ended 31 December 2017. (12 marks)

Additional information:

Explain four circumstances under which a manufacturer may shift the burden of a tax to the final consumer. (8 marks)

Tamu and Kali are in partnership sharing profits and losses in the ratio 3:2 respectively.

The income statement for the year ended 31 December 2017 was as follows :

Salaries and wages include Ksh 120,000 and Ksh 180,000 paid to Tamu and Kali for the year respectively.

The interest expense includes interest on capital to partners of Ksh 170,000.

The interest on capital to partners is shared on their profit sharing ratio.

Professional fees include Ksh 70,000 paid to Tamu for his services as an auditor.

Insurance of Ksh 60,000 relates to Tamu’s life insurance.

Drawings made by Tamu and Kali during the year amounted to Ksh 80,000 and

Ksh 100,000 respectively. The drawings has been included in the cost of sales.

The agreed capital allowances with the commissioner of Domestic Taxes was

Ksh 290,000.

Prepare:

) A statement of taxable profits for the year ended 31 December 2017.

(ii) A schedule showing the allocation of partners’ taxable income for the year of income 2017.

(iii) Kali intends to file his returns for the year of income 2017 with an estimated taxable income of Ksh 524,000. Using the results (11) advise him in his tax

position.

Explain two advantages in each of the following:

Direct tax. (4 marks)

(i) Withholding tax. (4 marks)

(b) Mr. Mwanza was employed as an accountant of Pendo Company with effect from

1 January 2017. The following information relates to his income for the year of income

2017.

– Basic salary Ksh 120,000 per month (PAYE Ksh 29,000 per month)

– He stays in a company house, whose market rental rate is Ksh 25,000 per month but mat jvai.

– Income from his retail business amounted to Ksh 450,000 for that year.

Calculate the:

(i) Taxable income for the year of income 2017.

(ii) Tax payable. (12 marks)

4. (a) Explain four offences that may be committed by a tax payer.

(b) Mrs. Okello has been operating business without proper accounting records for the last four years. The following information relates to the business for the year ending

(i) The total assets and liabilities as at 31 December 2013 were ksh 4,350,000 and Ksh 1,700,000 respectively.

(ii) Estimated living expenses were Ksh 275,000 in 2014 and increased by 25% every subsequent year.

(iii) | Furniture with a book value of Ksh 900,000 was sold for Ksh 750,000 in 2014.

(iv) | A motor vehicle with book value of Ksh 800,000 was sold in 2015ior Ksh 1,150,000.

(v) Interest charged on the loan is to be ignored.

Calculate the income chargeable to tax for the years 2014,2015,2016 and 2017. (12 marks)

Explain five ways in which Value Added Tax (VAT) satisfies the principles of a good tax system. (10 marks)

The following are the purchases and sales of Mako Traders for the months of April to September 2017.

50% of the June 2017 and August 2017 Sales were exported to Tanzania.

(ii) Issued credit notes to debtors amounted to Ksh 700,000 in July 2017.

(iii) Received credit note for Ksh 950,000 from Pema suppliers in September 2017.

(iv) ‘Transactions are exclusive of VAT at the rate of 16%.

Prepare a VAT account for each of the months showing the VAT payable or refundable. Explain the tax treatment of the following:) Loose tools.

(ii) Amount paid on passages.

Mr. Komeni is a commercial farmer in Nakuru Country. On 30 June 20 he completed building a farm house at the cost of Ksh 2,100,000 and occupied it immediately. Additional expenditure incurred during the year 2017 was as follows: