THURSDAY: 27 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Management of a limited liability company is appointed to promote and protect shareholders’ interest in the performance of their functions. The aim is to maximise shareholders’value. The management, however, could have interest that might be in conflict with shareholders’ interest.

Required:

In reference to the above statement:

- Identify this type of conflict in modern day financial management of a (1 mark)

- Explain THREE factors that could contribute to the conflict identified in (a) (i) (3 marks)

- As a financial management professional, explain FOUR strategies that could be used to manage or mitigate this conflict to protect (4 marks)

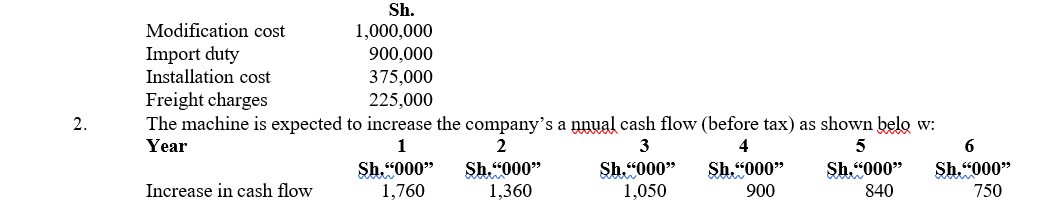

2. Cipo Ltd. is evaluating an investment project which requires the importation of a new machine at a cost of Sh.3,700,000. The machine has a useful life of six years and a salvage value of sh.1,000,000.

Additional information:

- The following additional costs would be incurred in relation to the machine:

3. The machine is to be fully depreciated over its useful life using the straight-line

4. The corporate rate of tax is 30% while the cost of capital is 10%.

5. The maximum acceptable payback period for the company for all capital project is four years

Required:

- Total initial (2 marks)

- Annual net cash (3 marks)

- Payback period of the (3 marks)

- Net present value (NPV) of the (3 marks)

- Advise the company’s management on whether to import the machine based on your results in (b) (iii) and (b) (iv) above. (1 mark)

(Total: 20 marks)

QUESTION TWO

1. Summarise FIVE factors that firms should consider when making financing (5 marks)

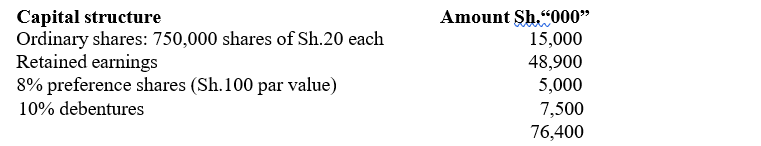

2. The following information was extracted from the financial statements of Rembo for the year ended 31 December 2022:

Additional information:

- The preference shares were originally sold in 2014 at Sh.104 per share. The current price is Sh.94 although a similar issue can be made at Sh.89 net.

- Ordinary shares are currently selling at 38.40 on the securities exchange.

- The debentures were sold in 2015 and realised 96 per unit. The current price is Sh.80 and it is anticipated that a similar issue would also sell at Sh.80 per unit. Corporate tax rate is 30%.

- Last year’s dividend amounted to Sh.3,000,000 which was 70% of the net earnings. The company expects these dividends to grow at a rate of 6% per annum and the dividend payout ratio to remain the same.

- New ordinary shares can be sold at Sh.40 but in order to guarantee success, they would have to be sold at Sh.35 per share.

Required:

- Cost of preference (2 marks)

- Cost of ordinary (2 marks)

- Cost of (2 marks)

- Market weighted average cost of capital (WACC) of the (3 marks)

3. Umi Limited is contemplating to issue 8% bonds redeemable at Sh.100 par value in three years time. Alternatively, each bond may be converted on that date into 30 ordinary shares of the company. The current market price per share is Sh.3.30 and this is expected to grow at a rate of 5% per annum. The company’s cost of debt is 6% per annum.

Required:

Compute the following:

- Market value of the bond assuming conversion occur after 3 (2 marks)

- The floor value of the bond assuming redemptions occur at (2 marks)

- The conversion premium per (2 marks)

(Total: 20 marks)

MASOMO MSINGI PUBLISHERS APP – Click to download and access past paper answers in PDF

QUESTION THREE

1. Highlight FIVE reasons for the increased popularity of Islamic Finance in the recent (5 marks)

2. Bright Moon Ltd. currently owns 100,000 outstanding ordinary shares with a market price of Sh.10 per share. The firm has Sh.1 million earnings after tax and intends to invest Sh.2 million during the year 2023. The firm is also considering declaring a dividend of Sh.5 per share at the end of the year. The firm’s opportunity cost of capital is 10%.

Required:

- The price of the share at the end of the year 2023 assuming dividend is not (2 marks)

- The price of the share at the end of the year 2023 assuming dividend is (2 marks)

- The number of new shares to be issued in (b) (i) and (b) (ii) (6 marks)

3. The Maji Group portfolio comprises of Maji A shares with an expected return of 10% and a standard deviation of 20% and Maji B shares with an expected return of 16% and a standard deviation of 40%. The correlation between Maji A shares and Maji B shares is 0.4. The portfolio is comprised of 30% Maji A and 70% Maji B.

Required:

- The expected return of the (2 marks)

- The standard deviation of the (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between the following terms as used in financial institutions and markets:

- “Disintermediation” and “intermediation”. (2 marks)

- “Call markets” and “continuous markets”. (2 marks)

2. Outline FOUR roles of mutual funds as investment (4 marks)

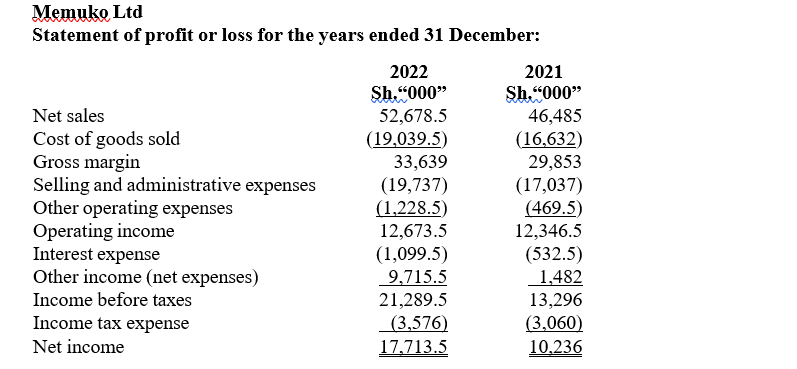

3. The following statement of profit or loss relates to Memuko for the year ended 31 December 2022 and 31 December 2021:

Required:

- Present the common size analysis for Memuko income statement. (8 marks)

- Analyse the changes in cost of goods sold, selling and administrative expenses, operating income and income before taxes for the year ended 31 December 2022 compared to 31 December (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Distinguish between “herd behaviour” and “anchoring bias” as used in behavioural (4 marks)

2. Outline SIX steps involved in personal financial (6 marks)

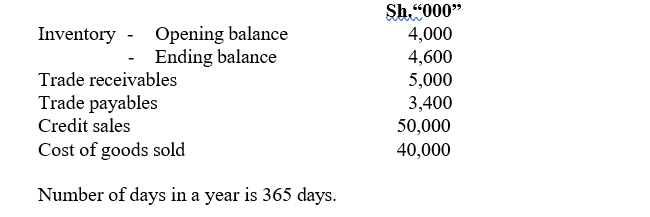

3. The following financial statement data relates to Bamaco for the year ended 31 December 2022:

Required:

Compute the net operating cycle of Bamaco Ltd. (6 marks)

4. John Osoro has deposited Sh.700,000 into a savings account at an annual interest rate of 5% compounded monthly with additional deposits of Sh.10,000 per month (made at the end of each month).

Required:

Determine the value of the investment after 10 years. (4 marks)