2.1 Financial markets

Financial market are institutions or arrangements that facilitate the exchange of financial assets, including deposits and loans, corporate stocks and bonds, government bonds, and more exotic instruments such as options and futures contracts. They are mechanism in our society for converting public savings into investments such as buildings, machinery, infrastructure and inventories of goods and raw materials. This enables the economy to grow; new jobs are created and living standards to rise. Financial markets therefore perform the essential economic function of channeling funds from economic units which have surplus funds (net savers) to economic units with a net deficit of funds (investors).

Classification of financial markets

There are several methods of classifying financial markets. Some are as follows:

1. Classification of the markets based on the type of instrument or service as follows:

Debt markets

This is the most familiar type of market. In debt markets, the lenders provide funds to borrowers for some specified period of time. In return for the funds, the borrower agrees to pay the lender the principal loan plus some specified amount of interest.

Debt markets are used by:

- Individuals to finance purchases such as houses, cars home appliances e.t.c.

- Corporate borrowers to finance working capital and new equipment

- The central and local governments to finance various public expenditures

Debt instruments include bonds, mortgages and the various types of bank loans. These are contractual agreements by the borrower to pay the holder of the instrument fixed amounts of money at regular intervals until the maturity date, when the final payment is made. The regular payments contain elements of both principal and interest payments.

Equity markets

This is the market for raising funds by issuing equities such as common stock. Equities are claims to share in the net income and the assets of a business. Equities usually make periodic payments in form of dividends to their holders. Holders are residual claimants in that the corporate must pay all its debt holders before its equity holders. Equities usually have no maturity dates.

Financial service markets

These are markets where individuals and corporate can purchase services that enhance the working of the debt and equity markets.

Bank for example; provide depositors many services in addition to paying them interest on their deposits. These include money transmission services, safe deposit facilities, payment servicese.t.c. Thus, in addition to participating in the debt market, by issuing loans banks also provide financial services that provide „convenience‟ to consumers in various ways.

Another financial service is brokerage services. Brokers are intermediaries who compete for the right to help people buy or sell something of value. Stockbrokers help individuals to buy or sell assets such as stocks and bonds. As intermediaries, brokers receive a fee for performing the services of matching buyers and sellers of assets. Dealers on the other hand, buy and sell securities on their portfolio, not just matching buyers and sellers.

Finally, financial service markets provide consumers, businesses, and governments with financial risk management services, that is, protection against life, health, property and income risks through sale of various insurance policies.

A broad classification that distinguishes between primary and secondary market

1. Primary market

The primary market is used for trading of new securities that have never before been issued. Its primary function is raising capital to support new investments or corporate expansions. The best example of a primary market is the market for corporate initial public offers (IPOs) which are used to sell company shares to the public for the first time.

2. Secondary markets

These are markets that deal in securities which were issued previously. The chief function of a secondary market is to provide liquidity to investors, that is, provide an avenue for converting financial instruments into ready cash. Examples of secondary markets are markets for stocks and shares and that of long-term bonds.

A classification of markets based on the term to maturity and liquidity of the instrument.

This method categories financial market into:-

1. Money market

2. Capital markets

1. Money markets

Money markets are financial markets that are used for trading of short-term debt instruments, generally those with original maturity of less than one year. The money market is the place where individuals and institutions with temporary surpluses of funds meet the needs of borrowers who have temporary fund shortages. Thus, the money markets enable economic units to manage their liquidity positions. A security with a maturity of period of less than one year is considered a money market instrument.

One principal function of the money market is to finance the working capital needs of corporations and to provide governments with short-term funds as they wait to collect tax. The money market also supplies funds for speculative buying of securities and commodities.

2. Capital markets

The capital market is designed to finance long-term investments by businesses, governments and households. Capital market instruments are mainly longer term securities (those with original maturities of more than one year) and equities. Examples include bonds and shares traded on the stock exchange.

2.2 Financial instruments

The following are some of the most common instruments in use today

Money market instruments

They are short-term dated securities. Because of their short terms to maturity, they undergo the least price fluctuations and are therefore the least risky instruments. These include treasury bills, negotiable bank certificate of deposit, commercial paper, repurchase agreements e.t.c.

1. Treasury bills

- These are short-term debt instruments issued by the government.

- They are issued in 3, 6 and 12 month maturities to finance government activities.

- They pay a set amount at maturity and have no interest payments.

- Interest is covered by the fact that they are initially sold at a discount, that is, an amount lower than the amount they are redeemed at on maturity.

- They are the most liquid of all money market securities because they are the most actively traded.

- Interest rates on treasury bills are usually the anchor/benchmark for all money market interest rates.

- They are also the safest among the money market instruments because the chance of default are minimal (the government can always increase taxes or issue currency to pay off its debts)

- Thus, T-bills are popular due to their zero default risk, ready marketability and high liquidity.

Types of treasury bills

There are several types of bills that are issued by governments:

1. Regular-series bills

These are issued routinely every week or month in competitive auctions

They have original maturities of three months, six months and one year.

New three and six month bills are auctioned weekly; one year bills are normally sold once each month.

2. Irregular-series bills

These are issued only when the treasury has a special cash need.

They can be strip bills or cash management bills.

Strip bills comprise of a package offering of bills requiring investors to bid for an entire series of different bill maturities. Investors who did successively must accept bills at their bid price each week for several weeks running.

Cash management bills consist simply of reopened issues of bills that were sold in prior weeks. The reopening of a bill issue normally occurs when there is an unusual or unexpected treasury need for cash.

Calculating the yield on bills

- Treasury bills do not carry a promised interest rate but instead are sold at a discount from par.

- Their yield is therefore based on their appreciation in price between time of issue and the time they mature or are sold by the investor.

- Bills yields are determined by the bank discount method which ignores compounding of interest rates and uses a 360-day year for simplicity.

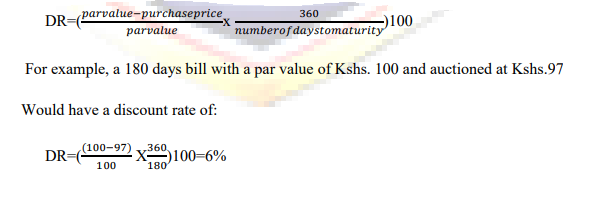

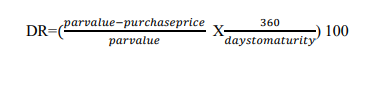

- The bank discount rate (DR) on bills is given by the following formula:

Because the rate of return on treasury bills is figured in a different way than the rate of return on most debt instruments, the investor must compare investment yield to make realistic comparisons with other securities.

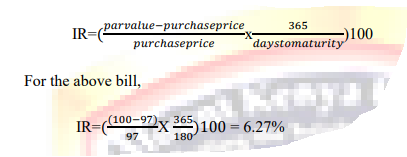

The investment yield or rate (IR) for treasury bills can be obtained by the following formula

This IR formula explicitly recognizes that each bill is purchased at a discounted price, which should be used instead of par value as the basis for determining the bills true return. The investment rate (IR) is always higher than discount rate (DR) because of the compounding of interest and the use of a 365 day year. In leap year, 366 is used instead of 365.

Commercial paper

- A commercial paper is a short-term debt instrument issued by large banks and well known corporations.

- It promises to pay back higher specified amount at a designated/specified time in the immediate future, say, 30 days.

- Issuers of commercial paper sell the instrument directly to other institutions as a way of raising funds for their immediate needs instead of borrowing from banks.

- Issuance of commercial paper is a cheaper way of raising funds for a firm than borrowing from a bank.

- A firm must be large and creditworthy enough for lenders to accept its commercial paper.

- Funds raised from paper issue are mainly used for current transactions e.g. to purchase inventories, pay taxes, meet pay rolls e.t.c. rather than capital transactions (long term investments)

- Commercial papers are traded in primary market.

- Opportunities for resale in the secondary market are limited, although some dealers redeem the notes they sell in advance of maturity and others trade paper issued by large finance companies and holding companies.

- Because of the limited resale possibilities, investors are usually careful to purchase those paper issues whose maturity matches their planned holding periods.

Types of commercial paper

There are two types of commercial paper:

1. Direct paper – issued directly to the investor, sold by large finance companies and bank holding companies that deal directly with the investor rather than using a securities dealer as an intermediary.

Directly placed paper must be sold in large volume to cover the substantial cost of distribution and marketing.

2. Dealer paper (industrial paper dealer) – usually issued by security dealers on behalf of their corporate customers. It is mainly issued by non financial companies who borrow less frequently than firms issuing direct paper. The issuing company may sell the paper directly to dealer, who buys less discount and commissions and then attempts to resell it at the highest possible price in the market. Alternatively, the issuing company may carry all the risk, with dealer only agreeing to sell the issue at the best price available less commission, referred to as a best effort basis.

Note

Yields of commercial paper are calculated by the bank discount method. Just like with treasury bills, most commercial papers are issued at par, where by the investor yield arise from the price appreciation of the security between its purchase date and maturity date.

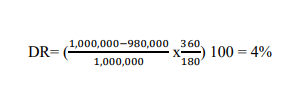

For example, if a million – shilling commercial note with a maturity of 180 days is acquired by an investor at a discounted price of Kshs. 980,000, the discount rate of return (DR) is:

Advantages of commercial paper

- It is a cheaper method of raising funds for a company because the interest rate is generally lower than bank loans.

- Interest rates are usually more flexible than for bank loans.

- Its quicker method of raising funds either through a dealer or direct finance. Dealers usually keep in close contact with the market and generally know where funds may be found quickly.

- Generally large amounts of funds may be borrowed more conveniently than through say, bank loans mainly because there are legal restrictions concerning the amount of money that can lend to a single company.

- The ability to issue commercial paper gives a company considerable leverage when negotiating with banks.

Disadvantages of issuing commercial paper

- Risk of a company that frequently issues commercial paper alienating itself from banks whose loans may be required in case of an emergency.

- Commercial paper cannot be paid off at the issuer’s discretion. It generally remains outstanding until maturity unlike bank loans which permit early retirement without penalty.

2. Repurchase agreements

A repurchase agreement(repo) is a short-term loan where by the borrower sells marketable securities such as treasury bonds to the lender but undertakes to buy them back at a later date at a fixed price plus interest or at a price which is slightly higher than one they were sold to the lender.

Thus, repos are in effect temporally extension of credit collateralized by marketable securities. Some repos are for a specified period of time (term) while others carry no express maturity dates but may be terminated by either party on short notice. These are known as continuing contracts.

The main borrowers in the repos markets are dealers and banks. Lenders in the market include large banks, corporations, state and local governments, insurance companies and foreign financial institutions who find the market a convenient, relatively low-risk way to invest temporary cash surpluses that may be retrieved quickly when needed.

Normally the securities that form collateral for a repo are supposed to be placed in a custodial account in a bank. When the loan is repaid, the borrower’s repo liability is cancelled and the securities returned to them.

Traditional overnight lending makes up the bulk repos but there is a growing trend of repos carrying longer maturities of between one and three months. These are known as term agreements.

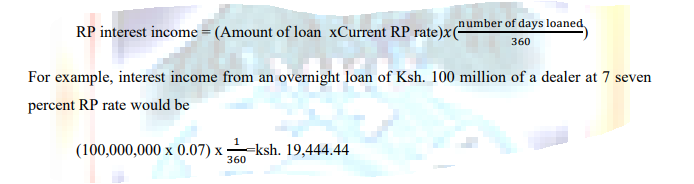

Interest income from repurchase agreements is usually determined from the formula:

Under a continuing contract, the rate changes daily, so the calculation would be made for each day the funds were loaned, with the total interest owed being paid to the lender when the contract is ended by either party.

2.2.2 Capital market instruments

These are debt and equity instruments which have maturities greater than one year. They have far wider price fluctuations than money market instruments and are considered to be fairly risky investments. The most common capital market instruments in use include

1. Corporate stocks

2. Mortgages

3. Corporate bonds

4. Marketable long-term government securities

5. State and local government bonds

6. Bank commercial loans

7. Consumer loans

1. stocks

These are equity claims on the net income and assets of a corporation. They confer on the holder, a number of rights as well as risks. They are two types of corporate stocks:

- Common stock

- Preferred/preference shares

1. Common stock

It is the most important form of corporate stock, it represents residual claim against the assets of the issuing firm. It also entitles the owner to share in the net earnings of the firm when it is profitable and to share in the net market value (after all debts are paid) of the company assets if it is liquidated.

Stock holders risk exposure is limited to the extent of investment in the company. If a company with outstanding shares of common stock is liquidated, the debts of the firm are paid first from the assets available, then preferred stock holders are paid their share and whatever remains is distributed among the common stock holders on a pro-rata basis. The volume of stock that a corporation may issue is known as the authorized share capital and additional shares can only be issued by amending the articles and memorandum of association with the approval of current stock holders in a general meeting.

2. Preferred stock

These carry a stated annual divided stated as a percentage of the par value e.g. a 8% preference share is entitled to 8% divided on each share held provided the company declares a divided. They occupy the middle ground between debt and equity including the advantages and disadvantages of both instruments used in raising long-term finance. In case of liquidation, they are paid after other creditors but before equity holders. They have no voting right.