Monday 4 April 2022 Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shorn at the end of the question. Show ALL your workings. Do Not write anything on this paper.

QUESTION ONE

1. Management commentary is a key source of information for financial statements analysis. It is one of the most useful sections of the annual report.

Required;

In light of the above statement enumerate four issues that management discusses in The management discussions and analysis (MDAS). (4 marks)

2. In the context of International ‘Financial Reporting Standard (IFRS) 5 “Non-current assets held for sale and discontinued operations”, explain the meaning of the term “discontinued operations”. (2 marks)

3. International Financial Reporting Standard (IFRS) 16 “Leases” sets out the principles for the recognition, measurement, presentation and disclosures of leases.

Required:

Explain the optional exemption from the full requirements of the standard in accounting for leases in the financial statements of the lessee. (4 marks)

4. Twiga Ltd. owns 70% of the ordinary share capital of Ndovu Ltd. The total group equity as at 31 December 2020 was Sh.4,000.,000, which included Sh.650,000 attributable to non-controlling interest. Twiga Ltd. purchased a further 20% of the ordinary share capital of Ndovu Ltd. on 1 October 2021 for Sh.540,000. During the year to 31 December 2021 Twiga Ltd. issued 2 million, Sh. 1 ordinary shares, fully paid at Sh. 1.30 per share. Dividends were paid by both group entities in April 2021. The dividends paid by Twiga Ltd. and Ndovu Ltd. were sh.200,000 and Sh.100,000 respectively. Total comprehensive income for the year ended 31 December 2021 for Twiga Ltd. was Sh.900,000 and for Ndovu Ltd. was Sh.600,000.

Income is accrue evenly throughout the year.

Required;

Explain the impact of the additional 20% purchase of Ndovu Ltd.’s ordinary share capital by Twiga Ltd. on the equity of the. Twiga Ltd. group. (2 marks)

Prepare the consolidated statement of changes in equity for the year ended 31 December 2021 for the Twiga Ltd group showing the total equity attributable to the parent and to the non-controlling interest. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. In recent years, many financial analysts have commented on a growing, disillusionment with the usefulness and reliability of the information contained in some companies’ income statements and statements of financial position.

In reference to the above statement, discuss two reasons as to why a company’s statement of cash flows may be more reliable than its income statement. (4 marks)

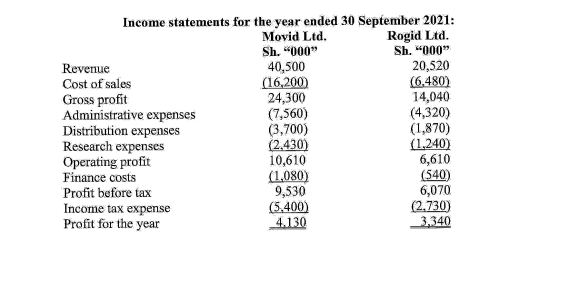

2. Solomon Mbogo, a financial analyst at Liman. Consultants, is tasked to carry out cross-sectional analysis of financial statements across firms within the same industry. The following financial statements for the year ended 30 September 2021 were extracted from industry competitors, Movid Limited and Rogid Limited.

Required:

Common size income statements for the two entities for the year ended 30 September 2021, (6 marks)

Common size statements of financial positions at 30 September 2021. (6 marks)

Analyse the relative financial performance and financial position of the two firms. (4 marks)

(Total: 20 marks)

QUESTION THREE

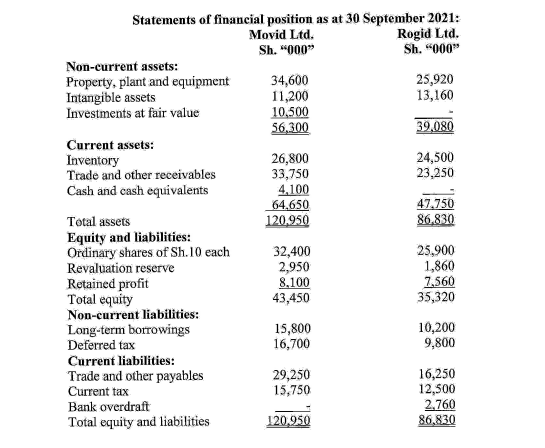

1. The following financial information was extracted from records of Maxson limited:

Required:

The entity’s return on equity (ROE) using ,a five-step Variant of DuPont analysis. (4 marks)

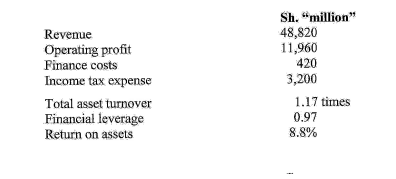

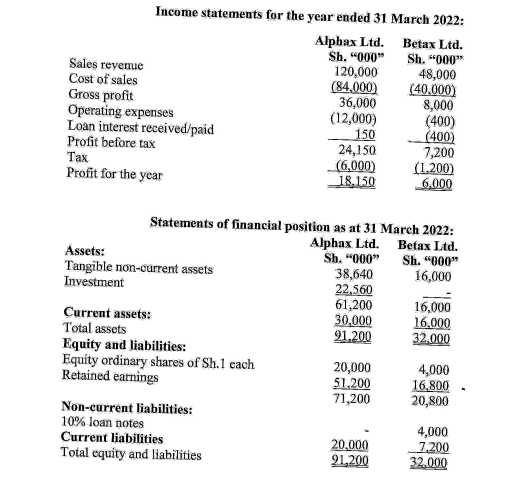

2. Betax Ltd. is a subsidiary of Alpha Ltd. The summarised draft financial statements of both companies are provided as follows:

Additional information:

1. On 1 July 2021, Alphax Ltd. acquired 80% of the ordinary share capital of Betax Ltd. at a cost of Sh.20,560,000. On the same date, it also acquired 50% of Betax Ltd. 10% loan notes at par.

2. The fair values of’ Betax Ltd.’s assets were equal to their book values with the exception of its plants which had a fair value of Sh.6.4 million in excess of its book value at the date of acquisition. The remaining, life of all the Betax Ltd. plant at the date of acquisition was four years and this has not changed as a result of the acquisition.

3. Depreciation of plant is on a straight line basis and charged to the cost of sales. Betax Ltd. has not adjusted the value of its plant to match its fair value.

4. In the post acquisition period, Alphax Ltd. sold goods to Betax Ltd. at a price of Sh.24 million. These goods had cost Alphax Ltd. Sh.18 million. During the year, Betax Ltd.: had sold Sh.20 million (at cost to Betax Ltd.) of these good for Sh.30 million.

5. Alphax Ltd. bears almost all of the administration costs incurred on behalf of the, group (invoicing, credit control among others). It does not charge Betax Ltd. for this service as to do so would not have a material effect on the group profit.

6. Revenues and profits should be deemed to accrue evenly throughout the year.

7. The current accounts of the two companies were reconciled at the year end with Betax Ltd., owing Alphax Ltd. sh. 1.5 million.

8. The goodwill was reviewed for impairment at the end of the reporting period and had suffered an impairment loss of Sh.600,000 which is to be treated as an operating expense.

9. Alphax Ltd.’s opening retained earnings were Sh.33,050,000 and Betax Ltd’s were Sh.10,800,000.

10. No dividends were paid or declared by either entity during the year.

11. It is the group policy to value the non-controlling interest at acquisition at fair value. The directors valued the non-controlling interests at Sh.5 million at the date of acquisition.

Required:

Consolidated statement of comprehensive income for the year ended`31 March 2022 for Aphax Ltd. (6 marks)

Consolidated statement a financial position as at 31 March 2022 for Alphax Limited, (8 marks)

Explain two reasons why it is necessary to eliminate unrealised profits when preparing group financial statements. (2 marks)

(Total; 20 marks)

QUESTION FOUR

1. Financial statements analysis can be a very useful tool for understanding a firm’s performance and financial condition. However, there are certain challenges and isskieS encountered in such analysis which call for care, discretion and judgement. In relation to the above statement, discuss six inherent challenges with hip-US-that will influences the quality of the output from the financial analysis. (6 marks)

2. Outline three circumstances under which International Financial Reporting Standard ( IFRS ) 9 “Financial Instruments” permits hedge accounting. (3 marks)

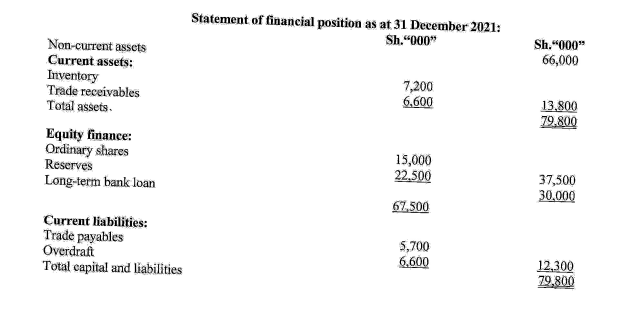

3. Flame Tree Ltd. achieved revenues of Sh.48,000,000 in the year that has just ended and expect a revenue growth rate of 10% in the next year. Cost of sales in the year that has just ended was Sh.32,640,000 and other expenses were Sh.4,320,000. The financial statement of flame tree Ltd. for the year ended 31 December 2021 are as follows:

Additional information:

- The long-term bank loan has a fixed annual interest rate of 8%.:

- The company pays corporation tax at an annual rate of 30% per shift.

- The following accounting ratios have been forecast for the year 2022.

Gross profit margin 30%

Operating profit margin 20%

Dividend payment ratio 50%

Inventory turnover period 110 days

Trade receivables period 155 clays

Trade payables period 75 days

The overdraft interest intlit year 2022 is forecast to be sh. 420, 000.

No change is expected in the level of non-current assets and depreciation should be ignored. Assume 365 days in a year.

Required;

Prepare the following forecast financial statements for Flame Tree Ltd. using the information provided:

A forecast Statatement of profit or loss for the year ending 31 December 2022. (5 marks)

A forecast statement of financial position as at 31 December 2022. (6 marks)

(Total 20 marks)

QUESTION FIVE

1. Describe three accounting warning signs that could indicate possible deviation from high quality financial reports (6 marks)

2. Discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale :

Goods are acquired by the business which it confidently expects to resell very quickly. ( 1 mark)

A customer places a firm order for goods ( 1 mark )

Goods are delivered to the customer ( 1 mark)

The customer is invoiced for goods ( 1 mark)

3. NPK United ordinary shares are Actively traded on the securities exchange . for the year ended 31 December 2021, the firm net income was sh. 183,000, its income tax rate is 30 %.

The average market price of its share during the year 2021 was sh.24.

Additional information:

1. There were 75,000 ordinary shares Outstanding at 1 January 2021. An additional 150,000 shares were issued on 1 July 2021.

2. A two for one share split was declared and distributed on 1 October 2021.

3. On 1 January 2020, NPK Limited issued at par Sh.300,0oo 8% bonds that mature on 1 January 2028. Each Sh.1,00 bond is convertible into 55 ordinary shares, The effecive interest rate is 8%.

4. There are 15,000 outstanding cumulative preference shares that are each entitled to an annual dividend of Sh..0.30. Dividends were not declared or paid during the year 2021. Bach preferred share is convertible into two ordinary shares.

5. NPK Limited previously granted its employees optitons to acqiru 5,000 ordinary shares at an exercise price of Sh.25 each. These options expire on 30 June 2026.

6. NPK Limited previously granted its executives options to acquire 1,800 ordinary shares at a exercise price of Sh.20 each. These options expire on 31 August 2027.

Required:

Calculate the following for the year ended 31 December 2021:

Basic earning per share ( EPS) (4 marks)

Diluted earnings per share (DPS) ( 6 marks )

( Total 20 marks)