WEDNESDAY: 26 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Revenue from rendering of services should be recognised by reference to the stage of completion of the transaction at the balance sheet date.

Describe THREE conditions to be met before the above treatment can be applied. (3 marks)

2. International Public Sector Accounting Standard (IPSAS) 1 – Presentation of Financial Statements, provides that the presentation and classification of items in the financial statements shall be retained from one period to the next. The standard however, provides exceptions to this principle.

Discuss TWO exceptions to the above principle. (4 marks)

3. Summarise FIVE limitations of ratios in analysing financial (5 marks)

4. With reference to International Financial Reporting Standard (IFRS) – 5, Non-Current Assets Held for Sale and Discontinued Operations, describe the conditions that must be met for an asset to be classified as held for sale. (8 marks)

(Total: 20 marks)

QUESTION TWO

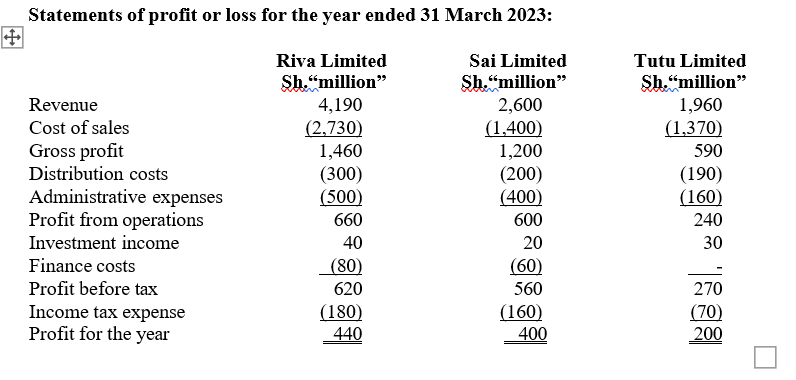

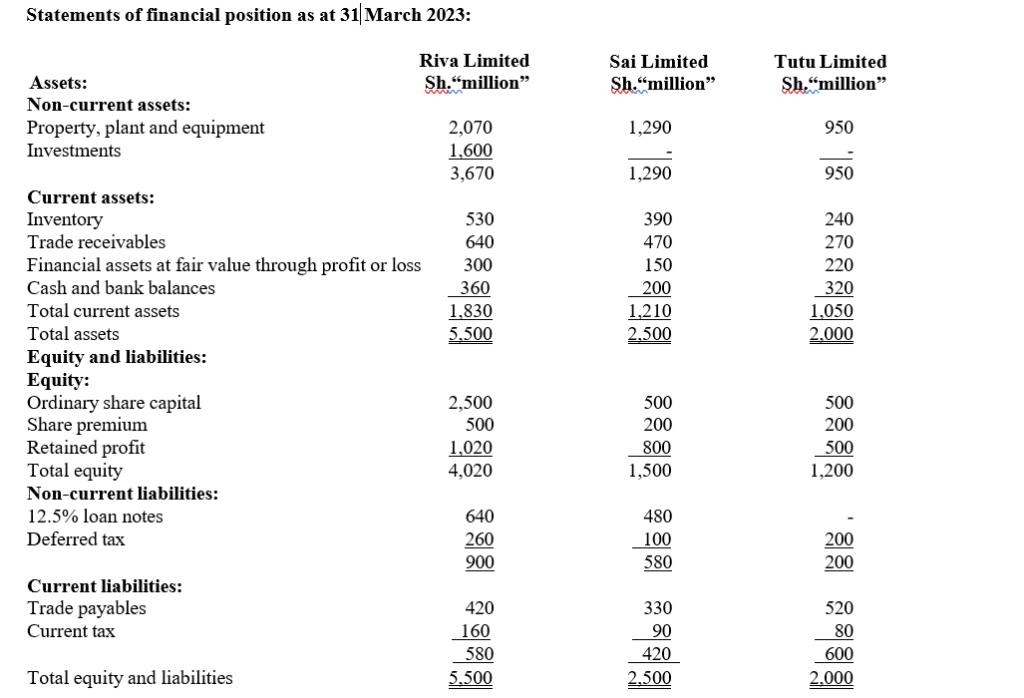

Riva Limited operates in a fast moving goods sub-sector. During the year ended 31 March 2023, Riva Limited expanded its operations by acquiring a controlling interest in Sai Limited and a significant influence over the activities of Tutu Limited. The following draft financial statements for the year ended 31 March 2023 relate to the three companies:

Additional information:

- On 1 July 2022, Riva Limited acquired an 80% ordinary shareholding in Sai Limited for a cash consideration of Sh.1,100 million. The fair value of assets and liabilities of Sai Limited were equal to their carrying amounts at the date of acquisition.

- The group policy is to measure the non-controlling interests at their proportionate share of net assets of the subsidiary at the date of acquisition.

- On 1 January 2023, Riva Limited acquired a 40% ordinary shareholding in Tutu Limited for a cash consideration of Sh.500 million.

- During the post-acquisition period, Riva Limited sold goods to Sai Limited for Sh.300 million. Riva Limited reported a 20% profit margin on this sale. Half of these goods remained in the ending inventory of Sai Limited at the year end of 31 March 2023.

- Included in the trade receivables of Riva Limited was Sh.80 million due from Sai Limited. In the books of Sai Limited, the amount due to Riva Limited was shown at Sh.60 million because Sai Limited had remitted Sh.20 million but Riva Limited had not recorded the remittance.

- On 1 October 2022, Riva Limited sold an assembly plant to Sai Limited for Sh.400 million reporting a 25% profit margin on the selling price and netted off the profit against its cost of sales.

The group charges depreciation on plant at the rate of 20% per annum on cost on full year basis in the year of asset purchase and none in the year of disposal.

- Impairment tests carried out on 31 March 2023 revealed that neither the goodwill on acquisition nor the investment in associate had been impaired during the year.

- None of the group companies paid dividends during the year to 31 March

Required:

- Consolidated statement of profit or loss for the year ended 31 March (8 marks)

- Consolidated statement of financial position as at 31 March (12 marks)

(Total: 20 marks)

MASOMO MSINGI PUBLISHERS APP – Click to download and access past paper answers in PDF

QUESTION THREE

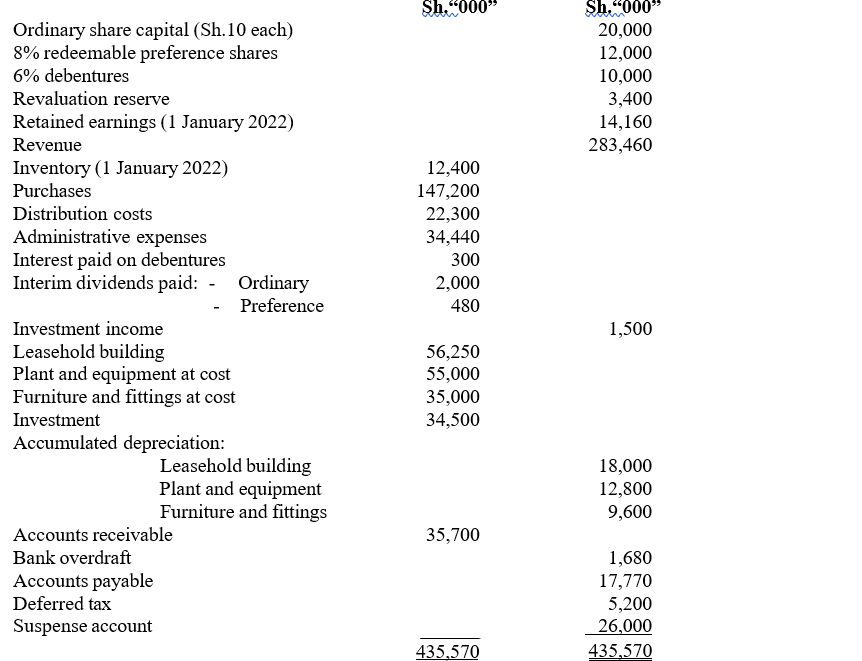

The following trial balance was prepared by Salama Ltd. as at 31 December 2022:

Additional information:

- The inventory as at 31 December 2022 was valued at Sh.16 million. However, there were some goods which were considered obsolete with a net realisable value of Sh.400,000 and a cost of Sh.450,000 with a net replacement value of Sh.350,000.

- The 6% debentures were issued on 1 July Interest on debentures is payable semi-annually.

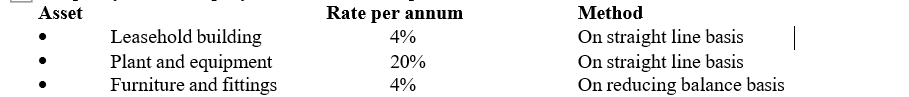

- The policy of the company in relation to the depreciation of its assets is as follows:

The plant and equipment had a residual value of Sh.5 million.

Depreciation is classified as cost of sales expense except for the depreciation on furniture and fittings which is classified as administrative expense.

- The taxable timing differences were 24 million while the deductible timing differences were Sh.10.5 million during the year.

- The corporation tax of 21.4 million is to be provided for the year.

- The suspense account represents two components:

- Proceeds from sale of plant of 16 million whose cost was Sh.20 million and an accumulated depreciation of Sh.2.5 million.

- 10 million being a bonus issue of shares.

- The directors propose to pay a final dividend of 1.50 per share on the outstanding shares at the year end.

- The tax rate was 30%.

Required:

- Statement of profit or loss for the year ended 31 December (8 marks)

- Statement of changes in equity for the year ended 31 December (4 marks)

- Statement of financial position as at 31 December (8 marks)

(Total: 20 marks)

QUESTION FOUR

Baraka and Faulu were in partnership sharing profits and loses equally until 30 September 2021 when they decided to convert the partnership into a limited company; Bafa Ltd. The conversion of the books of account was however not completed.

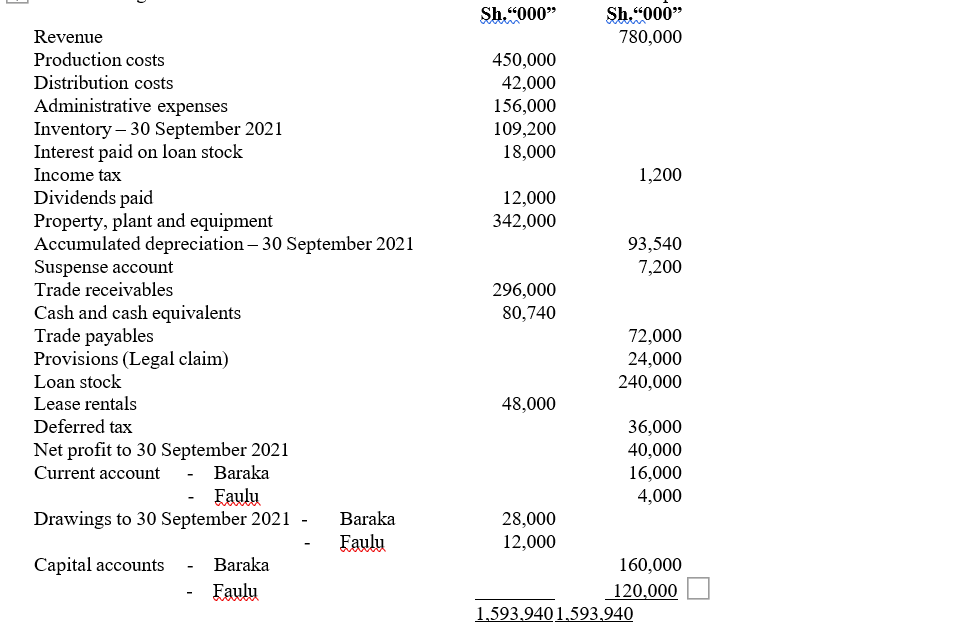

The following trial balance was extracted from the books of account as at 30 September 2022:

Additional information:

- Closing inventory as at 30 September 2022 was valued at 132 million.

- On 1 October 2021, the company leased some equipment to boost production. The lease was for five years. The lease rental payments were Sh.24 million payable semi-annually in arrears. The fair value of the equipment was Sh.186 million. Depreciation is to be charged on straight line basis and allocated to cost of sales. The interest rate implicit in the lease is at 5% per half year.

- The suspense account represents sales proceeds from some items of plant and equipment which had cost Sh.36 million and which were disposed of during the year. The accumulated depreciation for the disposed items as at 30 September 2021 was Sh.27 million. Any gain or loss on disposal was to be adjusted in the depreciation expense

- The income tax amount of Sh.1.2 million included in the trial balance was the estimated tax as at 30 September The current year’s tax is estimated at Sh.9 million. In addition, a deferred tax liability of Sh.36 million was provided for as at 1 October 2021. As at 30 September 2022, temporary differences were Sh.168 million. The tax rate is 30%.

- A legal claim of 60 million was lodged against the company during the year by a customer.

The directors estimated that there was a 40% possibility of the claim being successful and had made a provision of Sh.24 million which was included in the administrative expenses.

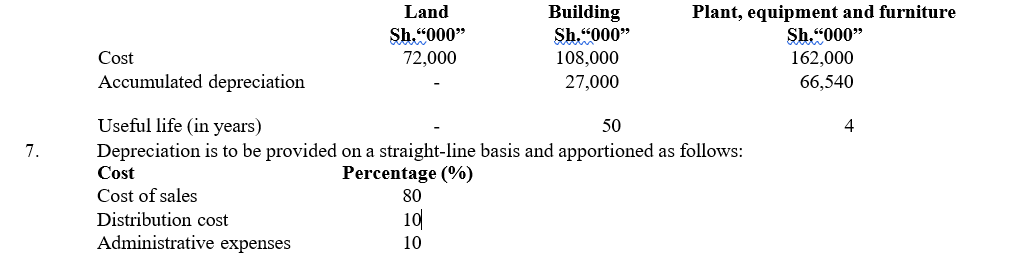

- Property, plant and equipment as at 30 September 2022 comprised:

8. No entries were made to record the conversion of the partnership into a limited The assets were taken over by the company on 1 October 2021 at their book values except land which was revalued to Sh.80 million. The company issued to the partners 32 million shares of Sh.10 each in settlement of their outstanding capital account balances.

Required:

- Statement of profit or loss for the year ended 30 September (8 marks)

- Statement of financial position as at 30 September (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. In the context of International Accounting Standard (IAS) 12, Income Taxes:

- Explain the difference between “taxable temporary differences” and “deductible temporary differences”. (2 marks)

- Suggest how the tax base for “assets”, “revenue received in advance” and “other liabilities” can be (6 marks)

- A deferred tax liability is generally recognised for all taxable differences. There are however exceptions to this rule. Summarise TWO exceptions to the above rule. (4 marks)

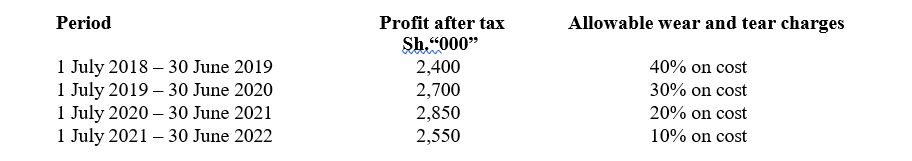

2. BXL Manufacturers Ltd., a small firm engaged in the production of fertilizer, purchased an item of equipment for Sh.12 million on 1 July The company provides depreciation on equipment on a straight-line basis at the rate of 25% per annum. During the four years from 1 July 2018 to 30 June 2022, the profit after tax and allowed wear and tear charges for tax purposes were as follows:

Corporation tax for the period of four years remained at the rate of 30%.

Required:

Compute for each of the years ended 30 June 2019, 2020, 2021 and 2022:

- Taxable (4 marks)

- Deferred (4 marks)

(Total: 20 marks)